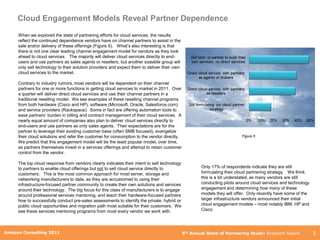

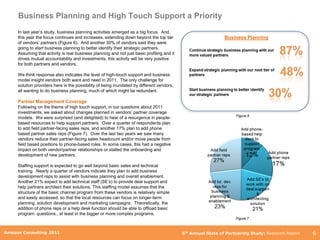

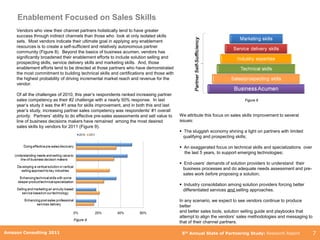

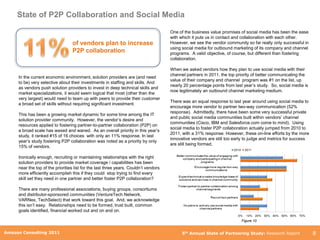

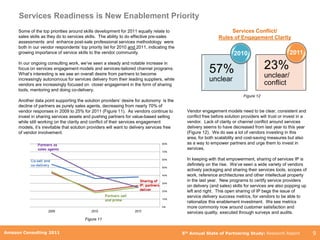

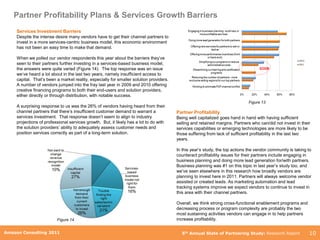

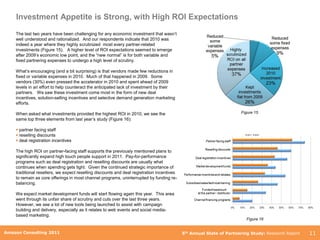

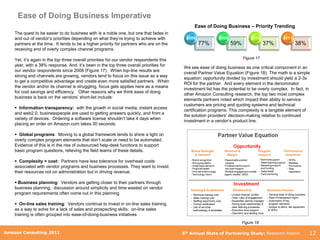

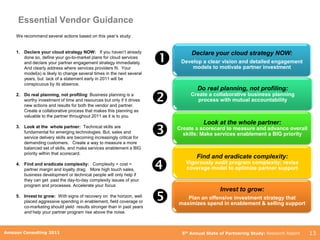

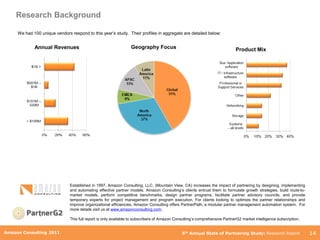

The Amazon Consulting 2011 report discusses the evolving landscape of IT vendor partnerships, highlighting trends such as the rise of service providers, the shift towards global program frameworks, and increasing emphasis on sales competencies. Key findings emphasize that as the market adapts to disruptive technologies and economic challenges, vendors prioritize strategic investments in partner enablement and service integration. The study underscores the importance of understanding partner needs and advancing collaboration efforts through various engagement models, particularly in the cloud services domain.