2009angelanalysis

•

0 likes•119 views

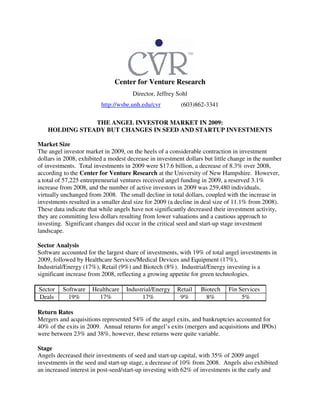

The angel investor market in 2009 saw a modest 8.3% decrease in total investments to $17.6 billion, though the number of investments increased slightly. Angels decreased their seed and start-up investments from 2008 levels, committing less to smaller deals. Software remained the most popular sector, receiving 19% of deals, followed by healthcare and industrial/energy. Mergers and acquisitions represented over half of angel exits, with annual returns between 23-38%.

Report

Share

Report

Share

Download to read offline

Recommended

Impact of cash flow on investment levels in quoted nigerian manufacturing firms.

International peer-reviewed academic journals call for papers, http://www.iiste.org

marginal efficiency of capital

a study on marginal efficiency of capital and attached cast study on the same.

Tax Incentives and Foreign Direct Investment in Nigeria

Given the significance of Foreign Direct Investment (FDI) to economic growth and the use of tax

incentives as a strategy among government of various countries to attract FDI, this study examines the influence

of tax incentives in the decision of an investor to locate FDI in Nigeria. Data were drawn from annual statistical

bulletin of the Central Bank of Nigeria and the World Bank World Development Indicators Database. The work

employs a model of multiple regressions using static Error Correction Modelling (ECM) to determine the time

series properties of tax incentives captured by annual tax revenue as a percentage of Gross Domestic Product

(GDP)and FDI. The result showed that FDI response to tax incentives is negatively significant, that is, increase

in tax incentives does not bring about a corresponding increase in FDI. Based on the findings, the paper

recommends, amongst others, that dependence on tax incentives should be reduced and more attention be put on

other incentives strategies such as stable economic reforms and stable political climate.

Italian banking-foundations-2014-02-05-1

Poche settimane fa, quando Alessandro Profumo ebbe a dire che l’opposizione della fondazione capeggiata dalla Mansi all’aumento immediato di capitale del Monte dei Paschi di Siena poteva avere conseguenze sulla stabilità di Mps e di riflesso su quella del sistema bancario italiano, andò incontro alla censura di Giuseppe Guzzetti, presidente del cartello delle fondazioni italiane. Definì l’affermazione di Profumo “avventata e destituita di ogni fondamento” . Ma da che pulpito veniva la predica? Guzzetti ha sempre sostenuto di essere un esperto di fondazioni e non di banche. Che cosa ci capisce allora di stabilità finanziaria e di corsa agli sportelli? O forse pensava che bastasse la sua parola per infondere fiducia nei correntisti del Monte dei Paschi? Non gli ha sfiorato la mente il pensiero che, proprio perché non è un esperto, potesse invece finire per spaventare i suoi interlocutori con rassicurazioni di facciata, per intenderci alla Schettino sulla plancia della Concordia?

http://www.lavoce.info/guzzetti-profumo-banche

PER SAPERNE DI PIU'

Il caso Monte dei Paschi chiama in causa, ancora una volta, il ruolo delle fondazioni, istituzioni non profit grandi azioniste degli istituti di credito. Farebbero meglio il loro mestiere se non si occupassero di banche. Qui sono raccolti i nostri recenti interventi sul tema.

http://www.lavoce.info/fondazioni-bancarie/

Bangladesh Private Commercial Banks Quarterly Overview - November 2011

Analysis of the Banking Sector's Performance at a time of Regulatory Changes & Developments

Q2 2015 Newsletter

Financial Synergies Q2 2015 Newsletter discusses many aspects of the current market conditions and our Financial Times recognition as one of the top 300 RIAs in the nation.

Recommended

Impact of cash flow on investment levels in quoted nigerian manufacturing firms.

International peer-reviewed academic journals call for papers, http://www.iiste.org

marginal efficiency of capital

a study on marginal efficiency of capital and attached cast study on the same.

Tax Incentives and Foreign Direct Investment in Nigeria

Given the significance of Foreign Direct Investment (FDI) to economic growth and the use of tax

incentives as a strategy among government of various countries to attract FDI, this study examines the influence

of tax incentives in the decision of an investor to locate FDI in Nigeria. Data were drawn from annual statistical

bulletin of the Central Bank of Nigeria and the World Bank World Development Indicators Database. The work

employs a model of multiple regressions using static Error Correction Modelling (ECM) to determine the time

series properties of tax incentives captured by annual tax revenue as a percentage of Gross Domestic Product

(GDP)and FDI. The result showed that FDI response to tax incentives is negatively significant, that is, increase

in tax incentives does not bring about a corresponding increase in FDI. Based on the findings, the paper

recommends, amongst others, that dependence on tax incentives should be reduced and more attention be put on

other incentives strategies such as stable economic reforms and stable political climate.

Italian banking-foundations-2014-02-05-1

Poche settimane fa, quando Alessandro Profumo ebbe a dire che l’opposizione della fondazione capeggiata dalla Mansi all’aumento immediato di capitale del Monte dei Paschi di Siena poteva avere conseguenze sulla stabilità di Mps e di riflesso su quella del sistema bancario italiano, andò incontro alla censura di Giuseppe Guzzetti, presidente del cartello delle fondazioni italiane. Definì l’affermazione di Profumo “avventata e destituita di ogni fondamento” . Ma da che pulpito veniva la predica? Guzzetti ha sempre sostenuto di essere un esperto di fondazioni e non di banche. Che cosa ci capisce allora di stabilità finanziaria e di corsa agli sportelli? O forse pensava che bastasse la sua parola per infondere fiducia nei correntisti del Monte dei Paschi? Non gli ha sfiorato la mente il pensiero che, proprio perché non è un esperto, potesse invece finire per spaventare i suoi interlocutori con rassicurazioni di facciata, per intenderci alla Schettino sulla plancia della Concordia?

http://www.lavoce.info/guzzetti-profumo-banche

PER SAPERNE DI PIU'

Il caso Monte dei Paschi chiama in causa, ancora una volta, il ruolo delle fondazioni, istituzioni non profit grandi azioniste degli istituti di credito. Farebbero meglio il loro mestiere se non si occupassero di banche. Qui sono raccolti i nostri recenti interventi sul tema.

http://www.lavoce.info/fondazioni-bancarie/

Bangladesh Private Commercial Banks Quarterly Overview - November 2011

Analysis of the Banking Sector's Performance at a time of Regulatory Changes & Developments

Q2 2015 Newsletter

Financial Synergies Q2 2015 Newsletter discusses many aspects of the current market conditions and our Financial Times recognition as one of the top 300 RIAs in the nation.

The Non-Dilutive Cash Injection: Selling Your Patents

Should you sell your patents for a cash infusion? If you have a patent portfolio, you may want to consider selling your patents to meet your liquidity needs. We analyze the steps to selling your patents, including developing the sales package and finding the right price.

2010 Global Location Trends Report

IBM-PLI\'s 4th Annual Global Location Trends Report covers a time of continued uncertainty and increased complexity for many organizations worldwide. The data in this new report also shows that the forces driving organizations to globally integrate are not letting up. Moreover, emerging trends signal the continuation and deepening of new business model approaches.

Trends in Healthcare Investments and Exits Report

Silicon Valley Bank’s annual healthcare M&A report, Trends in Healthcare Investments and Exits, examines the merger and acquisition and IPO activity of private, venture-backed bio-pharma and medical device companies.

The study found that healthcare IPOs tripled in 2013, leading to record potential IPO/big exit returns of $12.5 billion.

For a detailed analysis access the report at: http://www.svb.com/healthcare-report_2014/.

**Report updated on 8/4/2014

Turkish mid market m&a report, 2015

Review and analyses of mid market transactions in Turkish market.

Private Equity Trends through Q1 2010 -- from PitchBook

This is a great resource for anyone preparing a presentation or report who is looking for info on the state of the Private Equity industry. Thanks to PitchBook for the info

Investing in Ireland: A survey of foreign direct investors

Investing in Ireland: A survey of foreign direct investors is an Economist Intelligence Unit report sponsored by Matheson Ormsby Prentice. It examines the main factors that bring foreign direct investment to Ireland and the main ongoing challenges in attracting investment. Ronan Lyons was the report author. Aviva Freudmann and Jason Sumner were the editors.

Funding A Medical Device Startup In The Current Economy

A presentation delivered June 4, 2009 describing the impact of the economic crisis on venture and angel investing and common sense steps for fundraising for Medical Device Startups. No one is an expert now.

Angels Still Actively Stimulating The Economy

Funding for just a few entrepreneurs would mean that only a few companies have the chance of emergin...

Running head CURRENT ECONOMIC TRENDS1CURRENT ECONOMIC TRENDS .docx

Running head: CURRENT ECONOMIC TRENDS 1

CURRENT ECONOMIC TRENDS 3

Current Economic Trends

Jonathan Max Burkett

Capella University

January 13, 2019

Current Economic Trends

An economy is the management and utilization of a country’s resources to create the desired stability in terms of industry, money, and trade. Economies of countries rely on a network of purchase and sale of goods, taxes, and savings made by the central bank in terms of investment (Pons, 2000). A country’s economic stability is achieved when the wealth the industry and service sector are producing outweigh the money being spent. Trends refer to the socio-economic advancements of interests among commodities, music, films, fashion, and finance. Trends are mostly affected or influenced by affluent individuals or groups in society. In the 21st century trends have earned a position in the financial and economic sectors of the world as economy determining factors.

Industries are setups used to collect raw material of different kinds and manufacture and process them to attain a finer product than the original raw material. Around the world global consumerism has resulted in the construction of varieties of industries ranging from food, textiles, machinery, and agriculture. Industries may either be service or manufacture and processing. Modernization promotes the industrial revolution due to the demand for complex and efficient products (Baten, 2016). The availability of a vast selection of products has seen an annual influx of newer companies that offer better and more complex products. Economically there are two types of industries; cyclical and non-cyclical industries.

Cyclical industries are business or organization tied to market and price variations. Fluctuation within a business’s year affects the cyclical industry directly. Positive growth within the business boosts the business while negative growth results in the collapse of a business (Gordon & Robert J, 2000). Cyclical industries' activities move with an annual or seasonal business cycle. Examples of cyclical industries include the auto, airlines, housing, furniture, appliance, and financial services industries. Non-cyclical industries maintain their overall business performance all year round. Differences in productivity have little to no effect on business operations. Non-cyclical industries remain fairly constant over time. These include such industries as food, pharmaceuticals, utilities, and cosmetics.

American airlines have recently merged with US airlines expressing a steady growth percentage of 93%. Lawsuits, devastating weather patterns, and competition have seen the airline struggle through the past years with the stock prices dropping and insignificantly rising through it all. Apple, a technological giant amongst mobile and personal computer manufactures, has been on the rocks for quite some time. A collapse in iPhone sales has seen the company struggle to maintain the produ.

1 FIN 4303 – Commercial Banking Assignment – Part 1

1

FIN 4303 – Commercial Banking Assignment – Part 1

Return on equity equals the product of the equity multiplier and return on assets. It measures the

net income produced for each dollar of equity capital. The equity multiplier reflects the amount of

leverage the bank uses to finance its assets. As the equity multiplier increases, the firm’s solvency risk

increases. Return on assets measures net income produced for each dollar of total assets. Return on

assets is the product of asset turnover and profit margin. Profit margin represents the firm’s ability to

control expenses. Asset turnover measures the ability to produce net income from assets. These ratios are

most useful when used as relative valuations against other firms in the commercial banking industry or

over time1.

1 Saunders, Anthony. Financial Markets and Institutions

Return on Assets

.5%

Asset Turnover

3%

Equity Multiplier

12.1 times

Return on Equity

6.3%

Profit Margin

17.3%

2

Figure 1:

JPMorgan Chase & Co. 15

Figure 2:

Industry 15

Figure 3:

Ratio Analysis 15

15 http://www.fdic.gov

3

Interpreting the Trends

From 2000 to 2001, JPMorgan Chase & Co.’s (JPM) ROE decreased resulting from a decline in

net income, and thus profit margin. The recession had a large impact on JPM in 2001. Net income

dropped due to unfavorable spreads, reductions in asset values, and less liquidity in equity markets2.

Losses on private equity investments and lower investment banking fees caused revenues to decline3. The

investment banking segment’s operating revenue shrank in reaction to reduced demand for M&A and

equity underwriting in the market4. The firm also incurred higher non-interest expenses, namely merger

and restructuring costs, related to the JP Morgan and Chase merger. JPM recognized higher than

expected charge-offs in consumer and loan portfolios, forcing them to increase their provisions for loan

losses5.

Over the next years, from 2002 to 2003, JPM was able to significantly increase its profit margin as

a result of a 64% decrease in the provisions for loan losses that had been increased the previous year.

This decrease reflects improvement in JPM’s previously troubled commercial loan portfolio, as well as a

higher volume of credit card securitizations. The higher profit margin caused ROE to increase from 1.6%

to 11.5%, and also resulted in an increased ROA. JPM’s total assets declined relative to equity, and they

had to turn to outside, more costly debt financing due to reduced demand for their loans; these actions

were at the root of the decreasing equity multiplier6.

From 2003 to 2004, JPM’s previously inflated ROE decreased from 11.5% to 2.9% as a result of a

large increase in equity capital, primarily the result of JPM’s merger with Bank One. Also as a result of

this merger, noninterest ...

European Investment Fund, Invest Europe : Data-driven insights about VC-backe...

European Investment Fund, Invest Europe : Data-driven insights about VC-backe...Amalist Client Services

EUR 51bn in nearly 9000 Venture Capital-invested firms in 2007-15 : analyse their characteristics as well as subsequent performance.

VC cannot change the business reality where some firms make it while others cannot, but it can be the deciding factor in a start-up’s road to success. venture capital may not be that impactful for low growth companies.

December 2019More Related Content

Similar to 2009angelanalysis

The Non-Dilutive Cash Injection: Selling Your Patents

Should you sell your patents for a cash infusion? If you have a patent portfolio, you may want to consider selling your patents to meet your liquidity needs. We analyze the steps to selling your patents, including developing the sales package and finding the right price.

2010 Global Location Trends Report

IBM-PLI\'s 4th Annual Global Location Trends Report covers a time of continued uncertainty and increased complexity for many organizations worldwide. The data in this new report also shows that the forces driving organizations to globally integrate are not letting up. Moreover, emerging trends signal the continuation and deepening of new business model approaches.

Trends in Healthcare Investments and Exits Report

Silicon Valley Bank’s annual healthcare M&A report, Trends in Healthcare Investments and Exits, examines the merger and acquisition and IPO activity of private, venture-backed bio-pharma and medical device companies.

The study found that healthcare IPOs tripled in 2013, leading to record potential IPO/big exit returns of $12.5 billion.

For a detailed analysis access the report at: http://www.svb.com/healthcare-report_2014/.

**Report updated on 8/4/2014

Turkish mid market m&a report, 2015

Review and analyses of mid market transactions in Turkish market.

Private Equity Trends through Q1 2010 -- from PitchBook

This is a great resource for anyone preparing a presentation or report who is looking for info on the state of the Private Equity industry. Thanks to PitchBook for the info

Investing in Ireland: A survey of foreign direct investors

Investing in Ireland: A survey of foreign direct investors is an Economist Intelligence Unit report sponsored by Matheson Ormsby Prentice. It examines the main factors that bring foreign direct investment to Ireland and the main ongoing challenges in attracting investment. Ronan Lyons was the report author. Aviva Freudmann and Jason Sumner were the editors.

Funding A Medical Device Startup In The Current Economy

A presentation delivered June 4, 2009 describing the impact of the economic crisis on venture and angel investing and common sense steps for fundraising for Medical Device Startups. No one is an expert now.

Angels Still Actively Stimulating The Economy

Funding for just a few entrepreneurs would mean that only a few companies have the chance of emergin...

Running head CURRENT ECONOMIC TRENDS1CURRENT ECONOMIC TRENDS .docx

Running head: CURRENT ECONOMIC TRENDS 1

CURRENT ECONOMIC TRENDS 3

Current Economic Trends

Jonathan Max Burkett

Capella University

January 13, 2019

Current Economic Trends

An economy is the management and utilization of a country’s resources to create the desired stability in terms of industry, money, and trade. Economies of countries rely on a network of purchase and sale of goods, taxes, and savings made by the central bank in terms of investment (Pons, 2000). A country’s economic stability is achieved when the wealth the industry and service sector are producing outweigh the money being spent. Trends refer to the socio-economic advancements of interests among commodities, music, films, fashion, and finance. Trends are mostly affected or influenced by affluent individuals or groups in society. In the 21st century trends have earned a position in the financial and economic sectors of the world as economy determining factors.

Industries are setups used to collect raw material of different kinds and manufacture and process them to attain a finer product than the original raw material. Around the world global consumerism has resulted in the construction of varieties of industries ranging from food, textiles, machinery, and agriculture. Industries may either be service or manufacture and processing. Modernization promotes the industrial revolution due to the demand for complex and efficient products (Baten, 2016). The availability of a vast selection of products has seen an annual influx of newer companies that offer better and more complex products. Economically there are two types of industries; cyclical and non-cyclical industries.

Cyclical industries are business or organization tied to market and price variations. Fluctuation within a business’s year affects the cyclical industry directly. Positive growth within the business boosts the business while negative growth results in the collapse of a business (Gordon & Robert J, 2000). Cyclical industries' activities move with an annual or seasonal business cycle. Examples of cyclical industries include the auto, airlines, housing, furniture, appliance, and financial services industries. Non-cyclical industries maintain their overall business performance all year round. Differences in productivity have little to no effect on business operations. Non-cyclical industries remain fairly constant over time. These include such industries as food, pharmaceuticals, utilities, and cosmetics.

American airlines have recently merged with US airlines expressing a steady growth percentage of 93%. Lawsuits, devastating weather patterns, and competition have seen the airline struggle through the past years with the stock prices dropping and insignificantly rising through it all. Apple, a technological giant amongst mobile and personal computer manufactures, has been on the rocks for quite some time. A collapse in iPhone sales has seen the company struggle to maintain the produ.

1 FIN 4303 – Commercial Banking Assignment – Part 1

1

FIN 4303 – Commercial Banking Assignment – Part 1

Return on equity equals the product of the equity multiplier and return on assets. It measures the

net income produced for each dollar of equity capital. The equity multiplier reflects the amount of

leverage the bank uses to finance its assets. As the equity multiplier increases, the firm’s solvency risk

increases. Return on assets measures net income produced for each dollar of total assets. Return on

assets is the product of asset turnover and profit margin. Profit margin represents the firm’s ability to

control expenses. Asset turnover measures the ability to produce net income from assets. These ratios are

most useful when used as relative valuations against other firms in the commercial banking industry or

over time1.

1 Saunders, Anthony. Financial Markets and Institutions

Return on Assets

.5%

Asset Turnover

3%

Equity Multiplier

12.1 times

Return on Equity

6.3%

Profit Margin

17.3%

2

Figure 1:

JPMorgan Chase & Co. 15

Figure 2:

Industry 15

Figure 3:

Ratio Analysis 15

15 http://www.fdic.gov

3

Interpreting the Trends

From 2000 to 2001, JPMorgan Chase & Co.’s (JPM) ROE decreased resulting from a decline in

net income, and thus profit margin. The recession had a large impact on JPM in 2001. Net income

dropped due to unfavorable spreads, reductions in asset values, and less liquidity in equity markets2.

Losses on private equity investments and lower investment banking fees caused revenues to decline3. The

investment banking segment’s operating revenue shrank in reaction to reduced demand for M&A and

equity underwriting in the market4. The firm also incurred higher non-interest expenses, namely merger

and restructuring costs, related to the JP Morgan and Chase merger. JPM recognized higher than

expected charge-offs in consumer and loan portfolios, forcing them to increase their provisions for loan

losses5.

Over the next years, from 2002 to 2003, JPM was able to significantly increase its profit margin as

a result of a 64% decrease in the provisions for loan losses that had been increased the previous year.

This decrease reflects improvement in JPM’s previously troubled commercial loan portfolio, as well as a

higher volume of credit card securitizations. The higher profit margin caused ROE to increase from 1.6%

to 11.5%, and also resulted in an increased ROA. JPM’s total assets declined relative to equity, and they

had to turn to outside, more costly debt financing due to reduced demand for their loans; these actions

were at the root of the decreasing equity multiplier6.

From 2003 to 2004, JPM’s previously inflated ROE decreased from 11.5% to 2.9% as a result of a

large increase in equity capital, primarily the result of JPM’s merger with Bank One. Also as a result of

this merger, noninterest ...

European Investment Fund, Invest Europe : Data-driven insights about VC-backe...

European Investment Fund, Invest Europe : Data-driven insights about VC-backe...Amalist Client Services

EUR 51bn in nearly 9000 Venture Capital-invested firms in 2007-15 : analyse their characteristics as well as subsequent performance.

VC cannot change the business reality where some firms make it while others cannot, but it can be the deciding factor in a start-up’s road to success. venture capital may not be that impactful for low growth companies.

December 2019Similar to 2009angelanalysis (20)

Venture Capital Investment Q4 04 – MoneyTree Survey

Venture Capital Investment Q4 04 – MoneyTree Survey

The Non-Dilutive Cash Injection: Selling Your Patents

The Non-Dilutive Cash Injection: Selling Your Patents

Venture Capital Investments Q1 ’06 – MoneyTree Release

Venture Capital Investments Q1 ’06 – MoneyTree Release

Venture Capital Investment Q3 05 - MoneyTree Survey Results

Venture Capital Investment Q3 05 - MoneyTree Survey Results

Private Equity Trends through Q1 2010 -- from PitchBook

Private Equity Trends through Q1 2010 -- from PitchBook

Investing in Ireland: A survey of foreign direct investors

Investing in Ireland: A survey of foreign direct investors

Funding A Medical Device Startup In The Current Economy

Funding A Medical Device Startup In The Current Economy

Running head CURRENT ECONOMIC TRENDS1CURRENT ECONOMIC TRENDS .docx

Running head CURRENT ECONOMIC TRENDS1CURRENT ECONOMIC TRENDS .docx

1 FIN 4303 – Commercial Banking Assignment – Part 1

1 FIN 4303 – Commercial Banking Assignment – Part 1

European Investment Fund, Invest Europe : Data-driven insights about VC-backe...

European Investment Fund, Invest Europe : Data-driven insights about VC-backe...

More from Jose Gonzalez

More from Jose Gonzalez (20)

Why i believe in angels atlantic business magazine 01 09_0

Why i believe in angels atlantic business magazine 01 09_0

Thebeststartuppitchdeckhowtopresenttoangelsvcs 130706124526-phpapp01

Thebeststartuppitchdeckhowtopresenttoangelsvcs 130706124526-phpapp01

Recently uploaded

Embracing GenAI - A Strategic Imperative

Artificial Intelligence (AI) technologies such as Generative AI, Image Generators and Large Language Models have had a dramatic impact on teaching, learning and assessment over the past 18 months. The most immediate threat AI posed was to Academic Integrity with Higher Education Institutes (HEIs) focusing their efforts on combating the use of GenAI in assessment. Guidelines were developed for staff and students, policies put in place too. Innovative educators have forged paths in the use of Generative AI for teaching, learning and assessments leading to pockets of transformation springing up across HEIs, often with little or no top-down guidance, support or direction.

This Gasta posits a strategic approach to integrating AI into HEIs to prepare staff, students and the curriculum for an evolving world and workplace. We will highlight the advantages of working with these technologies beyond the realm of teaching, learning and assessment by considering prompt engineering skills, industry impact, curriculum changes, and the need for staff upskilling. In contrast, not engaging strategically with Generative AI poses risks, including falling behind peers, missed opportunities and failing to ensure our graduates remain employable. The rapid evolution of AI technologies necessitates a proactive and strategic approach if we are to remain relevant.

Acetabularia Information For Class 9 .docx

Acetabularia acetabulum is a single-celled green alga that in its vegetative state is morphologically differentiated into a basal rhizoid and an axially elongated stalk, which bears whorls of branching hairs. The single diploid nucleus resides in the rhizoid.

Synthetic Fiber Construction in lab .pptx

Synthetic fiber production is a fascinating and complex field that blends chemistry, engineering, and environmental science. By understanding these aspects, students can gain a comprehensive view of synthetic fiber production, its impact on society and the environment, and the potential for future innovations. Synthetic fibers play a crucial role in modern society, impacting various aspects of daily life, industry, and the environment. ynthetic fibers are integral to modern life, offering a range of benefits from cost-effectiveness and versatility to innovative applications and performance characteristics. While they pose environmental challenges, ongoing research and development aim to create more sustainable and eco-friendly alternatives. Understanding the importance of synthetic fibers helps in appreciating their role in the economy, industry, and daily life, while also emphasizing the need for sustainable practices and innovation.

Mule 4.6 & Java 17 Upgrade | MuleSoft Mysore Meetup #46

Mule 4.6 & Java 17 Upgrade | MuleSoft Mysore Meetup #46

Event Link:-

https://meetups.mulesoft.com/events/details/mulesoft-mysore-presents-exploring-gemini-ai-and-integration-with-mulesoft/

Agenda

● Java 17 Upgrade Overview

● Why and by when do customers need to upgrade to Java 17?

● Is there any immediate impact to upgrading to Mule Runtime 4.6 and beyond?

● Which MuleSoft products are in scope?

For Upcoming Meetups Join Mysore Meetup Group - https://meetups.mulesoft.com/mysore/

YouTube:- youtube.com/@mulesoftmysore

Mysore WhatsApp group:- https://chat.whatsapp.com/EhqtHtCC75vCAX7gaO842N

Speaker:-

Shubham Chaurasia - https://www.linkedin.com/in/shubhamchaurasia1/

Priya Shaw - https://www.linkedin.com/in/priya-shaw

Organizers:-

Shubham Chaurasia - https://www.linkedin.com/in/shubhamchaurasia1/

Giridhar Meka - https://www.linkedin.com/in/giridharmeka

Priya Shaw - https://www.linkedin.com/in/priya-shaw

Shyam Raj Prasad-

https://www.linkedin.com/in/shyam-raj-prasad/

Welcome to TechSoup New Member Orientation and Q&A (May 2024).pdf

In this webinar you will learn how your organization can access TechSoup's wide variety of product discount and donation programs. From hardware to software, we'll give you a tour of the tools available to help your nonprofit with productivity, collaboration, financial management, donor tracking, security, and more.

The Challenger.pdf DNHS Official Publication

Read| The latest issue of The Challenger is here! We are thrilled to announce that our school paper has qualified for the NATIONAL SCHOOLS PRESS CONFERENCE (NSPC) 2024. Thank you for your unwavering support and trust. Dive into the stories that made us stand out!

Model Attribute Check Company Auto Property

In Odoo, the multi-company feature allows you to manage multiple companies within a single Odoo database instance. Each company can have its own configurations while still sharing common resources such as products, customers, and suppliers.

Chapter 3 - Islamic Banking Products and Services.pptx

Chapter 3 - Islamic Banking Products and Services.pptxMohd Adib Abd Muin, Senior Lecturer at Universiti Utara Malaysia

This slide is prepared for master's students (MIFB & MIBS) UUM. May it be useful to all.June 3, 2024 Anti-Semitism Letter Sent to MIT President Kornbluth and MIT Cor...

Letter from the Congress of the United States regarding Anti-Semitism sent June 3rd to MIT President Sally Kornbluth, MIT Corp Chair, Mark Gorenberg

Dear Dr. Kornbluth and Mr. Gorenberg,

The US House of Representatives is deeply concerned by ongoing and pervasive acts of antisemitic

harassment and intimidation at the Massachusetts Institute of Technology (MIT). Failing to act decisively to ensure a safe learning environment for all students would be a grave dereliction of your responsibilities as President of MIT and Chair of the MIT Corporation.

This Congress will not stand idly by and allow an environment hostile to Jewish students to persist. The House believes that your institution is in violation of Title VI of the Civil Rights Act, and the inability or

unwillingness to rectify this violation through action requires accountability.

Postsecondary education is a unique opportunity for students to learn and have their ideas and beliefs challenged. However, universities receiving hundreds of millions of federal funds annually have denied

students that opportunity and have been hijacked to become venues for the promotion of terrorism, antisemitic harassment and intimidation, unlawful encampments, and in some cases, assaults and riots.

The House of Representatives will not countenance the use of federal funds to indoctrinate students into hateful, antisemitic, anti-American supporters of terrorism. Investigations into campus antisemitism by the Committee on Education and the Workforce and the Committee on Ways and Means have been expanded into a Congress-wide probe across all relevant jurisdictions to address this national crisis. The undersigned Committees will conduct oversight into the use of federal funds at MIT and its learning environment under authorities granted to each Committee.

• The Committee on Education and the Workforce has been investigating your institution since December 7, 2023. The Committee has broad jurisdiction over postsecondary education, including its compliance with Title VI of the Civil Rights Act, campus safety concerns over disruptions to the learning environment, and the awarding of federal student aid under the Higher Education Act.

• The Committee on Oversight and Accountability is investigating the sources of funding and other support flowing to groups espousing pro-Hamas propaganda and engaged in antisemitic harassment and intimidation of students. The Committee on Oversight and Accountability is the principal oversight committee of the US House of Representatives and has broad authority to investigate “any matter” at “any time” under House Rule X.

• The Committee on Ways and Means has been investigating several universities since November 15, 2023, when the Committee held a hearing entitled From Ivory Towers to Dark Corners: Investigating the Nexus Between Antisemitism, Tax-Exempt Universities, and Terror Financing. The Committee followed the hearing with letters to those institutions on January 10, 202

CACJapan - GROUP Presentation 1- Wk 4.pdf

Macroeconomics- Movie Location

This will be used as part of your Personal Professional Portfolio once graded.

Objective:

Prepare a presentation or a paper using research, basic comparative analysis, data organization and application of economic information. You will make an informed assessment of an economic climate outside of the United States to accomplish an entertainment industry objective.

Introduction to AI for Nonprofits with Tapp Network

Dive into the world of AI! Experts Jon Hill and Tareq Monaur will guide you through AI's role in enhancing nonprofit websites and basic marketing strategies, making it easy to understand and apply.

The French Revolution Class 9 Study Material pdf free download

The French Revolution, which began in 1789, was a period of radical social and political upheaval in France. It marked the decline of absolute monarchies, the rise of secular and democratic republics, and the eventual rise of Napoleon Bonaparte. This revolutionary period is crucial in understanding the transition from feudalism to modernity in Europe.

For more information, visit-www.vavaclasses.com

Francesca Gottschalk - How can education support child empowerment.pptx

Francesca Gottschalk from the OECD’s Centre for Educational Research and Innovation presents at the Ask an Expert Webinar: How can education support child empowerment?

CLASS 11 CBSE B.St Project AIDS TO TRADE - INSURANCE

Class 11 CBSE Business Studies Project ( AIDS TO TRADE - INSURANCE)

Recently uploaded (20)

Mule 4.6 & Java 17 Upgrade | MuleSoft Mysore Meetup #46

Mule 4.6 & Java 17 Upgrade | MuleSoft Mysore Meetup #46

Welcome to TechSoup New Member Orientation and Q&A (May 2024).pdf

Welcome to TechSoup New Member Orientation and Q&A (May 2024).pdf

Chapter 3 - Islamic Banking Products and Services.pptx

Chapter 3 - Islamic Banking Products and Services.pptx

June 3, 2024 Anti-Semitism Letter Sent to MIT President Kornbluth and MIT Cor...

June 3, 2024 Anti-Semitism Letter Sent to MIT President Kornbluth and MIT Cor...

Adversarial Attention Modeling for Multi-dimensional Emotion Regression.pdf

Adversarial Attention Modeling for Multi-dimensional Emotion Regression.pdf

Introduction to AI for Nonprofits with Tapp Network

Introduction to AI for Nonprofits with Tapp Network

The French Revolution Class 9 Study Material pdf free download

The French Revolution Class 9 Study Material pdf free download

Francesca Gottschalk - How can education support child empowerment.pptx

Francesca Gottschalk - How can education support child empowerment.pptx

CLASS 11 CBSE B.St Project AIDS TO TRADE - INSURANCE

CLASS 11 CBSE B.St Project AIDS TO TRADE - INSURANCE

2009angelanalysis

- 1. Center for Venture Research Director, Jeffrey Sohl http://wsbe.unh.edu/cvr (603)862-3341 THE ANGEL INVESTOR MARKET IN 2009: HOLDING STEADY BUT CHANGES IN SEED AND STARTUP INVESTMENTS Market Size The angel investor market in 2009, on the heels of a considerable contraction in investment dollars in 2008, exhibited a modest decrease in investment dollars but little change in the number of investments. Total investments in 2009 were $17.6 billion, a decrease of 8.3% over 2008, according to the Center for Venture Research at the University of New Hampshire. However, a total of 57,225 entrepreneurial ventures received angel funding in 2009, a reserved 3.1% increase from 2008, and the number of active investors in 2009 was 259,480 individuals, virtually unchanged from 2008. The small decline in total dollars, coupled with the increase in investments resulted in a smaller deal size for 2009 (a decline in deal size of 11.1% from 2008). These data indicate that while angels have not significantly decreased their investment activity, they are committing less dollars resulting from lower valuations and a cautious approach to investing. Significant changes did occur in the critical seed and start-up stage investment landscape. Sector Analysis Software accounted for the largest share of investments, with 19% of total angel investments in 2009, followed by Healthcare Services/Medical Devices and Equipment (17%), Industrial/Energy (17%), Retail (9%) and Biotech (8%). Industrial/Energy investing is a significant increase from 2008, reflecting a growing appetite for green technologies. Sector Software Healthcare Industrial/Energy Retail Biotech Fin Services Deals 19% 17% 17% 9% 8% 5% Return Rates Mergers and acquisitions represented 54% of the angel exits, and bankruptcies accounted for 40% of the exits in 2009. Annual returns for angel’s exits (mergers and acquisitions and IPOs) were between 23% and 38%, however, these returns were quite variable. Stage Angels decreased their investments of seed and start-up capital, with 35% of 2009 angel investments in the seed and start-up stage, a decrease of 10% from 2008. Angels also exhibited an increased interest in post-seed/start-up investing with 62% of investments in the early and

- 2. expansion stage, an increase from 2008. New, first sequence, investments represented 47% of 2009 angel activity, a significant decline from the last two years. This decrease in seed/start-up stage and first sequence investing is the unfortunate reality of a difficult economy and little or no support for angels, or the companies they invest in, from the various legislative initiatives enacted to stimulate the economy. Job Growth Angel investments continue to be a significant contributor to job growth with the creation of 250,000 new jobs in the United States in 2009, or 4.4 jobs per angel investment. This represents approximately 5% of new jobs in the US in 2009. Yield Rates The yield (acceptance) rate is defined as the percentage of investment opportunities that are brought to the attention of investors that result in an investment. In 2009 the yield rate was 14.5%, similar to the 2008 yield rate and solidifying a decline in yield rates that began in 2005 (23% yield rate). This stabilization of the yield rate indicates a cautious approach to investing, reduces the concern of an unsustainable investment rate, but also reflects an increased difficulty for entrepreneurs to secure angel funding. Women and Minority Entrepreneurs and Investors In 2009 women angels represented 11.3% of the angel market. Women-owned ventures accounted for 21% of the entrepreneurs that are seeking angel capital and 9.4% of these women entrepreneurs received angel investment in 2009. Both the number of women seeking angel capital and the percentage that receives angel investments are low compared to the overall market. These data indicate that when women do seek angel capital they lag behind the market yield rate by 5%. Minority angels accounted for 3.5% of the angel population and minority-owned firms represented 6.2% of the entrepreneurs that presented their business concept to angels. The yield rate for these minority-owned firms was 14.2%, which for the third straight year is in line with market yield rates. However, the small percentage of minority-owned firms seeking angel capital is of concern. The Center for Venture Research (CVR) has been conducting research on the angel market since 1980. The CVR’s mission is to provide an understanding of the angel market through quality research. The CVR is dedicated to providing reliable and timely information on the angel market to entrepreneurs, private investors and public policymakers. The Center for Venture Research would like to thank all the angel groups and individual angels that participate in our research efforts. The response rate for this survey was 24%. The Center for Venture Research also provides seminars to angels and entrepreneurs, and research reports on aspects of the angel market are also available. For more information visit http://wsbe.unh.edu/cvr or contact the CVR at 603-862-3341. The correct citation is: Jeffrey Sohl, “The Angel Investor Market in 2009: Holding Steady but Changes in Seed and Startup Investments”, Center for Venture Research, March 31, 2010.