This document discusses corporate control and governance. It covers several topics:

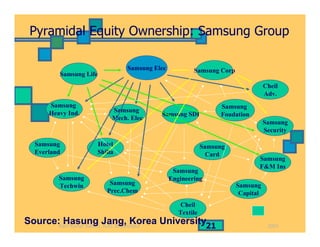

- The increasing power and influence of multinational corporations globally and within countries.

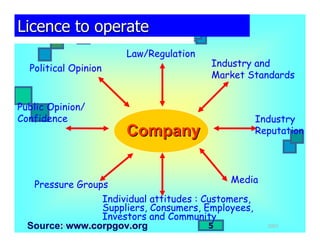

- The various stakeholders that influence a company's "license to operate" including shareholders, customers, employees, and communities.

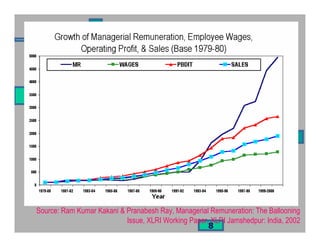

- Whether companies in the 21st century can focus only on shareholders and financial measures, or need to consider other stakeholders and transparency.

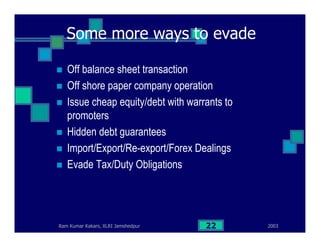

- Examples of governance issues like related party transactions and wealth transfers in some Indian companies.

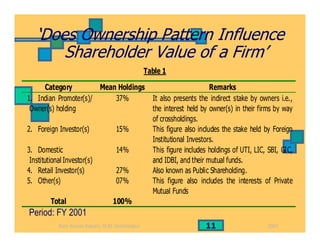

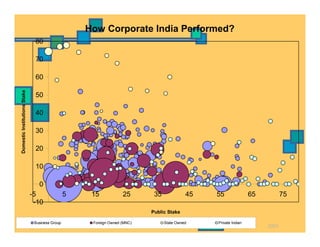

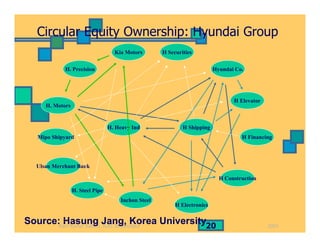

- How ownership patterns in India differ between foreign, state-owned, business group-controlled and private companies and how this influences performance.

- Some of the governance reforms and new regulations proposed or implemented in India.