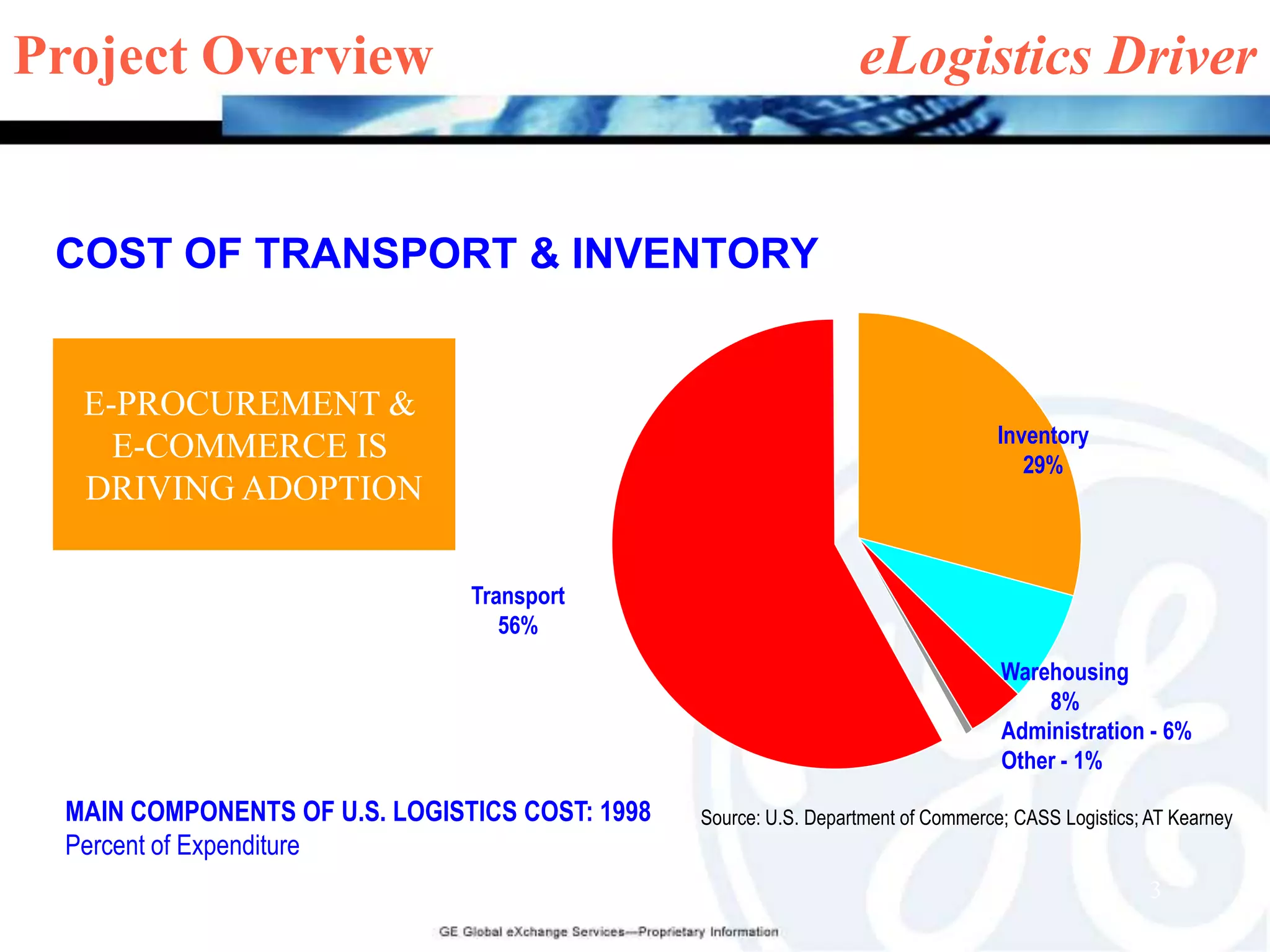

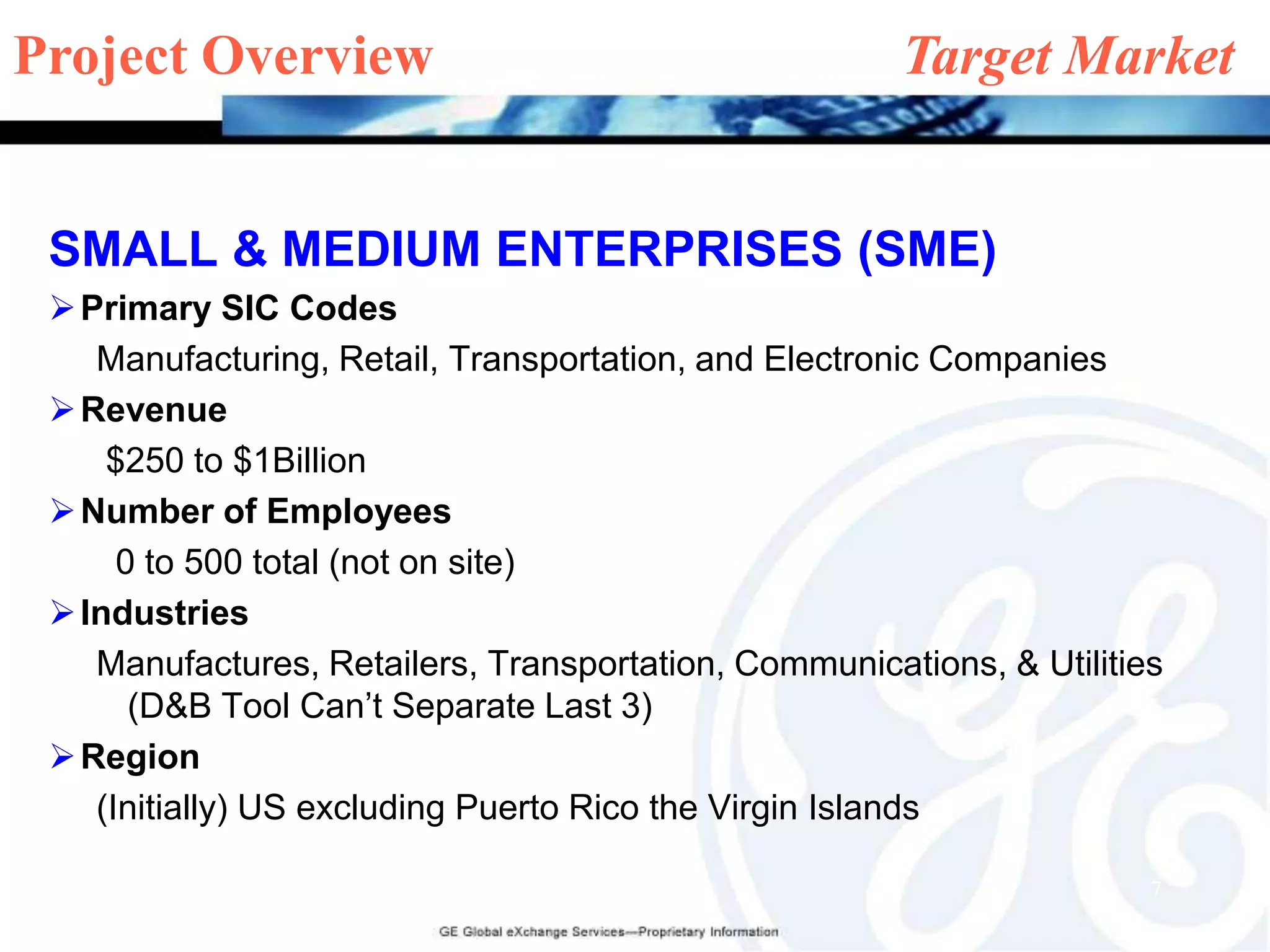

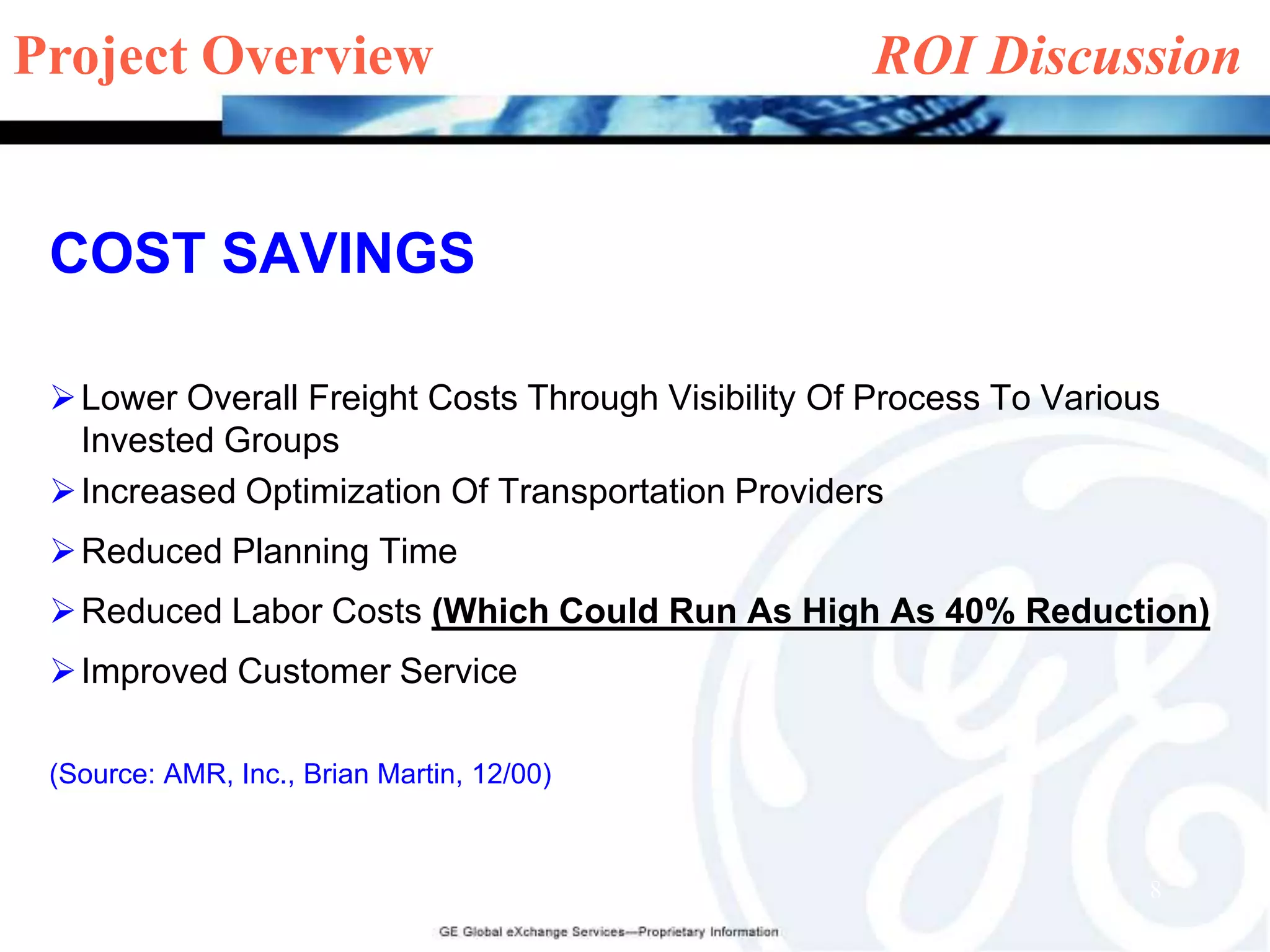

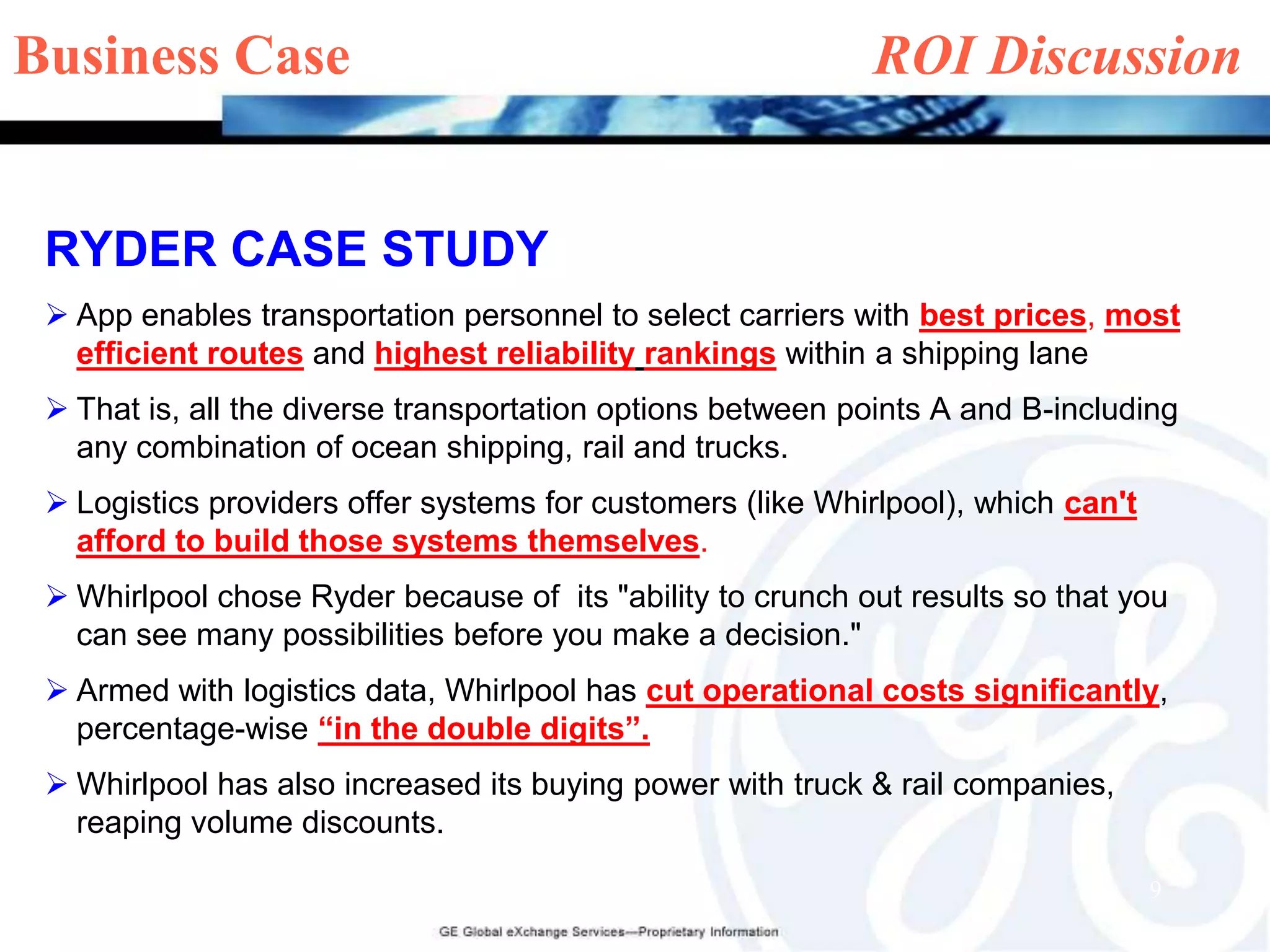

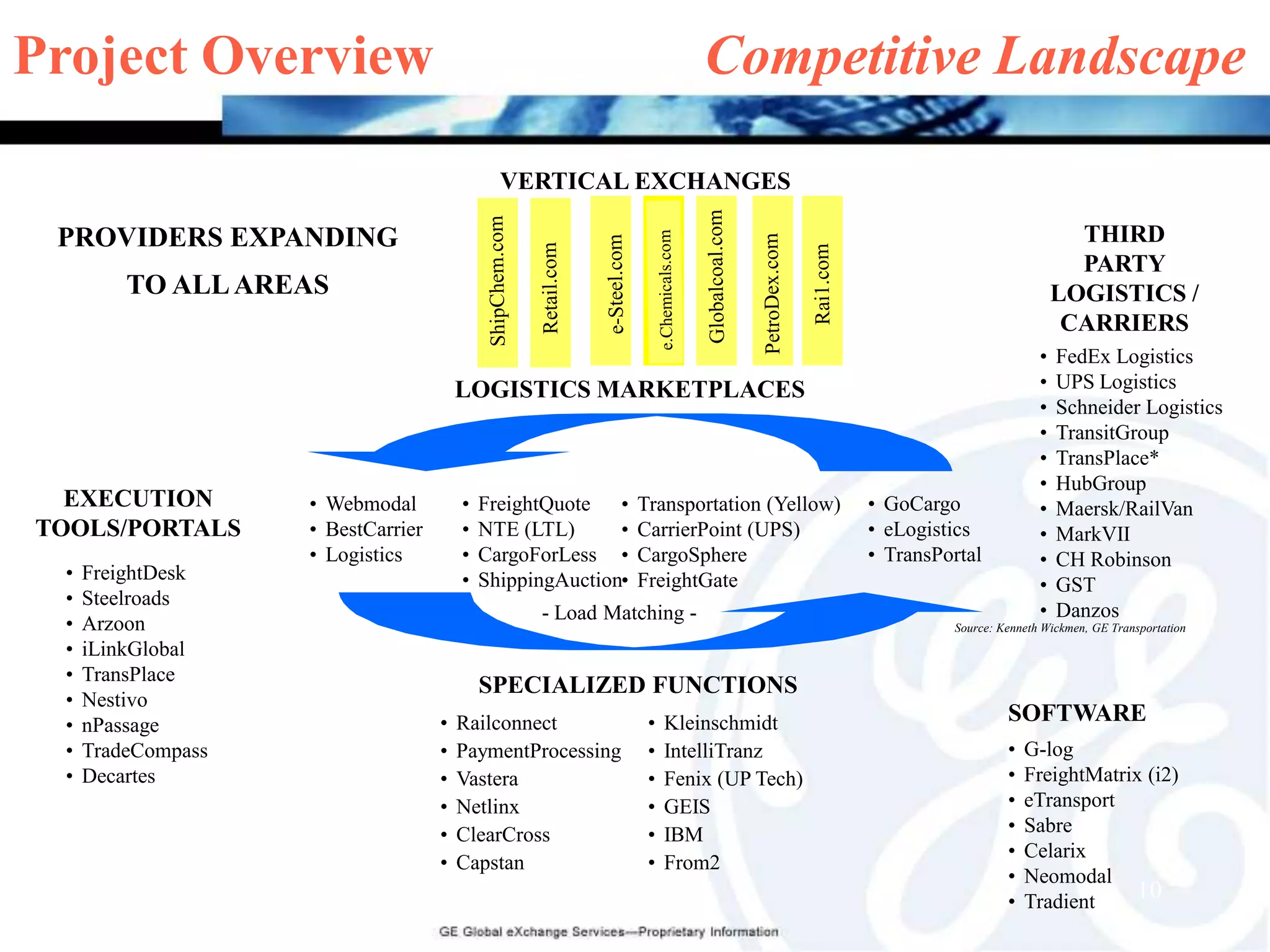

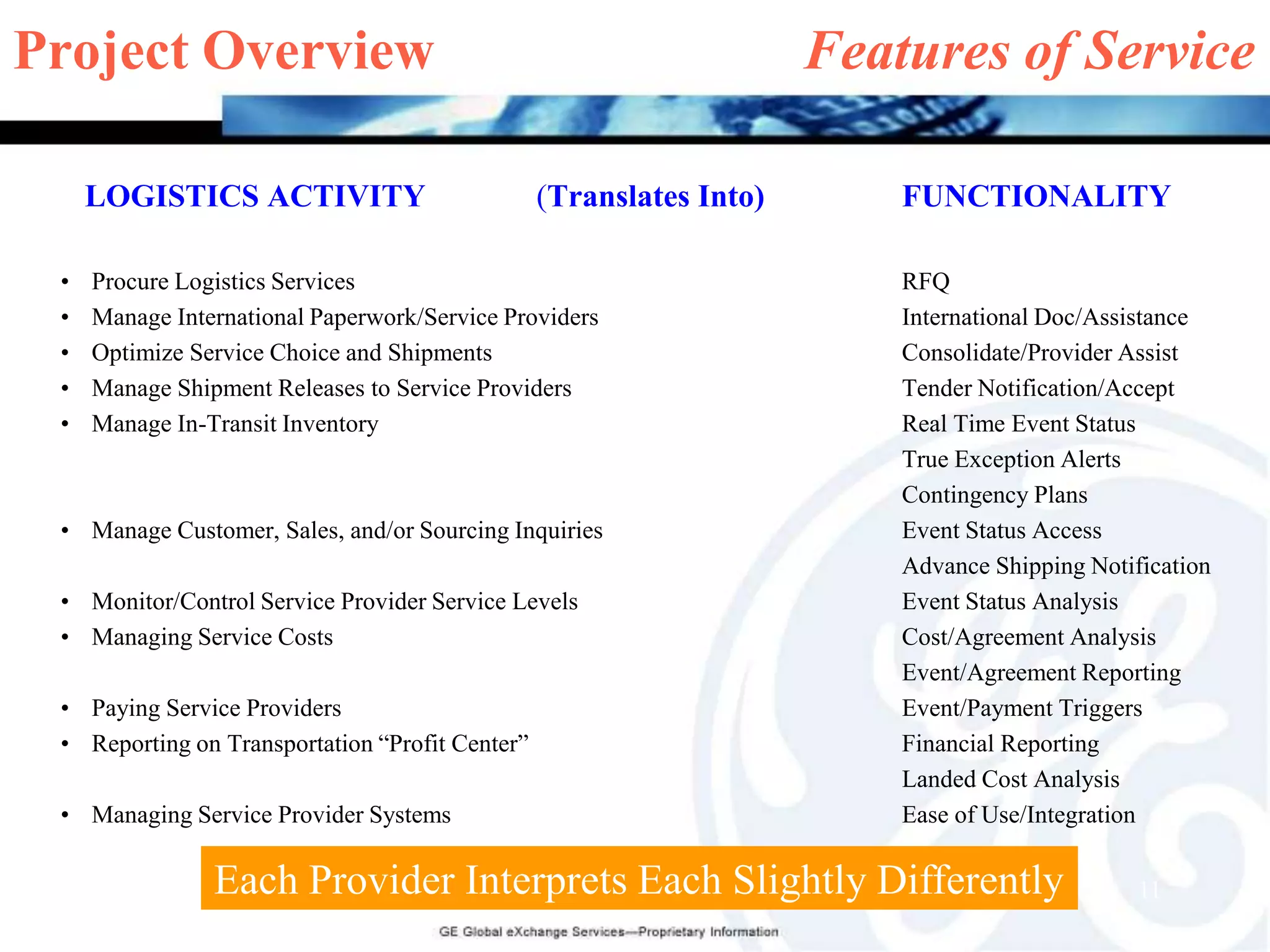

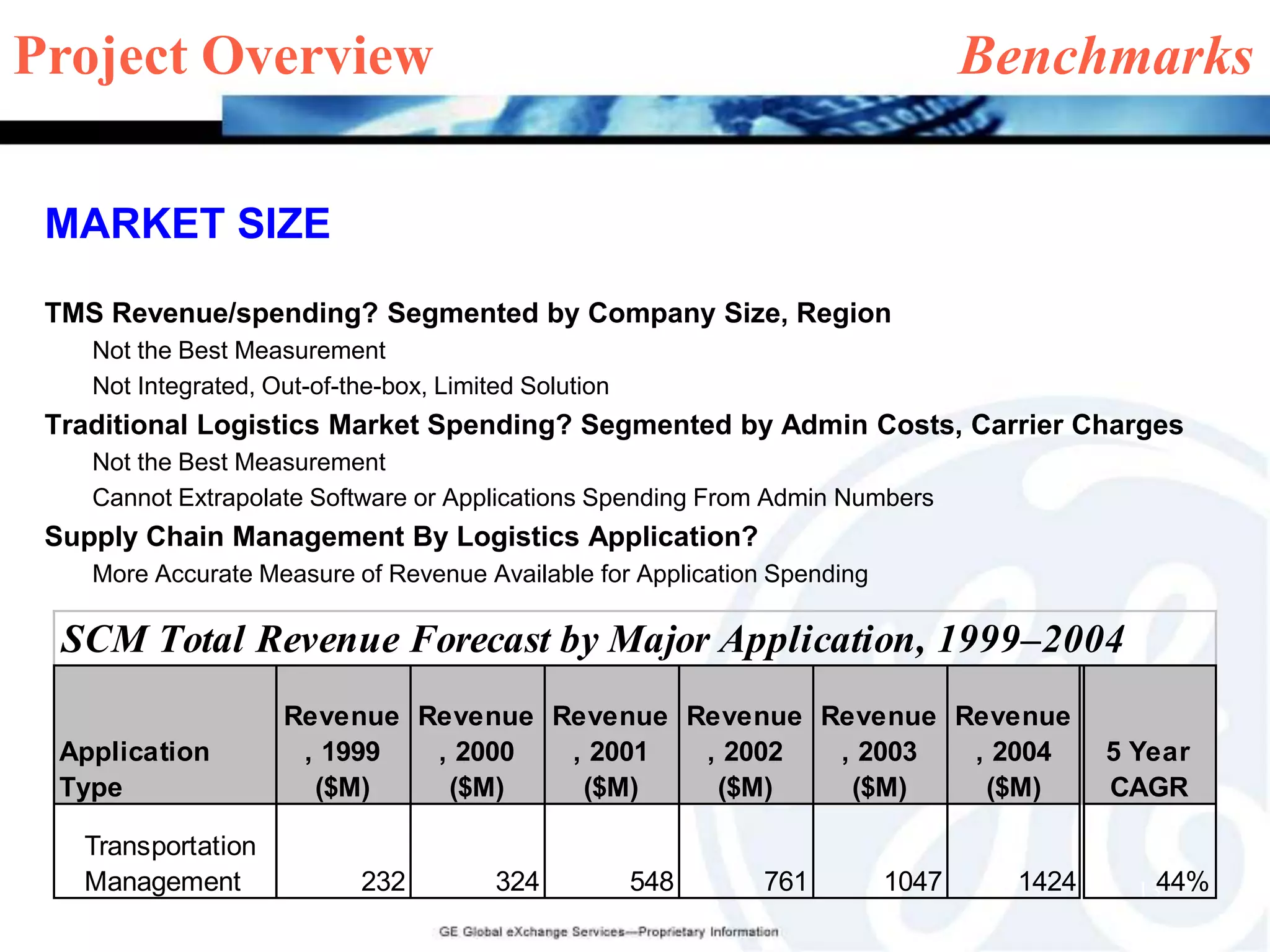

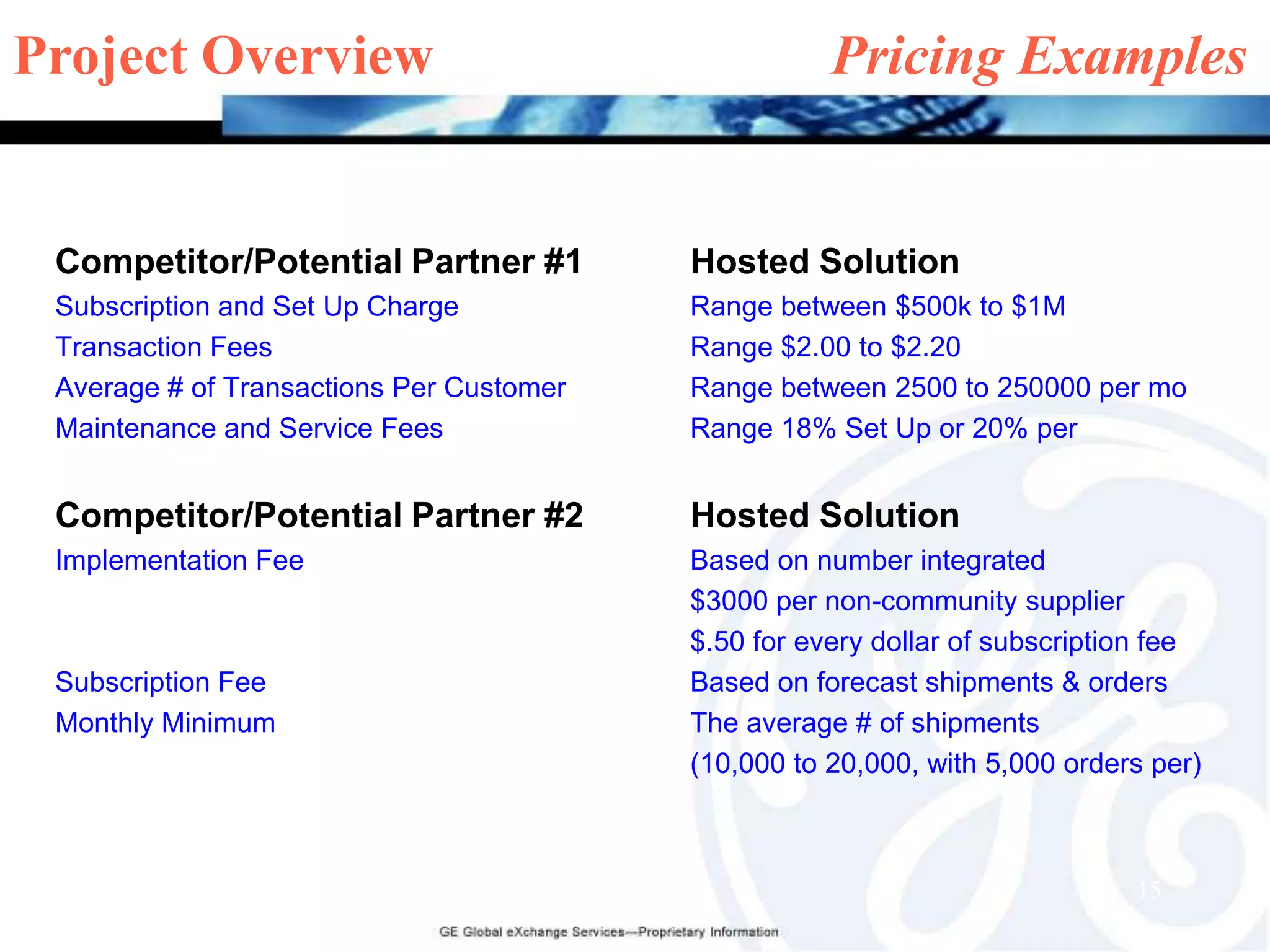

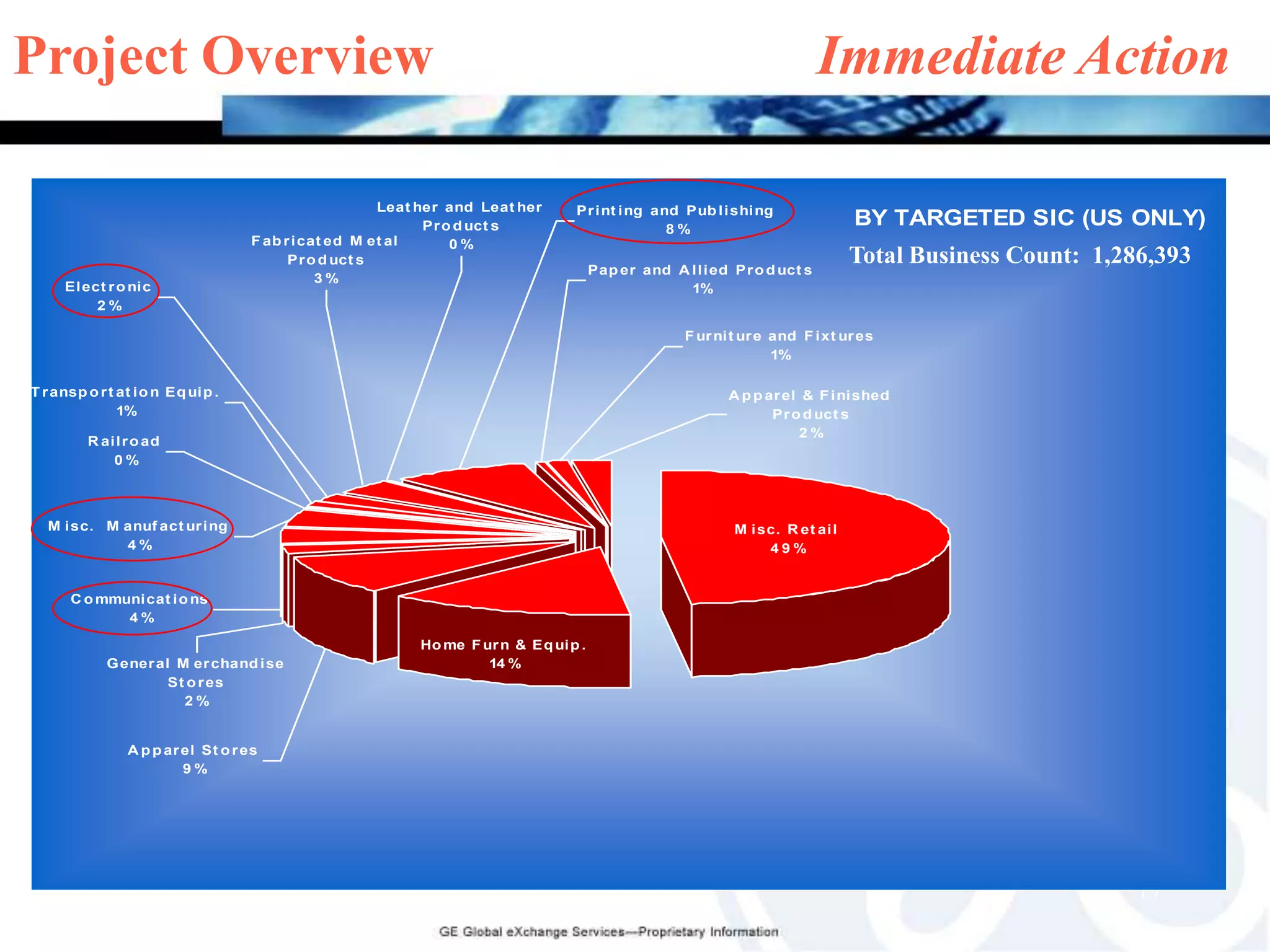

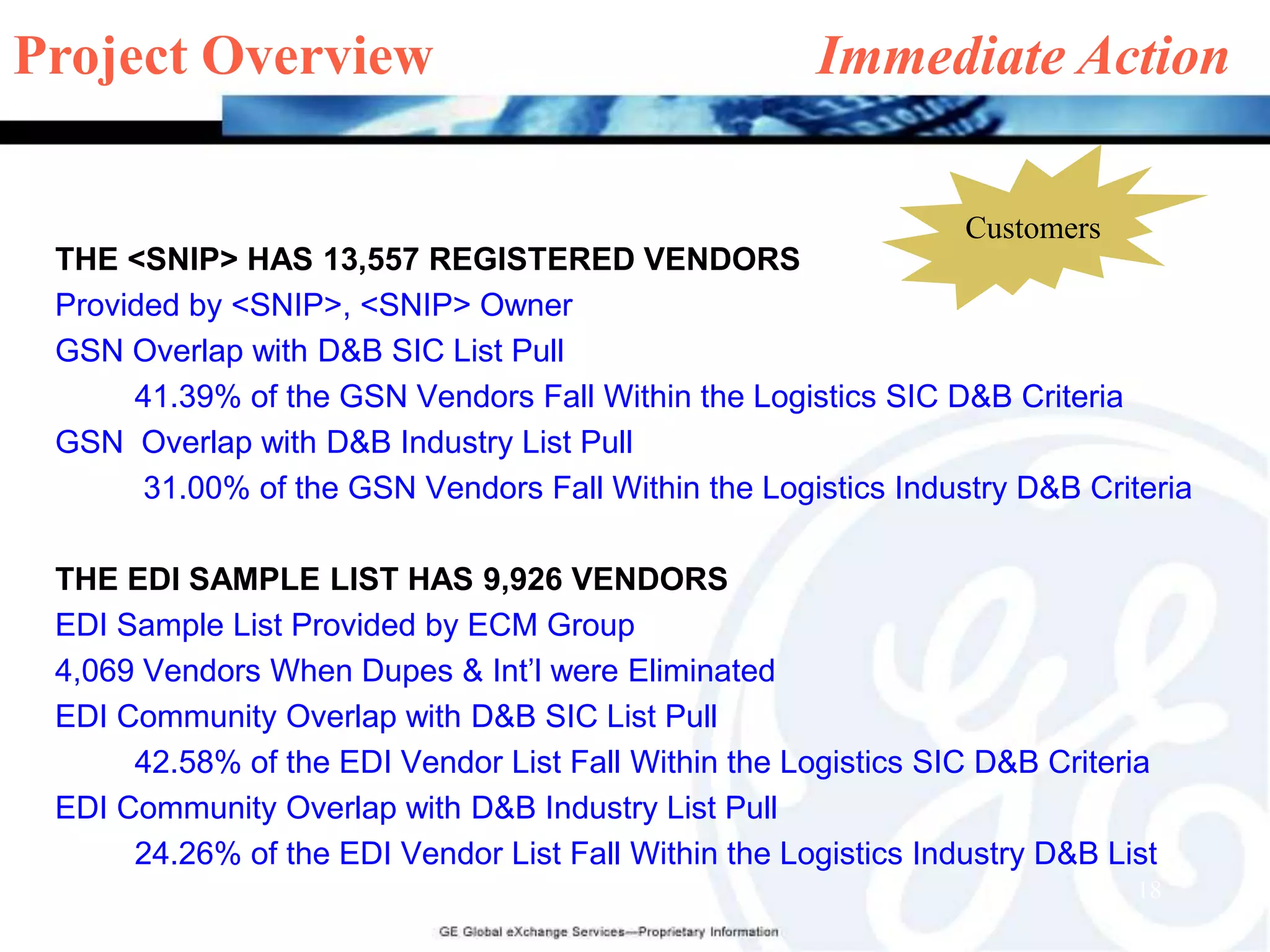

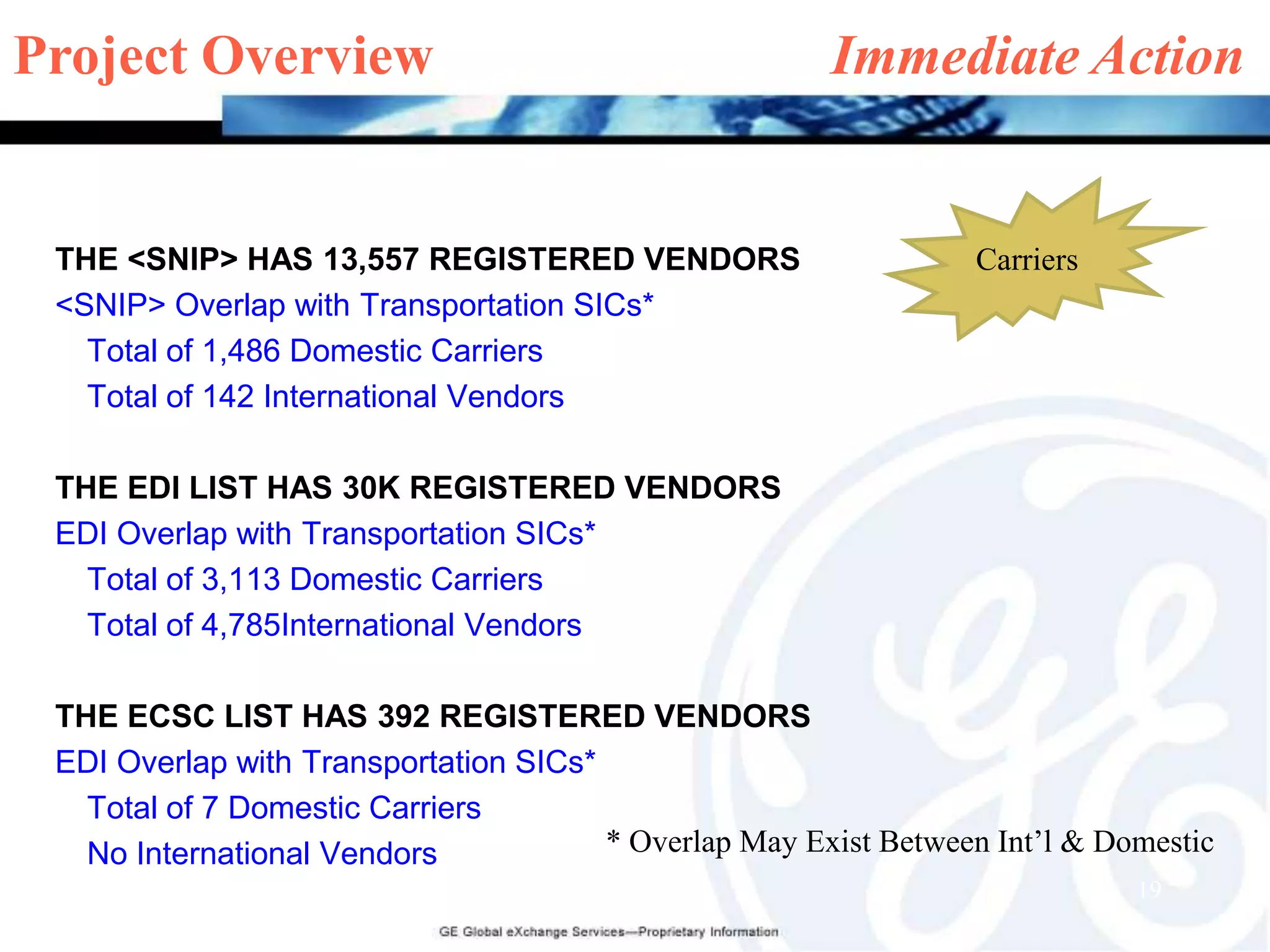

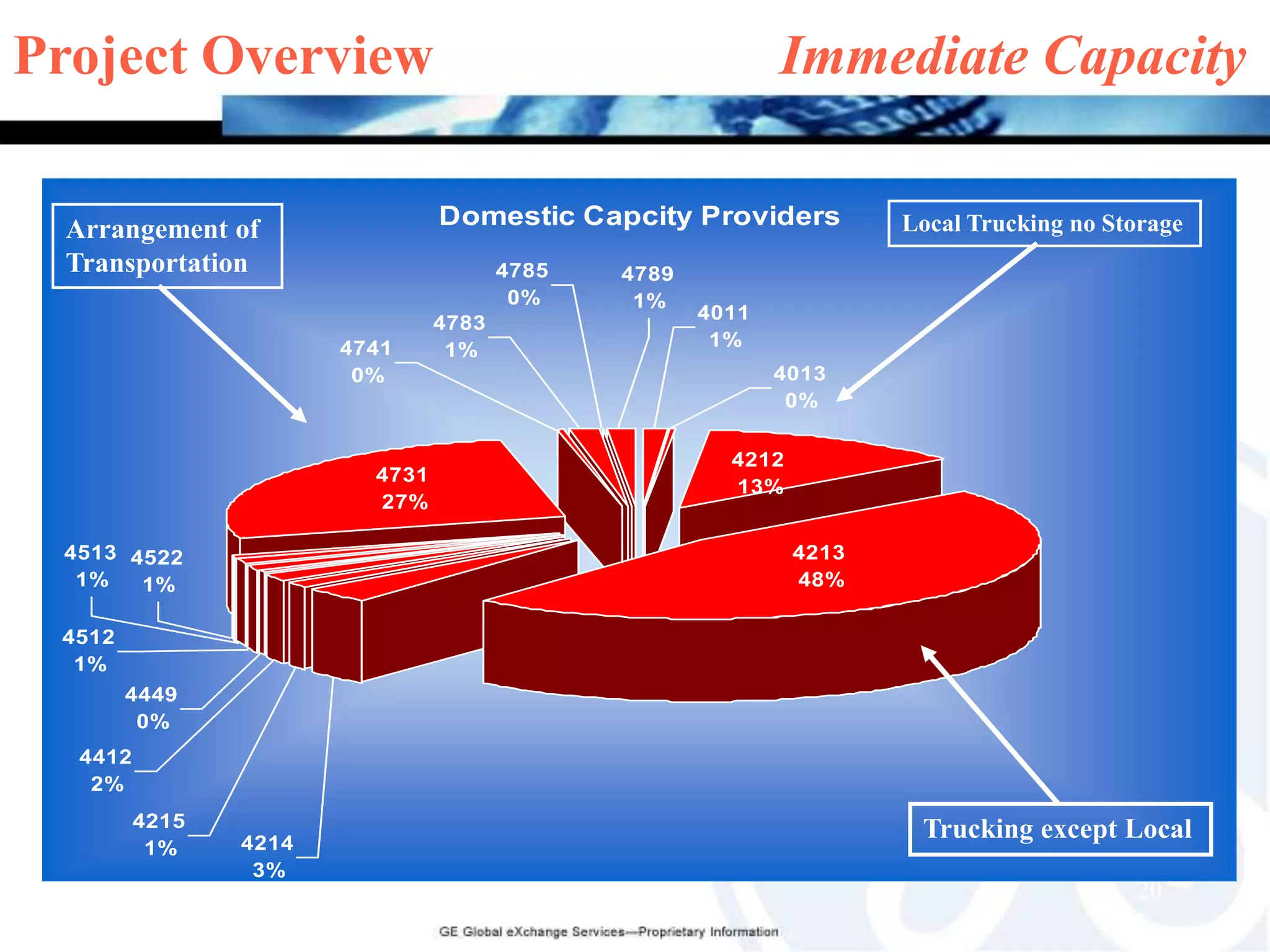

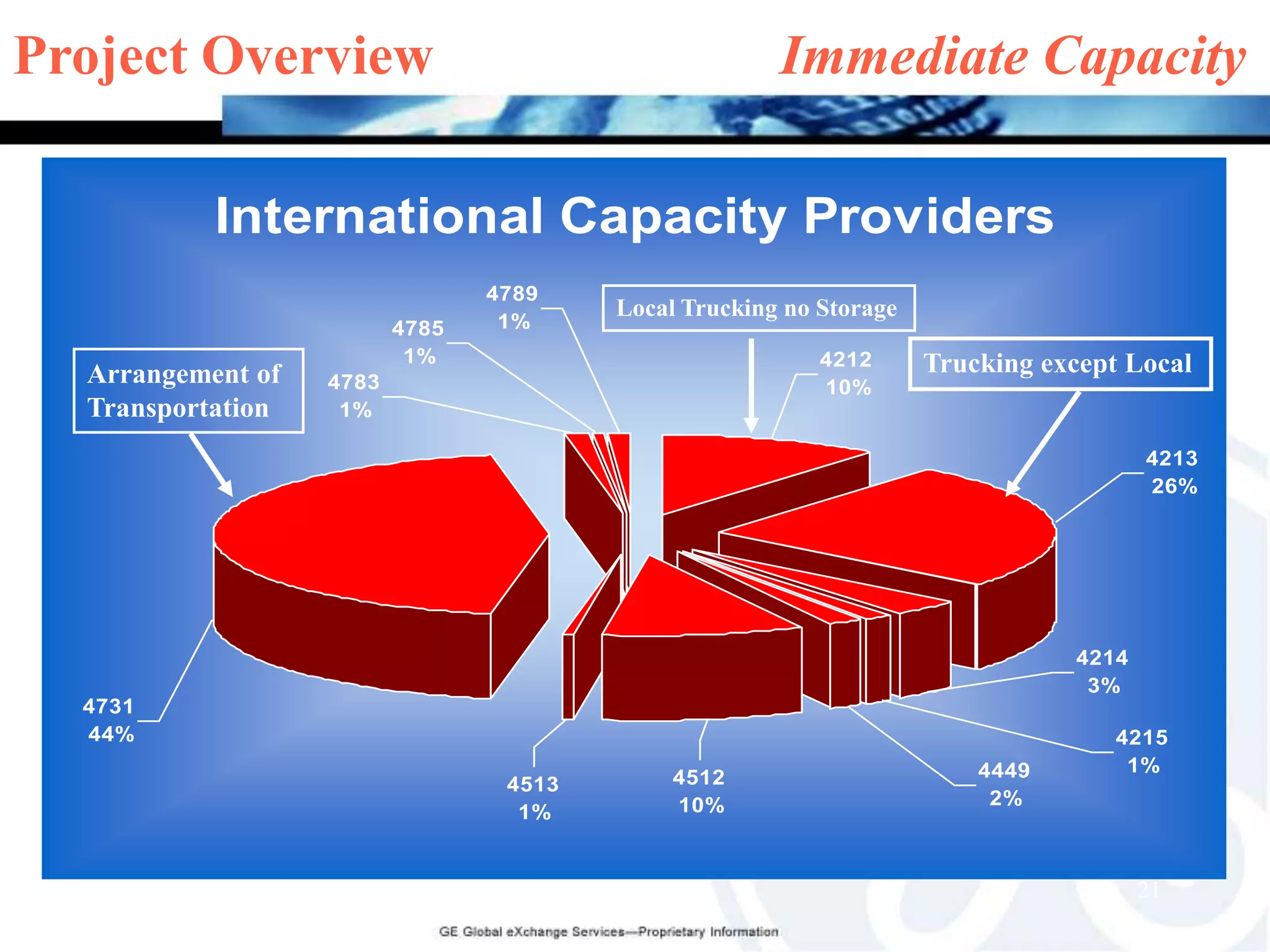

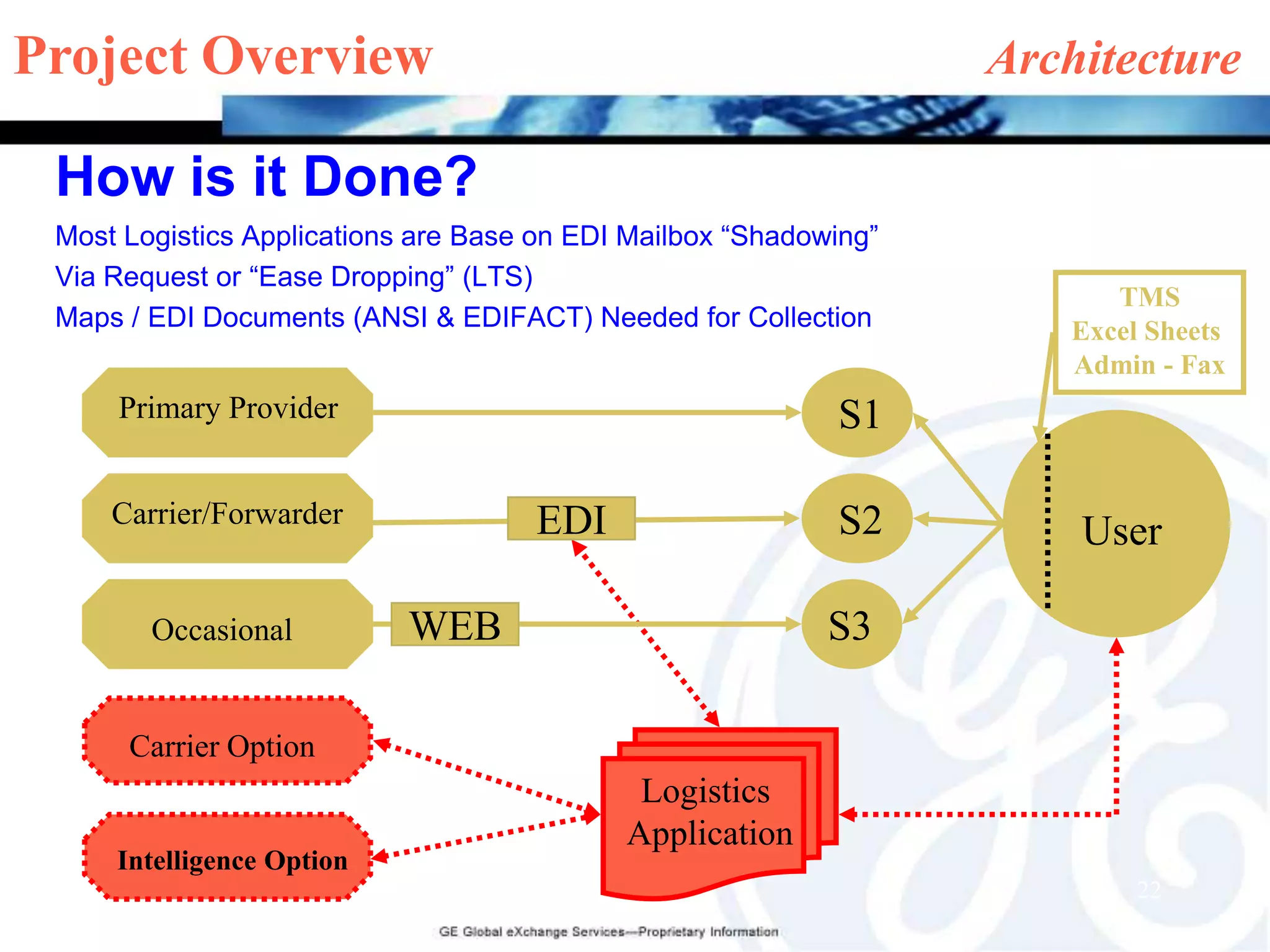

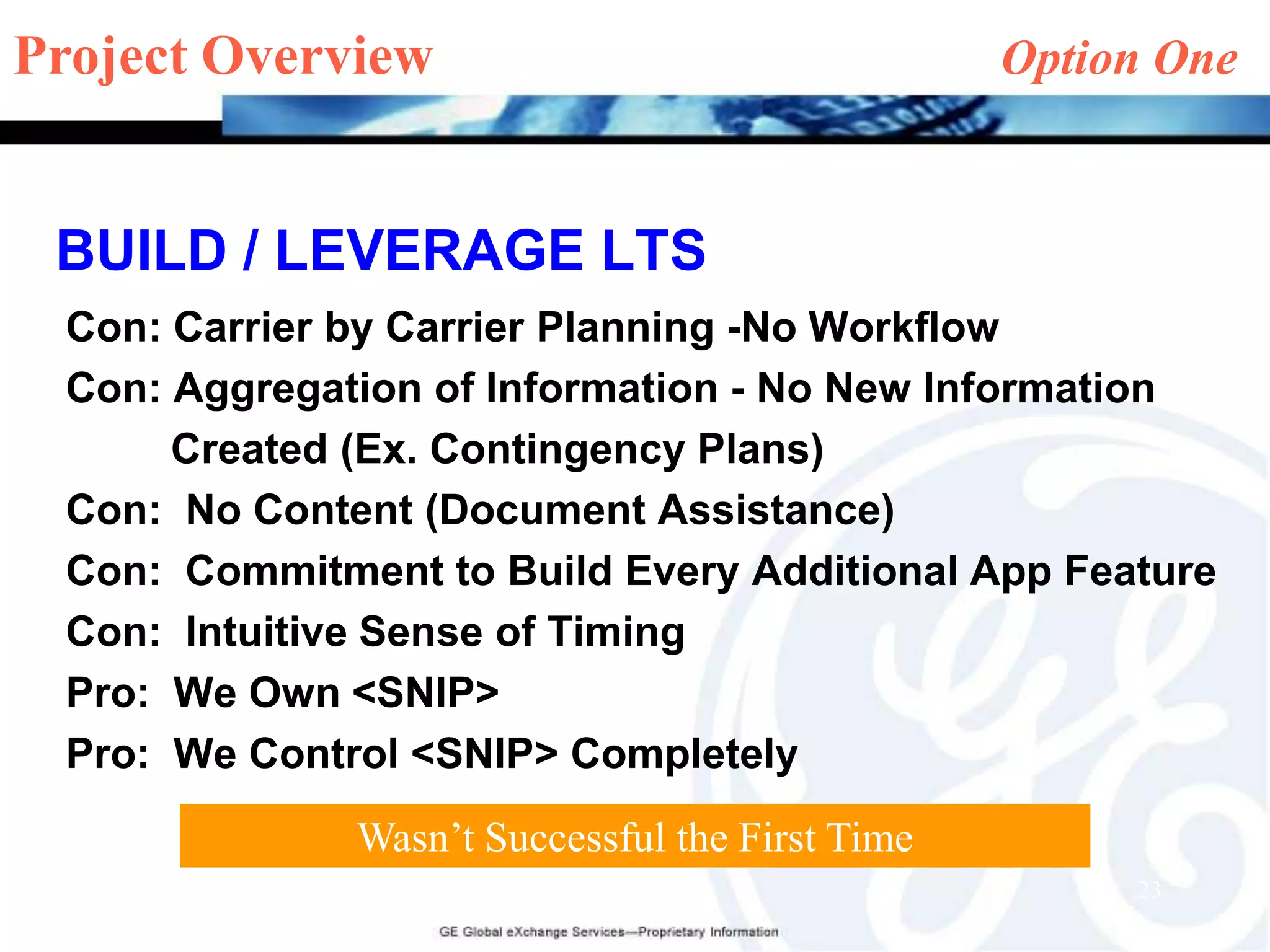

The document outlines a logistics project proposal by GXS to develop an integrated logistics application suite targeting small and medium enterprises, driven by the increasing need for visibility and efficiency in global shipping and transportation management. Key features include cost-saving strategies, competitive analysis, and subscription pricing models, aiming for a market size of $2.5 to $3 billion. Immediate actions include identifying potential customers and overlapping vendor networks to optimize the sales approach.