This document is Embraer S.A.'s annual report on Form 20-F filed with the U.S. Securities and Exchange Commission on April 13, 2012. It provides key information on Embraer's financial performance, business operations, directors and management, employees, risks, and other disclosures required for companies registered with the SEC. Specifically, the report discusses Embraer's history, business overview, organizational structure, properties, operating and financial results, research activities, contractual obligations, and corporate governance.

![ˆ200FVFj&BF0pXcZw]Š

200FVFj&BF0pXcZw

NYCFBUAC350897

EMBRAER S.A. RR Donnelley ProFile 10.10.16 NER feucs0nd 13-Apr-2012 10:47 EST 332497 TX 15 3*

FORM 20-F NYC HTM ESS 0C

Page 1 of 1

These and other future developments in the Brazilian economy and governmental policies may adversely affect us and our

business and results of operations and may adversely affect the trading price of our common shares and ADSs.

Inflation and government efforts to combat inflation may contribute significantly to economic uncertainty in Brazil and to

heightened volatility in the Brazilian securities markets and, consequently, may adversely affect the market value of our common

shares and ADSs.

Brazil experienced extremely high rates of inflation during the decade of the 1980s and in the early part of the 1990s. Since

1994, Brazil’s inflation has been under control. More recently, Brazil’s annual rate of inflation was 4.5%, 5.9%, 4.3%, 5.9%, and

6.5%, from 2007 through 2011, respectively, as measured by the Índice Nacional de Preços ao Consumidor Amplo (National

Consumer Price Index), or IPCA. Although inflation rates in Brazil are under control to a certain extent, there continues to be some

inflationary pressure as a result of the strong expansion of the Brazilian economy in recent years. Among the effects of such

inflationary pressure, labor costs have risen in the past couple of years. More recently, the Brazilian government has taken certain

fiscal actions in order to keep inflation under control.

Future Brazilian federal government actions, including interest rate decreases, intervention in the foreign exchange market and

actions to adjust or fix value of the real may trigger increases in inflation. If Brazil experiences high inflation again in the future, our

operating expenses and borrowing costs may increase, our operating and net margins may decrease and, if investor confidence

decreases, the price of our common shares and ADSs may fall.

Exchange rate instability may adversely affect our financial condition and results of operations and the market price of our

common shares and ADSs.

Although most of our revenue and debt is U.S. dollar-denominated, the relationship of the real to the value of the U.S. dollar,

and the rate of depreciation of the real relative to the prevailing rate of inflation, may adversely affect us.

As a result of inflationary pressures, among other factors, the Brazilian currency has devalued periodically during the last four

decades. Throughout this period, the Brazilian federal government has implemented various economic plans and utilized a number of

exchange rate policies, including sudden devaluations, periodic mini-devaluations during which the frequency of adjustments has

ranged from daily to monthly, floating exchange rate systems, exchange controls and dual exchange rate markets. Although over long

periods depreciation of the Brazilian currency generally has correlated with the rate of inflation in Brazil, devaluation over shorter

periods has resulted in significant fluctuations in the exchange rate between the Brazilian currency and the U.S. dollar and other

currencies.

For example, in 2002, the real to U.S. dollar exchange rate increased by 52.3% due in part to political uncertainty surrounding

the Brazilian presidential elections and the global economic slowdown. Although the R$ to US$ exchange rate decreased by 18.2%,

8.1%, 11.8%, 8.7%, and 17.2% in 2003, 2004, 2005, 2006, and 2007, respectively, in 2008 it appreciated by 31.9%, mainly as a result

of the global economic crisis. In 2009 and 2010, the real to U.S. dollar exchange rate decreased 25.5% and 4.3%, respectively, mainly

as the effects of the global economic crisis on the Brazilian economy appeared to be less severe than in other parts of the world. In

2011, such rate increased another 12.6%, a trend that persisted in the first months of 2012. No assurance can be given that the real

will not appreciate or depreciate significantly against the U.S. dollar in the future.

Historically, depreciations in the real relative to the U.S. dollar have also created additional inflationary pressures in Brazil by

generally increasing the price of imported products and requiring recessionary government policies to curb aggregate demand. On the

other hand, appreciation of the real against the U.S. dollar may lead to a deterioration of the current account and the balance of

payments, as well as dampen export-driven growth. Depreciations generally curtail access to foreign financial markets and may

prompt government intervention, including recessionary governmental policies. Depreciations of the real relative to the U.S. dollar

would also reduce the U.S. dollar value of distributions and dividends on our ADSs and may also reduce the market value of our

common shares and ADSs.

15](https://image.slidesharecdn.com/20ffinalenglish-120414100005-phpapp01/85/20-F-Final-English-2011-18-320.jpg)

![ˆ200FVFj&BDzuTzFw]Š 200FVFj&BDzuTzFw

NERPRFRS3

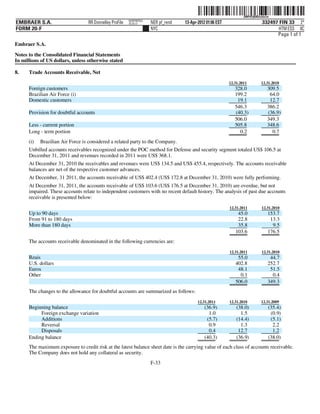

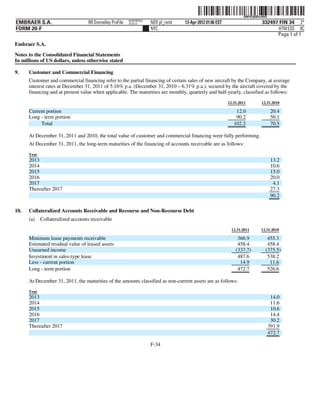

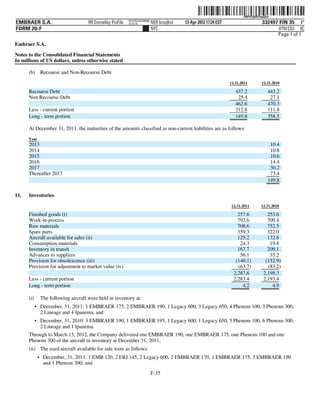

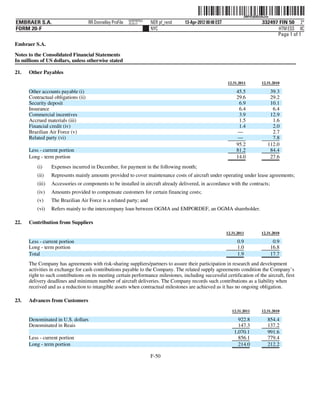

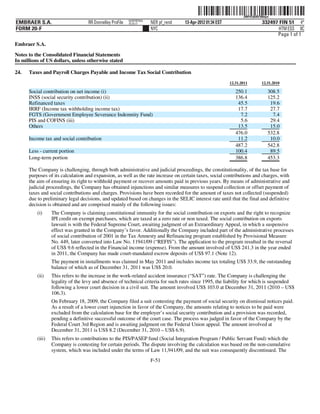

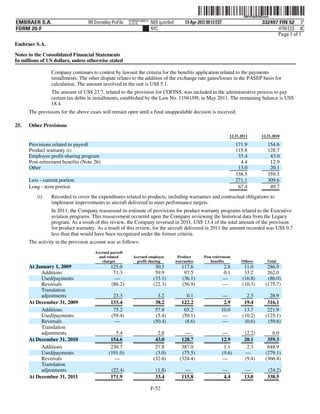

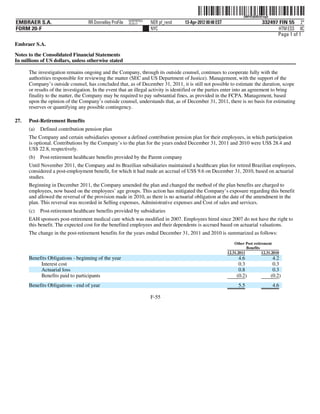

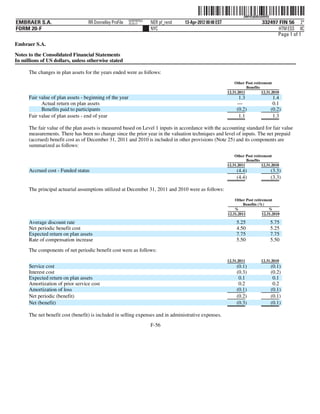

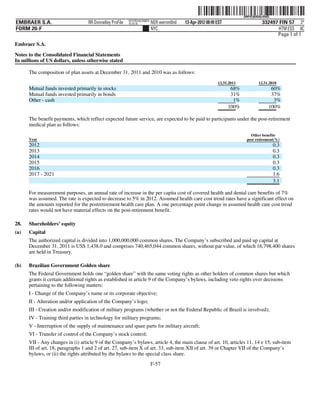

EMBRAER S.A. RR Donnelley ProFile 10.10.17 NER pf_rend 13-Apr-2012 01:05 EST 332497 FIN 16 2*

FORM 20-F NYC HTM ESS 0C

Page 1 of 1

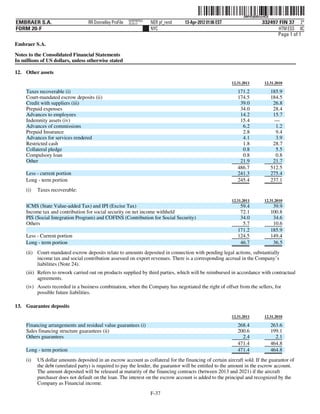

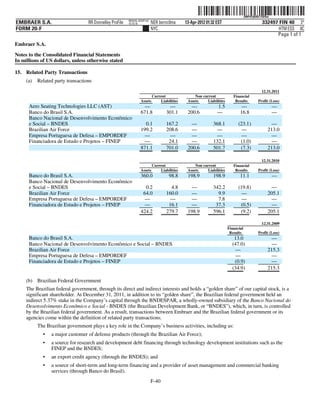

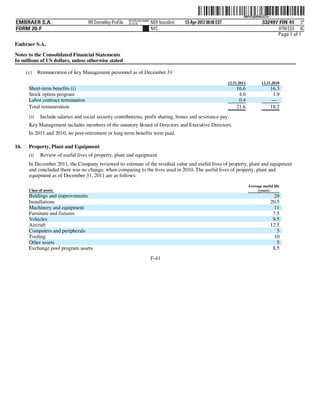

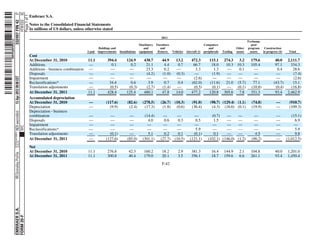

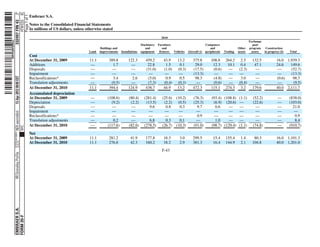

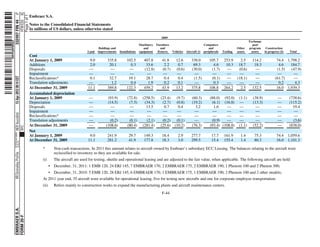

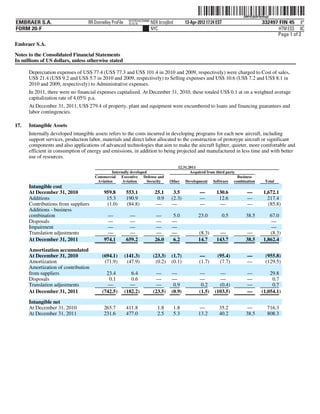

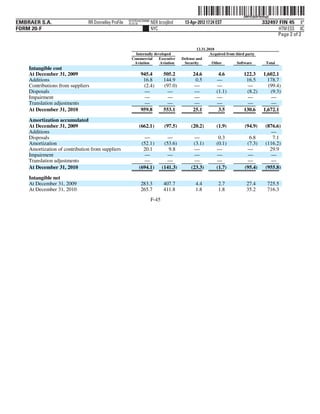

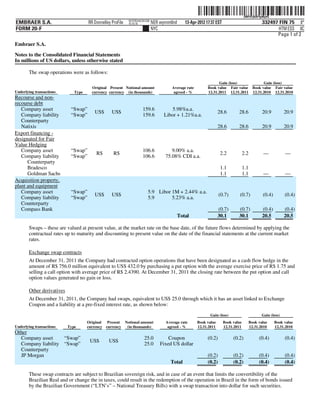

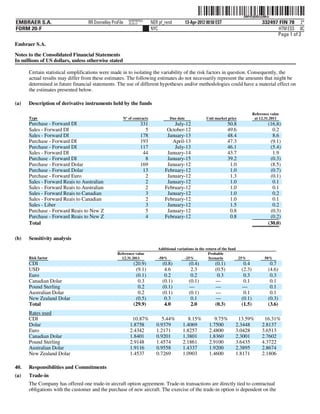

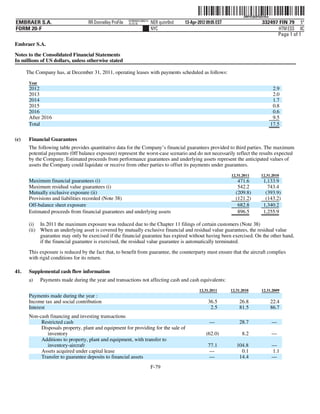

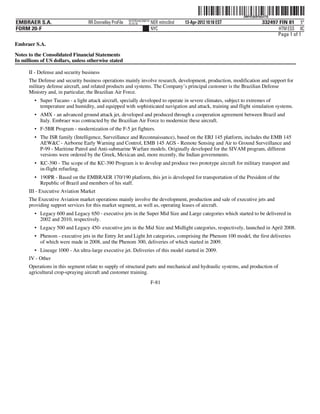

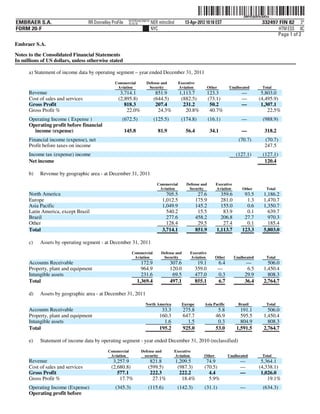

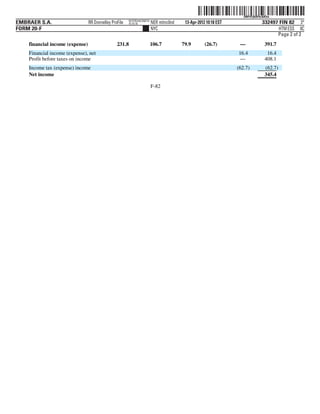

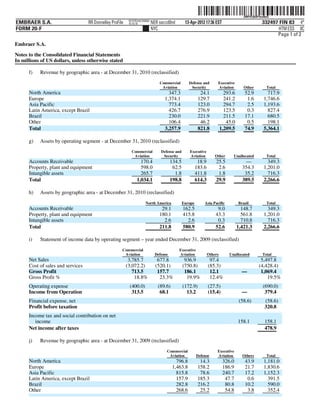

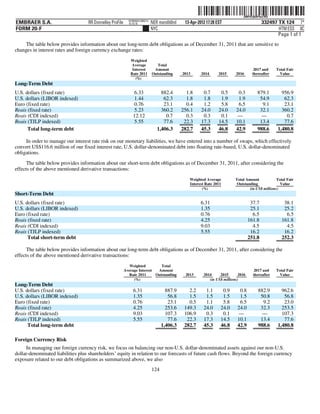

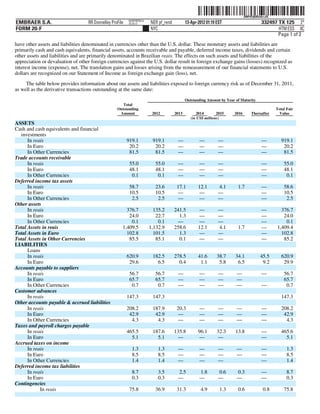

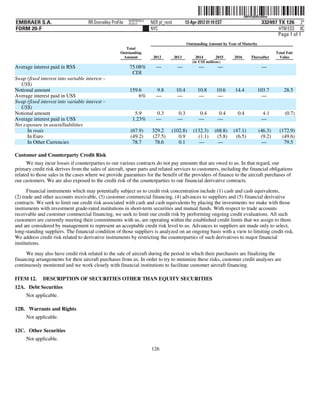

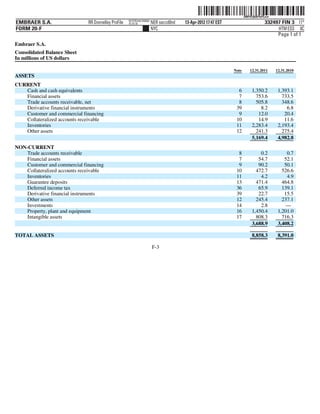

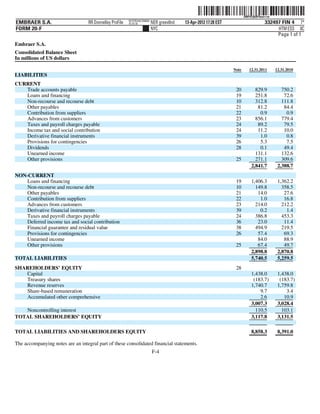

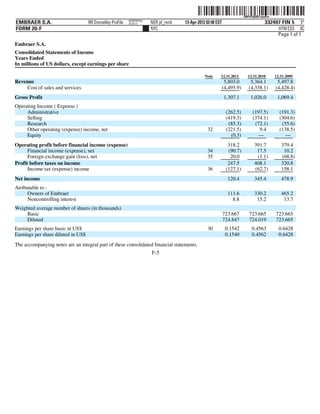

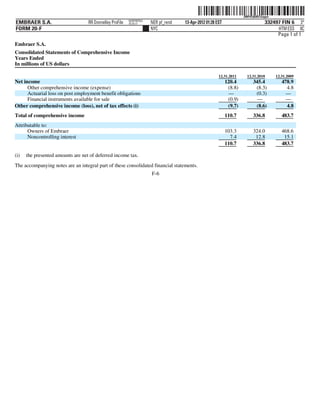

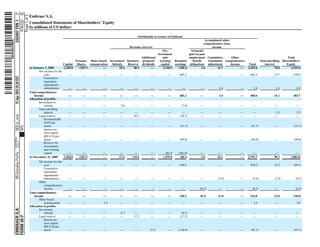

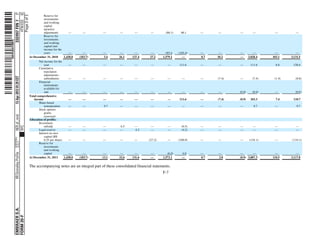

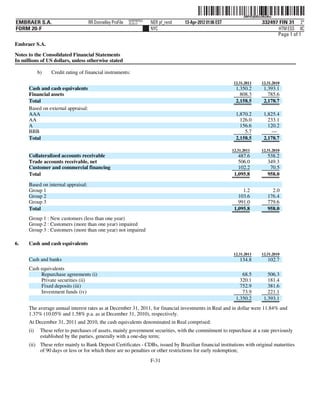

Embraer S.A.

Notes to the Consolidated Financial Statements

In millions of US dollars, unless otherwise stated

(h) Cash and cash equivalents

Cash and cash equivalents includes cash on hand, bank deposits and highly liquid short-term investments, usually maturing

within 90 days of the investment date, readily convertible into a known amount of cash and subject to an insignificant risk of

change in value. This classification includes repurchase agreements and Bank Deposit Certificates - CDBs with a daily

liquidity index in the Clearing House for the Custody and Financial Settlement of Securities - CETIP.

(i) Financial assets

Financial instrument assets are financial assets acquired by the Company, principally for the purpose of selling or repurchasing

in the short-term. Usually, this classification includes securities with original maturities over 90 days from the date of

application.

(j) Derivatives and hedge operations

Derivatives are initially recognized at fair value on the date on which a derivatives contract is signed and are, subsequently, re-

measured at fair value. The differences in fair value are recorded in the statement of income as Foreign Exchange Gains

(Losses), Net, except when the derivative is designated as a hedge instrument.

The Company holds instruments for fair value and cash flow accounting hedges:

(i) Fair value hedges

Changes in the fair value of derivatives that are designated and qualify as fair value hedges are recorded in the statement of

income, together with any changes in the fair value of the hedged asset or liability that are attributable to the hedged risk. The

Company only applies fair value hedge accounting to hedge fixed interest risk on borrowings. Changes in the fair value of the

hedged fixed rate borrowings attributable to interest rate risk are recognized in the statement of income within Financial

income (expense).

If the hedge no longer meets the criteria for hedge accounting, the adjustment to the carrying amount of a hedged item for

which the effective interest method is used is amortized to profit or loss over the period to maturity.

(ii) Cash flow hedges

The effective portion of changes in the fair value of derivatives that are designated and qualified as cash flow hedges is

recognized in Other comprehensive income. The gain or loss related to the ineffective portion is recognized immediately in the

statement of income as Financial income (expense).

Amounts accumulated in equity are reclassified to the statement of income in the periods when the hedged item affects profit or

loss. However, when the forecasted transaction that is hedged results in the recognition of a non-financial asset, the gains and

losses previously deferred in equity are transferred from equity and included in the initial measurement of the cost of the asset.

When a hedging instrument expires or is sold, or when a hedge no longer meets the criteria for hedge accounting, any

cumulative gain or loss existing in equity at that time remains in equity and is reclassified to profit or loss when the forecast

transaction is ultimately in the statement of income. When a forecasted transaction is no longer expected to occur, the

cumulative gain or loss that was reported in equity is immediately transferred to the statement of income within Financial

income (expense).

(k) Trade accounts receivable

Trade accounts receivable are recognized initially at present value and include revenues recorded using the percentage-of-

completion method, net of the respective customer advances. They are subsequently recorded at amortized cost using the

effective interest rate method, less provision for doubtful accounts.

F-16](https://image.slidesharecdn.com/20ffinalenglish-120414100005-phpapp01/85/20-F-Final-English-2011-157-320.jpg)

![ˆ200FVFj&BDzvZdpw]Š 200FVFj&BDzvZdpw

NERPRFRS3

EMBRAER S.A. RR Donnelley ProFile 10.10.17 NER pf_rend 13-Apr-2012 01:06 EST 332497 FIN 32 2*

FORM 20-F NYC HTM ESS 0C

Page 1 of 1

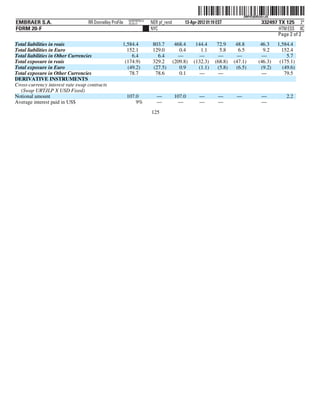

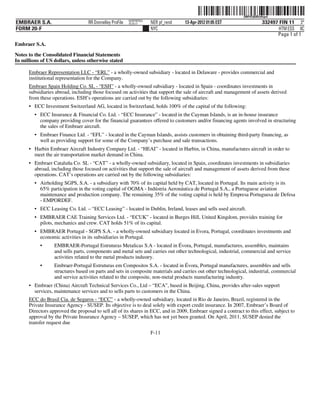

Embraer S.A.

Notes to the Consolidated Financial Statements

In millions of US dollars, unless otherwise stated

(iii) Fixed-term deposits with highly-rated financial institutions with terms of less than 90 days; and

(iv) Money Market Funds comprising portfolios of securities issued by international institutions abroad with a low risk of

change in value and with daily liquidity.

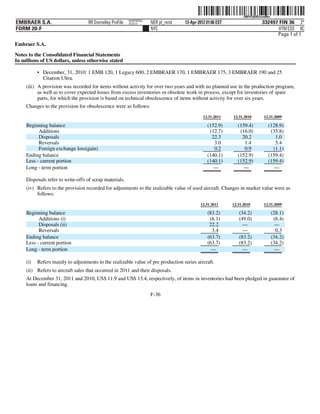

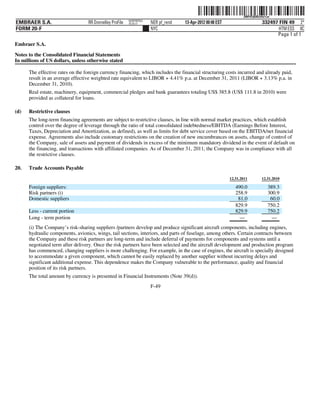

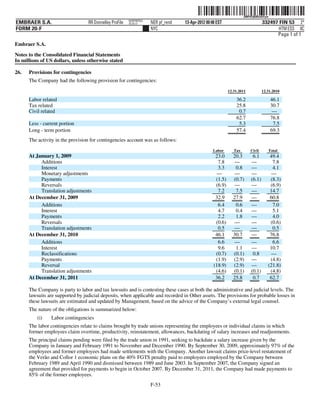

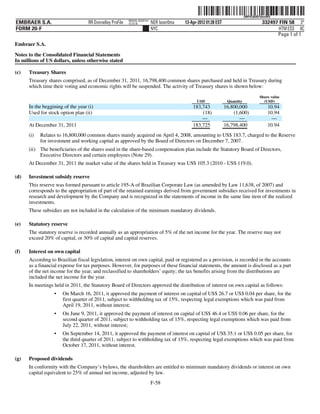

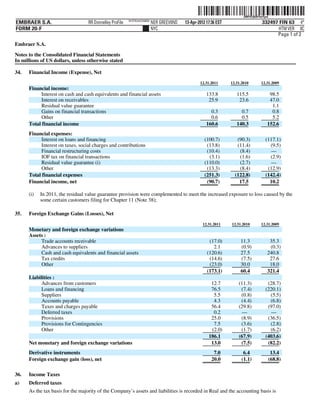

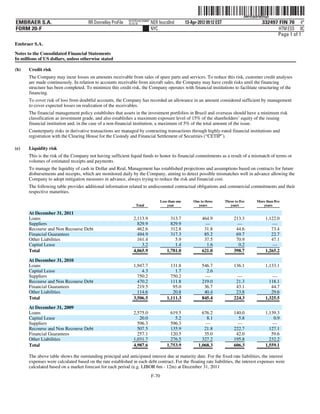

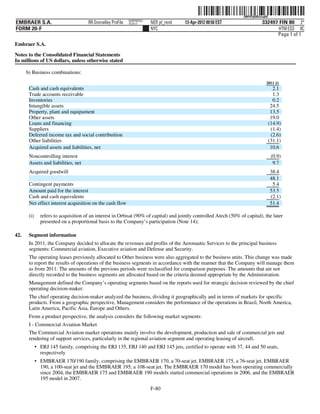

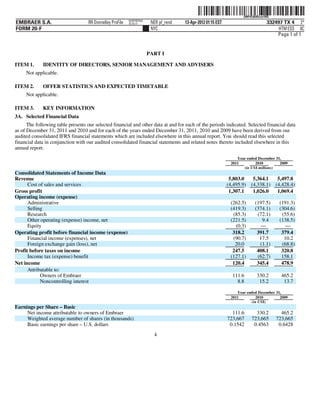

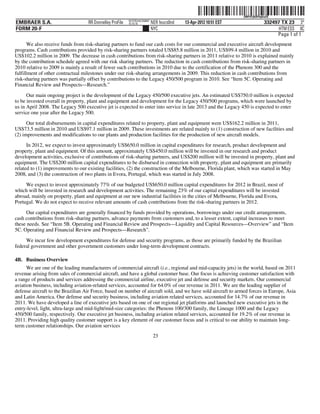

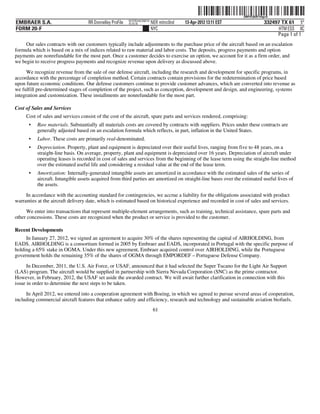

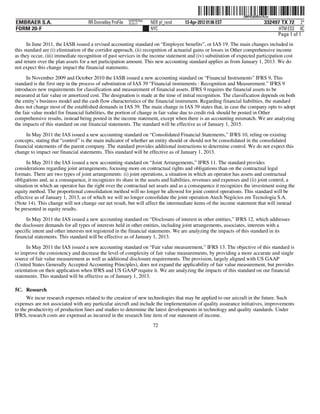

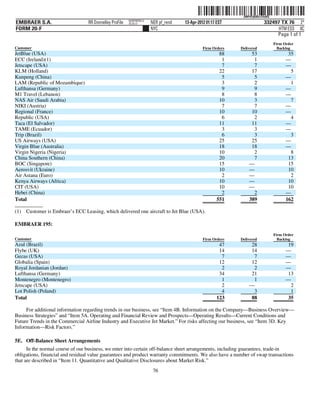

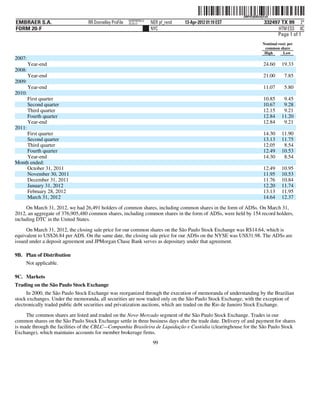

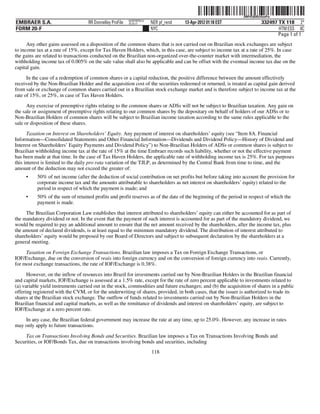

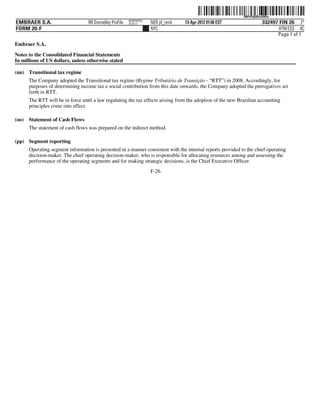

7. Financial Assets

12.31.2011 12.31.2010

Held for Held to Available Held for Held to

Trading maturity for sale Total Trading maturity Total

Financial instruments

Public securities 457.9 — — 457.9 339.7 2.3 342.0

Private securities 52.2 — — 52.2 20.3 — 20.3

Money market funds 30.0 — — 30.0 117.8 — 117.8

Investment funds 207.6 — — 207.6 234.0 — 234.0

Public securities(i) — 13.4 — 13.4 12.3 21.7 34.0

Other 0.4 38.5 8.3 47.2 0.5 37.0 37.5

748.1 51.9 8.3 808.3 724.6 61.0 785.6

Current Assets 748.1 5.5 — 753.6 724.6 8.9 733.5

Non-current assets — 46.4 8.3 54.7 — 52.1 52.1

At December 31, 2011 and 2010, the financial assets were comprised of treasury securities and securities of exclusive

investment funds. The portfolios of the exclusive investment funds in Brazil were mainly comprised of highly liquid Federal

government securities and Brazilian financial institution securities, measured at their realizable values. The funds are

exclusively for the benefit of the Company and are managed by third parties who charge a monthly commission. The

investments are marked to market daily at fair value through profit or loss, as the Company classifies these investments as held

for trading.

At December 31, 2011 and 2010, the portfolios of the exclusive investment funds abroad was comprised of securities issued by

institutions abroad with a low level risk of change in value and with daily liquidity, measured at their realizable values.

These private money market funds have no significant financial obligations. The financial obligations are restricted to asset

management, custody fees, audit fees and similar expenses. No assets from the Company were used as guarantee of these

obligations and the fund creditors have no right to recourse against the general credit of the Company.

(i) Securities issued by the Brazilian Government, classified as trading securities.

Held to maturity securities are receivables that represent securities issued by the Brazilian Government, comprising National

Treasury Bills - NTN, denominated in US dollars, acquired by the Company from its customers as an adjustment of the interest

rates payable by the Export Financing Program (“PROEX”) between the 11th and 15th year after the sale of the respective

aircraft, recorded at present value, since the Company intends and has the ability to hold them in portfolio to maturity.

F-32](https://image.slidesharecdn.com/20ffinalenglish-120414100005-phpapp01/85/20-F-Final-English-2011-173-320.jpg)