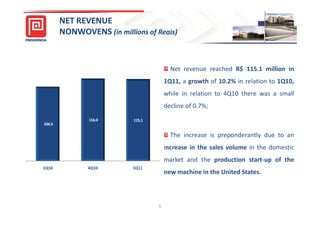

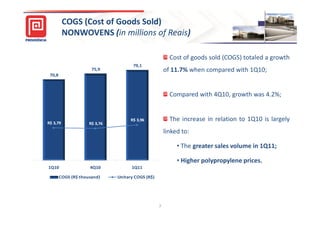

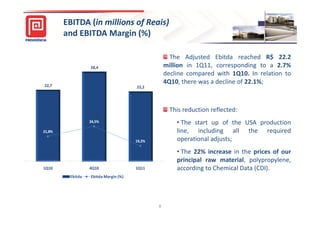

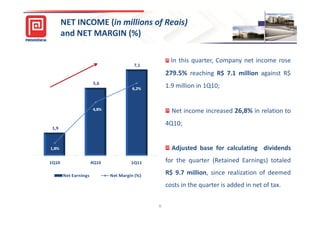

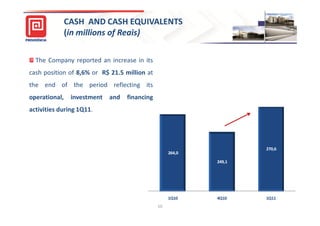

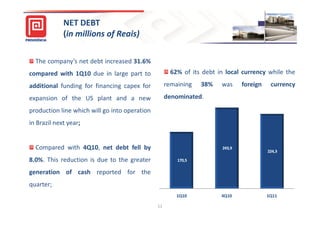

Providência USA reported financial results for the first quarter of 2011. Key highlights included a 7.1% increase in sales volume compared to the same period in 2010. The company's first production line in the United States contributed 492 tons sold in 1Q11, in line with forecasts. Net revenue increased 10.2% year-over-year due to higher sales volume domestically and production starting in the US. EBITDA declined 2.7% versus 1Q10 reflecting start-up costs for the US line and higher raw material prices. The company forecasts increased sales volume in 2011 and full capacity utilization of its US production line by early second half.