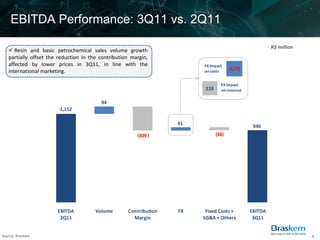

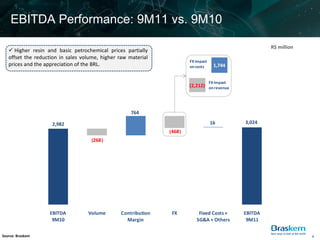

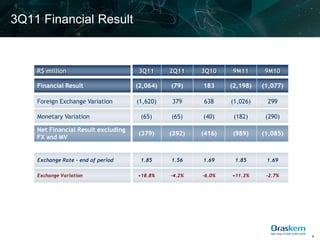

- Braskem's 3Q11 EBITDA was R$940 million, reflecting lower spreads. 9M11 EBITDA increased 10% to R$3 billion.

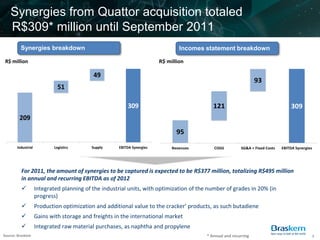

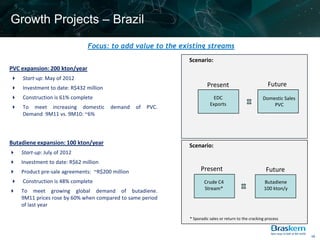

- Synergies from the Quattor acquisition totaled R$309 million in 9M11. Expansion projects for PVC and butadiene are on schedule.

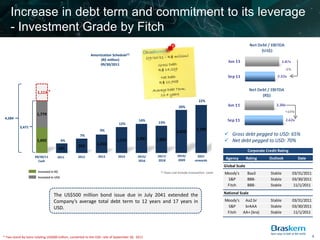

- Braskem's net debt to EBITDA ratio was affected by the 19% appreciation of the dollar, reaching 2.32x in USD and 2.62x in BRL.