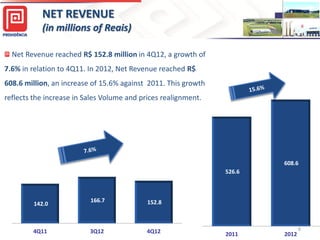

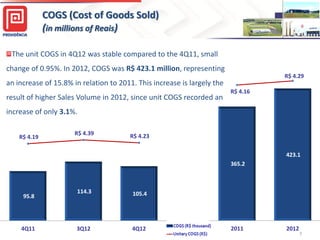

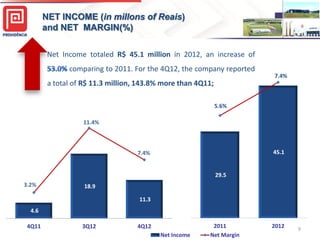

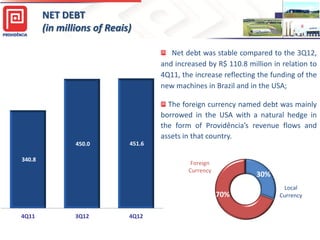

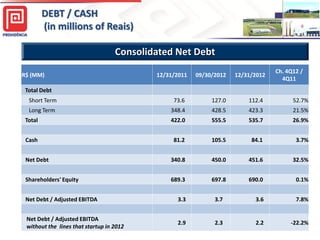

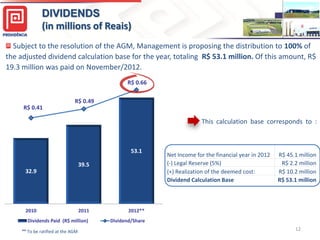

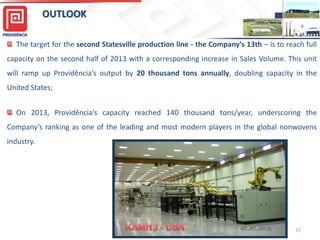

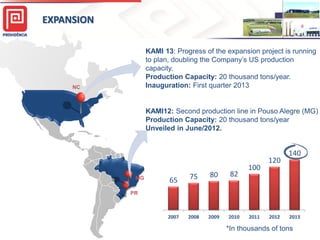

Providência USA reported record results for 4Q12 and 2012. Net revenue grew 7.6% in 4Q12 and 15.6% for 2012. Adjusted EBITDA reached a record R$127.0 million for 2012, a 24.4% increase over 2011. Net income totaled R$45.1 million for 2012, a 53.0% increase. The company proposes distributing dividends of R$53.1 million, subject to shareholder approval. For 2013, the company aims to reach full capacity at its second production line in the US and expand total capacity to 140,000 tons per year.