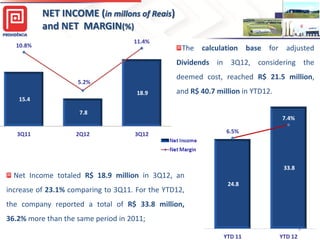

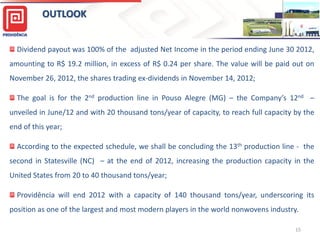

Providência USA reported strong financial results for 3Q 2012. Sales volume increased 14.6% compared to 3Q 2011 due to new production lines. Adjusted EBITDA grew 14% to a record $36.1 million for the quarter. Net income also reached a record at $18.9 million, up 23.1% year-over-year. The company expects its expansion projects to further increase production capacity in the US and Brazil throughout 2012.