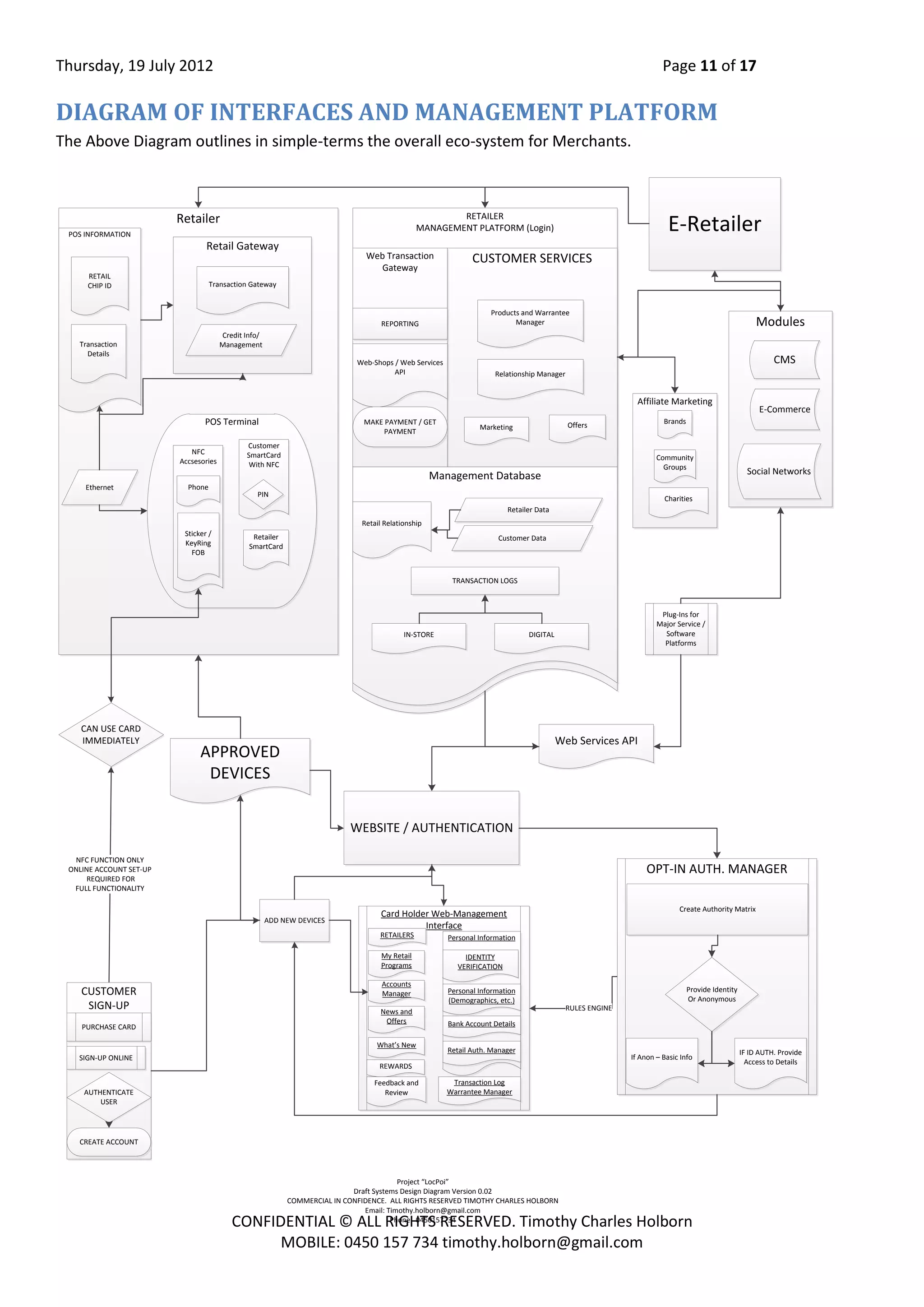

This document provides an overview of a proposed loyalty card and authentication platform called LocPoi. The platform would use physical point of sale access points and customer cards to enable a secure authentication method between individuals and retailers. It analyzes the growth of e-commerce and issues with internet security. It then describes how the proposed loyalty program would work, including customer sign-up, a retailer management platform, and modules. Diagrams show the interfaces and management platform. Potential markets like medical, community rewards, and staff networking are identified. The development strategy and potential partners are outlined. Next steps are to confirm the proposed team and move forward.

![Thursday, 19 July 2012 Page 5 of 17

CONFIDENTIAL © ALL RIGHTS RESERVED. Timothy Charles Holborn

MOBILE: 0450 157 734 timothy.holborn@gmail.com

An extract of this report is as follows:

When considering the online sophistocation of existing retail

Businesses, in addition to other SOHO / SME businesses, questions

surrounding the online sophistocation start to emerge as a potential

risk-factor for many businesses. Whereas, the proximinity of many

shops pre-internet was a determining factor for use of that store or

business, by a customer; And, where the customer relationship was more broadly forged upon

geographical proximity, and specialisation of retail businesses,

The Current market continues to offer new, innovative methods to supply a vast array of products from a

multitude of locations, in many cases regardless of whether these merchants have any form of physical

presence in the state let alone the country for which they’re supplying products or services.

Are existing retailers suitably resourced to compete with this emerging market of competitors?

INTERNET SECURITY

Internet Security is a significant challenge of our time. In order to approach the underlying market

opportunity or which this initiative is more specifically geared towards approaching, the underpinning

aspects of the security flaws and more importantly, the implications of these flaws are further discussed;

Over the next two years, there is positive growth projected in all categories of

online spending in Australia. Travel remains the leading category in Australian

online retail, accounting for $7.4 billion in 2011, made up predominantly of high

value purchases such as plane tickets. Travel is very closely followed by the

groceries – including pantry, household items, alcohol and other consumable

goods such as pet supplies – at $5.5 billion.”

Although groceries and travel combine to make up almost half of Australian

online retail, the strongest growth in Australian online spending year on year

can be seen in fashion – apparel, accessories and footwear – with a recorded

growth of 20% for 2011 [see Figure 2]. This is driven predominantly by the

launch of new online fashion stores, both domestically and internationally.

Fashion is followed by music and video purchases at 17% growth [see Figure 2].

Advances in payment innovations such as micropayments and mobile payments

will help to further propel growth in online music and video, as well as other

sectors such as online news, with the rise of paid and subscription content.

Technological innovation is also driving the growth of the consumer electronics

and computer-related product categories [see Figure 2]. As technology products

such as laptops and cameras are increasingly viewed as commodity items,

Australian consumers are tending to purchase them online.

Combined with the high level of competition in the market driving prices down,

the consumer electronics and computer-related categories have seen healthy

growth in the online space.

Source: Paypal, Secure Insight Changing The Way We Pay. Oct. 2011

2](https://image.slidesharecdn.com/locpoi-overviewv2-210803130136/75/19-July-2012-Loc-poi-overview-v2-5-2048.jpg)