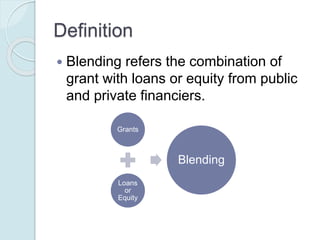

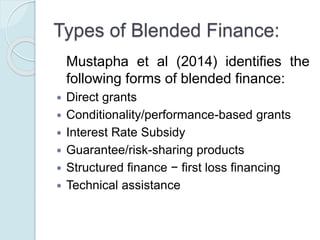

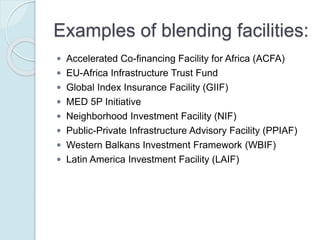

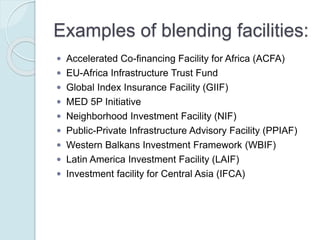

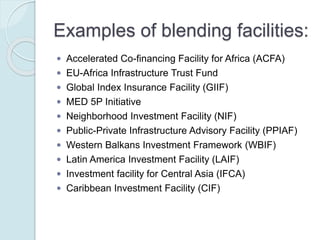

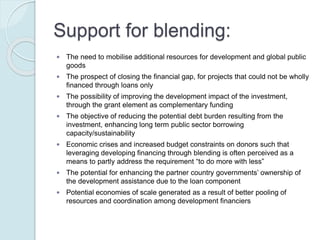

The document discusses blending, which refers to combining grants with loans or equity from public and private financiers for development projects. It outlines different types of blending facilities and provides examples. Benefits of blending include mobilizing additional resources and improving development impact. However, concerns relate to risks of financial incentives outweighing development goals and insufficient transparency. The document suggests reducing complexity, carefully assessing impacts, and ensuring timely decision making to effectively implement blended finance.