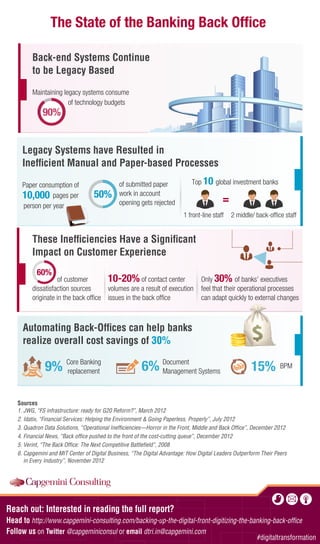

The document highlights the reliance on legacy systems in the banking back office, which consumes 90% of technology budgets and leads to inefficient processes and high paperwork rejection rates. Customer dissatisfaction is significantly influenced by back-office issues, with only 30% of bank executives feeling their operational processes can adapt quickly. Automating back-office functions could yield cost savings of 30% for banks.