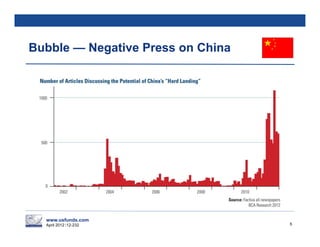

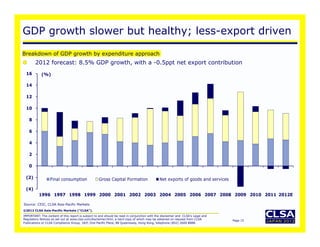

The document discusses China's transition to a consumer-driven economy. It provides analysis from CLSA China Macro Strategist Andy Rothman on trends in China's economy including the declining importance of exports, strong growth in domestic consumption, increasing incomes driving spending, and continued growth in infrastructure investment. The analysis suggests China's economy remains healthy and growing despite slowing external demand.