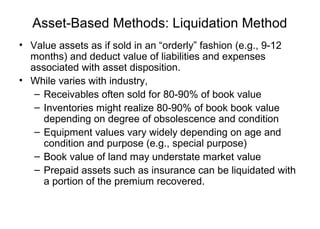

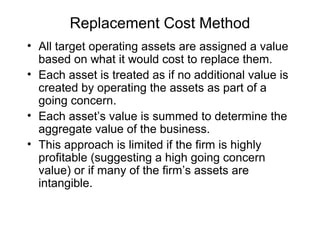

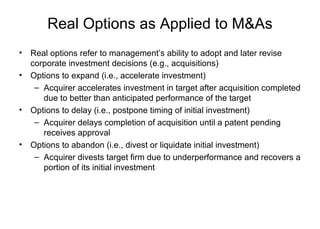

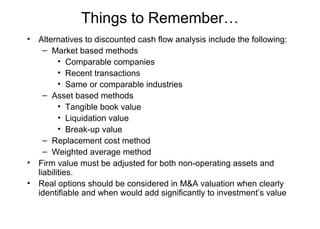

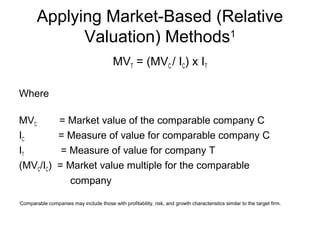

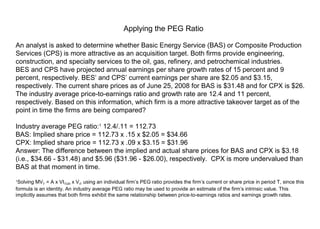

1) The document discusses various valuation methods that can be applied to mergers and acquisitions, including relative valuation methods like comparable company analysis and recent transactions methods, asset-based methods like tangible book value and liquidation value, and real options valuation.

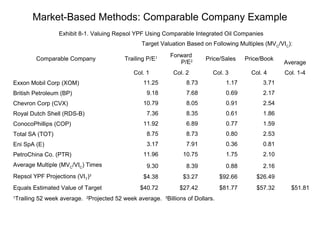

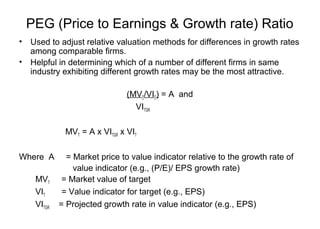

2) It provides an example of valuing Repsol YPF using comparable integrated oil companies and determining whether Basic Energy Service or Composite Production Services is a more attractive acquisition target using the PEG ratio method.

3) Key things to remember include considering market-based, asset-based, and replacement cost methods, adjusting for non-operating items, and accounting for real options when identifiable and value-adding.

![Asset-Based Methods:

Tangible Book Value

• Tangible book value (TBV) = (total assets - total

liabilities - goodwill)

• Target’s estimated value = Target’s TBV x

[(industry average or comparable firm market

value) / (industry or comparable firm TBV)].

• Often used for valuing

– Financial services firms where tangible book

value is primarily cash or liquid assets

– Distribution firms where current assets constitute

a large percentage of total assets](https://image.slidesharecdn.com/08chapter8primeronrelativevaluationmethods-141009094745-conversion-gate01/85/08-chapter-8-primer_on_relative_valuation_methods-8-320.jpg)