10 facts about taxation in Slovakia | Infographic

•

0 likes•55 views

Discover the top 10 facts about taxation in Slovakia, one of the many overviews to come about Slovak business environment.

Report

Share

Report

Share

Download to read offline

Recommended

Estonian taxes and tax structure as of 1 July 2017Estonian taxes and tax structure as of 1 July 2017

Estonian taxes and tax structure as of 1 July 2017Rahandusministeerium/Ministry of Finance of Estonia

Recommended

Estonian taxes and tax structure as of 1 July 2017Estonian taxes and tax structure as of 1 July 2017

Estonian taxes and tax structure as of 1 July 2017Rahandusministeerium/Ministry of Finance of Estonia

More Related Content

What's hot

What's hot (18)

Cyprus VAT Alert - Obligation for Submission of VAT Returns Electronically

Cyprus VAT Alert - Obligation for Submission of VAT Returns Electronically

10 facts about taxation in the Czech Republic | Infographic

10 facts about taxation in the Czech Republic | Infographic

Tax rates trends and regional comparison (EU10, Western Balkans, BRIC, Russia...

Tax rates trends and regional comparison (EU10, Western Balkans, BRIC, Russia...

International Indirect Tax - Global VAT/GST update (March 2018)

International Indirect Tax - Global VAT/GST update (March 2018)

An alternative exists. Fair Tax Code of Uspishna Kraina

An alternative exists. Fair Tax Code of Uspishna Kraina

Viewers also liked

Viewers also liked (7)

Arts & Crafts: 5 Tips for Becoming a Better Marketer-Designer

Arts & Crafts: 5 Tips for Becoming a Better Marketer-Designer

Similar to 10 facts about taxation in Slovakia | Infographic

Estonian taxes and tax structure as of September 2020. A presentation by the Tax Policy Department of the Ministry of Finance of the Republic of EstoniaEstonian taxes and tax structure (September 2020)

Estonian taxes and tax structure (September 2020)Rahandusministeerium/Ministry of Finance of Estonia

Estonian taxes and tax structure (as of 1 january 2019)Estonian taxes and tax structure (as of 1 january 2019)

Estonian taxes and tax structure (as of 1 january 2019)Rahandusministeerium/Ministry of Finance of Estonia

Similar to 10 facts about taxation in Slovakia | Infographic (20)

10 facts about taxation in the Czech Republic | Infographic

10 facts about taxation in the Czech Republic | Infographic

Tuca Zbarcea & Asociatii - Fiscal Bulletin - GEO 114

Tuca Zbarcea & Asociatii - Fiscal Bulletin - GEO 114

Presentation.News Tax Exec Sum.2011 02 28.Eng.Janist

Presentation.News Tax Exec Sum.2011 02 28.Eng.Janist

Taxation of individuals & corporates chamcham presentation 2012 - bw update

Taxation of individuals & corporates chamcham presentation 2012 - bw update

Estonian taxes and tax structure (as of 1 january 2019)

Estonian taxes and tax structure (as of 1 january 2019)

Baker & McKenzie's Doing Business in Poland - Chapter 5 (Tax System)

Baker & McKenzie's Doing Business in Poland - Chapter 5 (Tax System)

Recently uploaded

Recently uploaded (20)

USA classified ads posting – best classified sites in usa.pdf

USA classified ads posting – best classified sites in usa.pdf

12 Conversion Rate Optimization Strategies for Ecommerce Websites.pdf

12 Conversion Rate Optimization Strategies for Ecommerce Websites.pdf

Special Purpose Vehicle (Purpose, Formation & examples)

Special Purpose Vehicle (Purpose, Formation & examples)

falcon-invoice-discounting-a-premier-platform-for-investors-in-india

falcon-invoice-discounting-a-premier-platform-for-investors-in-india

Easy Way to Download and Set Up Gen TDS Software on Your Computer

Easy Way to Download and Set Up Gen TDS Software on Your Computer

What are the main advantages of using HR recruiter services.pdf

What are the main advantages of using HR recruiter services.pdf

Luxury Artificial Plants Dubai | Plants in KSA, UAE | Shajara

Luxury Artificial Plants Dubai | Plants in KSA, UAE | Shajara

Matt Conway - Attorney - A Knowledgeable Professional - Kentucky.pdf

Matt Conway - Attorney - A Knowledgeable Professional - Kentucky.pdf

5 Things You Need To Know Before Hiring a Videographer

5 Things You Need To Know Before Hiring a Videographer

chapter 10 - excise tax of transfer and business taxation

chapter 10 - excise tax of transfer and business taxation

NewBase 24 May 2024 Energy News issue - 1727 by Khaled Al Awadi_compresse...

NewBase 24 May 2024 Energy News issue - 1727 by Khaled Al Awadi_compresse...

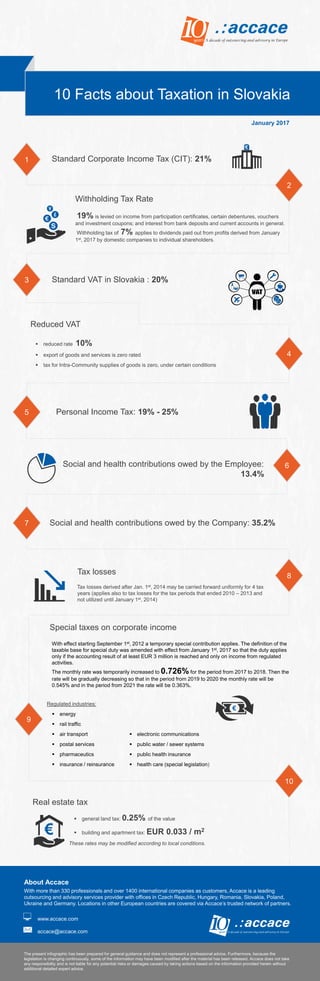

10 facts about taxation in Slovakia | Infographic

- 1. Standard Corporate Income Tax (CIT): 21% 19% is levied on income from participation certificates, certain debentures, vouchers and investment coupons; and interest from bank deposits and current accounts in general. Withholding tax of 7% applies to dividends paid out from profits derived from January 1st, 2017 by domestic companies to individual shareholders. Withholding Tax Rate Standard VAT in Slovakia : 20% 10 Facts about Taxation in Slovakia 1 2 8 9 10 Personal Income Tax: 19% - 25% Social and health contributions owed by the Employee: 13.4% Social and health contributions owed by the Company: 35.2% Tax losses Regulated industries: energy rail traffic air transport postal services pharmaceutics insurance / reinsurance Special taxes on corporate income About Accace With more than 330 professionals and over 1400 international companies as customers, Accace is a leading outsourcing and advisory services provider with offices in Czech Republic, Hungary, Romania, Slovakia, Poland, Ukraine and Germany. Locations in other European countries are covered via Accace’s trusted network of partners. www.accace.com accace@accace.com The present infographic has been prepared for general guidance and does not represent a professional advice. Furthermore, because the legislation is changing continuously, some of the information may have been modified after the material has been released. Accace does not take any responsibility and is not liable for any potential risks or damages caused by taking actions based on the information provided herein without additional detailed expert advice. 6 7 Reduced VAT reduced rate 10% export of goods and services is zero rated tax for Intra-Community supplies of goods is zero, under certain conditions 4 5 Tax losses derived after Jan. 1st, 2014 may be carried forward uniformly for 4 tax years (applies also to tax losses for the tax periods that ended 2010 – 2013 and not utilized until January 1st, 2014) Real estate tax general land tax: 0.25% of the value building and apartment tax: EUR 0.033 / m2 These rates may be modified according to local conditions. electronic communications public water / sewer systems public health insurance health care (special legislation) With effect starting September 1st, 2012 a temporary special contribution applies. The definition of the taxable base for special duty was amended with effect from January 1st, 2017 so that the duty applies only if the accounting result of at least EUR 3 million is reached and only on income from regulated activities. The monthly rate was temporarily increased to 0.726% for the period from 2017 to 2018. Then the rate will be gradually decreasing so that in the period from 2019 to 2020 the monthly rate will be 0.545% and in the period from 2021 the rate will be 0.363%. 3 January 2017