Embed presentation

Download to read offline

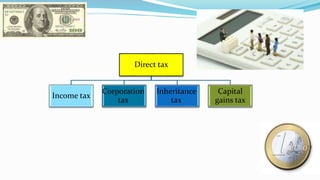

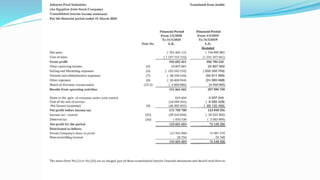

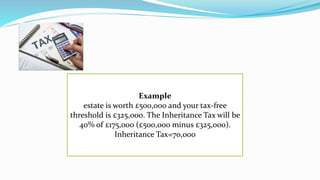

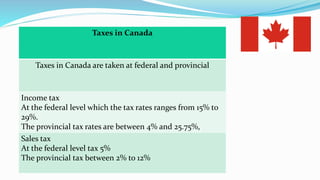

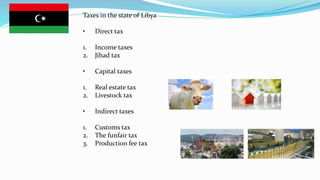

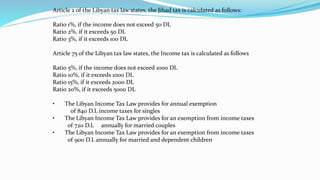

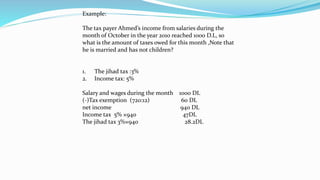

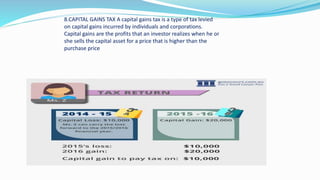

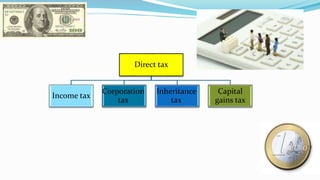

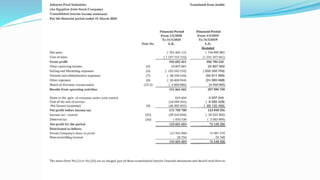

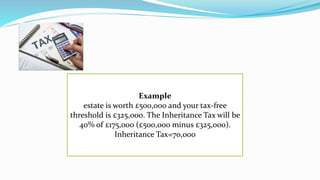

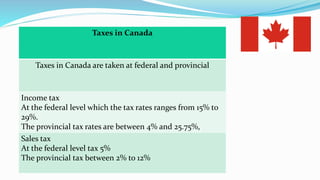

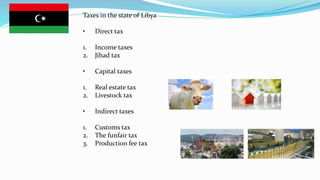

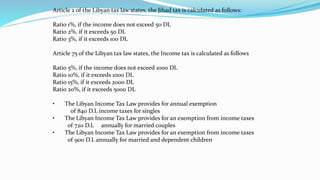

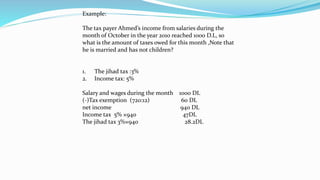

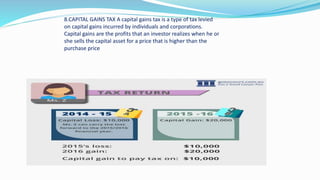

This document provides information about different tax systems. It discusses direct and indirect taxes, and provides examples of different types of taxes like income tax, value added tax, customs duty, and inheritance tax. It also provides examples of tax rates and calculations in countries like Canada, Libya, and the UK. Key taxes discussed include income tax, sales tax, value added tax, corporation tax, inheritance tax, and capital gains tax.