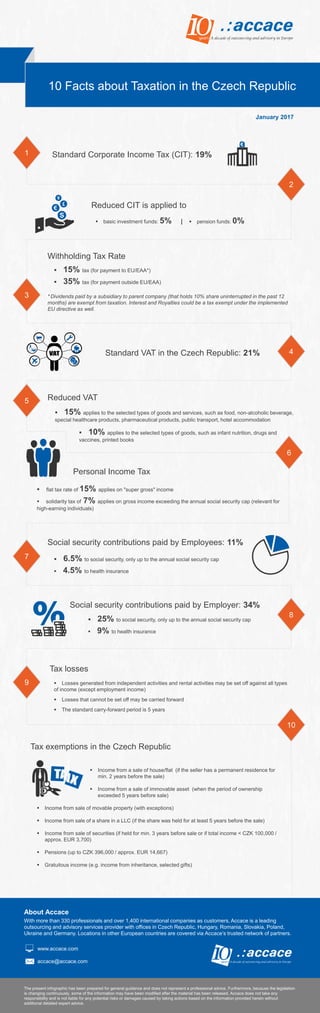

10 facts about taxation in the Czech Republic | Infographic

•

0 likes•66 views

Accace´s 10 facts about taxation in the Czech Republic is an overview that must not be missed if you own or intend to open a business in the Czech Republic.

Report

Share

Report

Share

Download to read offline

Recommended

Estonian Tax System

Tax breakout room at TOA Skill exchange: Overview of Estonian Tax System with tips on cross-border implications for the e-Residents and other non-residents interested in running business in Estonia.

10 facts about taxation in Slovakia | Infographic 2017

Discover the top 10 facts about taxation in Slovakia, one of the many overviews to come about Slovak business environment.

Taxation System in UK

UK government massive earning includes Personal income tax, a substantial amount of national insurance contribution, Limited company for contractors, value-added tax (VAT) and from the corporation tax.

Tax rates trends and regional comparison (EU10, Western Balkans, BRIC, Russia...

tax, rates, Europe, Central, Eastern, Western Balkan, BRIC, Russia, China, Harvard, summer school, politics, economics, Kubicová

SORIANEN: Opening studio in the European Union

What does it take and why open a studio in EU and Lithuania in particular – benefits, requirements and drawbacks of doing business in some of the most popular EU countries (Cyprus, Malta and Luxembourg).

Tax reform in Latvia in 2018

The new Tax reform in Latvia will come into force from January 1, 2018 and will impact both - individual and corporate tax payers in Latvia. The social tax rate will increase by 1%. Maximum turnover for all micro-enterprises is decreased to EUR 40,000.

Recommended

Estonian Tax System

Tax breakout room at TOA Skill exchange: Overview of Estonian Tax System with tips on cross-border implications for the e-Residents and other non-residents interested in running business in Estonia.

10 facts about taxation in Slovakia | Infographic 2017

Discover the top 10 facts about taxation in Slovakia, one of the many overviews to come about Slovak business environment.

Taxation System in UK

UK government massive earning includes Personal income tax, a substantial amount of national insurance contribution, Limited company for contractors, value-added tax (VAT) and from the corporation tax.

Tax rates trends and regional comparison (EU10, Western Balkans, BRIC, Russia...

tax, rates, Europe, Central, Eastern, Western Balkan, BRIC, Russia, China, Harvard, summer school, politics, economics, Kubicová

SORIANEN: Opening studio in the European Union

What does it take and why open a studio in EU and Lithuania in particular – benefits, requirements and drawbacks of doing business in some of the most popular EU countries (Cyprus, Malta and Luxembourg).

Tax reform in Latvia in 2018

The new Tax reform in Latvia will come into force from January 1, 2018 and will impact both - individual and corporate tax payers in Latvia. The social tax rate will increase by 1%. Maximum turnover for all micro-enterprises is decreased to EUR 40,000.

International Indirect Tax - Global VAT/GST update (March 2018)

These are the slides from the International Indirect Tax - Global VAT/GST update presented at Grant Thornton's VAT Club held in London on 9th March 2018.

The topics discussed include:

EU

• Bulgarian Presidency

• VAT Action Plan – proposal for a Definitive VAT System based on destination principle

• Customs: Binding Valuation Information (BVI)

• Considerations for using TP for Customs value

• Hungary: Electronic Invoicing

• Spain: SII 1.1 new version

• Italy: Simplifications to “Communications of data of invoices issued and received”

• Italy: Mandatory e-invoicing?

EMEA

• South Africa: VAT rate increase

• GCC – where are we?

• UAE: What's been released ? What's missing? Designated Zones

NOAM

• USA: Landmark sales tax nexus case to be heard in Supreme Court

APAC

• India: GST update

• China: Further VAT reform

• Malaysia: GST Compliance Assurance Program (MyGCAP)

• Singapore: Future GST rate increase / reverse charge

• Australia: Final guidance published for online retailers - GST on low value imported goods

This publication has been prepared only as a high level guide. No responsibility can be accepted by us for loss occasioned to any person acting or refraining from acting as a result of any material in this publication.

Spain - First penalties relating to SII

The Spanish Tax Authorities have announced that they start to impose penalties for the non-compliance with the Immediate Supply of Information on VAT (ISI). The ISI entered into force last 1 July 2017, but the appropriate regulation of certain specific penalties did not come into effect until 1 January 2018.

Inheritance tax deductions aragon

Setting out the main deductions allowable for beneficiaries of an inheritance when residents of the region of Aragon, Spain

Brexit Broadcast: What we know so far and where is the momentum heading

2017 headlines have been dominated by the ongoing Brexit process, and the currency markets have been closely watching the developments. While dealing is now taking place in a calmer and more liquid environment than during the initial shock following the vote, Sterling remains weakened and is sensitive to both positive and negative headlines about the negotiations.

As both sides work to reach a deal on the financial settlement, citizens’ rights and the Irish border before the EU Summit on 14th December, we take a look at what’s happened so far and what could happen next.

The UK’s New Immigration System For EU Citizens

The United Kingdom had made an official exit from the European Union on January 31, 2020. However, both parties decided to keep many clauses and functions untouched till December 31, 2020 for a smooth transition. Therefore, as a result of the ‘Brexit’, from January 1, 2021, many things changed for the people of the United Kingdom, as well as, for the European Union.

Link to original article - https://www.skuad.io/blog/brexit-aftermath-the-uks-new-immigration-system-for-eu-citizens/

Cyprus VAT Alert - Obligation for Submission of VAT Returns Electronically

The Taxation Department has informed that pursuant to the amendment of Regulation 17, of the VAT Regulations (Κ.Δ.Π 367/2016), all taxable persons from 2/5/2017 will have an obligation to submit their VAT return (Form VAT4) electronically. The relevant provisions exempt from this obligation any persons who are subject to the agricultural scheme and the special regime for taxis.

Please see full alert attached.

Hukum bernoulli

Slide PowerPoint ini berisi sedikit penjelasan tentang Hukum Bernoulli dan penurunan rumusnya.

Site Audit At Mount Pedro (Piduruthalagala)

Macro Economic and Micro Economic Factors which affects the beauty of Mount Pedro is discussed in this Presentation

This Includes:

-What is Mount Pedro (Piduruthalagala)?

-TV Tower of Rupavahini Corporation

-Peak of Piduruthalgala

-Location of Piduruthalagala

-Highest House in Sri Lanka

-Highest Temple in Sri Lanka

-Highest and Coolest Village in Sri Lanka

-Political and Legal Factors at Mount Pedro

-Environmental, Economical and Technological Factors at Mount Pedro

-Customers Suppliers and Media at mount Pedro

-Position of Mount Pedro in the Butlers Cycle

-Future Strategies and Actions Recommended to Mount Pedro

More Related Content

What's hot

International Indirect Tax - Global VAT/GST update (March 2018)

These are the slides from the International Indirect Tax - Global VAT/GST update presented at Grant Thornton's VAT Club held in London on 9th March 2018.

The topics discussed include:

EU

• Bulgarian Presidency

• VAT Action Plan – proposal for a Definitive VAT System based on destination principle

• Customs: Binding Valuation Information (BVI)

• Considerations for using TP for Customs value

• Hungary: Electronic Invoicing

• Spain: SII 1.1 new version

• Italy: Simplifications to “Communications of data of invoices issued and received”

• Italy: Mandatory e-invoicing?

EMEA

• South Africa: VAT rate increase

• GCC – where are we?

• UAE: What's been released ? What's missing? Designated Zones

NOAM

• USA: Landmark sales tax nexus case to be heard in Supreme Court

APAC

• India: GST update

• China: Further VAT reform

• Malaysia: GST Compliance Assurance Program (MyGCAP)

• Singapore: Future GST rate increase / reverse charge

• Australia: Final guidance published for online retailers - GST on low value imported goods

This publication has been prepared only as a high level guide. No responsibility can be accepted by us for loss occasioned to any person acting or refraining from acting as a result of any material in this publication.

Spain - First penalties relating to SII

The Spanish Tax Authorities have announced that they start to impose penalties for the non-compliance with the Immediate Supply of Information on VAT (ISI). The ISI entered into force last 1 July 2017, but the appropriate regulation of certain specific penalties did not come into effect until 1 January 2018.

Inheritance tax deductions aragon

Setting out the main deductions allowable for beneficiaries of an inheritance when residents of the region of Aragon, Spain

Brexit Broadcast: What we know so far and where is the momentum heading

2017 headlines have been dominated by the ongoing Brexit process, and the currency markets have been closely watching the developments. While dealing is now taking place in a calmer and more liquid environment than during the initial shock following the vote, Sterling remains weakened and is sensitive to both positive and negative headlines about the negotiations.

As both sides work to reach a deal on the financial settlement, citizens’ rights and the Irish border before the EU Summit on 14th December, we take a look at what’s happened so far and what could happen next.

The UK’s New Immigration System For EU Citizens

The United Kingdom had made an official exit from the European Union on January 31, 2020. However, both parties decided to keep many clauses and functions untouched till December 31, 2020 for a smooth transition. Therefore, as a result of the ‘Brexit’, from January 1, 2021, many things changed for the people of the United Kingdom, as well as, for the European Union.

Link to original article - https://www.skuad.io/blog/brexit-aftermath-the-uks-new-immigration-system-for-eu-citizens/

Cyprus VAT Alert - Obligation for Submission of VAT Returns Electronically

The Taxation Department has informed that pursuant to the amendment of Regulation 17, of the VAT Regulations (Κ.Δ.Π 367/2016), all taxable persons from 2/5/2017 will have an obligation to submit their VAT return (Form VAT4) electronically. The relevant provisions exempt from this obligation any persons who are subject to the agricultural scheme and the special regime for taxis.

Please see full alert attached.

What's hot (11)

International Indirect Tax - Global VAT/GST update (March 2018)

International Indirect Tax - Global VAT/GST update (March 2018)

Brexit Broadcast: What we know so far and where is the momentum heading

Brexit Broadcast: What we know so far and where is the momentum heading

Cyprus VAT Alert - Obligation for Submission of VAT Returns Electronically

Cyprus VAT Alert - Obligation for Submission of VAT Returns Electronically

Viewers also liked

Hukum bernoulli

Slide PowerPoint ini berisi sedikit penjelasan tentang Hukum Bernoulli dan penurunan rumusnya.

Site Audit At Mount Pedro (Piduruthalagala)

Macro Economic and Micro Economic Factors which affects the beauty of Mount Pedro is discussed in this Presentation

This Includes:

-What is Mount Pedro (Piduruthalagala)?

-TV Tower of Rupavahini Corporation

-Peak of Piduruthalgala

-Location of Piduruthalagala

-Highest House in Sri Lanka

-Highest Temple in Sri Lanka

-Highest and Coolest Village in Sri Lanka

-Political and Legal Factors at Mount Pedro

-Environmental, Economical and Technological Factors at Mount Pedro

-Customers Suppliers and Media at mount Pedro

-Position of Mount Pedro in the Butlers Cycle

-Future Strategies and Actions Recommended to Mount Pedro

10 facts about taxation in Slovakia | Infographic

Discover the top 10 facts about taxation in Slovakia, one of the many overviews to come about Slovak business environment.

Viewers also liked (14)

141369904 chirurgie-si-specialitati-inrudite-dr-d-vasile-dr-m-grigoriu-transf...

141369904 chirurgie-si-specialitati-inrudite-dr-d-vasile-dr-m-grigoriu-transf...

Similar to 10 facts about taxation in the Czech Republic | Infographic

10 facts about taxation in Romania | Infographic

Targeting both current business owners but also future entrepreneurs, our “10 facts about taxation in Romania” is an essential overview of local taxation aspects - find out more bellow!

2015 Tax Guideline for Slovakia

If you are considering to expand your business activities in Central and Eastern Europe, Slovakia should be on the top of your destinations list. Thank to its political stability, strategic location, common European currency, competitive taxation system and well-educated and highly skilled workforce Slovakia counts as one of the most attractive country in the region of CEE.

2015 Handbook: Doing business in Germany

If you are considering to face new challenges and expand your business to the direction west, Germany would probably stand on the top of your destinations list.

Baker & McKenzie's Doing Business in Poland - Chapter 5 (Tax System)

Key insights for prospective foreign investors in Poland from country's leading law firm.

The most important changes foreseen by the new 2018 Tax Code in Romania

On November 10, 2017, was published the Emergency Ordinance 79/2017 on the amendment of the Fiscal Code.

Taxation of individuals & corporates chamcham presentation 2012 - bw update

Tax Seminar 2012:Slovakia, new fiscal reform

2019 Tax Guideline for Hungary

As with previous years, our tax experts have prepared a comprehensive yet brief overview of taxation in Hungary.

Our material shall provide you with the necessary information about Hungarian business environment and its statutory framework, therefore we encourage you to pay close attention.

Taxation in Brazil

Presentation to Students of the School of Business, University of Victoria, Canada in São Paulo

11 April 2013

The spanish tax system

This presentation explains the basics of the Spanish Tax system in force in 2014.

Taxation in Finland

Taxation in Finland: Corporate taxation, Individual taxation, Tax rates in Finland, VAT, R&D Tax break for companies

Brexit Indirect Tax Impact Analysis

Helping you to understand the Customs Duty, VAT and administrative costs associated with Brexit

Similar to 10 facts about taxation in the Czech Republic | Infographic (20)

Baker & McKenzie's Doing Business in Poland - Chapter 5 (Tax System)

Baker & McKenzie's Doing Business in Poland - Chapter 5 (Tax System)

The most important changes foreseen by the new 2018 Tax Code in Romania

The most important changes foreseen by the new 2018 Tax Code in Romania

Taxation of individuals & corporates chamcham presentation 2012 - bw update

Taxation of individuals & corporates chamcham presentation 2012 - bw update

Recently uploaded

Authentically Social by Corey Perlman - EO Puerto Rico

Authentically Social by Corey Perlman - EO Puerto RicoCorey Perlman, Social Media Speaker and Consultant

Social media for business Top mailing list providers in the USA.pptx

Discover the top mailing list providers in the USA, offering targeted lists, segmentation, and analytics to optimize your marketing campaigns and drive engagement.

An introduction to the cryptocurrency investment platform Binance Savings.

Learn how to use Binance Savings to expand your bitcoin holdings. Discover how to maximize your earnings on one of the most reliable cryptocurrency exchange platforms, as well as how to earn interest on your cryptocurrency holdings and the various savings choices available.

Maksym Vyshnivetskyi: PMO Quality Management (UA)

Maksym Vyshnivetskyi: PMO Quality Management (UA)

Lemberg PMO School 2024

Website – https://lembs.com/pmoschool

Youtube – https://www.youtube.com/startuplviv

FB – https://www.facebook.com/pmdayconference

Discover the innovative and creative projects that highlight my journey throu...

Discover the innovative and creative projects that highlight my journey through Full Sail University. Below, you’ll find a collection of my work showcasing my skills and expertise in digital marketing, event planning, and media production.

ModelingMarketingStrategiesMKS.CollumbiaUniversitypdf

Implicitly or explicitly all competing businesses employ a strategy to select a mix

of marketing resources. Formulating such competitive strategies fundamentally

involves recognizing relationships between elements of the marketing mix (e.g.,

price and product quality), as well as assessing competitive and market conditions

(i.e., industry structure in the language of economics).

LA HUG - Video Testimonials with Chynna Morgan - June 2024

Have you ever heard that user-generated content or video testimonials can take your brand to the next level? We will explore how you can effectively use video testimonials to leverage and boost your sales, content strategy, and increase your CRM data.🤯

We will dig deeper into:

1. How to capture video testimonials that convert from your audience 🎥

2. How to leverage your testimonials to boost your sales 💲

3. How you can capture more CRM data to understand your audience better through video testimonials. 📊

Buy Verified PayPal Account | Buy Google 5 Star Reviews

Buy Verified PayPal Account

Looking to buy verified PayPal accounts? Discover 7 expert tips for safely purchasing a verified PayPal account in 2024. Ensure security and reliability for your transactions.

PayPal Services Features-

🟢 Email Access

🟢 Bank Added

🟢 Card Verified

🟢 Full SSN Provided

🟢 Phone Number Access

🟢 Driving License Copy

🟢 Fasted Delivery

Client Satisfaction is Our First priority. Our services is very appropriate to buy. We assume that the first-rate way to purchase our offerings is to order on the website. If you have any worry in our cooperation usually You can order us on Skype or Telegram.

24/7 Hours Reply/Please Contact

usawebmarketEmail: support@usawebmarket.com

Skype: usawebmarket

Telegram: @usawebmarket

WhatsApp: +1(218) 203-5951

USA WEB MARKET is the Best Verified PayPal, Payoneer, Cash App, Skrill, Neteller, Stripe Account and SEO, SMM Service provider.100%Satisfection granted.100% replacement Granted.

3.0 Project 2_ Developing My Brand Identity Kit.pptx

A personal brand exploration presentation summarizes an individual's unique qualities and goals, covering strengths, values, passions, and target audience. It helps individuals understand what makes them stand out, their desired image, and how they aim to achieve it.

Exploring Patterns of Connection with Social Dreaming

Exploring Patterns of Connection -Introduction to Social Dreaming

#Systems Psychodynamics

#Innovation

#Creativity

#Consultancy

#Coaching

-- June 2024 is National Volunteer Month --

Check out our June display of books on voluntary organisations

VAT Registration Outlined In UAE: Benefits and Requirements

Vat Registration is a legal obligation for businesses meeting the threshold requirement, helping companies avoid fines and ramifications. Contact now!

https://viralsocialtrends.com/vat-registration-outlined-in-uae/

Recently uploaded (20)

Authentically Social by Corey Perlman - EO Puerto Rico

Authentically Social by Corey Perlman - EO Puerto Rico

Training my puppy and implementation in this story

Training my puppy and implementation in this story

An introduction to the cryptocurrency investment platform Binance Savings.

An introduction to the cryptocurrency investment platform Binance Savings.

Discover the innovative and creative projects that highlight my journey throu...

Discover the innovative and creative projects that highlight my journey throu...

ModelingMarketingStrategiesMKS.CollumbiaUniversitypdf

ModelingMarketingStrategiesMKS.CollumbiaUniversitypdf

Auditing study material for b.com final year students

Auditing study material for b.com final year students

Bài tập - Tiếng anh 11 Global Success UNIT 1 - Bản HS.doc

Bài tập - Tiếng anh 11 Global Success UNIT 1 - Bản HS.doc

LA HUG - Video Testimonials with Chynna Morgan - June 2024

LA HUG - Video Testimonials with Chynna Morgan - June 2024

Buy Verified PayPal Account | Buy Google 5 Star Reviews

Buy Verified PayPal Account | Buy Google 5 Star Reviews

3.0 Project 2_ Developing My Brand Identity Kit.pptx

3.0 Project 2_ Developing My Brand Identity Kit.pptx

Exploring Patterns of Connection with Social Dreaming

Exploring Patterns of Connection with Social Dreaming

Set off and carry forward of losses and assessment of individuals.pptx

Set off and carry forward of losses and assessment of individuals.pptx

VAT Registration Outlined In UAE: Benefits and Requirements

VAT Registration Outlined In UAE: Benefits and Requirements

10 facts about taxation in the Czech Republic | Infographic

- 1. Standard Corporate Income Tax (CIT): 19% basic investment funds: 5% | Withholding Tax Rate 15% tax (for payment to EU/EAA*) 35% tax (for payment outside EU/EAA) * Dividends paid by a subsidiary to parent company (that holds 10% share uninterrupted in the past 12 months) are exempt from taxation. Interest and Royalties could be a tax exempt under the implemented EU directive as well. Reduced CIT is applied to Standard VAT in the Czech Republic: 21% Reduced VAT 10 Facts about Taxation in the Czech Republic 1 2 3 4 8 9 10 15% applies to the selected types of goods and services, such as food, non-alcoholic beverage, special healthcare products, pharmaceutical products, public transport, hotel accommodation 10% applies to the selected types of goods, such as infant nutrition, drugs and vaccines, printed books Personal Income Tax Social security contributions paid by Employees: 11% Social security contributions paid by Employer: 34% Tax losses Losses generated from independent activities and rental activities may be set off against all types of income (except employment income) Losses that cannot be set off may be carried forward The standard carry-forward period is 5 years Income from a sale of house/flat (if the seller has a permanent residence for min. 2 years before the sale) Income from a sale of immovable asset (when the period of ownership exceeded 5 years before sale) Income from sale of movable property (with exceptions) Income from sale of a share in a LLC (if the share was held for at least 5 years before the sale) Income from sale of securities (if held for min. 3 years before sale or if total income < CZK 100,000 / approx. EUR 3,700) Pensions (up to CZK 396,000 / approx. EUR 14,667) Gratuitous income (e.g. income from inheritance, selected gifts) Tax exemptions in the Czech Republic About Accace With more than 330 professionals and over 1,400 international companies as customers, Accace is a leading outsourcing and advisory services provider with offices in Czech Republic, Hungary, Romania, Slovakia, Poland, Ukraine and Germany. Locations in other European countries are covered via Accace’s trusted network of partners. www.accace.com accace@accace.com The present infographic has been prepared for general guidance and does not represent a professional advice. Furthermore, because the legislation is changing continuously, some of the information may have been modified after the material has been released. Accace does not take any responsibility and is not liable for any potential risks or damages caused by taking actions based on the information provided herein without additional detailed expert advice. 6 7 5 pension funds: 0% flat tax rate of 15% applies on "super gross" income solidarity tax of 7% applies on gross income exceeding the annual social security cap (relevant for high-earning individuals) 6.5% to social security, only up to the annual social security cap 4.5% to health insurance 25% to social security, only up to the annual social security cap 9% to health insurance January 2017