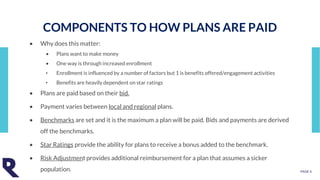

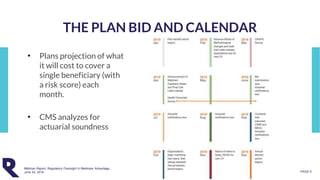

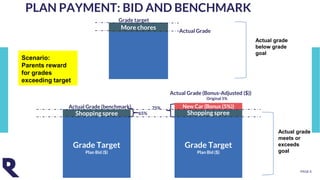

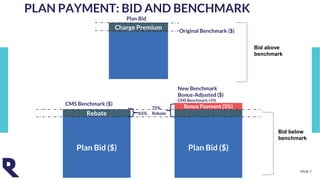

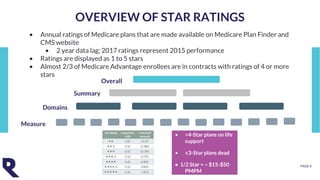

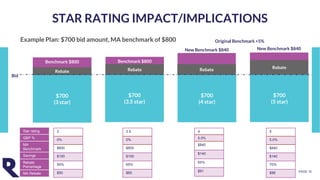

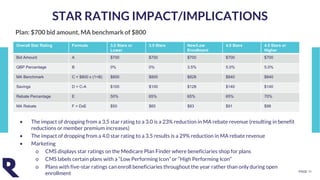

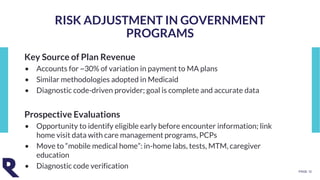

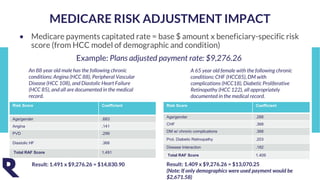

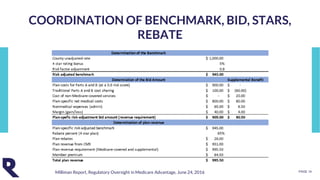

The document discusses the impact of government-sponsored health programs on organic growth, highlighting the importance of star ratings, member experience, and risk adjustment in determining reimbursement rates for plans. It emphasizes the relationship between plan offerings, enrollment, and financial outcomes, including risk adjustment calculations and the effects of star ratings on rebates. Lastly, it outlines new opportunities for plans to benefit from changes in regulations and payment adjustments.