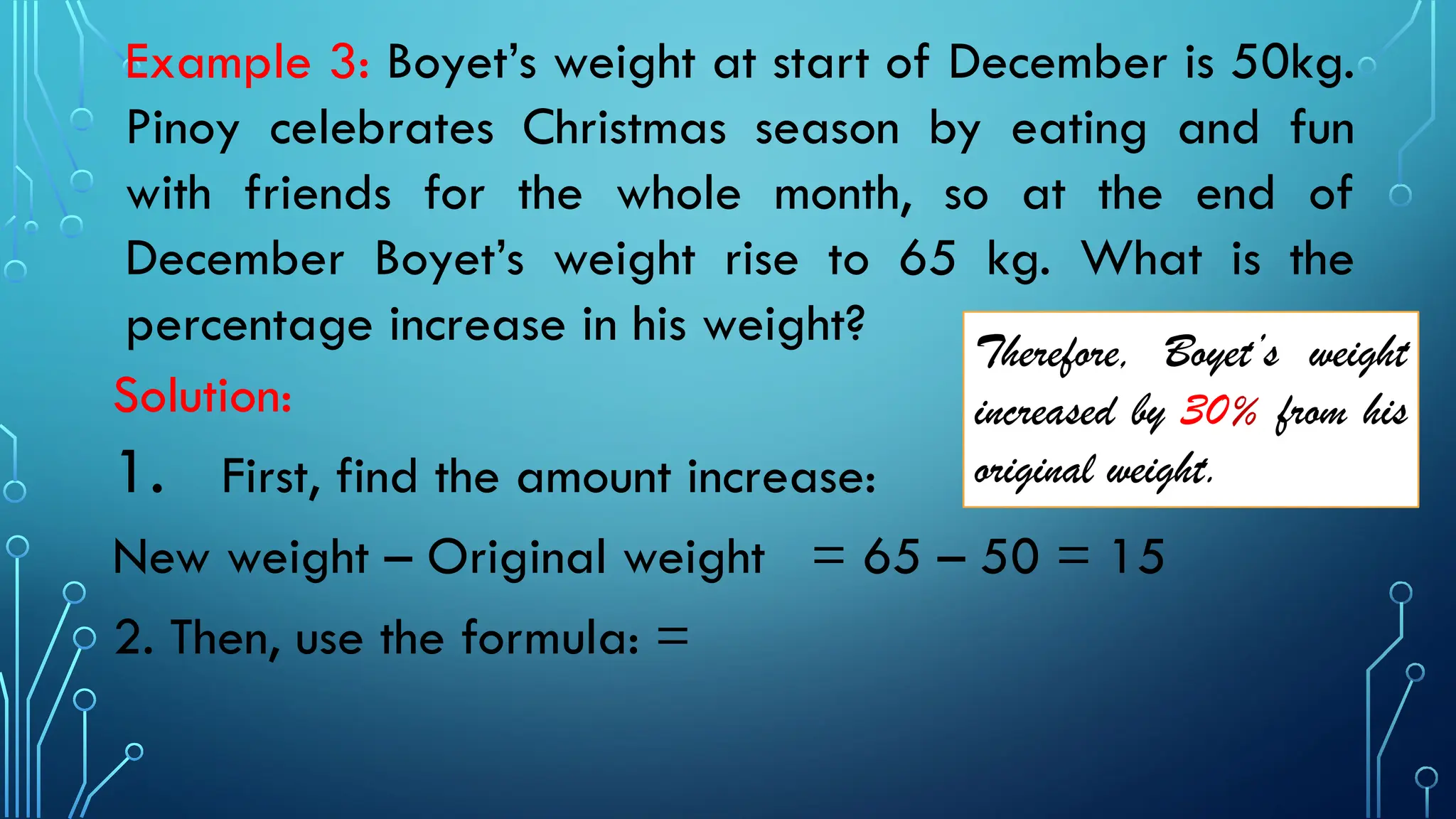

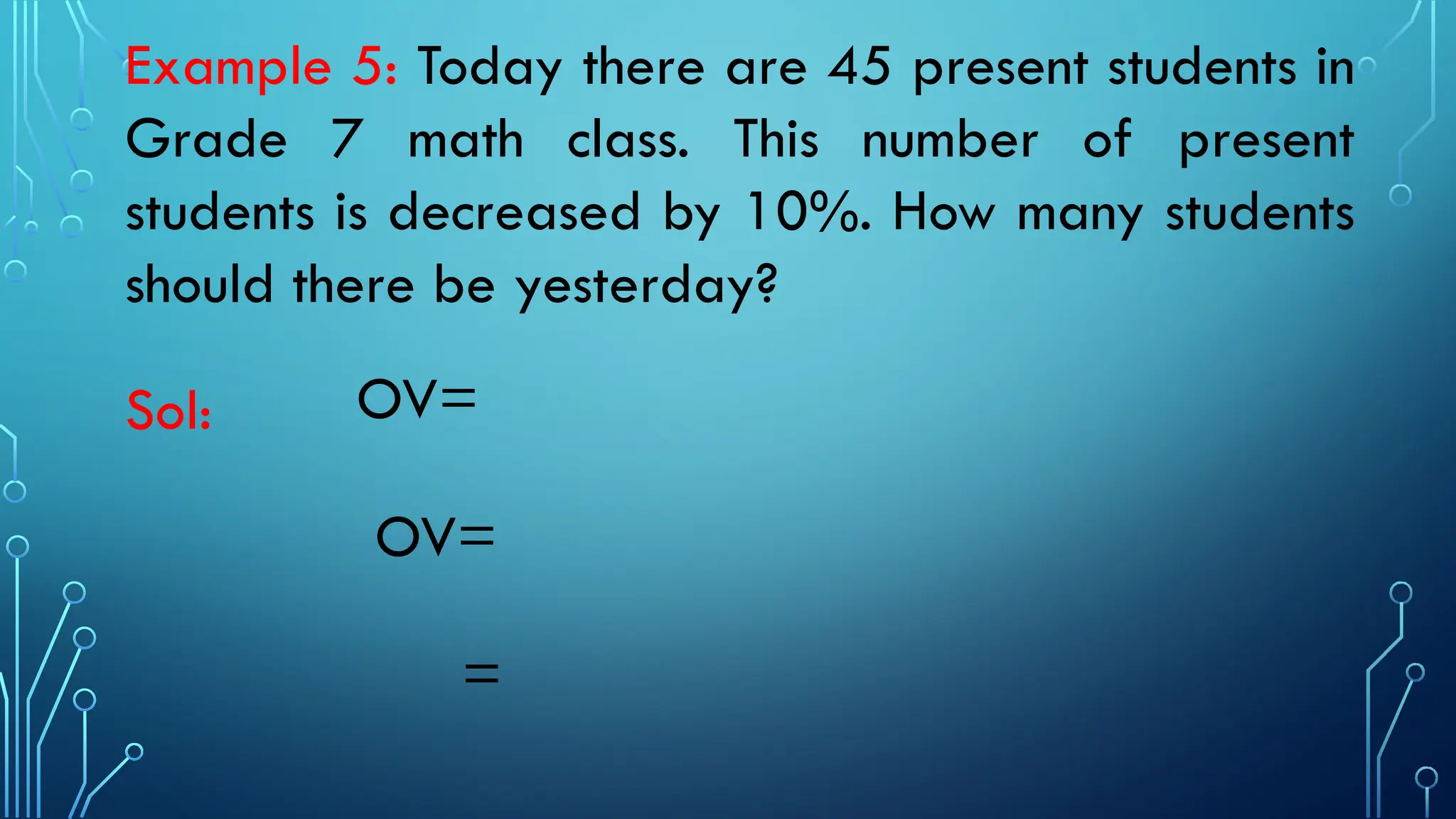

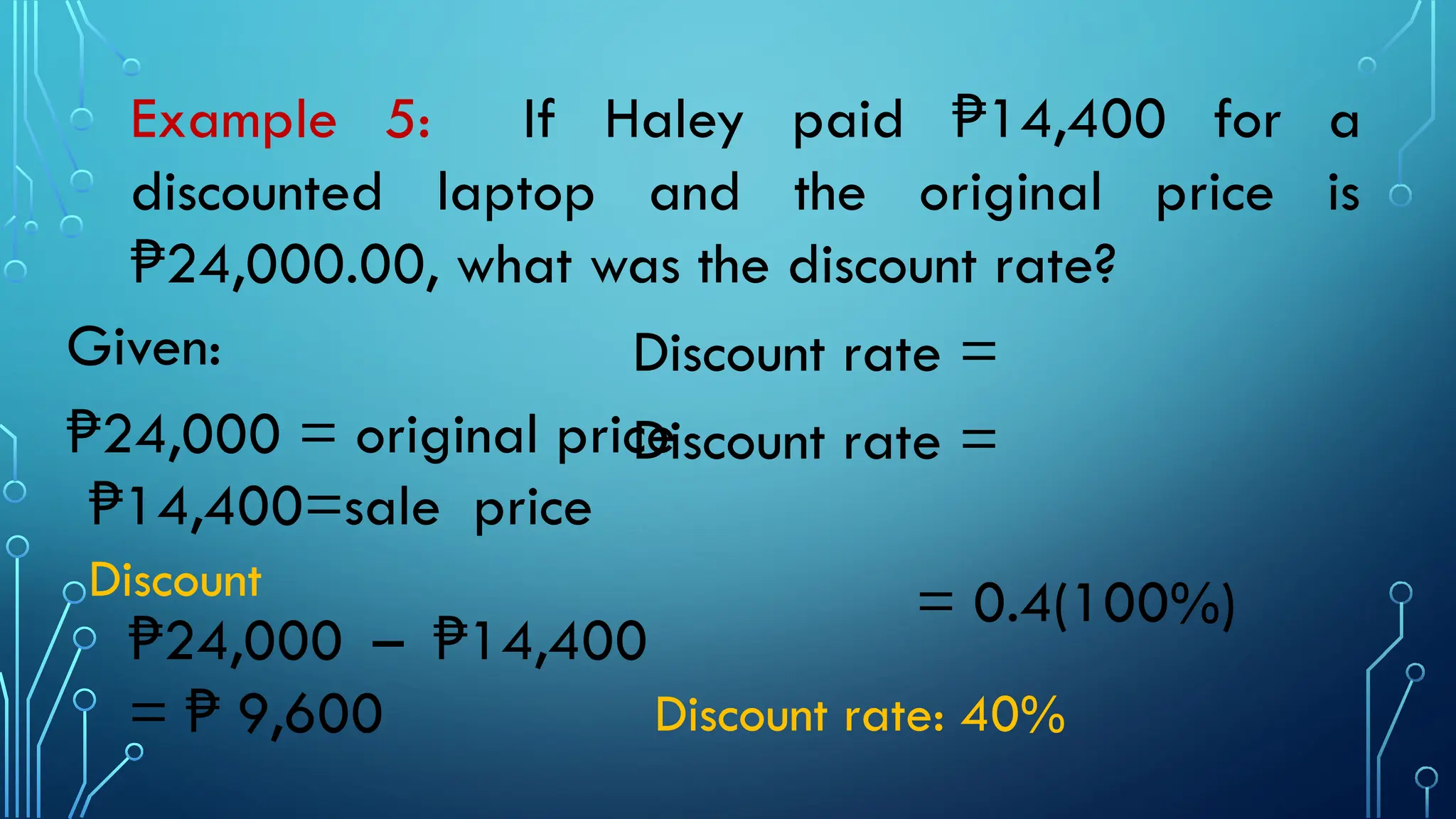

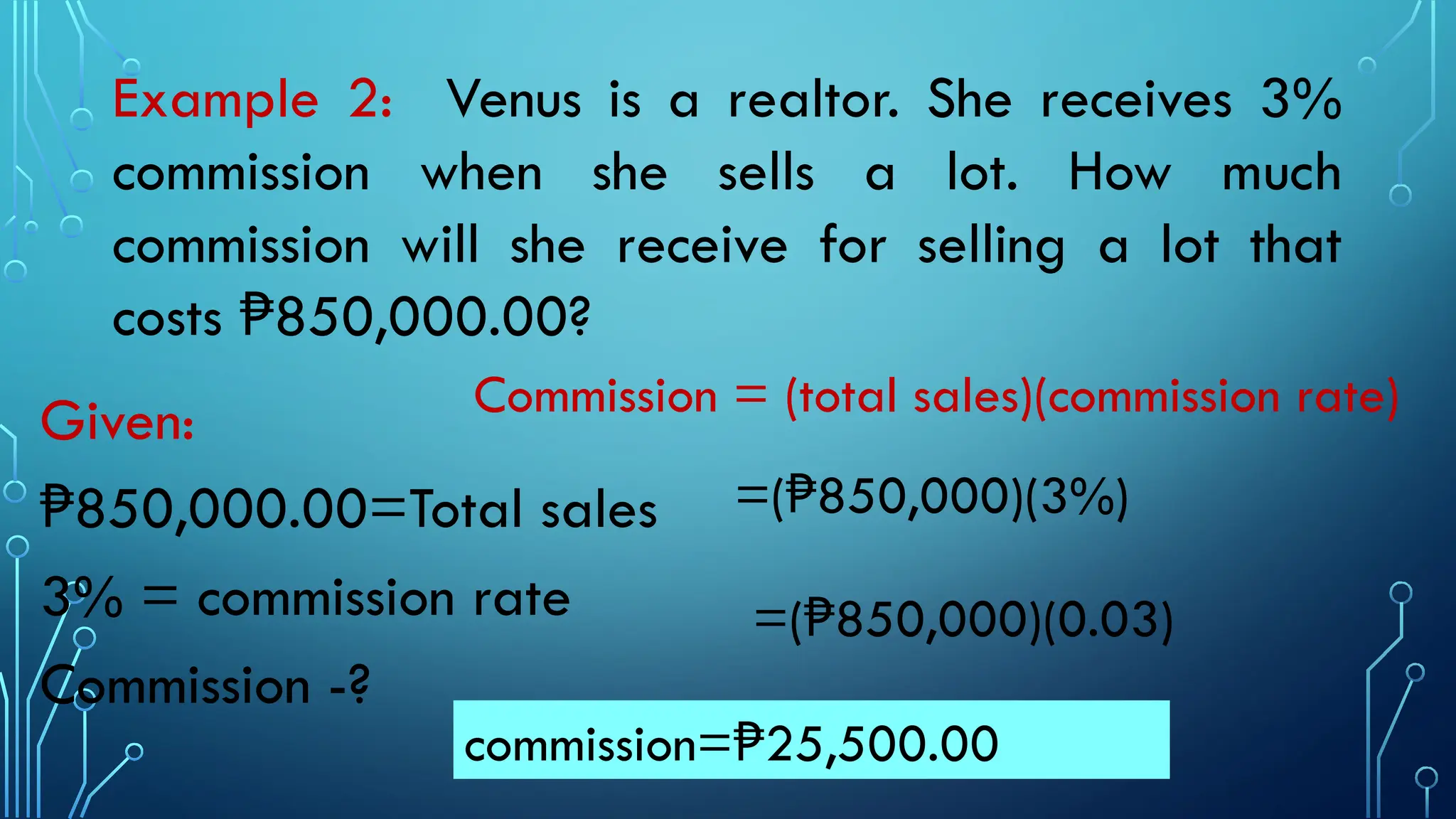

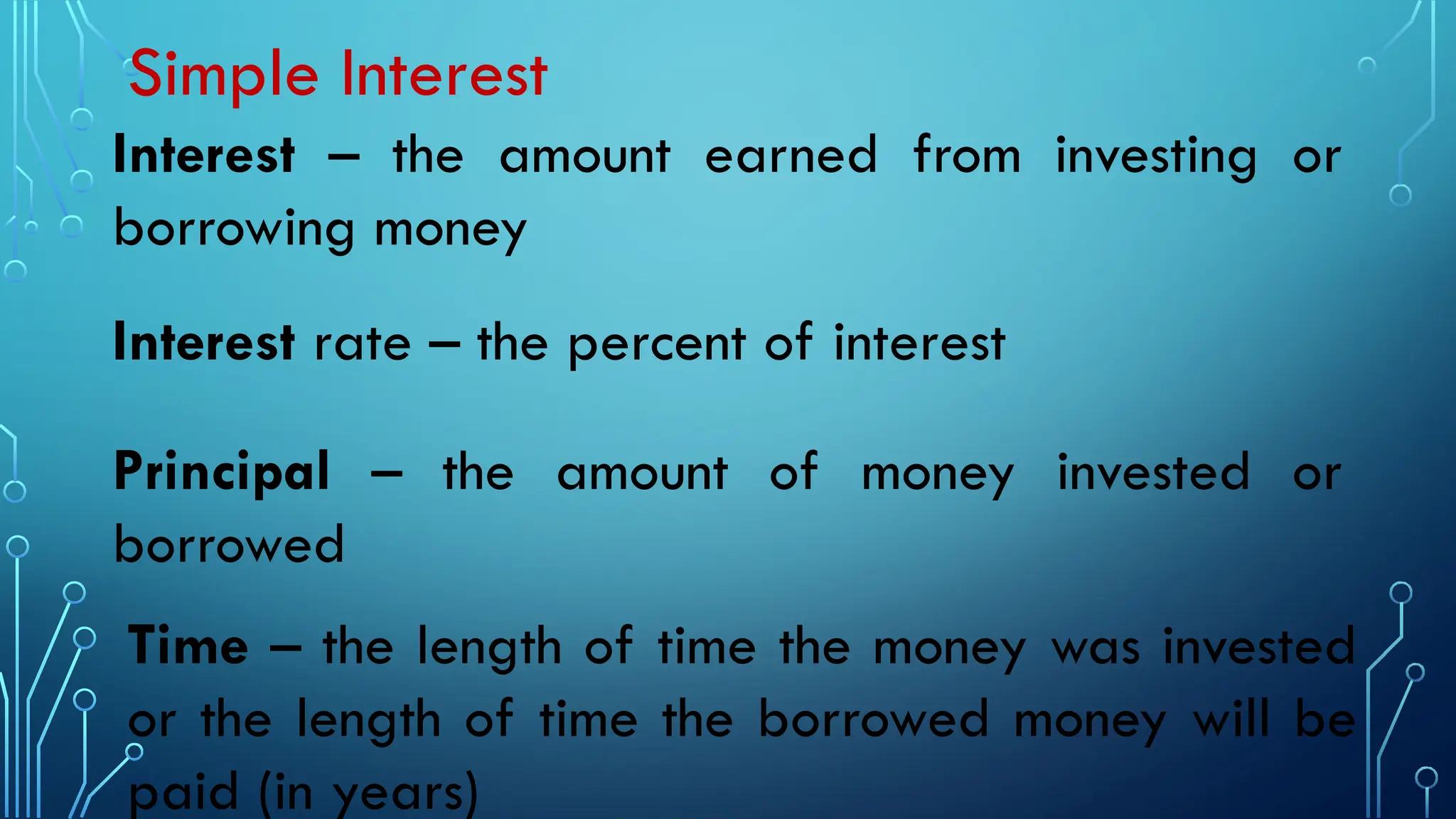

The document provides a comprehensive guide on calculating percentage increases, decreases, discounts, and simple interest. It includes formulas and multiple examples demonstrating how to find the percent of change for various scenarios. Additionally, it covers concepts related to commission rates and sales tax calculations.