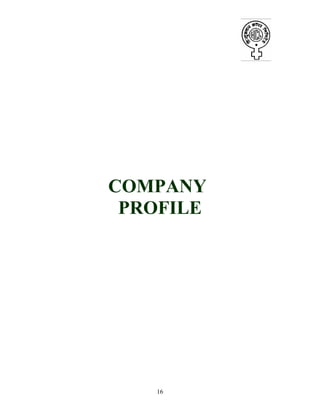

The document is a project report by Sourav Vijay Prusty on the finance department of Hindustan Copper Limited (HCL), submitted for an MBA course at the University of Pune. It includes acknowledgments, an executive summary detailing the history and operations of HCL, and various chapters covering the company's profile, research methodology, and financial analysis. The report emphasizes copper's significance, the production capacities of HCL's mining projects, and the contribution of the Malanjkhand Copper Project to India's copper reserves.

![13

INTRODUCTION

Hindustan copper ltd was incorporated on 9-Nov-1967. It was the only vertically

Integrated multi-unit copper producer in India , engaged in a wide spectrum Of activities

Hindustan Copper Limited the premier copper producer for he last 37 years, Has

made its landmark in the history of copper mining ,smelting and refining

In India . H.C.L operation in short include mining, crushing and grinding of Ore to

produce concentrate, which is then smelted and electro refined to Produce copper

cathodes ,wire bars and continous cast copper wire rods.

These operation involve highly Mechanized Mining Technology. In 1967 H.C.L

established itself as an “A” grade company with four producing unit ,one each in

Rajasthan, Jharkhand, Madhaya Pradesh, Maharastra and a series of commercial office

all over India .

These units are:-

Khetri copper complex [Rajasthan]

Indian copper complex [Jharkhand]

Malanjkhand Copper Project [Madhya Pradesh]

Taloja Copper Project [Maharastra]](https://image.slidesharecdn.com/0601063studyonfinanancedepartment-140324105220-phpapp02/85/0601063-study-on-finanance-department-14-320.jpg)

![20

[Malanjkhand Copper Project]

Present Operation

Open Pit Mines

Concentrator

Infrastructure Facility](https://image.slidesharecdn.com/0601063studyonfinanancedepartment-140324105220-phpapp02/85/0601063-study-on-finanance-department-21-320.jpg)

![33

WORK / CONTRACTS

Nature of job:

Pass the tender proposal and the estimate were made. i.e

NIT – Notice inventory tender

LIE – Limited tender enquiry

OTE- Open tender

Comparative statement according to:-

DSR – Delhi schedule of rates

CPWD – Central public worries depth

Mine development

Press tender

Work order passed

Bills also passed

E.M.D earnest money deposit

10% security deposit of contract amount

Secured advance – [fixed items only]

Mobilized items [to mobilized the work]](https://image.slidesharecdn.com/0601063studyonfinanancedepartment-140324105220-phpapp02/85/0601063-study-on-finanance-department-34-320.jpg)

![34

Management Information System

MIS [section]

According to various: receipts voucher

Payment voucher

Issue voucher

MIS Section prepared the journal voucher all the daily records

are recorded in it

Debit and credit entries passed in it and balance amount in last

Ay of the month.

According to the journal voucher

*trail balance

*and ledger prepared

*costing](https://image.slidesharecdn.com/0601063studyonfinanancedepartment-140324105220-phpapp02/85/0601063-study-on-finanance-department-35-320.jpg)

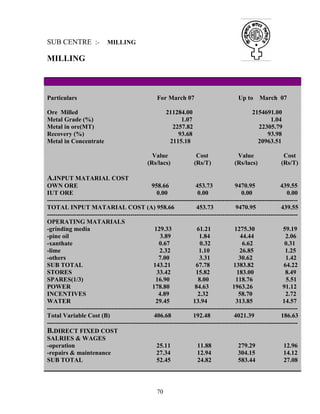

![69

---------------------------------------------------------------------------------------------------------------

total allocated fixed cost (C) 51.99 22.60 635.58 25.32

---------------------------------------------------------------------------------------------------------------

total cost (A+B+C) 51.99 22.60 635.58 25.32

---------------------------------------------------------------------------------------------------------------

cont with blasting exp. 151.84 203.54 2601.66 204.48

]](https://image.slidesharecdn.com/0601063studyonfinanancedepartment-140324105220-phpapp02/85/0601063-study-on-finanance-department-70-320.jpg)

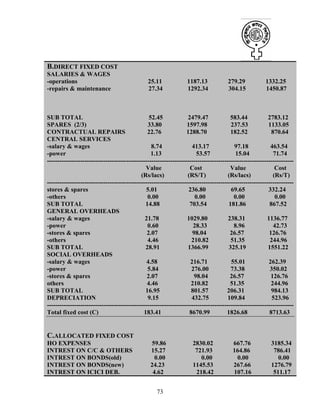

![79

FINDINGS

All the section of finance department

(1) Follow same procedure [according to the rules of govt].and all their section are

linked with each other

(2) In each department centralized authority may finally pass for all the orders and

payments.

(3) In all the finance department Paper work is more so it is better to say that paper work

involve must.

(4) In finance departments authority may not be delegated to each and every person the

work is delegated to only efficient and experienced person .

(5) All the work is done as per rules and regulation and every step follow procedures.

(6) For every movement of activities they maintain the record so lots of paper work

followed here, so proof or evidence of any loop holes in activity easily recognized.

(7) Efficiency in work, accuracy in all work done, maintain discipline.

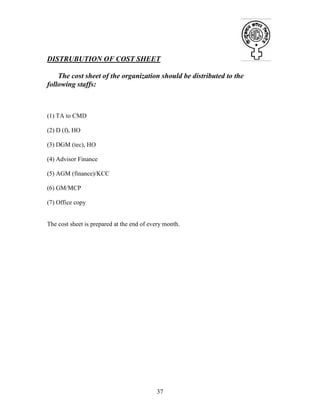

(8) On comparing the turn over, profit & loss of the company it is found that the company

turn over is good on the year 95-96,04-05,05-06 otherwise the company is in loss.

(9)The company internal resources is decrease year after year.

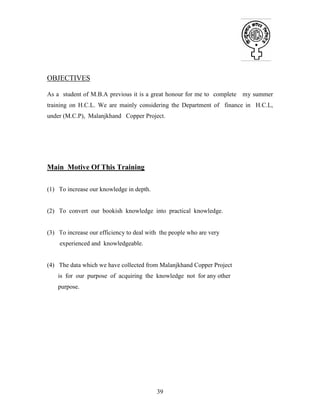

(10) The percentage of net profit of first, second, third fourth quarter is by 84.75%,

201.15%, 388.71%,36.82%.

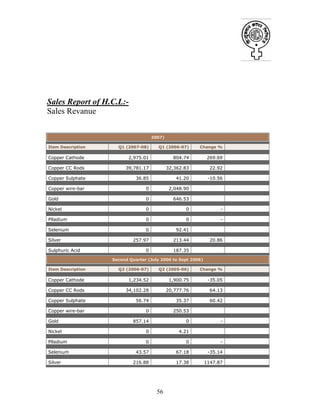

(11) The company makes sales of various items namely Copper cathode, Copper CC rod,

Copper Sulphate, Copper Wire bar, gold, nickel, palladium, selenium, sulphur and

sulphuric acid.

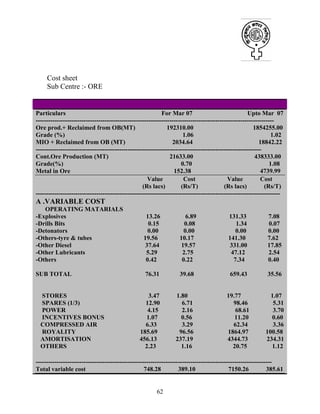

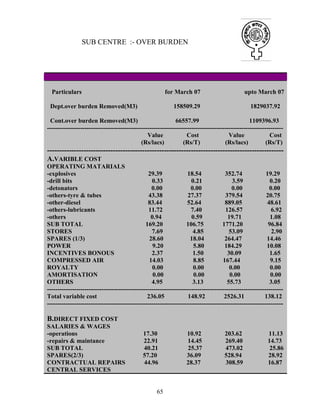

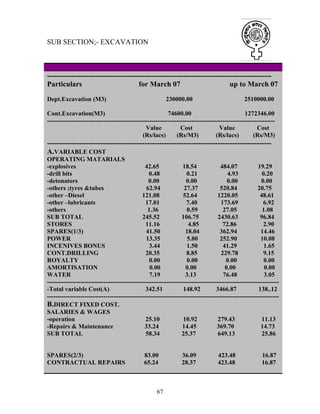

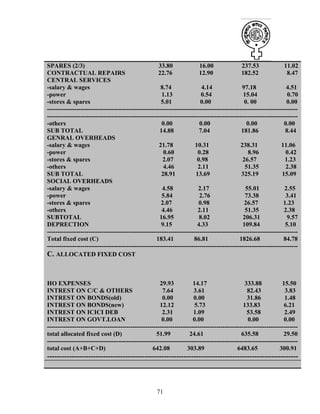

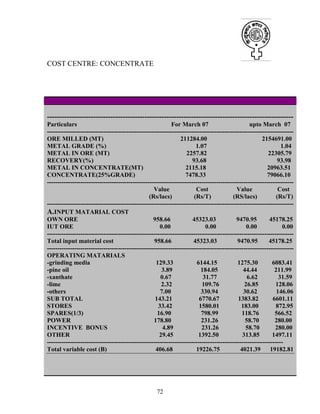

(12) Under costing department cost sheet is prepared for Ore, Overburden, Excavation,

Milling, Concentrate and cost sheet is distributed to mainly director finance, DGM,

Advisor Finance, AGM(finance), GM.](https://image.slidesharecdn.com/0601063studyonfinanancedepartment-140324105220-phpapp02/85/0601063-study-on-finanance-department-80-320.jpg)

![81

CONCLUSION

Hindustan copper project [M.C.P] is a big organization. All the work is done very

efficiently and effectively. But some where its inefficiency was observed, Technology

which are used here is not efficient

(1) All the department in finance adopt same type of procedure so it is important that

Some research and development section is to be made by which work is to be done in

fast and effective manner.

(2) Authority for some important work also delegated to inefficient employee and by

which the employees are motivated and emphasized by the superior for best performance

and are rewarded for incentives and promotions.

(3) There are lots of old techniques used in finance department of MCP which

is time consuming and people working by those techniques take more time to do their

work so It is time consuming as well as there maintenance is more and there is also

wastage of money e.g., typewriter is used instead of computer.

(4) The organization has lots of paper work which take lots of extra time and there is

chance of misuse of important papers, documents etc, so there should be reduction in

paper work.

(5) Because it is a govt organization so discipline is not maintained in a proper way. The

organization should be more disciplined.](https://image.slidesharecdn.com/0601063studyonfinanancedepartment-140324105220-phpapp02/85/0601063-study-on-finanance-department-82-320.jpg)