FIN 401 Entire Course NEW

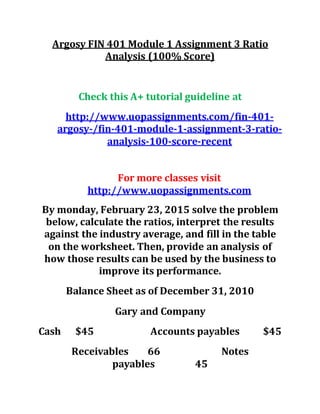

- 1. Argosy FIN 401 Module 1 Assignment 3 Ratio Analysis (100% Score) Check this A+ tutorial guideline at http://www.uopassignments.com/fin-401- argosy-/fin-401-module-1-assignment-3-ratio- analysis-100-score-recent For more classes visit http://www.uopassignments.com By monday, February 23, 2015 solve the problem below, calculate the ratios, interpret the results against the industry average, and fill in the table on the worksheet. Then, provide an analysis of how those results can be used by the business to improve its performance. Balance Sheet as of December 31, 2010 Gary and Company Cash $45 Accounts payables $45 Receivables 66 Notes payables 45

- 2. Inventory 159 Other current liabilities 21 Marketable securities 33 Total current liabilities $111 Total current assets $303 Net fixed assets 147 Long Term Liabilities Total Assets $450 Long-term debt 24 Total Liabilities $135 Owners Equity Common stock $114 Retained earnings 201 Total stockholders’ equity 315 Total liabilities and equity $450 Income Statement Year 2010

- 3. Net sales $795 Cost of goods sold 660 Gross profit 135 Selling expenses 73.5 Depreciation 12 EBIT 49.5 Interest expense 4.5 EBT 45 Taxes (40%) 18 Net income 27 1. Calculate the following ratios AND interpret the result against the industry average: Ratio Your Answer Industry Average Your Interpretation (Good-Fair-Low-Poor)

- 4. Profit margin on sales 3% Return on assets 9% Receivable turnover 16X Inventory turnover 10X Fixed asset turnover 2X Total asset turnover 3X Current ratio 2X Quick ratio 1.5X Times interest earned 7X 2. Analysis: Give your interpretation of what the ratios calculations show and how the business can use this information to improve its performance. Justify all answers. Highlight your answers. Receivable turnover requires the use of credit sales. Since you are not given this number please use the sales figure of 795.

- 5. I am pasting the required form for you to complete, as a reminder. Remember to show me your work. You can put the calculations at the end of your paper. If these are not included I will have to count the answer wrong. Ratio Your Answer Industry Average Your Interpretation (Good-Fair-Low-Poor) Profit margin on sales 3% Return on assets 9% Receivable turnover 1.6X Inventory turnover 10X Fixed asset turnover 2X Total asset turnover 3X Current ratio 2X Quick ratio 1.5X

- 6. Argosy FIN 401 Module 2 Assignment 2 Cash Management (100 Score) Check this A+ tutorial guideline at http://www.uopassignments.com/fin-401- argosy-/fin-401-module-2-assignment-2-cash- management-100-score-recent For more classes visit http://www.uopassignments.com Norma’s Cat Food of Shell Knob ships cat food throughout the country. Norma has determined that through the establishment of local collection centers around the country, she can speed up the collection of payments by two and one-half days. Furthermore, the cash management department of her bank has indicated to her that she can defer her payments on her accounts by one-half day without affecting suppliers. The bank has a remote disbursement center in Iowa. a.If the company has $5 million per day in collections and $3 million per day in

- 7. disbursements, how many dollars will the cash management system free up? Justify your answers. b.If the company can earn 8 percent per annum on freed-up funds, how much will the income be? Justify your answers. c.If the annual cost of the new system is $800,000, should it be implemented? Explain why or why not.

- 8. Argosy FIN 401 Module 3 Assignment 2 LASA 1 The Time Value of Money (100 Score) Check this A+ tutorial guideline at http://www.uopassignments.com/fin-401- argosy-/fin-401-module-3-assignment-2-lasa- 1-the-time-value-of-money-100-score-recent For more classes visit http://www.uopassignments.com Mary has been working for a university for almost 25 years and is now approaching retirement. She wants to address several financial issues before her retirement and has asked you to help her resolve the situations below. Her assignment to you is to provide a 4-5 page report, addressing each of the following issues separately. You are to show all your calculations and provide a detailed explanation for each issue. Issue A:

- 9. For the last 19 years, Mary has been depositing $500 in her savings account , which has earned 5% per year, compounded annually and is expected to continue paying that amount. Mary will make one more $500 deposit one year from today. If Mary closes the account right after she makes the last deposit, how much will this account be worth at that time? Issue B: Mary has been working at the university for 25 years, with an excellent record of service. As a result, the board wants to reward her with a bonus to her retirement package. They are offering her $75,000 a year for 20 years, starting one year from her retirement date and each year for 19 years after that date. Mary would prefer a one-time payment the day after she retires. What would this amount be if the appropriate interest rate is 7%? Issue C: Mary’sreplacement is unexpectedly hired away by another school, and Mary is asked to stay in her position for another three years. The board assumes the bonus should stay the same, but Mary knows the present value of her bonus will change.

- 10. What would be the present value of her deferred annuity? Issue D: Mary wants to help pay for her granddaughter Beth’s education. She has decided to pay for half of the tuition costs at State University, which are now $11,000 per year. Tuition is expected to increase at a rate of 7% per year into the foreseeable future. Beth just had her 12th birthday. Beth plans to start college on her 18th birthday and finish in four years. Mary will make a deposit today and continue making deposits each year until Beth starts college. The account will earn 4% interest, compounded annually. How much must Mary’s deposits be each year in order to pay half of Beth’s tuition at the beginning of each school each year?

- 11. Argosy FIN 401 Module 4 Assignment 2 The Weighted Average Cost of Capital (100 Score) Check this A+ tutorial guideline at http://www.uopassignments.com/fin-401- argosy-/fin-401-module-4-assignment-2-the- weighted-average-cost-of-capital-100-score- recent For more classes visit http://www.uopassignments.com Coogly Company is attempting to identify its weighted average cost of capital for the coming year and has hired you to answer some questions they have about the process. They have asked you to present this information in a PowerPoint presentation to the company’s management team. The company would like for you to keep your presentation to approximately 10 slides and use the notes section in PowerPoint to clarify your point. Your presentation should address the following questions and offer a final recommendation to Coogly. Make sure you support your answers and clearly explain the advantages and disadvantages of utilizing the weighted

- 12. average cost of capital methodology. Include at least one graph or chart in your presentation. Company Information The capital structure for the firm will be maintained and is now 10% preferred stock, 30% debt, and 60% new common stock. No retained earnings are available. The marginal tax rate for the firm is 40%. Coogly has outstanding preferred stock That pays a dividend of $4 per share and sells for $82 per share, with a floatation cost of $6 per share. What is the component cost for Coogly's preferred stock? What are the advantages and disadvantages of using preferred stock in the capital structure? If the company issues new common stock, it will sell for $50 per share with a floatation cost of $9 per share. The last dividend paid was $3.80 and this dividend is expected to grow at a rate of 7% for the foreseeable future. What is the cost of new equity to the firm? What are the advantages and disadvantages of issuing new equity in the capital structure? The company will use new bonds for any capital project, according to the capital structure. These bonds will have a market and par value of $1000,

- 13. with a coupon rate of 6% and a floatation cost of 7%. The bonds will mature in 20 years and no other debt will be used for any new investments. What is the cost of new debt? What are the advantages and disadvantages of issuing new debt in the capital structure? Given the component costs identified above and the capital structure for the firm, what is the weighted average cost of capital for Coogly? What are the advantages and disadvantages of using this method in the capital budgeting process?

- 14. Argosy FIN 401 Module 5 Assignment 1 LASA 2 The Capital Budgeting Decision (100 Score) Check this A+ tutorial guideline at http://www.uopassignments.com/fin-401- argosy-/fin-401-module-5-assignment-1-lasa- 2-the-capital-budgeting-decision-100-score- recent For more classes visit http://www.uopassignments.com As a financial consultant, you have contracted with Wheel Industries to evaluate their procedures involving the evaluation of long term investment opportunities. You have agreed to provide a detailed report illustrating the use of several techniques for evaluating capital projects including the weighted average cost of capital to the firm, the anticipated cash flows for the projects, and the methods used for project selection. In addition, you have been asked to evaluate two projects, incorporating risk into the calculations.

- 15. You have also agreed to provide an 8-10 page report, in good form, with detailed explanation of your methodology, findings, and recommendations. Company Information Wheel Industries is considering a three-year expansion project, Project A. The project requires an initial investment of $1.5 million. The project will use the straight-line depreciation method. The project has no salvage value. It is estimated that the project will generate additional revenues of $1.2 million per year before tax and has additional annual costs of $600,000. The Marginal Tax rate is 35%. Required: 1. Wheel has just paid a dividend of $2.50 per share. The dividends are expected to grow at a constant rate of six percent per year forever. If the stock is currently selling for $50 per share with a 10% flotation cost, what is the cost of new equity for the firm? What are the advantages and disadvantages of using this type of financing for the firm?

- 16. 2. The firm is considering using debt in its capital structure. If the market rate of 5% is appropriate for debt of this kind, what is the after tax cost of debt for the company? What are the advantages and disadvantages of using this type of financing for the firm? 3. The firm has decided on a capital structure consisting of 30% debt and 70% new common stock. Calculate the WACC and explain how it is used in the capital budgeting process. 4. Calculate the after tax cash flows for the project for each year. Explain the methods used in your calculations. 5. If the discount rate were 6 percent calculate the NPV of the project. Is this an economically acceptable project to undertake? Why or why not? 6. Now calculate the IRR for the project. Is this an acceptable project? Why or why not? Is there a conflict between your answer to part C? Explain why or why not? Wheel has two other possible investment opportunities, which are mutually exclusive, and independent of Investment A above. Both

- 17. investments will cost $120,000 and have a life of 6 years. The after tax cash flows are expected to be the same over the six year life for both projects, and the probabilities for each year's after tax cash flow is given in the table below. Investment B Investment C Probability After Tax Cash Flow Probability After Tax Cash Flow 0.25 $20,000 0.30 $22,000 0.50 32,000 0.50 40,000 0.25 40,000 0.20 50,000 7. What is the expected value of each project’s annual after tax cash flow? Justify your answers and identify any conflicts between the IRR and the NPV and explain why these conflicts may occur. 8. Assuming that the appropriate discount rate for projects of this risk level is 8%, what is the risk-adjusted NPV for each project? Which project,

- 18. if either, should be selected? Justify your conclusions.