Report

Share

Download to read offline

Recommended

More Related Content

What's hot

What's hot (20)

Similar to Tds chart for 2015 16

Similar to Tds chart for 2015 16 (20)

From Tedious to TDS | Entrepreneur's guide to withholding taxes in India

From Tedious to TDS | Entrepreneur's guide to withholding taxes in India

U.S.Gandhi Budget 2016 2017 analysis - Finance Bill 2016

U.S.Gandhi Budget 2016 2017 analysis - Finance Bill 2016

Nepal Budget Synopsis FY 2074 75 (FY 2017-18) BRSA-ELITE

Nepal Budget Synopsis FY 2074 75 (FY 2017-18) BRSA-ELITE

Budget 2014: Crisp analysis of Income Tax provisions by Blue Consulting Pvt. ...

Budget 2014: Crisp analysis of Income Tax provisions by Blue Consulting Pvt. ...

More from Shrikrishna Barure

More from Shrikrishna Barure (8)

Recently uploaded

Recently uploaded (20)

Audience profile - SF.pptxxxxxxxxxxxxxxxxxxxxxxxxxxx

Audience profile - SF.pptxxxxxxxxxxxxxxxxxxxxxxxxxxx

KEY NOTE- IBC(INSOLVENCY & BANKRUPTCY CODE) DESIGN- PPT.pptx

KEY NOTE- IBC(INSOLVENCY & BANKRUPTCY CODE) DESIGN- PPT.pptx

The doctrine of harmonious construction under Interpretation of statute

The doctrine of harmonious construction under Interpretation of statute

IBC (Insolvency and Bankruptcy Code 2016)-IOD - PPT.pptx

IBC (Insolvency and Bankruptcy Code 2016)-IOD - PPT.pptx

WhatsApp 📞 8448380779 ✅Call Girls In Nangli Wazidpur Sector 135 ( Noida)

WhatsApp 📞 8448380779 ✅Call Girls In Nangli Wazidpur Sector 135 ( Noida)

Smarp Snapshot 210 -- Google's Social Media Ad Fraud & Disinformation Strategy

Smarp Snapshot 210 -- Google's Social Media Ad Fraud & Disinformation Strategy

Philippine FIRE CODE REVIEWER for Architecture Board Exam Takers

Philippine FIRE CODE REVIEWER for Architecture Board Exam Takers

Presentation on Corporate SOCIAL RESPONSIBILITY- PPT.pptx

Presentation on Corporate SOCIAL RESPONSIBILITY- PPT.pptx

Tds chart for 2015 16

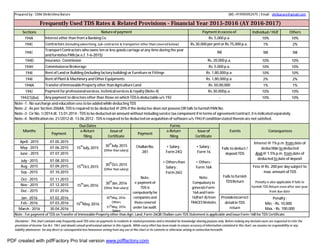

- 1. Prepared by : CMA Shrikrishna Barure (M) +919595952475 | Email : shribarure@gmail.com Frequently Used TDS Rates & Related Provisions ‐ Financial Year 2015‐2016 (AY 2016‐2017) Sections Natureof payment Payment in excess of Individual/ HUF Others 194A Interest other than from a Banking Co. Rs. 5,000 p.a. 10% 10% 194C Contractors (including advertising, sub‐contractor & transporter other than covered below) Rs.30,000 per pmt or Rs.75,000 p.a. 1% 2% 194C TransportContractors who owns ten or less goods carriage atany time during the year andfurnishes PAN(w.e.f.1‐6‐2015) Nil Nil Nil 194D Insurance Commission Rs. 20,000 p.a. 10% 10% 194H CommissionorBrokerage Rs. 5,000 p.a. 10% 10% 194I Rent of Land or Building (including factory building) or Furniture or Fittings Rs. 1,80,000p.a. 10% 10% 194I Rent of Plant& Machinery and Other Equipments Rs. 1,80,000p.a. 2% 2% 194IA Transfer ofImmovableProperty other thanAgriculture Land Rs.50,00,000 1% 1% 194J Paymentfor professionalservices, technicalservices& royalty(Note‐4) Rs.30,000p.a. 10% 10% 194J(1)(ba) Any payment to directors other than those on whichTDSis deductable u/s 192 ‐ 10% 10% Note ‐1 : No surcharge and educationcess to be added while deducting TDS Note ‐2 : As per Section 206AA, TDS is required to be deducted @ 20% if the deductee does not possess OR fails to furnish PAN No. Note ‐3 : Cir No. 1/2014 dt. 13.01.2014 ‐ TDS to be deducted on amount without including service tax component if in terms of agreement/contract, it is indicatedseparately. Note ‐4 : Notification no. 21/2012 dt. 13.06.2012 ‐ TDS is required to be deducted on acquisition of software u/s 194J if condition stated therein are not satisfied. Months DueDates Forms Events Consequences Payment e‐Return filing Issueof Certificate Payment e‐Return filing Issueof Certificate April ‐ 2015 07.05.2015 15 th July,2015 30 th July,2015 (Other than salary) ChallanNo. 281 Note: e‐payment of TDS is compulsorily for companies and thosecovered under tax audit. • Salary : Form 24Q • Othersthan Salary : Form 26Q • Salary : Form 16 • Others : Form 16A Note: Compulsory to generateForm‐ 16A and Form‐ 16(Part‐A)from TRACESWebsite. Fails to deduct / depositTDS Interest @ 1% p.m. from date of deductible todeducted And @ 1.5% p.m. from date of deducted to date of deposit May ‐ 2015 07.06.2015 June ‐ 2015 07.07.2015 July ‐ 2015 07.08.2015 15 th Oct,2015 30 th Oct,2015 (Other than salary) Aug ‐ 2015 07.09.2015 Fails to furnish TDSReturn Fess @ Rs. 200 per day subject to max. amount of TDS Penalty is also applicable if fails to furnish TDS Return even after one year from due date Sep ‐ 2015 07.10.2015 Oct ‐ 2015 07.11.2015 15 th Jan,2016 30 th Jan,2016 (Other than salary) Nov ‐ 2015 07.12.2015 Dec ‐ 2015 07.01.2016 Jan ‐ 2016 07.02.2016 15 th May,2016 30 th May, 2016‐ Others 31 th May, 2016‐ Salary Provideincorrect detail in TDS return Penalty : Min. ‐ Rs. 10,000 Max. ‐ Rs. 100,000 Feb ‐ 2016 07.03.2016 March ‐ 2016 30.04.2016 Note : For payment of TDS on Transfer of Immovable Property other than Agri. Land, Form‐26QB Challan‐cum‐TDS Statement is applicable and issue Form‐16B for TDS Certificate. Disclaimer : This chart contains only frequently used TDS rates on payments to residents & related provisions and is intended for knowledge sharing purpose only. Before making any decision users are requested to refer the provisions of Income Tax Act, 1961 and should consult professional advisor in this regards. While every effort has been made to ensure accuracy of information contained in this chart, we assume no responsibility or any liability whatsoever for any direct or consequential loss howsoever arising from any use of this chart or its contents or otherwise arising in connection herewith. PDF created with pdfFactory Pro trial version www.pdffactory.com