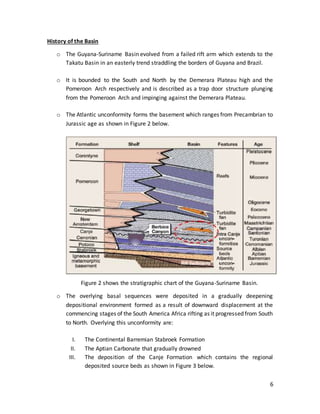

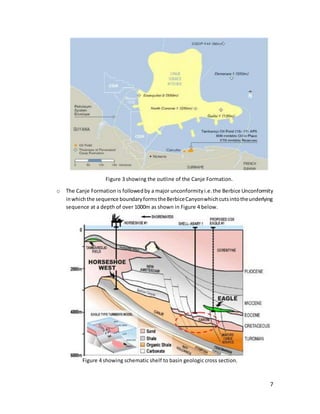

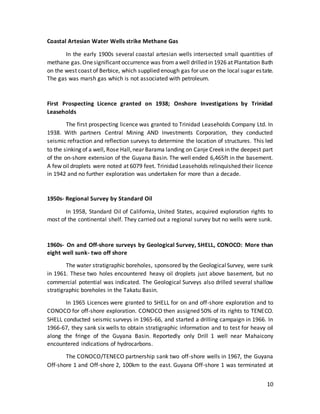

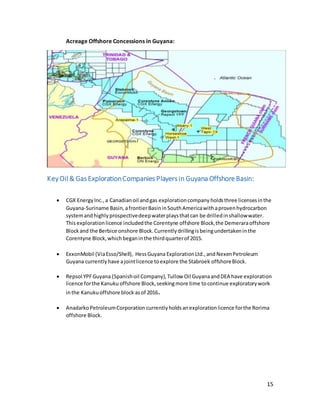

This document provides a summary of the history of oil and gas exploration in Guyana. It discusses early observations of oil seeps in the 18th century. The first exploration well was drilled in the 1850s but found only small amounts of tarry oil. In the 1900s, several coastal wells encountered methane gas. The first prospecting license was granted in 1938 and led to the drilling of the Rose Hall well in 1941, which found a few oil droplets. Throughout the 1960s-1970s, various companies including Shell, Conoco, and Deminex conducted seismic surveys and drilled over 15 exploration wells both onshore and offshore, with some encountering gas shows but no commercial hydrocarbon discoveries. Offshore exploration is now