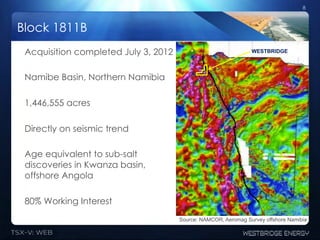

Westbridge Energy acquired an oil and gas exploration block in offshore Namibia. The block is located in a basin with similar geology to productive areas in Angola and Brazil. Westbridge plans to acquire seismic data and drill an exploratory well on the block in the next two years. The company has an experienced management team with a track record in Africa and plans to pursue additional assets and partnerships.