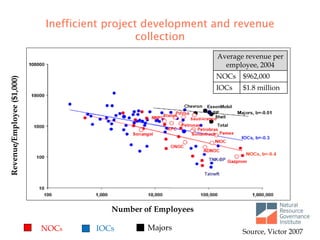

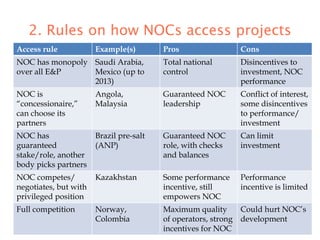

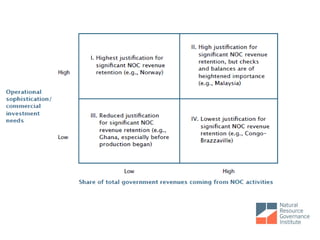

The document discusses the oil sector's institutional structure and contract incentives, highlighting key roles and accountability for entities like Pertamina and SKK Migas, along with the associated risks and benefits of state-owned enterprises. It outlines various petroleum agreement types and fiscal relations, emphasizing the need for checks and balances within the regulatory framework. Additionally, it presents different country models, including Norway, Malaysia, and Brazil, to illustrate varying strategies in managing national oil companies and governance structures.