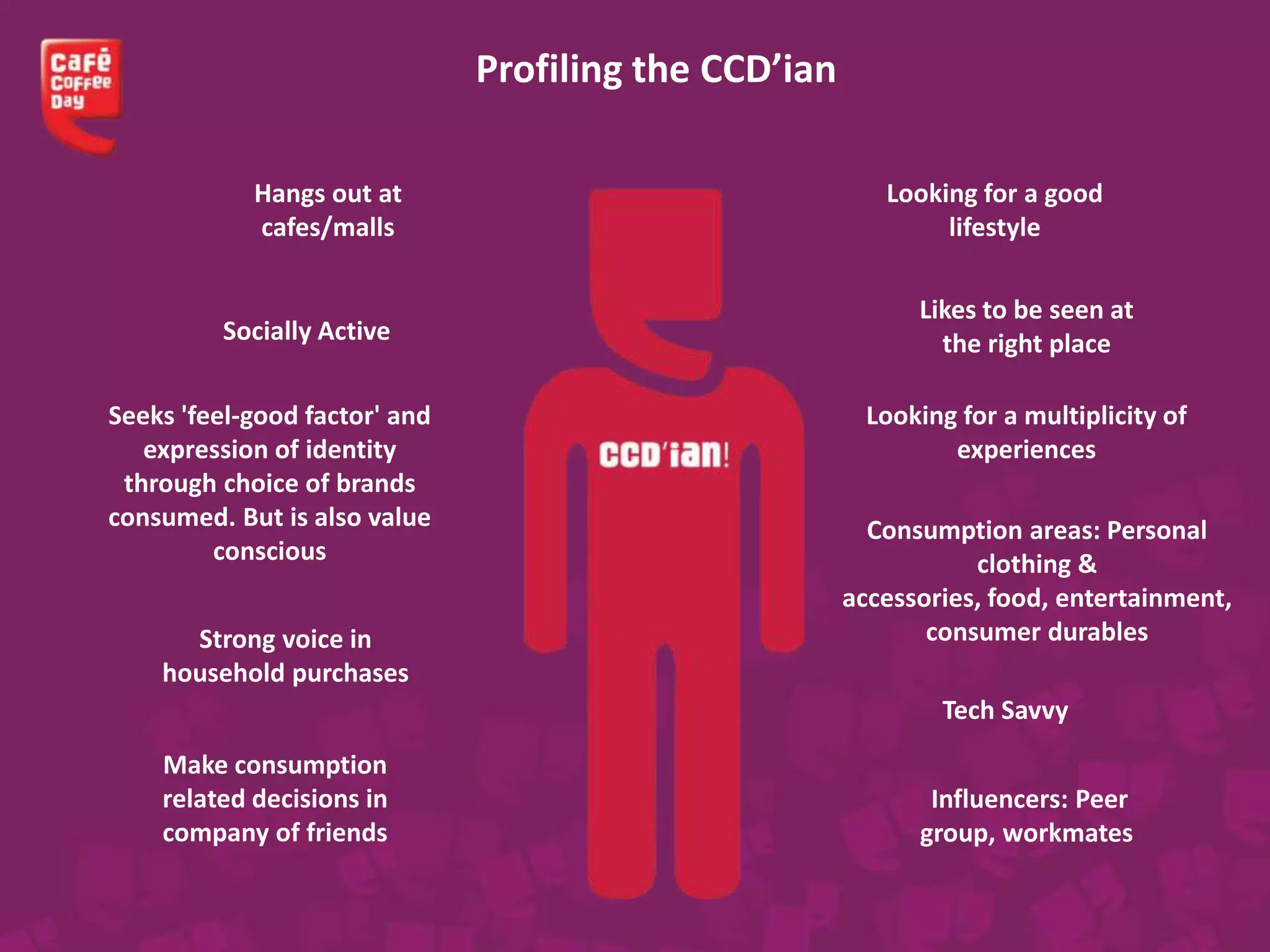

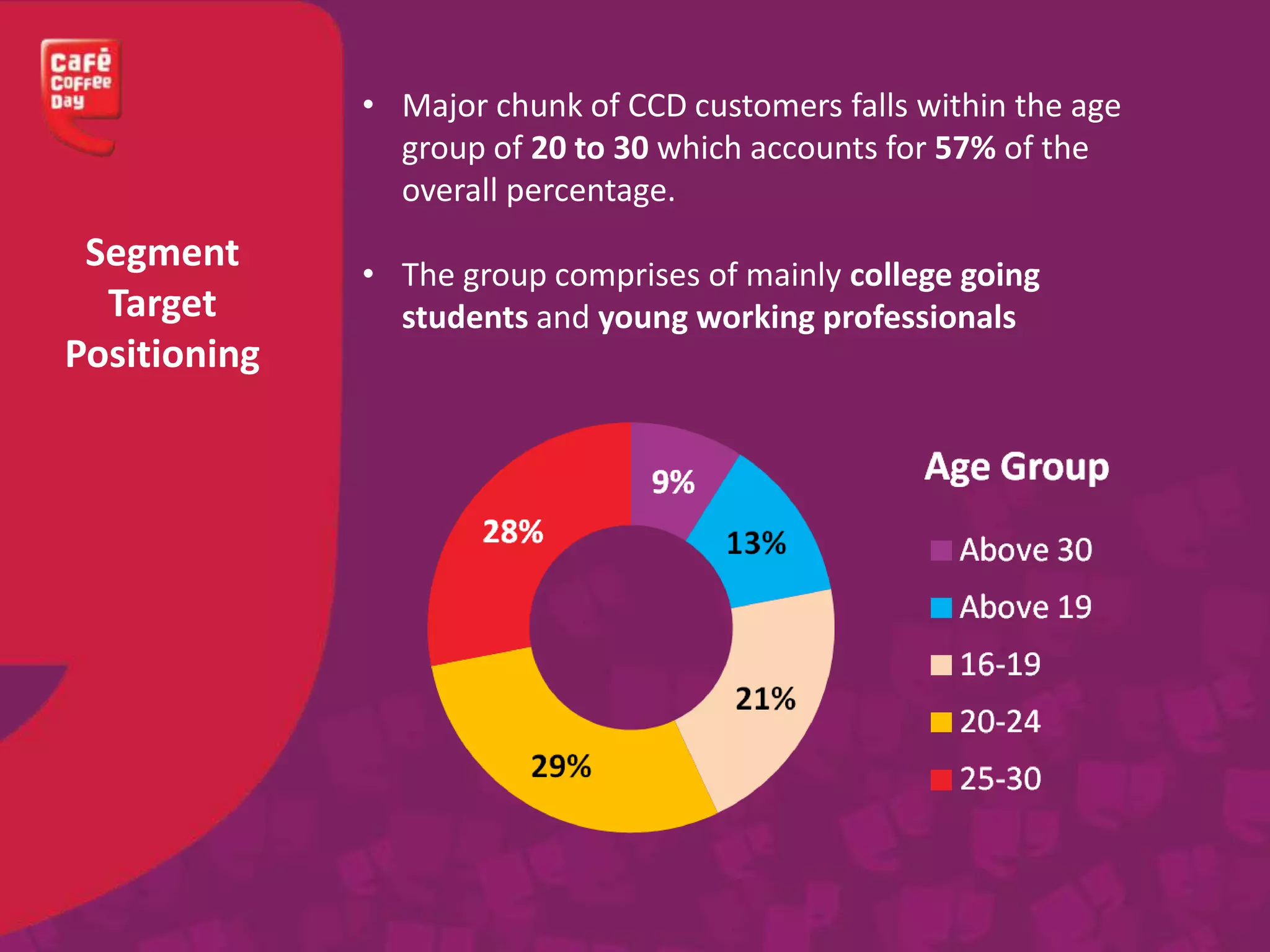

Café Coffee Day is India's largest coffee chain with over 1400 cafés across 200 cities. It pioneered the café culture in India and sees growing demand from the young population. CCD targets youth aged 15-35 and sees 57% of customers in this segment. It aims to expand its network of cafés to smaller towns. Competitors include Starbucks, Barista and local coffee shops but CCD maintains the largest market share. The presentation provides analysis of CCD's business model and strategies through frameworks like SWOT, PESTEL, Porter's Five Forces and marketing mix. Suggestions are given to cultivate coffee aficionados and improve customer experience.

![Product

•Wide range

•Frappe – Summer

•Cappuccino -

Winter

•Merchandizing

Price

•Range from Rs45 to

Rs100

•Over the years only

minor changes in

pricing policy

Place

•All locations

•Strategically

located outlets

•Coffee machines in

college canteens

•Kiosks in offices

Promotion

•Channel [V]’s “Get

Gorgeous” Contest

•Tie up with youth

brands

•Khakee and Main

Hun Na

•Sales Promotion

Process

•Self service to table

service

•Complaints and

feedback

•Response time

People

•“People are hired for

what they know but

fired for how they

behave”

•Motivation and

personal skills

Physical

Evidence

•Logo in “Dialogue

Box”

•Architecture and

décor

•Coffee table books

•Tag line : “A lot can

happen over coffee”

Marketing Mix](https://image.slidesharecdn.com/ccd1-130901032949-phpapp02/75/cafe-coffee-day-13-2048.jpg)