Financial Management Class assignment on Capital Budgeting Techniques

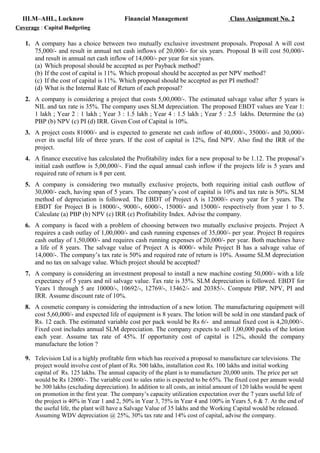

- 1. IILM–AHL, Lucknow Financial Management Class Assignment No. 2 Coverage : Capital Budgeting 1. A company has a choice between two mutually exclusive investment proposals. Proposal A will cost 75,000/- and result in annual net cash inflows of 20,000/- for six years. Proposal B will cost 50,000/- and result in annual net cash inflow of 14,000/- per year for six years. (a) Which proposal should be accepted as per Payback method? (b) If the cost of capital is 11%. Which proposal should be accepted as per NPV method? (c) If the cost of capital is 11%. Which proposal should be accepted as per PI method? (d) What is the Internal Rate of Return of each proposal? 2. A company is considering a project that costs 5,00,000/-. The estimated salvage value after 5 years is NIL and tax rate is 35%. The company uses SLM depreciation. The proposed EBDT values are Year 1: 1 lakh ; Year 2 : 1 lakh ; Year 3 : 1.5 lakh ; Year 4 : 1.5 lakh ; Year 5 : 2.5 lakhs. Determine the (a) PBP (b) NPV (c) PI (d) IRR. Given Cost of Capital is 10%. 3. A project costs 81000/- and is expected to generate net cash inflow of 40,000/-, 35000/- and 30,000/- over its useful life of three years. If the cost of capital is 12%, find NPV. Also find the IRR of the project. 4. A finance executive has calculated the Profitability index for a new proposal to be 1.12. The proposal’s initial cash outflow is 5,00,000/-. Find the equal annual cash inflow if the projects life is 5 years and required rate of return is 8 per cent. 5. A company is considering two mutually exclusive projects, both requiring initial cash outflow of 30,000/- each, having span of 5 years. The company’s cost of capital is 10% and tax rate is 50%. SLM method of depreciation is followed. The EBDT of Project A is 12000/- every year for 5 years. The EBDT for Project B is 18000/-, 9000/-, 6000/-, 15000/- and 15000/- respectively from year 1 to 5. Calculate (a) PBP (b) NPV (c) IRR (e) Profitability Index. Advise the company. 6. A company is faced with a problem of choosing between two mutually exclusive projects. Project A requires a cash outlay of 1,00,000/- and cash running expenses of 35,000/- per year. Project B requires cash outlay of 1,50,000/- and requires cash running expenses of 20,000/- per year. Both machines have a life of 8 years. The salvage value of Project A is 4000/- while Project B has a salvage value of 14,000/-. The company’s tax rate is 50% and required rate of return is 10%. Assume SLM depreciation and no tax on salvage value. Which project should be accepted? 7. A company is considering an investment proposal to install a new machine costing 50,000/- with a life expectancy of 5 years and nil salvage value. Tax rate is 35%. SLM depreciation is followed. EBDT for Years 1 through 5 are 10000/-, 10692/-, 12769/-, 13462/- and 20385/-. Compute PBP, NPV, PI and IRR. Assume discount rate of 10%. 8. A cosmetic company is considering the introduction of a new lotion. The manufacturing equipment will cost 5,60,000/- and expected life of equipment is 8 years. The lotion will be sold in one standard pack of Rs. 12 each. The estimated variable cost per pack would be Rs 6/- and annual fixed cost is 4,20,000/-. Fixed cost includes annual SLM depreciation. The company expects to sell 1,00,000 packs of the lotion each year. Assume tax rate of 45%. If opportunity cost of capital is 12%, should the company manufacture the lotion ? 9. Television Ltd is a highly profitable firm which has received a proposal to manufacture car televisions. The project would involve cost of plant of Rs. 500 lakhs, installation cost Rs. 100 lakhs and initial working capital of Rs. 125 lakhs. The annual capacity of the plant is to manufacture 20,000 units. The price per set would be Rs 12000/-. The variable cost to sales ratio is expected to be 65%. The fixed cost per annum would be 300 lakhs (excluding depreciation). In addition to all costs, an initial amount of 120 lakhs would be spent on promotion in the first year. The company’s capacity utilization expectation over the 7 years useful life of the project is 40% in Year 1 and 2, 50% in Year 3, 75% in Year 4 and 100% in Years 5, 6 & 7. At the end of the useful life, the plant will have a Salvage Value of 35 lakhs and the Working Capital would be released. Assuming WDV depreciation @ 25%, 30% tax rate and 14% cost of capital, advise the company.

- 2. IILM–AHL, Lucknow Financial Management Class Assignment No. 2 Coverage : Capital Budgeting 1. A company has a choice between two mutually exclusive investment proposals. Proposal A will cost 75,000/- and result in annual net cash inflows of 20,000/- for six years. Proposal B will cost 50,000/- and result in annual net cash inflow of 14,000/- per year for six years. (e) Which proposal should be accepted as per Payback method? (f) If the cost of capital is 11%. Which proposal should be accepted as per NPV method? (g) If the cost of capital is 11%. Which proposal should be accepted as per PI method? (h) What is the Internal Rate of Return of each proposal? 2. A company is considering a project that costs 5,00,000/-. The estimated salvage value after 5 years is NIL and tax rate is 35%. The company uses SLM depreciation. The proposed EBDT values are Year 1: 1 lakh ; Year 2 : 1 lakh ; Year 3 : 1.5 lakh ; Year 4 : 1.5 lakh ; Year 5 : 2.5 lakhs. Determine the (a) PBP (b) NPV (c) PI (d) IRR. Given Cost of Capital is 10%. 3. A project costs 81000/- and is expected to generate net cash inflow of 40,000/-, 35000/- and 30,000/- over its useful life of three years. If the cost of capital is 12%, find NPV. Also find the IRR of the project. 4. A finance executive has calculated the Profitability index for a new proposal to be 1.12. The proposal’s initial cash outflow is 5,00,000/-. Find the equal annual cash inflow if the projects life is 5 years and required rate of return is 8 per cent. 5. A company is considering two mutually exclusive projects, both requiring initial cash outflow of 30,000/- each, having span of 5 years. The company’s cost of capital is 10% and tax rate is 50%. SLM method of depreciation is followed. The EBDT of Project A is 12000/- every year for 5 years. The EBDT for Project B is 18000/-, 9000/-, 6000/-, 15000/- and 15000/- respectively from year 1 to 5. Calculate (a) PBP (b) NPV (c) IRR (e) Profitability Index. Advise the company. 6. A company is faced with a problem of choosing between two mutually exclusive projects. Project A requires a cash outlay of 1,00,000/- and cash running expenses of 35,000/- per year. Project B requires cash outlay of 1,50,000/- and requires cash running expenses of 20,000/- per year. Both machines have a life of 8 years. The salvage value of Project A is 4000/- while Project B has a salvage value of 14,000/-. The company’s tax rate is 50% and required rate of return is 10%. Assume SLM depreciation and no tax on salvage value. Which project should be accepted? 7. A company is considering an investment proposal to install a new machine costing 50,000/- with a life expectancy of 5 years and nil salvage value. Tax rate is 35%. SLM depreciation is followed. EBDT for Years 1 through 5 are 10000/-, 10692/-, 12769/-, 13462/- and 20385/-. Compute PBP, NPV, PI and IRR. Assume discount rate of 10%. 8. A cosmetic company is considering the introduction of a new lotion. The manufacturing equipment will cost 5,60,000/- and expected life of equipment is 8 years. The lotion will be sold in one standard pack of Rs. 12 each. The estimated variable cost per pack would be Rs 6/- and annual fixed cost is 4,20,000/-. Fixed cost includes annual SLM depreciation. The company expects to sell 1,00,000 packs of the lotion each year. Assume tax rate of 45%. If opportunity cost of capital is 12%, should the company manufacture the lotion ? 9. Television Ltd is a highly profitable firm which has received a proposal to manufacture car televisions. The project would involve cost of plant of Rs. 500 lakhs, installation cost Rs. 100 lakhs and initial working capital of Rs. 125 lakhs. The annual capacity of the plant is to manufacture 20,000 units. The price per set would be Rs 12000/-. The variable cost to sales ratio is expected to be 65%. The fixed cost per annum would be 300 lakhs (excluding depreciation). In addition to all costs, an initial amount of 120 lakhs would be spent on promotion in the first year. The company’s capacity utilization expectation over the 7 years useful life of the project is 40% in Year 1 and 2, 50% in Year 3, 75% in Year 4 and 100% in Years 5, 6 & 7. At the end of the useful life, the plant will have a Salvage Value of 35 lakhs and the Working Capital would be released. Assuming WDV depreciation @ 25%, 30% tax rate and 14% cost of capital, advise the company.