GST and GSP (GST Suvidha Provider) Role

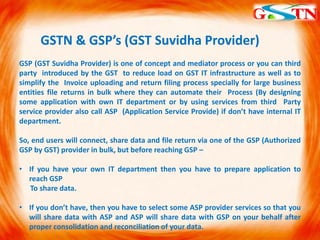

- 1. GSTN & GSP’s (GST Suvidha Provider) GSP (GST Suvidha Provider) is one of concept and mediator process or you can third party introduced by the GST to reduce load on GST IT infrastructure as well as to simplify the Invoice uploading and return filing process specially for large business entities file returns in bulk where they can automate their Process (By designing some application with own IT department or by using services from third Party service provider also call ASP (Application Service Provide) if don’t have internal IT department. So, end users will connect, share data and file return via one of the GSP (Authorized GSP by GST) provider in bulk, but before reaching GSP – • If you have your own IT department then you have to prepare application to reach GSP To share data. • If you don’t have, then you have to select some ASP provider services so that you will share data with ASP and ASP will share data with GSP on your behalf after proper consolidation and reconciliation of your data.

- 2. End User (Taxpayer/ Business Entity) ASP (Applicatio n Service Provider) GSP (GST Suvidha Provider) GSTN Secure GSTN API Secure GSP API NOTE :- You have to make process and Agreement with ASP to protect your personal data GSTN Public Portal For Individual/Small Business Entities HIGH LEVEL FLOW WOULD BE LIKE BELOW

- 3. MORE DETAILS ABOUT ASP AND GSP CONCEPT It’s cleat that after GST implementation all Indirect Tax Payers will have to file return Via centralized GSTN system. So if you are individual or small tax payer with few monthly or quarterly invoices which you can manage by yourself, then you can directly login to GSTN portal and file your return. But of you are a large business entities where you have large invoice then it’s not feasible for you or your designated CA’s, Lawyers to use GSTN portal to upload invoices and file Return. So, in that case you need some option where your invoices can upload automatically return also file easily. To make it for you GST introduces GSP (GST Suvidha Provide). You can reach any GSP to take services, but problem is how you are going to consolidate and reconcile your large data and how you are going to same with GSP? So for to consolidate, reconcile and share your large clean verified data with GSP you need some third service provider who can consolidate, reconcile, clean and send data to GSP to file return on behalf of you. So, here you need and ASP (Application Service Provider) as Third part service provider. If you have your own IT department with skilled developers then you can develop your own System which can act as ASP to reach GSP but make sure to analyze related development and regular support cost, as it need to change whenever GST will introduce some new laws.

- 4. PROCESS TO FOLLOW TO COMPLY ON GST I would recommend start looking for some ASP provider like TechMahindra Ltd, IT division of Mahindra and Mahindra group handling large enterprise customers across globe. Once Identified, rest will be taken care by ASP. You have to make some agreement with for confidentiality of your data as you are going to share your data with them, also allow them to study your finance and invoice process which may need ASP to update his application or to identify process to fetch data from your organization. You don’t need to worry about GSP or GST or GSTN. Just subscribe ASP services and ASP will Be your single point of contact related with invoice uploading, payment and return filing. You can leverage more services from ASP like different kind of reports for audit, CEO, CFO etc you can also prepares your P/L (Profit and Loss) statement easily without any manual efforts.