Embed presentation

Downloaded 51 times

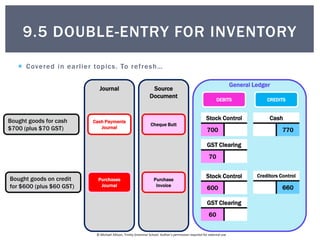

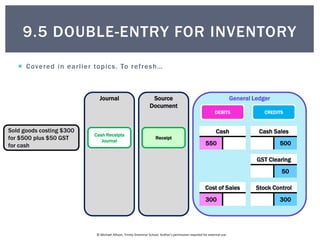

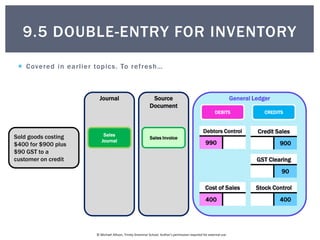

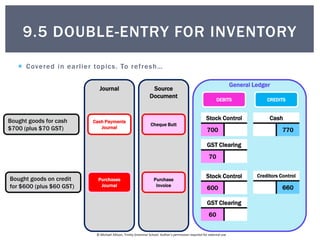

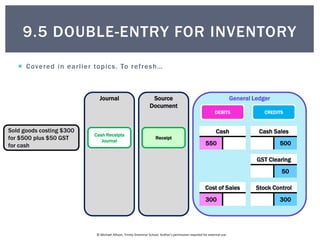

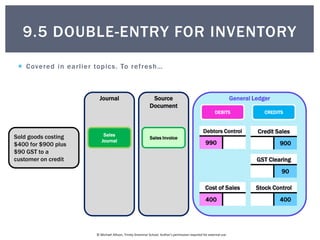

This document discusses double-entry accounting for inventory transactions. It provides examples of journal entries for purchasing inventory for cash and on credit, selling inventory for cash, and selling inventory on credit. For each transaction there is a debit and credit to accounts like stock control, cash, creditors control, debtors control, cost of sales, and GST clearing.