M.com Assignments

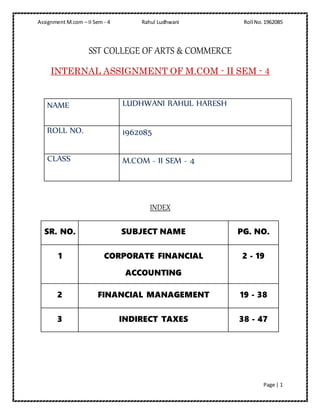

- 1. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 1 SST COLLEGE OF ARTS & COMMERCE INTERNAL ASSIGNMENT OF M.COM - II SEM - 4 NAME LUDHWANI RAHUL HARESH ROLL NO. 1962085 CLASS M.COM - II SEM - 4 INDEX SR. NO. SUBJECT NAME PG. NO. 1 CORPORATE FINANCIAL ACCOUNTING 2 - 19 2 FINANCIAL MANAGEMENT 19 - 38 3 INDIRECT TAXES 38 - 47

- 2. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 2 CORPORATE FINANCIAL ACCOUNTING Q. 1. Explain Minority Interest. Answer: A minority interest is ownership or interest of less than 50% of an enterprise. The term can refer to either stock ownership or a partnership interest in a company. The minority interest of a company is held by an investor or another organization other than the parent company. Minority interests generally come with some rights for the stakeholder such as the participation in sales and certain audit rights. A minority interest shows up as a noncurrent liability on the balance sheet of companies with a majority interest in a company. This represents the proportion of its subsidiaries owned by minority shareholders. Minority interests are the portion of a company or stock not held by the parent company, which has a majority interest. Most minority interests range between 20% and 30%. While the majority stakeholder—in most cases, the parent company—has voting rights to set policy and procedures, the minority stakeholders generally have very little say or influence in the direction of the company. That's why it's also referred to as non-controlling interests (NCIs). In some cases, a minority may have some rights such as the ability to take part in sales. There are laws that also allow minority interest holders to certain audit rights. They also may be able to attend shareholder or partnership meetings. In the world of private equity, companies and investors with a minority interest may be able to negotiate control rights.

- 3. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 3 For example, venture capitalists may ask to negotiate for a seat on the board of directors in exchange for his investment in a startup. In the corporate world, a corporation lists minority ownership on its balance sheet. In addition to being reflected on the balance sheet, a minority interest is reported on the consolidated income statement as a share of profit belonging to minority equity holders. KEY TAKEAWAYS 1. A minority interest is ownership or interest of less than 50% of an enterprise. 2. Minority interests generally range between 20% and 30%, and stakeholders have very little say or influence in the enterprise. 3. Companies with a majority interest will list the minority interest on their balance sheet as a noncurrent liability. Types of Minority Interests: A minority interest can either be passive or active. Passive minority interests, where a company owns 20% or less, are those in which a company has no material influence on the company in which it maintains a minority interest. In accounting terms, only the dividends received from the minority interest are recorded for those with minority passive interests. This is referred to as the cost method—the ownership stake is treated as an investment at cost, and any dividends received are treated as dividend income.

- 4. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 4 Active minority interests—owning 21% to 49%—are those in which a company has the ability to materially influence the company in which it holds a minority interest. Unlike passive interests, dividends received and a percentage of income is recorded for those with active minority interests. This is referred to as the equity method. Dividends are treated as a return of capital, decreasing the value of the investment on the balance sheet. The percentage of income the minority interest is entitled to is added to the investment account on the balance sheet as this effectively increases its equity share in the company. Example of Minority Interest ABC Corporation owns 90% of XYZ Inc., which is a $100 million company. ABC records a $10 million minority interest as a noncurrent liability to represent the 10% of XYZ Inc. it does not own. XYZ Inc. generates $10 million in net income. As a result, ABC recognizes $1 million—or 10% of $10 million—of net income attributable to minority interest on its income statement. Correspondingly, ABC marks up the $10 million minority interest by $1 million on the balance sheet. The minority interest investors do not record anything unless they receive dividends, which are booked as income. The Majority Stakeholder: The Parent Company The parent company is a majority stakeholder in the subsidiary. It owns more than 50% but less than 100% of a subsidiary's voting shares and recognizes a minority interest in its financial statements. The parent company consolidates the financial results of the subsidiary with its own, and as a result, a proportional share of income shows up on the parent company's income statement attributable to the minority interest. Likewise, a proportional share of equity in the subsidiary company shows up on the parent's balance sheet attributable to the minority interest. The minority interest can be found in the noncurrent liability section or equity section of the parent company's balance sheet under the generally accepted accounting principles (GAAP) rules. Under International Financial Reporting Standards (IFRS), however, the minority interest must be recorded in the equity section of the balance sheet.

- 5. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 5 Q. 2. Indian Accounting Standard 23 – Borrowing Cost Answer: Borrowing costs that are directly attributable to the acquisition, construction or production of a qualifying asset form part of the cost of that asset. Other borrowing costs are recognized as an expense. Borrowing costs are interest and other costs that an entity incurs in connection with the borrowing of funds. An entity shall capitalize borrowing costs that are directly attributable to the acquisition, construction or production of a qualifying asset as part of the cost of that asset. An entity shall recognize other borrowing costs as an expense in the period in which it incurs them. A qualifying asset is an asset that necessarily takes a substantial period of time to get ready for its intended use or sale. To the extent that an entity borrows funds specifically for the purpose of obtaining a qualifying asset, the entity shall determine the amount of borrowing costs eligible for capitalization as the actual borrowing costs incurred on that borrowing during the period less any investment income on the temporary investment of those borrowings.

- 6. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 6 To the extent that an entity borrows funds generally and uses them for the purpose of obtaining a qualifying asset, the entity shall determine the amount of borrowing costs eligible for capitalization by applying a capitalization rate to the expenditures on that asset. The capitalization rate shall be the weighted average of the borrowing costs applicable to the borrowings of the entity that are outstanding during the period, other than borrowings made specifically for the purpose of obtaining a qualifying asset. The amount of borrowing costs that an entity capitalizes during a period shall not exceed the amount of borrowing costs it incurred during that period. An entity shall begin capitalising borrowing costs as part of the cost of a qualifying asset on the commencement date. The commencement date for capitalisation is the date when the entity first meets all of the following conditions: 1. it incurs expenditures for the asset; 2. it incurs borrowing costs; and 3. it undertakes activities that are necessary to prepare the asset for its intended use or An entity shall suspend capitalization of borrowing costs during extended periods in which it suspends active development of a qualifying asset.

- 7. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 7 An entity shall cease capitalizing borrowing costs when substantially all the activities necessary to prepare the qualifying asset for its intended use or sale are complete. An entity shall disclose 1. the amount of borrowing costs capitalized during the period; and 2. the capitalization rate used to determine the amount of borrowing costs eligible for Scope of AS-23 Borrowing Cost This standard is applied in accounting for borrowing cost. It does not deal with the actual or imputed cost of equity, including preferred capital not classified as a liability. For example: Dividend paid on equity shares, cost of issuance of equity, cost on Irredeemable preference share capital will not be included as borrowing cost within the purview of this standard. This standard is not required to apply on borrowing cost directly attributable to the acquisition, construction or production of: 1. Qualifying asset measured at fair value {For example: A biological asset Ind AS 41} 2. Inventories that are manufactured, or otherwise produced, in large quantities on a repetitive basis. Exchange differences to be included in borrowing costs With regard to exchange difference required to be treated as borrowing costs in accordance with paragraph 6(e), the manner of arriving at the adjustments stated therein shall be as follows:

- 8. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 8 (i) the adjustment should be of an amount which is equivalent to the extent to which the exchange loss does not exceed the difference between the cost of borrowing in functional currency when compared to the cost of borrowing in a foreign currency. (ii) where there is an unrealised exchange loss which is treated as an adjustment to interest and subsequently there is a realised or unrealised gain in respect of the settlement or translation of the same borrowing, the gain to the extent of the loss previously recognised as an adjustment should also be recognised as an adjustment to interest. Treatment of Borrowing Cost 1) If the borrowing cost incurred is directly attributable to the acquisition, construction or production of qualifying asset, then it should be capitalised as part of the cost of the asset. 2) Otherwise it should be expensed in the profit or loss. 3) Note: In case of hyperinflationary economy, part of borrowing cost which compensates for the inflation during the same period should be expensed in profit of loss. Borrowing cost eligible for capitalisation Borrowing cost which is directly attributable to the acquisition, construction or production of a qualifying asset is capitalised. A borrowing cost is said to be directly attributable if it can be avoided when the expenditure on qualifying asset is not made. Specific borrowing When an entity borrows funds specifically for the purpose of obtaining a particular qualifying asset, the borrowing costs that directly relate to that qualifying asset can be readily identified. Amount of borrowing costs eligible for capitalisation is the actual borrowing costs incurred on those funds during the period reduced by any investment income earned on temporary investment of idle funds.

- 9. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 9 General borrowing In case of general borrowings it may be difficult to identify a direct relationship between particular borrowings and a qualifying asset and to determine the borrowings that could otherwise have been avoided. Rate of Capitalisation Total general borrowing cost for the period / Weighted average total general borrowings Expenditure to which the capitalisation rate is applied: - Particular Amount Opening balance of Qualifying Asset (Including borrowing cost previously capitalised) XXX Add: Cash expenditure incurred XXX Add: Transfer or consumption of other assets and material XXX Add: Assumption of Interest-bearing liabilities XXX Less: Progress payments received XXX Less: Pre-Sale Deposit XXX Note: Amount of borrowing cost eligible to capitalise should not exceed the actual borrowing cost in case of general borrowing.

- 10. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 10 Q. 3. Explain the accounting for Fixed assets Fixed assets, also known as Property, Plant and Equipment, are tangible assets held by an entity for the production or supply of goods and services, for rentals to others, or for administrative purposes. These assets are expected to be used for more than one accounting period. Fixed assets are generally not considered to be a liquid form of assets unlike current assets. Examples of common types of fixed assets include buildings, land, furniture and fixtures, machines and vehicles. The term 'Fixed Asset' is generally used to describe tangible fixed assets. This means that they have a physical substance unlike intangible assets which have no physical existence such as copyright and trademarks. Fixed assets are not held for resale but for the production, supply, rental or administrative purposes. Assets that held for resale must be accounted for as inventory rather than fixed asset. So for example, if a company is in the business of selling cars, it must not account for cars held for resale as fixed assets but instead as inventory assets. However, any vehicles other than those held for the purpose of resale may be classified as fixed assets such as delivery trucks and employee cars.

- 11. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 11 Fixed assets are normally expected to be used for more than one accounting period which is why they are part of Non-Current Assets of the entity. Economic benefits from fixed assets are therefore derived in the long term. In order for fixed assets to be recognized in the financial statements of an entity, the basic criteria for the recognition of assets laid down in the IASB Framework must be met: The inflow of economic benefits to entity is probable; and The cost/value can be measured reliably.

- 12. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 12

- 13. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 13 Fixed assets are tangible assets purchased for the supply of services or goods, use in the process of production, letting out on rent to third parties or for using for administrative purposes. They are bought for usage for more than one accounting year. They are generally referred to as property, plant, and equipment (PP&E) and are referred to as Capital assets. Now let us understand examples of Fixed Assets as well as Fixed Asset Accounting. EXAMPLES OF FIXED ASSETS Machinery Furniture Land and building Computer and its equipment’s Machinery Vehicles etc. CRITERIA FOR RECOGNITION OF FIXED ASSETS IN THE BOOKS OF ACCOUNTS 1. Inflow of economic benefits associated with the assets is probable in nature; 2. Asset can be reliably measured. INITIAL VALUATION: THE INITIAL COST OF AN ASSET INCLUDES: The cost of the asset, incidental costs necessary to bring the asset to its workable condition, duties, and taxes paid pertaining to the acquisition of an asset, preparation of the site, handling and delivery cost of the asset, fees pertaining to installation, cost of dismantling the asset and site restoration. EXCLUDES: Administrative costs, general overhead costs, costs not directly related to bringing the asset to its usable condition. COST OF AN ASSET When there is a purchase of an asset. Value of the Asset is at cost considering the above list.

- 14. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 14 ASSET PURCHASED AT EQUATED MONTHLY INSTALLMENT The overall cost of the asset should include the market rate of interest cost. ASSET EXCHANGED FOR AN ASSET Cost of the asset will be measured at fair value except for cases wherein it is not possible to measure the value of either of the assets or it is not a commercially identifiable transaction. Apart from this when it is not possible to measure the fair value of the acquired asset; then the value is carrying the amount of the asset given up. JOURNAL ENTRY FOR PURCHASE OF AN ASSET Particulars Debit Credit Fixed Asset A/C – To Cash/Bank/Creditor A/C – Accounting Models for Measurement of Asset Post Its Initial Measurement COST MODEL BASIS The valuation of the asset is at its cost price less accumulated depreciation and impairment cost. REVALUATION MODEL BASIS The valuation of the asset is the fair value less its subsequent depreciation and impairment. Valuation of assets should be carried out regularly because there should not be much of a difference between the carrying value of the assets and its fair value. If the cost of one asset in a group undergoes revaluation, then it applies to the entire class of assets to which the asset belongs. REVALUATION OF ASSETS In case of revaluation of an asset, the differential increase in the value of an asset is classified under the head Reserves and Surplus under the category Revaluation Reserve in the balance sheet. On account of the disposal of the assets, one should transfer any amount lying down in the revaluation reserves to retained earnings.

- 15. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 15 Particulars Debit Credit Fixed Asset A/C – To Revaluation Reserve – After the revaluation, if the carrying amount is more than the fair value, the differential is charged to Revaluation Surplus account. Particulars Debit Credit Revaluation Reserve A/C – To Fixed Asset A/C – When there is an increase in the valuation of the asset, there is a transfer of the differential to revaluation reserve. After the upward revaluation, when there is a downward revaluation, the same is first written off against the balance in the revaluation reserve. And if there is any leftover balance, one should charge it to the income statement. Particulars Debit Credit Revaluation Reserve A/C – Impairment loss A/C – To Fixed Asset A/C – To Accumulated Impairment Loss A/C – DEPRECIATION 1. Treatment for Depreciation remains the same for the assets classified under the cost model as well as under the revaluation model. 2. As per IAS 16, the cost of the asset less the residual amount should be allocated in a systematic manner over the useful life of the asset. 3. As per IAS 8, one should estimate the useful life as well as the residual life of the asset at the end of each financial year to factor any changes over the year and have a better disclosure.

- 16. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 16 4. The decision of the depreciation method should be based upon the consumption of the economic benefits of the asset by the organization. 5. During the life of the asset, one can change the method of depreciation only once. This forms a part of the disclosure in the financial statement of the organization.(Board, 2017) 6. Depreciation is based upon the Straight line method of depreciation. Value of the asset is spread over the useful life of the asset. Therefore there will be only a downward movement in the value of the asset. Whereas when the organization switches to the revaluation model, there can be a movement both upwards as well as downwards. JOURNAL ENTRY FOR DEPRECIATION Particulars Debit Credit Depreciation A/C – To Accumulated depreciation A/C – IMPAIRMENT IN THE VALUE OF ASSETS As per IAS 36, there has to be the accounting for any type of impairment in the assets so that the carrying value of the assets shall not be more than its recoverable amount. DISPOSAL OF ASSETS 1. When the future benefits from asset are zero, it should be removed from the balance sheet. 2. Recognize the Gain or loss on sale in the profit and loss statement. 3. An organization providing assets on rent ceases to provide them, then transfer these assets to Inventory at their then carrying values. ENTIRE VALUE OF THE ASSET IS DEPRECIATED: Particulars Debit Credit Accumulated Depreciation A/C – To Fixed Asset A/C –

- 17. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 17 IN CASE OF LOSS ON SALE OF AN ASSET Particulars Debit Credit Cash A/C – Accumulated Depreciation A/C – Loss on sale of Asset – To Fixed Asset A/C – 1IN CASE OF GAIN ON SALE OF AN ASSET Particulars Debit Credit Cash A/C – Accumulated Depreciation A/C – To Gain on sale of Asset – To Fixed Asset A/C – DISCLOSURE Below mentioned are the disclosures related to fixed assets in the financial statement of the organization: Initial valuation of the asset for determining the carrying amount; Method of depreciation adopted Rate of depreciation The useful life of the asset Accumulated impairment loss and depreciation Revaluation reserve balance at the end of each financial year Changes in the value of the carrying amount of the assets due to any sort of additions or reductions during the year. It should even include acquisitions, disposals, net foreign exchange impact on the value of the assets etc. There has to be a disclosure of any change in the value of assets due to revaluation. It should be along with all the upward and downward movements and its impact on the carrying amount of the assets.

- 18. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 18 Q. 4. Explain the methods of valuation of shares. Valuation of shares is the process of knowing the value of company’s shares. Share valuation is done based on quantitative techniques and share value will vary depending on the market demand and supply. The share price of the listed companies which are traded publicly can be known easily. Methods of Valuation of Shares: 1. Asset-based This approach on based on the value of company’s assets and liabilities which includes intangible assets and contingent liabilities. This approach may be very useful to manufacturers, distributors etc where a huge volume of capital assets are used. This approach is also used as a reasonableness check to confirm the conclusions derived under the income or market approaches. Here, the company’s net assets value is divided by the number of shares to arrive at the value of each share. Following are some of the important points to be considered while valuing of shares under to this method: All the asset base of the company including current assets and liabilities such as receivables, payables, provisions should be considered. Fixed assets have to be considered at their realizable value. Valuation of goodwill as a part of intangible assets is important Even unrecorded assets and liabilities to be considered NET ASSETS METHOD YIELD/ MARKET VALUE METHOD EARNING CAPACITY METHOD FAIR VALUE METHOD

- 19. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 19 The fictitious assets such as preliminary expenses, discount on issue of shares and debentures, accumulated losses etc. should be eliminated. For determination of the net value of assets, deduct all the external liabilities from the total asset value of the company. The net value of assets so determined has to be divided by the number of equity shares for finding out the value of the share. The formula used is as follows: 2. Income-based This approach is used when the valuation is done for a small number of shares. Here, the focus is on the expected benefits from the business investment i.e what the business generates in the future. A common method used is the estimate of a business’s value by dividing its expected earnings by a capitalization rate. There are two other methods used such as DCF and PEC. PEC can be used by an established entity and newly started business or companies with volatile short-term earnings expectations can use the more complex analysis such as discounted cash flow analysis. Value per share is calculated on the basis of profit of the company available for distribution. This profit can be determined by deducting reserves and taxes from net profit. Listed below are the steps to determine the value per share under the income-based approach: Obtain the company’s profit (available for dividend) Obtain the capitalized value data Calculate the share value (Capitalized value/ Number of shares) Capitalized Value is calculated as follows:

- 20. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 20 3. Market-based The market-based approach generally uses the share prices of comparable public traded companies and the asset or stock sales of comparable private companies. Data related to private companies can be obtained from various proprietary databases available in the market. What is more important is how to choose the comparable companies – a lot of pre-conditions to be kept in mind while selecting such as nature and volume of the business, industry, size, financial condition of the comparable companies, the transaction date etc. There are two different methods when using the yield method (Yield is expected rate of return on an investment) they are explained below: 3.1. Earning Yield Shares are valued on the basis of expected earning and the normal rate of return. Under this method, value per share is calculated using the below formula: 3.2. Dividend Yield Under this method, shares are valued on the basis of expected dividend and the normal rate of return. The value per share is calculated by applying following formula: Expected rate of dividend = (profit available for dividend/paid up equity share capital) X 100

- 21. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 21 FINANCIAL MANAGEMENT Q.1. Explain the types of budget. Answer: A budget is an estimation of revenue and expenses over a specified future period of time and is usually compiled and re-evaluated on a periodic basis. Budgets can be made for a person, a group of people, a business, a government, or just about anything else that makes and spends money. A budget is an estimation of revenue and expenses over a specified future period of time and is utilized by governments, businesses, and individuals. A budget is basically a financial plan for a defined period, normally a year. It greatly enhances the success of any undertaking. As the saying goes, "if you fail to plan then plan to fail." Corporate budgets are essential for operating at peak efficiency. Aside from earmarking resources, a budget can also aid in setting goals, measuring outcomes and planning for contingencies. Personal budgets are extremely useful in managing an individual's or family's finances over both the short- and long-term horizon.

- 22. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 22 Types of Budget: - 1. Fixed Budget: According to CIMA, London – “A fixed budget is a budget designed to remain unchanged irrespective of the level of activity actually attained.” Thus, a budget which is prepared on the basis of standard or fixed level of activity is known as fixed budget. Fixed budget is based on the assumption that there will be no change in the level of activity. This budget is more useful for a short period of time when level of activity is not expected to change. Practically, this budget is of less use and has limited applications in controlling cost. 2. Flexible Budget: According to CIMA, London- “A flexible budget is a budget designed to change with the level of activity actually attained.” The other names used for flexible budget are variable budget and sliding scale budget. In flexible budget, budgeted figures can be changed according to the level of activity. E.g. – Budget was prepared for 60% production capacity but in actual 50% or 70% production capacity was used. The budgeted figures are changed according to these production levels. Furthermore, flexible budget recognizes the behavior of cost into variables, semi variable and fixed cost. It is more realistic and practically used for cost control purpose. 3. Functional Budget/Operating Budget: Functional budget is the budget which relates to a specific function of the business, e.g., sales budget, production budget. These budgets are prepared for each function and they contribute to the master budget. The number of functional budgets depends upon the size and nature of the business. a) Production Budget: The production budget is prepared for making a plan of production e.g., quantity of production, cost of production, type of products, plant capacity, operating cycle, availability of inputs, make or buy policy etc., during the budgeted period. The production manager is responsible for the preparation of production budget and executing it. Production budget is generally based on sales budget. b) Sales Budget: The sales budget is a statement of planned sales in quantity and value both. In sales budget, sale is forecasted during the budget period. The sales manager is responsible for preparation of this budget.

- 23. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 23 c) Purchase Budget: This budget is prepared for every purchase item to be purchased in each department. The purchase manager is entrusted with the responsibility of making this budget. This budget enables the purchase department to make bulk purchases. 4. Cash Budget (Financial Budget): The cash budget is the most important as it controls the cash. It is a detailed statement of cash receipts, cash payments and cash balance for the budgeted period. Cash Budget coordinates-and controls the financial aspects of business. This budget is prepared after the preparation of all other functional budgets. This budget is prepared by the chief accountant of the firm. 5. Long-Term Budget: Long-term budgets are prepared for a period exceeding one year. They are only forward-looking plans. They act as guidelines for preparing short term budgets. Long- term budgets are not meant for immediate implementation. 6. Short-Term Budget: A budget prepared for a period less than a year is called short-term budget. Short term budgets are prepared for actual implementation and it has a practical value. 7. Basic Budget: Essentially it is a long-term budget. The conditions and assumptions for preparing budgets should remain unaltered for a long period. Basic budgets are like long-term budget act as guidelines for preparing short-term budgets. 8. Current Budget: A budget prepared for a short time is called a current budget. It is meant for actual implementation. Conditions prevailing at the present are the basis for preparing these budgets. 9. MasterBudget: Master budget is a summary of all functional budgets. It gives an overall view of the firm’s plan of action for the budget period. In a master budget a summary of functional budgets is incorporated. Master budget takes two forms – a budgeted profit and loss account and budgeted balance sheet. In the budgeted profit and loss account all cost and revenues of all functional budgets are shown in summary form. It reveals the forecasted profit or loss for the budget period. In budgeted balance sheet all assets and liabilities are shown.

- 24. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 24 Q2. Explain the objectives of inventory management. Answer: Inventory management is the supervision of non-capitalized assets, or inventory, and stock items. As a component of supply chain management, inventory management supervises the flow of goods from manufacturers to warehouses and from these facilities to point of sale. A key function of inventory management is to keep a detailed record of each new or returned product as it enters or leaves a warehouse or point of sale. Organizations from small to large businesses can make use of inventory management to manage their flow of goods. There are numerous inventory management techniques, and using the correct one can lead to providing the correct goods, at the correct amount, place and time. Inventory control is a separate area of inventory management that is concerned with minimizing the total cost of inventory while maximizing the ability to provide customers with products in a timely manner. In some countries, the two terms are used as synonyms.

- 25. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 25 Objectives of Inventory Management Below are some of the major objectives of inventory management. 1) Smooth fulfillment of orders This is one of the most important objectives of inventory management. A situation where you have an order for your finished products in hand but you cannot fulfill the order due to the shortage of inventory is not ideal. It not just puts the fulfillment of the order at risk but also harms the reputation of your company due to delay in committed fulfillment timelines. To make sure such a situation doesn’t occur, inventory needs to be properly maintained at all times, and an inventory management system helps in doing the same. Let us understand this better with the help of an example. Suppose you are a book publisher. You have an order in hand of supplying 100 books to a retailer in the city. When the sales representative takes the order from the retailer, he doesn’t know about the inventory available. He just takes the order and passes it to the warehouse for fulfillment. At the warehouse, you realize that there are only 50 titles available against an order for 100. This will impact no just this single order but also your future business relationship with that retailer. Such issues can be solved by using an inventory management system where there are multiple users with different roles assigned to each of them- working on the same system.

- 26. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 26 2) Reduce losses due to theft, wastage, etc. This is another major objective of inventory management. In most organizations, the amount of inventory that is being managed in huge- right from procured raw material to the finished goods. All this inventory needs to be managed extra carefully so that there is minimal loss due to theft, wastage, etc. If the inventory is not handled properly, incidents of theft and other undesired events will not come to anyone’s notice. Let us take an example. You run an eCommerce business of selling mobile accessories having an inventory of 1000+ unique SKU’s. Also, at any given point of time, there are hundreds of products dispatched from your warehouse to the customers via courier. At the same time, there are many packages which are coming back to your warehouse as returns, undelivered shipments, etc. There has to be a proper inventory management system tracking all of them. In its absence, even if any warehouse staff member doesn’t mark an inward entry in the system for a shipment received back from the customer and just steals it, it may be a loss to the company due to theft. 3) Know when to scale or shrink the production of goods If you are a manufacturer of products, you would be already knowing that there times when you just need to scale the production to meet the market demand and reduce the production especially when the peak season ends. Inventory management can help you know exactly when to scale up or down your production as you get a precise picture of how many products are currently lying in your inventory at any point in time. To illustrate this better, let us consider an example. You have a small business of manufacturing umbrellas. You cannot just keep producing umbrellas at full swing whole year round since the demand for umbrellas in only during certain months of the year.

- 27. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 27 Having an inventory tracking system in place tells you exactly how many manufactured umbrellas are available with you at any point of time on a real-time basis. This helps you take a call on scaling up the production or shrink it towards the end of the season. 4) Keep investment in inventory at minimum possible levels Businesses, especially small businesses need adequate working capital for their day to day functioning. No business can afford to keep producing goods without having buyers for them and keep the working capital tied up in the stocks. Inventory management helps you address this pain point & keep your investment in inventory at a minimum possible level. For this, you can use inventory management software to track the inventory levels at any given point of time. You can decide and keep a threshold for every product, like say ten units. When the inventory count falls below this quantity, only then you take up the production activity for that product. This helps you keep your investments in inventory at minimum possible levels without hurting your top line. 5) Clear off the slow-moving goods In many cases, not all the goods produced by you would be flying off the shelf. There would be quite a few goods which are slow moving in the market, but you already have lots of these in your

- 28. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 28 inventory. Any kind of business cannot just keep their working capital blocked in such type of goods. Clearing off such slow-moving goods is another objective of inventory management. Let us consider that you are a manufacturer of garments. You got a manufactured around 100 different styles as a part of your summer collection. As the season ends, you realize that around 10 of these styles have failed to get a response in the market and are not moving off the shelves. Since you do not want to keep your investment in these items, you take a call to mark down the prices by 50% to sell them on no profit no loss basis. Taking such an informed decision is possible only when you have a proper inventory management system in place which analyzes sales patterns and tells you which are your slow-moving goods. 6) Analyze product sales patterns This can be one of the secondary objectives of inventory management. Analyzing product sales patterns is important so that you can make future sales assumptions and also see which are the fast and the slow-moving goods. Inventory management helps you significantly in this since you exactly know the flow of products in and out of your warehouse. You can even export data as per your requirements for any given timeframe. In fact, most of the modern inventory management already have the functionality of analyzing product sales patterns. All you need to do is only select the product category or individual products along with the time frame and generate reports at a click on the button.

- 29. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 29 Conclusion We have all the major as well as minor objectives of inventory management in depth in this article. You would have understood by now how crucial is inventory management for any business and what are the effects it can cause in case inventory management is not done properly. Make sure you use a good inventory management software for the same and provide proper training to your staff members so that the whole inventory management activity can be done seamlessly in your organization. 3. Write a note on Credit policy of receivable management. Answer: Receivables management is professional dunning, with the goal of avoiding payment defaults and ensuring the long-term liquidity of a company. It is part of the internal accounting department and

- 30. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 30 begins with arranging, recording and organizing outstanding payments. In the event of a default in payment, functioning receivables management ensures that the recipient of the invoice is not only reminded of his payment obligation in a timely and effective manner, but is also instructed to settle. Efficient receivables management begins before the collection of outstanding payments and a first payment reminder. Even before initiation of a business relation, especially for large-volume orders, it is advisable to check the credit rating of the business partner, and to view their debtors' and commercial register as well as annual financial statements. This is referred to as debtor management. It consolidates all processes within a company's accounting department and is likely to prevent bad debts from the beginning, as well as to effectively counter any existing bad debts. Concept of Credit Policy The discharge of the credit function in a company embraces a number of activities for which the policies have to be clearly laid down. Such a step will ensure consistency in credit decisions and actions. A credit policy thus, establishes guidelines that govern grant or reject credit to a customer, what should be the level of credit granted to a customer etc. A credit policy can be said to have a direct effect on the volume of investment a company desires to make in receivables. A company falls prey of many factors pertaining to its credit policy. In addition to specific industrial attributes like the trend of industry, pattern of demand, pace of technology changes, factors like financial strength of a company, marketing organization, growth of its product etc. also influence the credit policy of an enterprise. Certain considerations demand greater attention while formulating the credit policy like a product of lower price should be sold to customer bearing greater credit risk. Credit of smaller amounts results, in greater turnover of credit collection. New customers should be least favored for large credit sales. The profit margin of a company has direct relationship with the degree or risk. They are said to be inter-woven. Since, every increase in profit margin would be counterbalanced by increase in the element of risk.

- 31. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 31 Credit policy of every company is at large influenced by two conflicting objectives irrespective of the native and type of company. They are liquidity and profitability. Liquidity can be directly linked to book debts. Liquidity position of a firm can be easily improved without affecting profitability by reducing the duration of the period for which the credit is granted and further by collecting the realized value of receivables as soon as they fail due. To improve profitability one can, resort to lenient credit policy as a booster of sales, but the implications are: 1. Changes of extending credit to those with week credit rating. 2. Unduly long credit terms. 3. Tendency to expand credit to suit customer’s needs; and 4. Lack of attention to over dues accounts. Setting a Credit Policy

- 32. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 32 To establish a credit policy, a company must establish credit terms, credit standards and a collection policy. 1. Credit Terms Credit terms refer to the stipulations recognized by the firms for making credit sale of the goods to its buyers. In other words, credit terms literally mean the terms of payments of the receivables. A firm is required to consider various aspects of credit customers, approval of credit period, acceptance of sales discounts, provisions regarding the instruments of security for credit to be accepted are a few considerations which need due care and attention like the selection of credit customers can be made on the basis of firms, capacity to absorb the bad debt losses during a given period of time. However, a firm may opt for determining the credit terms in accordance with the established practices in the light of its needs. The amount of funds tied up in the receivables is directly related to the limits of credit granted to customers. These limits should never be ascertained on the basis of the subject’s own requirements, they should be based upon the debt paying power of customers and his ledger record of the orders and payments. There are two important components of credit terms which are detailed below: Credit period: The credit period lays its multi-faced effect on many aspects the volume of investment in receivables; its indirect influence can be seen on the net worth of the company. A long period credit term may boost sales but it’s also increase investment in receivables and lowers the quality of trade credit. While determining a credit period a company is bound to take into consideration various factors like buyer’s rate of stock turnover, competitors’ approach, the nature of commodity, margin of profit and availability of funds etc. The period of credit diners form industry to industry. In practice, the firms of same industry grant varied credit period to different individuals. as most of such firms decide upon the period of credit to be allowed to a customer on the basis of his financial position in addition to the nature of commodity, quality involved in transaction, the difference in the economic status of customer that may considerably influence the credit period. The general way of expressing credit period of a firm is to coin it in terms of net date that is, if a firm’s credit terms are “Net 30”, it means that the customer is expected to repay his credit obligation within 30 days. Generally, a free credit period granted, to pay for the goods

- 33. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 33 purchased on accounts tends to be tailored in relation to the period required for the business and in turn, to resale the goods and to collect payments for them. A firm may tighten its credit period if it confronts fault cases too often and fears occurrence of bad debt losses. On the other side, it may lengthen the credit period for enhancing operating profit through sales expansion. Anyhow, the net operating profit would increase only if the cost of extending credit period will be less than the incremental operating profit. But the increase in sales alone with extended credit period would increase the investment in receivables too because of the following two reasons: (i) Incremental sales result into incremental receivables, and (ii) The average collection period will get extended, as the customers will be granted more time to repay credit obligation. Cash Discount Terms: The cash discount is granted by the firm to its debtors, in order to induce them to make the payment earlier than the expiry of credit period allowed to them. Granting discount means reduction in prices entitled to the debtors so as to encourage them for early payment before the time stipulated to the i.e. the credit period. Grant of cash discount beneficial to the debtor is profitable to the creditor as well. A customer of the firm i.e. debtor would be realized from his obligation to pay Soon that too at discounted prices. On the other hand, it increases the turnover rate of working capital and enables the creditor firm to operate a greater volume of working capital. It also prevents debtors from using trade credit as a source of working capital. Cash discount is expressed is a percentage of sales. A cash discount term is accompanied by (a) the rate of cash discount, (b) the cash discount period, and (c) the net credit period. For instance, a credit term may be given as “1/10 Net 30” that mean a debtor is granted 1 percent discount if settles his accounts with the creditor before the tenth day starting from a day after the date of invoice. But in case the debtor does not opt for discount he is bound to terminate his obligation within the credit period of thirty days. Change in cash discount can either have positive or negative implication and at times both. Any increase in cash discount would directly increase the volume of credits sale. As the cash discount reduces the price of commodity for sale. So, the demand for the product ultimately increase leading to more sales. On the other hand, cash discount lures the debtors for prompt payment so that they can relish the discount facility available to them. This in turn reduces the average collection period and bad debt expenses thereby, bringing about a decline in the level of investment in receivables. Ultimately the profits would increase. Increase in discount rate can negatively affect the profit margin per unit of sale due to reduction of prices. A situation exactly reverses of the one stated above will occur in case of decline in cash discount.

- 34. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 34 Yet, the management of business enterprises should always take note of the point that cash discount, as a percentage of invoice prices, must not be high as to have an uneconomic bearing on the financial position of the concern. It should be seen in this connection that terms of sales include net credit period so that cash discount may continue to retain its significance and might be prevented from being treated by the buyers just like quantity discount. To make cash discount an effective tool of credit control, a business enterprise should also see that is allowed to only those customers who make payments at due date. And finally, the credit terms of an enterprise on the receipt of securities while granting credit to its customers. Credit sales may be got secured by being furnished with instruments such as trade acceptance, promissory notes or bank guarantees. 2. Credit Standards Credit standards refers to the minimum criteria adopted by a firm for the purpose of short listing its customers for extension of credit during a period of time. The nature of credit standard followed by a firm can be directly linked to changes in sales and receivables. A liberal credit standard always tends to push up the sales by luring customers into dealings. The firm, as a consequence would have to expand receivables investment along with sustaining costs of administering credit and bad- debt losses. As a more liberal extension of credit may cause certain customers to the less conscientious in paying their bills on time. Contrary, to these strict credit standards would mean extending credit to financially sound customers only. This saves the firm from bad debt losses and the firm has to spend lesser by a way of administrative credit cost. But this reduces investment in receivables besides depressing sales. In this way profit sacrificed by the firm on account of losing sales amounts more than the cost saved by the firm. Prudently, a firm should opt for lowering its credit standard only up to that level where profitability arising through expansion in sales exceeds the various costs associated with it. That way, optimum credit standards can be determined and maintained by inducing trade-off between incremental returns and incremental costs. 3. Collection Policy Collection policy refers to the procedures adopted by a firm (creditor) collect the amount of from its debtors when such amount becomes due after the expiry of credit period. The requirements of collection policy arise on account of the defaulters i.e. the customers not making the payments of receivables in time. As a few turnouts to be slow payers and some other non-payers. A collection

- 35. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 35 policy shall be formulated with a whole and sole aim of accelerating collection from bad-debt losses by ensuring prompt and regular collections. Regular collection on one hand indicates collection efficiency through control of bad debts and collection costs as well as by inducing velocity to working capital turnover. On the other hand, it keeps debtors alert in respect of prompt payments of their dues. A credit policy is needed to be framed in context of various considerations like short-term operations, determinations of level of authority, control procedures etc. Credit policy of an enterprise shall be reviewed and evaluated periodically and if necessary, amendments shall be made to suit the changing requirements of the business. It should be designed in such a way that it co-ordinates activities of concerns departments to achieve the overall objective of the business enterprises. Finally, poor implementation of good credit policy will not produce optimal results. To conclude, the credit policy of a company should be developed in accord with the strategic, marketing, financial and organizational context of the business and be designed to contribute to the achievement of corporate objectives. The corporate strategy can include trade credit management not just in terms of its contribution to collection and cash flow but as a means of generating sales and profits, and of investing in customers by building relationships. The management of trade credit can help build stable and long-term relationships with customers, generate information about the customer and their requirements and facilitate different customer strategies in terms of credit granting, credit terms and customer service. The objective is to generate growing but profitable sales. Q. 4. Explain the objectives of financial planning Answer: Financial planning is a step-by-step approach to meet one’s life goals. A financial plan acts as a guide as you go through life’s journey. Essentially, it helps you be in control of your income,

- 36. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 36 expenses and investments such that you can manage your money and achieve your goals. If you take a closer look at the above examples, you’ll find that there is one factor that connects all of them: money. You need to have an adequate amount of money to fulfil your goals and desires. More importantly, you need to have money at the right point in time. For example, if you want to build up a corpus of Rs. 10 lakhs for your daughter’s college education through investments, you need to grow this amount by the time she turns 18. Not a year later. This is where financial planning becomes essential. Before initiating a new business, the organization puts an immense focus on the topic of Financial Planning. Financial planning is the plan needed for estimating the fund requirements of a business and determining the sources for the same. It essentially includes generating a financial blueprint for company’s future activities. It is typically done for 3-5 years-broad in scope and generally includes long-term investment, growth and financing decisions. Objectives of financial planning: Financial Planning is having an important role to Financial Management. In fact, planning is the very first operate out of management. Prior to embarking on any sort of new business, the company need to have a best plan and should define the objectives of financial planning. Let us discuss some of the objectives of financial planning here. 1. Evaluate Business Objectives: Objectives of financial planning is always concerning assessing to examining the value for the business goals periodically. Businesses of all sizes create methods, strategies and techniques to meet their goals. You’ll evaluate business procedures, strategies before you actually implement it. For example: Business improvement goal requires techniques, strategies to monitor and control their desired business improvements.

- 37. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 37 2. Verify Business Mission, Vision and Objectives: Your business mission, vision and objectives direction associated with the team. These kinds of vision sound like large multi-national companies or an organization required it. But you might quickly discover, without a proper leading direction, you may lose quickly. Especially in the continuously changing environment of a new businesses these are an essential objective of financial planning for an organization. 3. Identify Resources to Achieve your Objectives: Setting goals like: Specified, Measurable, Achievable, Relevant and Time which is also known as SMART goals can help you evaluate each objective one chooses to set for your business. Consider either they’re realistic. You should write down the goals inside business plan to keep you in track towards achieving those goals. Here are the goals you need to set initially:

- 38. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 38 Specified – Get clear vision concerning what goal you want to achieve. Measurable – Ensure your objective are measured, therefore you can recognize it whether goals are achieved. Achievable – Confirm that your objective has whatever you’ve got the resources, funds, time to satisfy them. Relevant – Make sure on your goal was relevant to the direction you desire your business to follow. For example: adding staff, increasing profit, re-brand awareness and more. Time – You need to set some real deadlines for goals to be achievable. 4. Quantify Amount of Funds Required: In general terms, quantification process regularly decide how much of the funds is required for the purpose of procurement. Then again additional quantification is involves estimating the further requirement of the source of funds required to achieve the objectives of financial planning for an organization. 5. Estimate Time Required: Times is an important objective of financial planning in any new business. Delivering the funds at a right place and at the right time is very much important. When source of funds is an important factor for a business and Time is equally an important factor at the same time to achieve those goals. 6. Summarize the Costs to Create a Financial Plan: A brief description of the business development plan is essential to prepare financial plan, but it simply not fully completed here. Here you require an overview of the cost required to meet the objectives. This cost may change toward each stage of process but a realistic cost is must to put your financial plan in proper place. 7. Identify Issues and Risks with that Financial Plan:

- 39. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 39 The extend and type of a business exposure to financial risks is determined by nature of borrowings and its underlying operations. You can make use of risk planning to determine prospective issues that might lead to issues concerning your project. For example: analyse how probably these are typically in order to occur, bring action to prevent the potential risks you can avoid, and reduce the ones that which cannot be avoided. 8. Define the Capital Structure of an Organization: Capital structure are that composition of the funds of an organization, typically, the proportion and type of funds required to achieve the objectives of financial planning of the business. This consists of planning concerning debt-equity ratio for the funds required for both short-term plus long-term purpose. 9. Avoid Overspending Funds: It is a significant objectives of financial planning associated with the business to ensure that each firm does not raise unwanted resources. Lack to funds in an organization can lead to missing payment deadlines and commitments. However, by having a surplus of funds, that company does not make profit on investment but it adds additional expenses. 10. Profit Maximization: Inside economics, profit maximization is a process by which an organization might find out the price, input, and also output level it triggers towards maximizing revenue. That firm maximizes its earnings when it satisfies that two phenomenal rules. When MC (Marginal expense) is equal to MR (Marginal Revenue) and when MC curve slices the MR from below profits are maximized. Conclusion: It is actually the task concerning determining exactly how per business will manage to achieve its strategic aim and objectives of financial planning. Usually, an organization or a business create a financial plan immediately after setting the vision, idea and objectives of financial planning. If you are planning to start a business, start step by step process to achieve your goals. INDIRECT TAXES

- 40. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 40 Q. 1. Explain the conceptof GST & its features Answer: GST is a tax on goods and services with comprehensive and continuous chain of setoff benefits from the Producer’s point and Service provider’s point up to the retailer level. GST is expected be levied only at the destination point, and not at various points (from manufacturing to retail outlets). It is essentially a tax only on value addition at each stage and a supplier at each stage is permitted to setoff through a tax credit mechanism which would eliminate the burden of all cascading effects, including the burden of CENVAT and service tax. Under GST structure, all different stages of production and distribution can be interpreted as a mere tax pass through and the tax essentially sticks on final consumption within the taxing jurisdiction. Earlier a manufacturer needs to pay tax when a finished product moves out from the factory, and it is again taxed at the retail outlet when sold. The taxes are levied at the multiple stages such as CENVAT, Central sales tax, State Sales Tax, Octroi, etc. will be replaced by GST to be introduced at Central and State level. All goods and services, barring a few exceptions, will be brought into the GST base. There will be no distinction between goods and services. Under GST, the taxation burden will be divided equitably between manufacturing and services, through a lower tax rate by increasing the tax base and minimizing exemptions. However, the basic features of law such as chargeability, definition of taxable event and taxable person, measure of levy including valuation provisions, basis of classification etc. would be uniform across these statutes as far as practicable. The existing CST will be discontinued. Instead, a new statute known as IGST will come into place on the inter-state transfer of the Goods and Services. By removing the cascading effect of taxes (CST, additional customs duty, surcharges, luxury Tax, Entertainment Tax, etc. ),CGST & SGST will be charged on same price . eatures of GST:

- 41. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 41 1. Levy of GST: The center will levy Central GST (CGST) and the states will levy State GST (SGST) on the supply of goods and services within a state. The center will levy IGST in the case of (i) inter-state supply of goods and services, (ii) imports and exports, and (iii) supplies to and from special economic zones. 2. Exemptions from GST: The center exempts certain goods and services from the purview of GST through a notification. This will be based on recommendations of the GST Council. 3. Turnover limit under GST and tax right over low turnover entities: GST is applied when turnover of the business exceeds Rs 20lakhs per year (Limit is Rs 10lakhs for the North-Eastern States). Traders who would like to get input tax credit should make a voluntary registration even if their sales are below Rs 20 lakh per year. Traders supplying goods to other states have to register under GST, even if their sales are less than Rs 20 lakh. There is a composition scheme for selected group of tax payers whose turnover is up to Rs 75 lakhs a year. 4. The four-tier rate structure: The GST proposes a four-tier rate structure. The tax slabs are fixed at 5%, 12%, 18% and 28% besides the 0% tax on essentials. Gold is taxed at 3%. The center

- 42. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 42 has strictly demanded and got an additional cess on demerit luxury goods that comes under the high 28% tax. Essential commodities like food items are exempted from taxes under GST. Other consumer goods which are common items will be taxed at 5%.4. The new GST seems to have two standard rates – 12% and 18%. GST rate structure for the goods and services are fixed by considering different factors including luxury/necessity nature. 5. Tax revenue appropriation between the center and states: The center and states will share GST tax revenues at 50:50 ratios (except the IGST). This means that if a service is taxed at 18%, 9% will go to the center and 9% will go to the concerned state. 6. Input tax credit: Every taxpayer while paying taxes on outputs may take credit for taxes paid earlier by the supplier on inputs. However, this will not be applicable on supplies related to: (i) motor vehicles when used for personal consumption, (ii) supply of food, health services, etc. unless they are further used to make a supply. 7. Taxable amount (value of supply): The GST levied on the supply of goods and services, whose value will include: (i) price paid on the supply, (ii) taxes and duties levied under other tax laws, (iii) interest, late fee, penalties for delayed payments, among others. 8. Refunds and welfare fund: Any taxpayer may apply for refund of taxes in cases including: (i) payment of excess taxes, or (ii) unutilized input tax credit. The refund may be credited to the taxpayer, or to a Consumer Welfare Fund under certain circumstances. 9. Returns: Every taxpayer should self-assess and file tax returns on a monthly basis by submitting: (i) details of supplies provided, (ii) details of supplies received, and (iii) payment of tax. In addition to the monthly returns, an annual return will have to be filed by each taxpayer. 10. Apportionment of IGST revenue: The IGST collected will be apportioned between the center and the state where the goods or services are consumed. The revenue will be apportioned to the center at the CGST rate, and the remaining amount will be apportioned to the consuming state. Q. 2. Explain the conceptof Composite& Mixed supply. Answer:

- 43. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 43 Concept of Mixed Supply & Composite Supply under GST is a new concept introduced in GST which will cover supplies made together whether the supplies are related or not. Supplies of two or more goods or services can be either ‘composite supply’ or ‘mixed supply’. The concept of composite supply in GST regime is similar to the concept of naturally bundled services under Service Tax Law. However, the concept of mixed supply is entirely new. Mixed Supply under GST: Under GST, a mixed supply means two or more individual supplies of goods or services, or any combination thereof, made in conjunction with each other by a taxable person for a single price where such supply does not constitute a composite supply; For example- A Diwali gift box consisting of canned foods, sweets, chocolates, cakes, dry fruits, and aerated drink and fruit juices supplied for a single price is a mixed supply. All are also sold separately. Since aerated drinks have the highest GST rate of 28%, aerated drinks will be treated as principal supply and 28% will apply on the entire gift box. Time of supply in case of mixed supplies:

- 44. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 44 The mixed supply, if involves supply of a service liable to tax at higher rates than any other constituent supplies, such mixed supply would qualify as supply of services and accordingly the provisions relating to time of supply of services would be applicable. Alternatively, the mixed supply, if involves supply of goods liable to tax at higher rates than any other constituent supplies, such mixed supply would qualify as supply of goods and accordingly the provisions relating to time of supply of services would be applicable. Composite Supply under GST Under GST, a composite supply would mean a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both, or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply; For Example: Where goods are packed and transported with insurance, the supply of goods, packing materials, transport and insurance is a composite supply and supply of goods is a principal supply. Time of supply in case of Composite supply If the composite supply involves supply of services as principal supply, such composite supply would qualify as supply of services and accordingly the provisions relating to time of supply of services would be applicable. Alternatively, if composite supply involves supply of goods as principal supply, such composite supply would qualify as supply of goods and accordingly, the provisions relating to time of supply of goods would be applicable. Q. 3. Explain the provision based on which a personliable for registration under GST.

- 45. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 45 Answer: Section 22 of the CGST Act, specified that “ Every supplier shall be liable to be registered under this Act in the State or Union territory , other than special category States, from where he makes a taxable supply of goods or services or both , if his aggregate turnover in a financial year exceeds twenty lakh rupees” But the person makes taxable supplies of goods or services or both from any of the special category States; he shall be liable to be registered if his aggregate turnover in a financial year exceeds ten lakh rupees. Every person who is holding a license or registration under the earlier laws shall be liable to be registered under this Act, with effect from 01.07.2017. When a business carried on by a taxable person registered under this Act is transferred on account of succession or otherwise, to another person as a going concern, the transferee or the successor as the case may be liable to be registered with effect from the date of such transfer or succession. In a case of transfer pursuant to sanction of a scheme or an arrangement for amalgamation or, as the case may be, demerger of two or more companies pursuant to an order of a High Court, Tribunal or otherwise, the transferee shall be liable to be registered, with effect from the date on which the Registrar of Companies issues a certificate of incorporation giving effect to such order of the High Court or Tribunal. For the purposes of this section there are certain points has been clarified as under, –– (i) The expression “aggregate turnover” shall include all supplies made by the taxable person, whether on his own account or made on behalf of all his principals; (ii) the supply of goods, after completion of job work, by a registered job worker shall be treated as the supply of goods by the principal referred to in section 143, and the value of such goods shall not be included in the aggregate turnover of the registered job worker;

- 46. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 46 (iii) the expression “special category States” shall mean the States as specified in sub-clause (g) of clause (4) of article 279A of the Constitution. Thus, from the above analysis there are two terms are very important needs to be defined before proceeding to further analysis of the topic and the two words are namely “supplier” and “aggregate turnover” Section 2 (105) of the CGST Act, defines “Supplier” in relation to any goods or services or both, shall mean the person supplying the said goods or services or both and shall include an agent acting as such on behalf of such supplier in relation to the goods or services; Section 2(6) of the CGST Act, defines “aggregate turnover” means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis), exempt supplies, exports of goods or services or both and inter-State supplies of persons having the same Permanent Account Number, to be computed on all India basis but excludes central tax, State tax, Union territory tax, integrated tax and cess. Q. 4. Explain the place of supply of goods other than Import /Export under sec. 10 of IGST act,2017.

- 47. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 47 Answer: Place of Supply (POS) in GST In GST, the concept of a place of supply has been made relevant not only for the supply of services but also for the transaction of goods. In this article, we shall be discussing on provisions relating to the place of supply of goods. Which tax is to be levied (IGST or CGST and SGST/UTGST) will depend on whether a particular transaction is an Inter-state supply or Intra-state supply? Hence, every transaction will have to go through the test of provisions relating to the place of supply in order to determine which tax is to be levied. (e) Where the goods are supplied on board a conveyance, including a vessel, an aircraft, a train or a motor vehicle, the place of supply shall be the location at which such goods are taken on board. The purpose of the place of supply provisions is two-fold: 1) In case of cross-border transactions, to determine whether tax is to be levied on a particular transaction 2) In the case of domestic transactions, to determine whether a particular transaction is an inter-state supply or an intra-state supply. Transactions other than Import or Export (Section 10) 1) Movement of Goods: Section 10(1) (a) states that "where the supply involves movement of goods, whether by the supplier or the recipient or by any other person, the place of supply of such goods shall be the location of the goods at the time at which the movement of goods terminates for delivery to the recipient" This implies that place of supplier or receiver is of no consequence to determine the place of supply when it comes to those transactions which involve the movement of goods. The place where delivery terminates i.e. where the ownership is passed on shall be critical to determine the place of supply. 2) Bill to Ship to Transactions: Section 10(1)(b) states "where the goods are delivered by the supplier to a recipient or any other person on the direction of a third person, whether acting as an agent or otherwise, before or during movement of goods, either by way of transfer of documents of title to the goods or otherwise, it shall be deemed that the said

- 48. Assignment M.com – II Sem - 4 Rahul Ludhwani Roll No.1962085 Page | 48 third person has received the goods and the place of supply of such goods shall be the principal place of business of such person" When goods are delivered to a party on the direction of a third person the place of supply will be the location of such third person and not where the delivery terminates. 3) No Movement of Goods: Section 10(1) (c) states that where the supply does not involve movement of goods, whether, by the supplier or the recipient, the place of supply shall be the location of such goods at the time of the delivery to the recipient; When goods are of such nature which does not require any movement, place of supply shall be the location of such goods. 4) When Goods are installed: Section 10(1) (d) states where the goods are assembled or installed at site, the place of supply shall be the place of such installation or assembly 5)Goods on Board a conveyance: Section 10(1) (e) states "where the goods are supplied on board a conveyance, including a vessel, an aircraft, a train or a motor vehicle, the place of supply shall be the location at which such goods are taken on board." This provision includes those purchases which are done while traveling on a conveyance.