1) The document discusses various legal documents required to register a company including the Memorandum of Association (MOA), Articles of Association (AOA), and Prospectus. The MOA defines the objectives and rules of incorporation while the AOA contains the internal management rules.

2) It also discusses key concepts related to company registration like ultra vires, indoor management, and minimum subscription. The doctrine of ultra vires states that an act of a company must not be beyond the object clause of its MOA. Indoor management allows outsiders to assume internal procedures are properly followed.

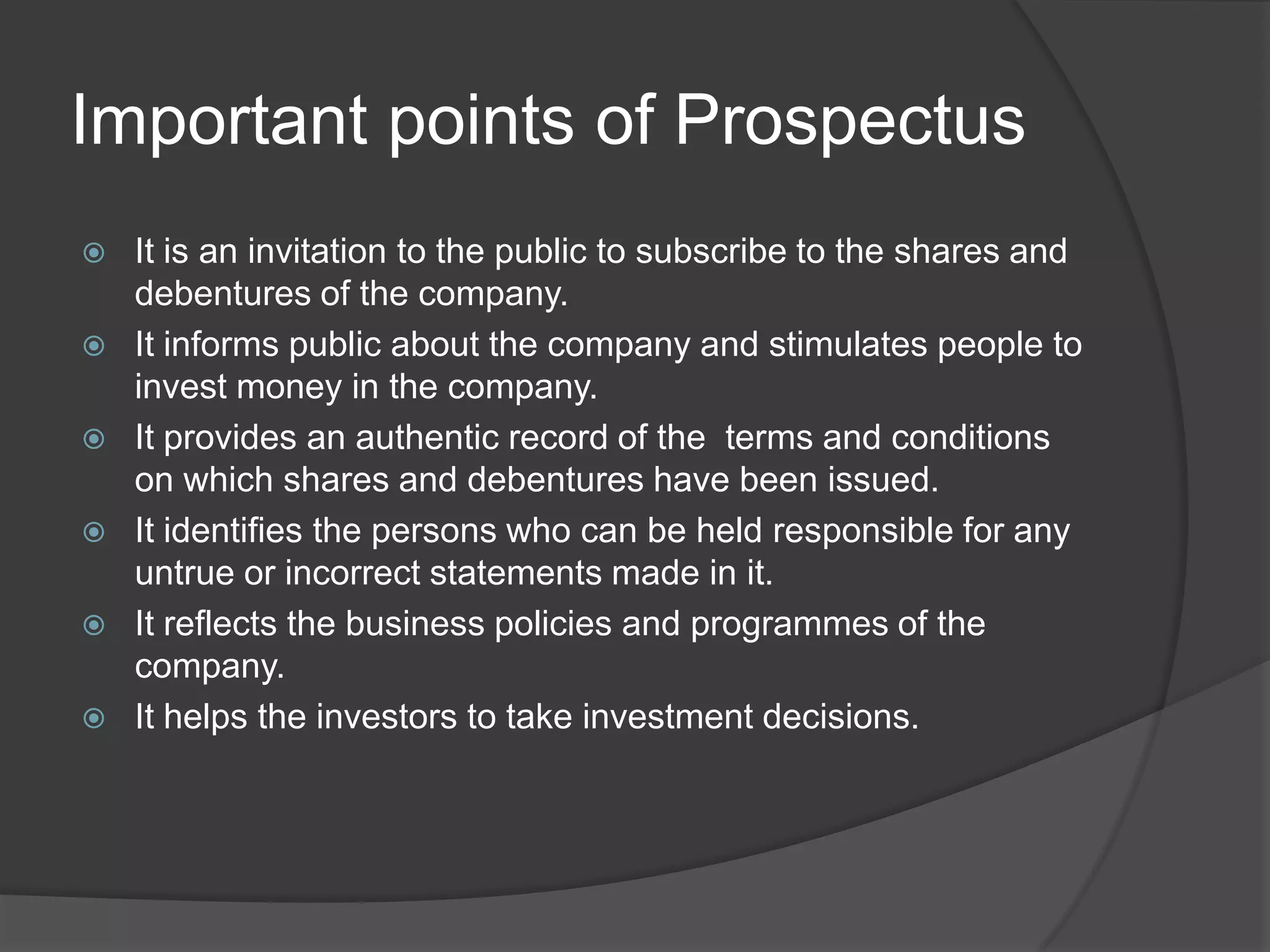

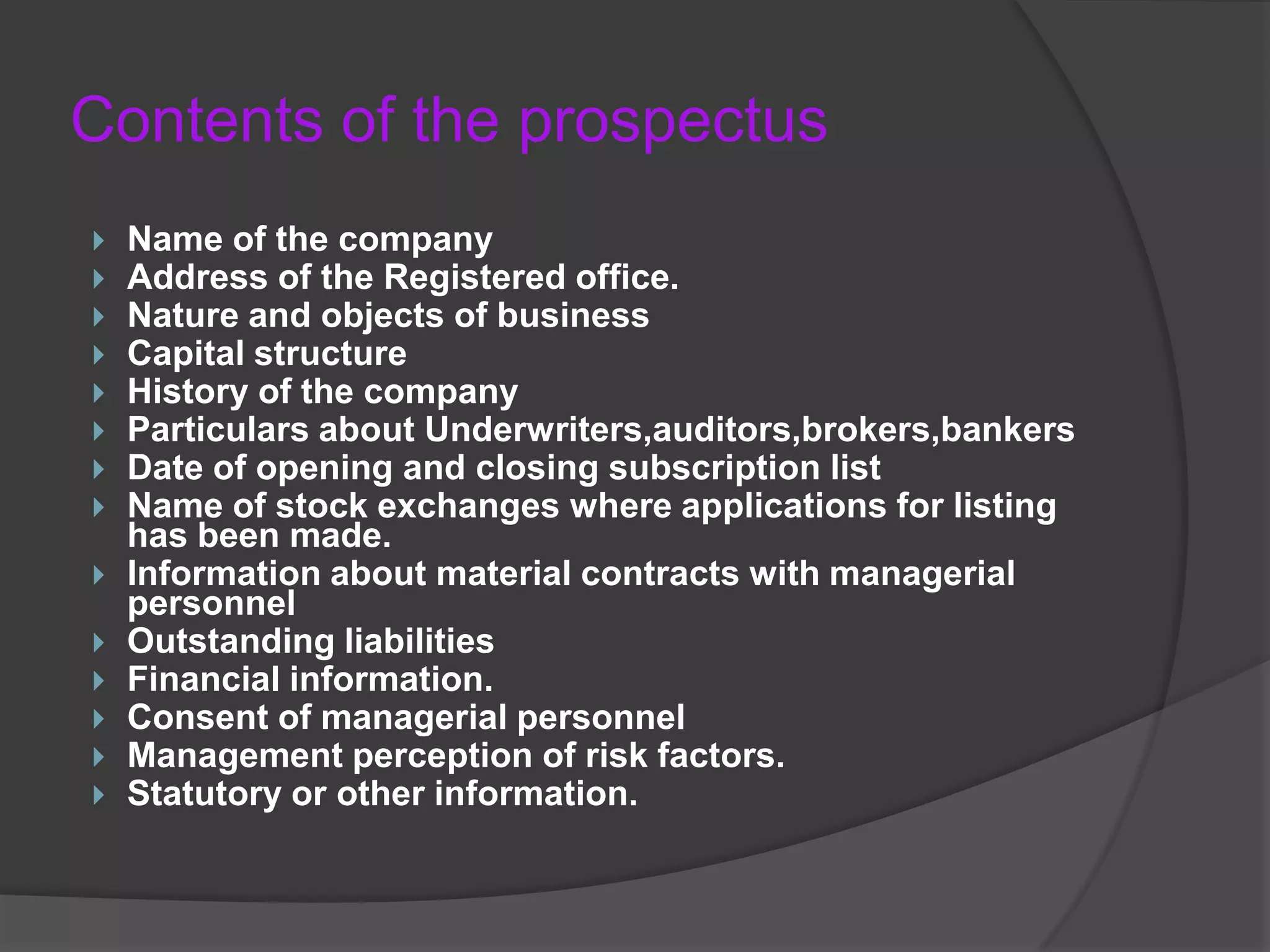

3) A prospectus invites public investment and must disclose important company details and terms to help investors make informed decisions. It is accompanied