Report

Share

Download to read offline

Recommended

More Related Content

What's hot (8)

Dan starr realtor - scope of real estate investments

Dan starr realtor - scope of real estate investments

Viewers also liked

Viewers also liked (20)

Capital budgeting Slideshow for new product peneration

Capital budgeting Slideshow for new product peneration

Similar to 2 net present value ex

Similar to 2 net present value ex (20)

Presentation on Time value of money (Lecture 2).pptx

Presentation on Time value of money (Lecture 2).pptx

Aminullah assagaf p6 manj keu 2 (2 april 2020)_versi 2

Aminullah assagaf p6 manj keu 2 (2 april 2020)_versi 2

More from Malinga Perera

More from Malinga Perera (15)

Floyd Warshall algorithm easy way to compute - Malinga

Floyd Warshall algorithm easy way to compute - Malinga

4 the theory of the firm and the cost of production

4 the theory of the firm and the cost of production

2 net present value ex

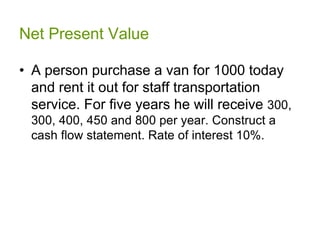

- 1. Net Present Value • A person purchase a van for 1000 today and rent it out for staff transportation service. For five years he will receive 300, 300, 400, 450 and 800 per year. Construct a cash flow statement. Rate of interest 10%.

- 2. Year 0 1 2 3 4 5 Cash Outflows Investment -1000 Cash Inflows Revenue 300 300 400 450 800 Total -1000 300 300 400 450 800 1.10 1.1-1 1.1-2 1.1-3 1.1-4 1.1-5 Discount rate =1 =.909 =.826 =.751 =.683 =.621 Dis. C/F -1000 272.7 247.8 300.4 300.4 496.8 Net Present Value @ 10%, NPV = 568

- 3. Net Present Value Year Total Cash Discount rate Discounted Flow Cash Flow (Rs) (@10%) 0 -1000 1.10 = 1 -1000 1 300 1.11 = 0.909 272.7 2 300 1.12 = 0.826 247.8 3 400 1.13 = 0.751 300.4 4 450 1.14 = 0.683 307.35 5 800 1.15 = 0.621 496.8 Total 625.05 Net Present Value @ 10% - 568

- 4. CF1 CF2 NPV CF0 (1 i ) (1 i ) 2 .... CFr (1 i ) r ... NPV | CF0 | CF j ( P / F , i %, j ) where j = 0 to n Free Cash Salvage |CF0| : initial cash flow flows Rs Value (an outlay) which is a . negative Time Horizon Time Amount to be Invested