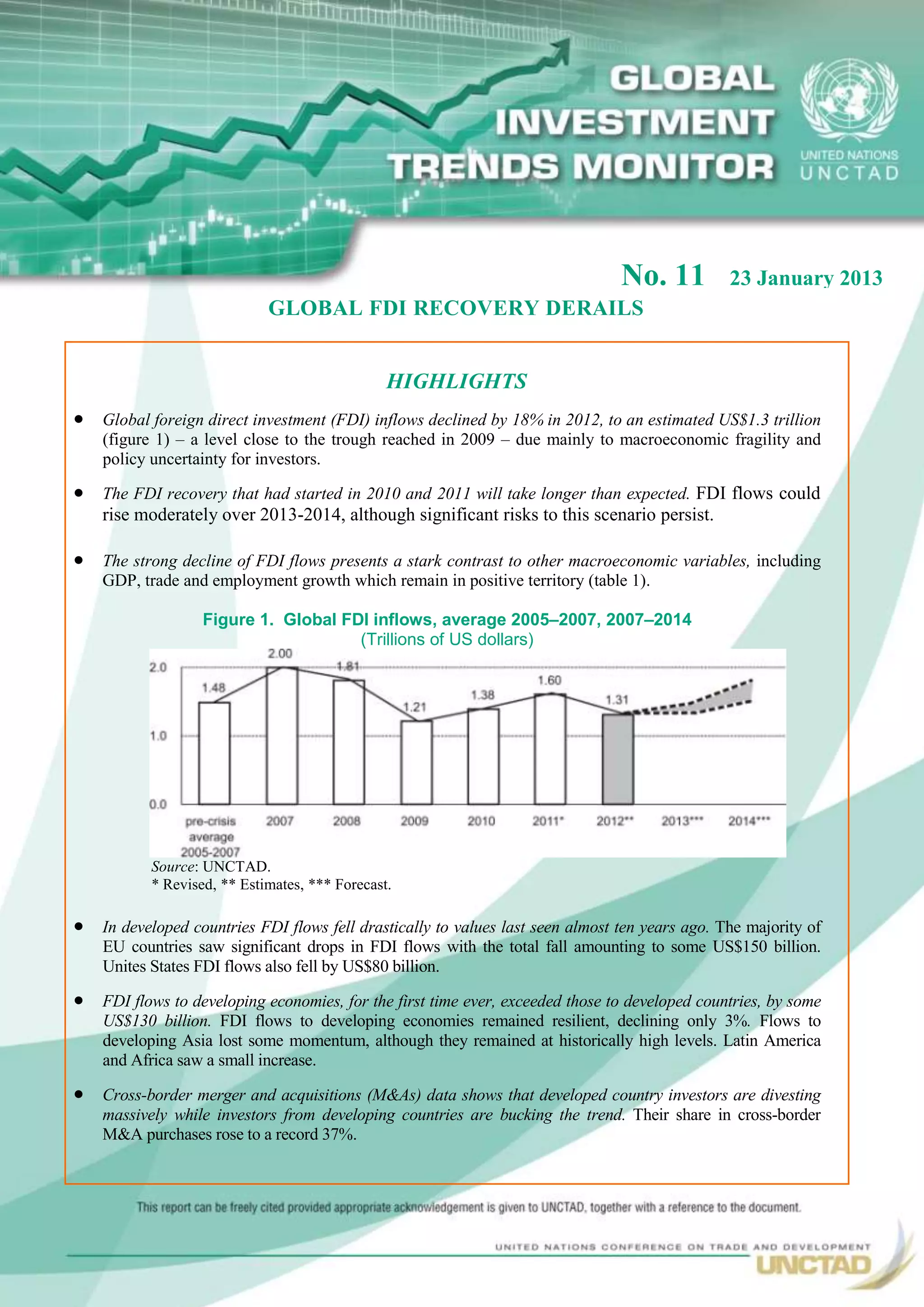

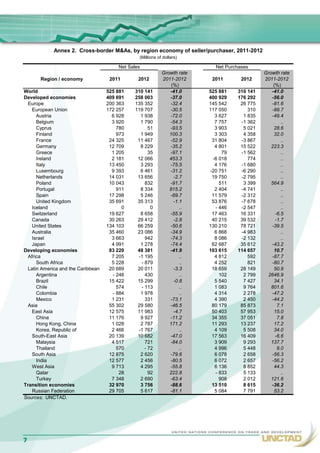

Global FDI flows declined significantly in 2012, dropping 18% to an estimated $1.3 trillion. This decline reversed the recovery that began in 2010-2011. Developing countries saw more resilient FDI, absorbing $130 billion more than developed nations for the first time. Macroeconomic and policy uncertainties continued to dampen investor confidence, though FDI may rise moderately in 2013-2014 if the global economy improves. Significant risks to a recovery remain, however.