New base energy news 31 may 2020 issue no. 1343 senior editor eng. khaled al awadi-compressed_compressed

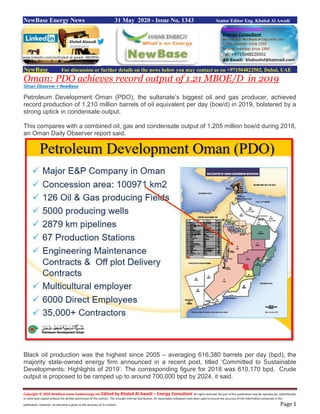

- 1. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 31 May 2020 - Issue No. 1343 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Oman: PDO achieves record output of 1.21 MBOE/D in 2019 Oman Observer + NewBase Petroleum Development Oman (PDO), the sultanate’s biggest oil and gas producer, achieved record production of 1.210 million barrels of oil equivalent per day (boe/d) in 2019, bolstered by a strong uptick in condensate output. This compares with a combined oil, gas and condensate output of 1.205 million boe/d during 2018, an Oman Daily Observer report said. Black oil production was the highest since 2005 – averaging 616,380 barrels per day (bpd), the majority state-owned energy firm announced in a recent post, titled ‘Committed to Sustainable Developments: Highlights of 2019’. The corresponding figure for 2018 was 610,170 bpd. Crude output is proposed to be ramped up to around 700,000 bpd by 2024, it said. www.linkedin.com/in/khaled-al-awadi-38b995b

- 2. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 Gas production averaged 62.2 million cum/day last year, which was slightly lower from previous year’s average of 64.8 million cum/day. However, condensate output surged to 93,000 barrels per day (bpd) last year, up from around 65,300 bpd in 2018. Among the many highlights of 2019 was its success in booking 136 million barrels of contingent oil resources, and 1.1 trillion cubic feet of commercial contingent resource of non-associated gas volumes in “some of the most testing terrain in the world”, said the company. Significantly, the company achieved a further reduction in the unit finding cost (UFC) of oil to $1 per barrel, with an overall UFC of $0.9 per barrel of oil equivalent, it said. Furthermore, the Exploration Directorate drilled 26 wells and production from exploration wells was delivered as planned at a daily average rate of approximately 1,250 barrels, with further output expected from new exploration wells coming on stream during this year (2020), said the company in a report published in the latest issue of its Al Fahal magazine. A key highpoint of 2019, according to PDO, was the “safe and successful start-up” of the company’s largest project – Rabab Harweel Integrated Project (RHIP) — representing the largest reserve addition (more than 500 million barrels of oil equivalent) and capital project in PDO history. This world-class, highly technical and complex project was delivered two months ahead of schedule and over $1 billion under budget, said PDO. Additionally, as part of its transition to a full-fledged energy company, PDO is placing a greater emphasis on renewables such as solar and wind. It is also continuing to deploy and trial technologies to improve its energy and water management, and reduce flaring and greenhouse gas emissions, it said. Building on its contribution to In-Country Value (ICV) development, PDO’s strategies helped ensure the local retention of cumulatively around $615 million in contract value last year, it said. It also delivered 11 manufacturing and services facilities in 2019, creating around 200 jobs for locals.

- 3. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Saudi Aramco plan a pipeline sale to follow steps of ADNOC Reuters + NewBase Many international financial institute are looking to the potential sale of a stake in Saudi Aramco’s pipeline business, a deal worth over $10 billion, two sources told Reuters. The U.S. investment bank, which has previously advised the world’s largest oil company, was originally looking to be part of the advisory group on any deal, the sources added. However, Aramco has mandated JP Morgan (JPM.N) and Japan’s MUFG (8306.T) to advise it on the deal, which is still in its early stages but would provide the company with cash at a time of low oil prices caused by the coronavirus crisis, the sources said. Morgan Stanley, Aramco, JP Morgan and MUFG all declined to comment. U.S. investment banks have recently been shrinking lending outside their home market during the coronavirus crisis, sources told Reuters last month. Aramco’s pipeline sale would be similar to the path taken by Abu Dhabi’s national oil company ADNOC last year, when it raised $4 billion by selling a 40% stake in its pipelines division to U.S. investment firms KKR and BlackRock, the sources said. While ADNOC is in the process of replicating its deal by selling its natural gas pipeline assets, sources have told Reuters, in Aramco’s case the process is proving more difficult and moving more slowly, the sources added.

- 4. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Oman’s first utility-scale solar power project now online Oman Observer - Conrad Prabhu The Sultanate has officially brought into commercial operation its first utility-scale solar photovoltaic (PV) scheme – a 105 MWac capacity Independent Power Project (IPP) located at Amin in the south of the Block 6 license of Petroleum Development Oman (PDO). Amin Renewable Energy Company (AREC), representing a consortium led by the Japanese-based international conglomerate Marubeni Corporation, built the facility under a long-term Power Purchase Agreement (PPA) signed with PDO. Featuring 336,000 solar PV panels, output from the sprawling solar farm is earmarked exclusively for use by PDO in powering its Interior operations. An official of the majority-government owned Oil and Gas company revealed in an interview to a local news portal that the Amin solar farm came on stream earlier this week after several weeks of performance testing and commissioning. It follows the award of a generation license (renewable energy) by the Authority for Electricity Regulation (AER) Oman to the developer, Amin Renewable Energy Company (AREC), in January this year. In April, Amin Solar exported more than three million units of commissioning energy to PDO’s grid, “achieving the target by fair margin”, AREC said in a recent post on LinkedIn. AREC is a partnership of Marubeni Corporation, Oman Gas Company SAOC, Bahwan Renewable Energy Company, and Nebras. In January 2019, Muscat-based AREC had been awarded the contract to “develop, finance, build, operate and maintain” what is billed as the world’s first utility-scale solar project with an oil and gas company as the offtaker of its electricity output. According to PDO, the project has secured carbon credit registration within the European Union. At full capacity, clean energy from the plant will help offset more than 225,000 tons per year of CO2 emissions – the equivalent of taking some 23,000 vehicles off the road, it noted.

- 5. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Significantly, Amin Solar joins a growing portfolio of renewables and other clean energy based initiatives embraced by PDO as part of its long-term commitment to reducing its carbon footprint. The project also aligns with the company’s broader vision to evolve into a full-fledged energy development organisation with a remit that transcends its current focus on hydrocarbon based resources and encompasses a variety of low-carbon opportunities. PDO is a global pioneer in the use of solar energy to generate steam necessary for its Enhanced Oil Recovery (EOR) operations. To this end, PDO is overseeing the implementation of a 1-gigawatt Miraah project that harnesses solar energy to produce heavy oil from the Amal oilfield instead of natural gas for steam generation. Furthermore, PDO is exploring avenues for investment in solar and wind resources for power generation and water desalination, power to ‘X’, solar to hydrogen, and other opportunities. The company has also expressed an interest in bidding for large-scale solar power schemes procured by state-run Oman Power and Water Procurement Company (OPWP). The project will be the first large scale solar plant in Oman. It also marks Marubeni’s second Independent Power Project (IPP) in the Sultanate, the first being the Sur Gas Fired Combined Cycle IPP Project (2,000MW) which has been in operation since 2014. Recently, the Marubeni-led consortium signed a power purchase agreement (PPA) with PDO for the output of the 105 MW Amin photovoltaic project in the south of Oman. The consortium is a partnership created through a special purpose company between Marubeni, with a 50.1 per cent stake, Oman Oil Facilities Development Company (30 per cent), Bahwan Renewable Energy Co (10 per cent) and Modern Channel Services with 9.9 per cent. The PPA, which will last for 23 years, will task the consortium to develop, construct operate and maintain the solar PV plant which has a capacity of 105 MW. Marubeni said the scheduled commercial operation date is projected for May 2020. Marubeni added that project financing is also being arranged for this project.

- 6. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Norway plans $369 million green industry investments Reuters + NewBase The Norwegian government proposes spending 3.6 billion Norwegian crowns ($369 million) on investments to make its economy greener as it gradually emerges from coronavirus lockdowns, the government said on Friday. “The crisis we are now in hasn’t made the need for transformation smaller - it has increased it,” Prime Minister Erna Solberg told a news conference. While a half-century of oil and gas production has made Norway one of the world’s wealthiest nations, the country aims to transition into a less oil-dependent economy and make more room for other, especially greener, industries to grow. The centre-right minority government of oil and gas producing Norway now faces negotiations with opposition parties on the contents of the package. Some 2 billion crowns will be distributed by Enova, a state agency supporting companies’ efforts to reduced greenhouse gas emissions, while 1 billion crowns will go to science projects, the government said in a whitepaper. The government has further raised its projected 2020 spending from the country’s sovereign wealth fund by 5 billion crowns to 424.6 billion crowns compared to its previous forecast published on May 12. Hydrogen power solutions, battery technology, ocean windfarms and efforts to cut pollution from the shipping industry are among the potential beneficiaries. “A temporary reduction in emissions as a consequence of lower activity doesn’t change the long- term challenge,” the government said in the policy document. The whitepaper is the third major initiative by the government to boost the economy following a March 12 lockdown to combat the COVID-19 pandemic. Norway in recent weeks lifted many coronavirus restrictions and will allow some cross-border business travel from June 1.

- 7. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 UK approves country’s largest solar farm in the south of England CNBC + NewBase The U.K. government on Thursday gave the green-light for plans to develop the country’s largest solar park, a sprawling project which will cover a large chunk of land on the north Kent coast. A joint venture between Hive Energy and Wirsol Energy, the £450 million ($555 million) Cleve Hill Solar Park will be located near the towns of Faversham and Whitstable. The subsidy-free 350 megawatt scheme will use 880,000 solar panels and have the capacity to power more than 91,000 homes. The project is also set to include an energy storage facility to send electricity to the grid as and when required. The U.K. government is targeting net zero greenhouse gas emissions by the year 2050 and is aiming to remove coal from Britain’s energy system by the year 2025. It recently announced it would consult on moving this deadline to October 1, 2024. All of these goals will inevitably require the development of more renewable energy projects. Chris Hewett, the chief executive of the Solar Trade Association, said in a statement published Thursday that the government’s decision on the Cleve Hill Solar Park had shown it recognized the “vital contribution” solar can make to Britain’s energy mix. “This is a major milestone on the road towards a U.K. powered by clean, affordable renewables,” Hewett added. While the approval of the scheme has been welcomed by some, concerns have been raised about its impact on the local landscape and wildlife and the project has been opposed by a number of organizations. In a Facebook post, the Conservative Member of Parliament for Faversham and Mid Kent, Helen Whately, described the news as: “Hugely frustrating and upsetting”. For their part, the project’s developers say they have “collaborated with local groups and nature conservation bodies to deliver significant local environmental benefits in the design of the scheme”. The decision comes in the same week that Leicestershire County Council announced plans for a solar farm which could produce nearly 10,000 megawatt-hours of electricity annually once up and running. If the plans are approved, the first phase of the development is estimated to cost approximately £14 million, according to authorities.

- 8. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 World’s ‘largest all electric commercial aircraft’ completes its first flight CNBC - Anmar Frangoul The planet’s “largest all electric commercial aircraft” has completed its maiden flight, the latest example of a zero-emission form of transport taking to the skies. The Cessna 208B Grand Caravan took off from an airport in Moses Lake, Washington, on Thursday and used a 750-horsepower all-electric motor developed by a Redmond-headquartered company called magniX. Work to convert the aircraft was undertaken by magniX and another firm called AeroTEC. “The iconic Caravan has been a workhorse of industry moving people and transporting goods on short routes for decades,” Roei Ganzarski, the CEO of magniX, said in a statement on Thursday. “This first flight of the eCaravan is yet another step on the road to operating these middle-mile aircraft at a fraction of the cost, with zero emissions, from and to smaller airports,” Ganzarski added. “These electric commercial aircraft will enable the offering of flying services of people and packages in a way previously not possible.” Thursday’s flight represents another step forward for electric aircraft, albeit a small one. In December 2019, the world’s first fully-electric aircraft for commercial flight completed a test in Canada. The DHC-2 de Havilland Beaver seaplane used in that flight was also fitted with a motor from magniX. Can aviation go green? According to the International Council on Clean Transportation, “commercial aviation accounts for about 2% of global carbon emissions.” For the transportation sector as a whole, its responsible for around 12% of all carbon dioxide emissions. In a bid to reduce the environmental impact of aviation, some airlines, such as KLM, have used bio- fuels to power their planes. The last few years have also seen a number of innovative aircraft complete journeys. In 2016, the Solar Impulse 2, a manned aircraft powered by the sun, managed to circumnavigate the globe without using fuel. The trip was completed in 17 separate legs. In 2018, an unmanned solar-powered aircraft from European aerospace giant Airbus completed a maiden flight lasting 25 days, 23 hours, and 57 minutes.

- 9. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 U.S. :Crude Flurry of export fixtures offers glimmer of hope Reuters + NewBase A flurry of tentative bookings to export U.S. crude oil from the Gulf Coast suggests demand is edging up after the coronavirus slammed energy consumption worldwide. BP (BP.L), Trafigura [TRAFGF.UL] and Equinor (EQNR.OL) have all tentatively fixed vessels this past week to carry U.S. crude to global destinations over the coming month, according to Refinitiv Eikon data and shipping sources. Commodities merchant Trafigura and Occidental Petroleum (OXY.N) are among companies looking to book vessels to ship crude from the U.S. Gulf Coast to Asia, one shipbroker said. The U.S. Gulf export market was particularly active last week, with around six ships confirmed with June loading dates, another shipping source said. Occidental, Equinor and BP declined comment. Trafigura did not immediately respond to requests for comment. U.S. crude exports plunged as the coronavirus pandemic eroded global demand by 30% in April. Exports dipped to 3.2 million barrels per day (bpd) last week, lowest in a month, the U.S. Energy Information Administration said. While U.S. crude’s discount to Brent LCOc1-CLc1 is still narrow, freight rates for supertankers from the U.S. Gulf to Singapore TD-LPP-SIN plunged more than 80% from early April to the lowest since August 2019 this month, Refinitiv Eikon data showed. Those rates are currently near $5.75 million after peaking around $20 million in late March, sources said. “Vessel freight rates have been coming down over the last couple of weeks which is re-igniting interest in export opportunities,” said Andy Lipow, president of consultants Lipow Oil Associates. He said demand in China and India is expected to keep rising as the countries contain the spread of COVID-19. Taiwanese refiner CPC Corp purchased 6 million barrels of U.S. West Texas Intermediate (WTI) Midland crude for delivery in August, traders said on Tuesday. Markets are concerned about rising

- 10. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 U.S.-China tensions, traders said, specifically that Washington could slap trade sanctions on China following Beijing’s move to impose a new security law on Hong Kong. U.S. Oil and Gas productions down U.S. crude oil production fell 28,000 bpd, or 0.2%, in March to 12.716 million barrels per day, the lowest level since October, the U.S. Energy Information Administration said in a monthly report on Friday. Abundant U.S. crude production is being throttled back in response to oversupply and low demand due to the coronavirus pandemic. Oil output fell in most states, and in federal waters in the Gulf of Mexico, but rose in Texas, the largest-producing state. Output in Texas climbed 1.2% to 5.42 million bpd in March, according to the report. Monthly gross natural gas production in the U.S. Lower 48 states, meanwhile, increased for the first time in four months to 105.41 billion cubic feet per day (bcfd) in March from 105.21 bcfd in February, according to the EIA 914 report. That compares with an all-time monthly high for gas output of 107.04 bcfd in November. In Texas, the biggest gas producing state, output rose 0.9% to a record 29.85 bcfd in March from 29.59 bcfd in February. In Pennsylvania, the second-biggest gas-producing state, output slipped 0.6% to 19.68 bcfd in March. The state’s all-time high was 19.92 bcfd in November.

- 11. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 NewBase May 31-2020 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil jumps nearly 90% in May , registering best month on record Reuters + CNBC + NewBase West Texas Intermediate, the U.S. oil benchmark, registered its best month on record after gaining more than 80% in May. An uptick in demand as well as record supply cuts have pushed prices higher. Still, WTI is about 46% below its recent January high of $65.65 per barrel. “It certainly doesn’t feel like it was oil’s best month ever,” said Regina Mayor, KPMG’s global head of energy. “Low $30s for WTI is clearly better than where we were at the end of April, but it’s not sufficient enough to bring the bulk of production back online.” Oil jumped more than 5% on Friday, the last trading day of the month, capping off its best month in history as an uptick in demand as well as record supply cuts pushed prices higher. West Texas Intermediate, the U.S. oil benchmark, finished May with a gain of 88%. To put the number in context, WTI’s second best month on record was Sept. 1990, when it gained 44.6%. Oil price special coverage

- 12. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 But experts are quick to note that the surge in prices follows the steepest downturn on record, and that oil still has a ways to go before it regains old highs. In other words, WTI at $35 per barrel is hardly something to celebrate. “It certainly doesn’t feel like it was oil’s best month ever,” said Regina Mayor, KPMG’s global head of energy. “Low $30s for WTI is clearly better than where we were at the end of April, but it’s not sufficient enough to bring the bulk of production back online,” she added. In April, with billions of people around the world under some sort of lockdown in an effort to slow the spread of Covid-19, demand for oil fell off a cliff, which sent prices plunging. WTI dropped below zero and into negative territory for the first time on record. Part of the move was due to the contract’s imminent expiration, but it also reflected the very real fact that no one wanted to take the physical delivery of crude while demand was expected to remain depressed. Since then, things have started to improve. Data released by the U.S. Energy Information Administration on Thursday showed that for the week ending May 22 gasoline demand rose to 7.3 million barrels per day from the prior week. This marked an improvement, although was still below 2019′s number ahead of Memorial Day weekend, which was 9.4 million bpd. Storage in Cushing, Oklahoma — the main delivery point for WTI — decreased by 3.4 million barrels, and refinery utilization also rose to 71% from 69%. Overall inventory rose by 7.928 million barrels, compared with the 1.3 million barrel draw analysts had been expecting, according to FactSet. On the other side of the equation, producers have scaled back output at a record pace as plunging prices made operation uneconomical. OPEC and its oil-producing allies agreed to the steepest production cut in history during an extraordinary, multi-day meeting in April. Then, earlier in May, Saudi Arabia said that, beginning June 1, it would voluntarily cut an additional 1 million bpd, on top of its portion of the cuts agreed to by OPEC+. Kuwait and UAE were among the other cartel members that followed suit and said they would also exercise additional cuts.

- 13. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 In the U.S., production has dropped to 11.4 million bpd, 1.9 million bpd below March’s record high of 13.1 million bpd. Norway and Canada are among the other nations that have scaled back output. The OPEC+ production cuts as they stand now will begin to taper on July 1, and the group is expected to decide on whether or not to extend the deeper cuts at its June 9-10 meeting. Doubts over whether or not the the deeper cuts will be extended sent some jitters through the oil market this week, although WTI still on track for its fifth straight week of gains. On Friday the contract gained $1.78, or 5.28%, to settle at $35.49 per barrel. Earlier in the session it traded as low as $32.36 per barrel as geopolitical tensions weighed on sentiment. International benchmark Brent crude gained 4 cents, or 0.11%, to settle at $35.33 per barrel. For the month Brent gained 39.81%, for its best month since 1999. Of course, crude’s record month is partially due to the fact that after falling to such low levels, a smaller price move now accounts for a much larger percentage move. WTI is still 4% below its recent high of $65.65 from January.

- 14. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 Additionally, oil contracts roll on a monthly basis, but the roll doesn’t align with the standard calendar meaning that evaluating price on a standard monthly basis — rather than the duration of the month- long contract — can be somewhat arbitrary. Mayor, who is based in Houston, said the market is more positive than those who are on the ground in oil country feel. “I think it’s too early for the level of optimism we’re seeing in the market, and to be frank, I think it’s a bit inexplicable,” she said. “I don’t think demand fundamentals are the key driver of the optimism. I think it’s more quick on supply, which means to me that there’s downside risk to the current elevated price.” Still, others are more positive on oil’s outlook. In a recent note to clients, Morgan Stanley said that the rally looks like it can continue in the coming months, while also acknowledging that many unknowns remain in the market. Meanwhile, Rystad Energy said that wild price swings are now in the rearview mirror. “Supply developments and other geopolitical tensions that could affect demand are priced in...Now, waiting for the next OPEC+ meeting, the market is also comfortable in a relative calmness,” said Bjornar Tonhaugen, Rystad’s head of oil markets. Oil analysts see prices edging up but still capped below $40/bbl Oil prices will gradually gain this year with demand improving and supply falling, although tensions between the United States and China are hanging over the coronavirus-hit market, a Reuters poll showed on Friday. The survey of 43 analysts forecast Brent crude would average $37.58 a barrel in 2020, about 5% above April’s $35.84 consensus, but still lower than the $42.37 average so far this year. U.S. West Texas Intermediate crude is seen averaging $32.78 a barrel, up from $31.47 last month, after a brief historic fall in the front-month futures contract to minus $40 in April. “The rise in demand may be painstakingly slow in the coming weeks and months, but it is expected to gradually rise over the course of the year,” said Marshall Steeves, energy markets analyst at IEG Vantage. Global benchmark Brent hit a 21-year low of $15.98 a barrel last month as demand collapsed amid the coronavirus pandemic. However, strong adherence to a major supply cut by the Organization of the Petroleum Exporting Countries, Russia and other allies, a group known as OPEC+, has helped Brent rebound about 39% so far in May, on track for its best month since March 1999. “Oil demand has bottomed out and supply from OPEC+ and North America is falling sharply. The market is thus no longer as oversupplied as

- 15. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 feared,” said Commerzbank analyst Carsten Fritsch, adding that there could be a considerable supply deficit in the second half of 2020. A re-emergence of U.S.-China tensions has, however, raised the prospect of protracted disruption to the global economy. The poll shows demand could fall by 6.4-10 million barrels per day (bpd) over 2020, compared with a contraction of 9.2-10.6 million bpd forecast in the last poll. “From a peak annual contraction of 21 million bpd in the second quarter of 2020, we expect global oil demand contraction to eventually abate to 2.1 million bpd in the fourth quarter,” said Harry Tchilinguirian, head of commodity research at BNP Paribas. Asian LNG spot prices fall on supply overhang pressure Asian spot liquefied natural gas (LNG) prices fell this week amid a weak European gas market and ample global supply, trade sources said. The average LNG price for July delivery into northeast Asia fell to an estimated $1.85 per million British thermal units (mmBtu), down 7 cents from the previous week, traders said. Several cargoes were offered in the spot market this week, dragging down prices in Asia, they added. Russia’s Sakhalin 2 plant had offered a cargo for July loading while Angola LNG offered cargoes for June to September delivery through two separate tenders, traders said.

- 16. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 Papua New Guinea LNG had also offered a cargo for June loading, though results of the tender were not immediately clear. Woodside Petroleum had likely sold a Northwest Shelf cargo for June loading at about $1.85 per mmBtu, but this could not be immediately confirmed. On the other hand, demand remained stale globally with industrial demand for gas still not picking up pace amid the coronavirus outbreak. Some demand was seen from China with Guangzhou Gas seeking two cargoes for delivery in August and September, while Thailand’s PTT was seeking a cargo for July delivery, traders said. Mexico’s CFE was seeking two cargoes for delivery in June while Portugal’s EDP was seeking a cargo for delivery over June to July, they said. Some Chinese buyers who had been scouting around for cargoes last week may now be slowing down their requirements amid a slide in spot prices, an industry source said. ADVERTISEMENT Malaysia’s LNG exports in May are set to drop to their lowest since mid-2018, as producers globally are pressured to cut production amid record low spot prices. Australia’s APLNG has also extended maintenance at its Curtis Island plant to mid-June, according to a notice on the Australian Energy Market Operator’s website.

- 17. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 After oil’s best month ever, these are the key levels to watch West Texas Intermediate crude oil rallied nearly 90% in May, its best month ever. It was a bounce back from April losses. “When I look at the crude oil price, I would say when you look at that chart, we’re coming right up into the downtrend resistance line and a close above about $33 and change leaves the next resistance at $42,” said Craig Johnson, chief market technician at Piper Sandler, on CNBC’s “Trading Nation” on Friday. Crude oil closed above $35 on Friday afternoon. Resistance at $42 implies further upside of 20%. Energy stocks, however, aren’t keeping up with those gains. The XLE energy ETF climbed just 2% in May in what Johnson calls a “disconnect” between supply and demand. He does see potential for gains in the group, though. “There was a concern of bankruptcy for a lot of these smaller [exploration and production] producers out there that appears to be sort of coming off the table to a degree, and really lifting these individual equities. So, XLE to me still looks pretty attractive, and it’s making a nice series of higher highs and higher lows on the charts. And I think you’ve got room for that particular ETF to continue to move higher in here,” said Johnson.

- 18. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 Johnson sees the next band of resistance in the XLE ETF at its 200-day moving average at around $50.70. The ETF closed Friday at $38.76. Should energy stocks find some momentum, Federated Hermes portfolio manager Steve Chiavarone is picking out the high-quality names that should ride higher. “I think that when you look at the space, our story has remained the same -- companies with good strong balance sheets that you know are going to be around in two, three years as the sector consolidates, and that can pay yield in the meantime we think provide the best opportunity for long term winners,” Chiavarone said during the same segment. The XLE ETF yields nearly 6%, far better than the 1.9% dividend yield on the S&P 500.

- 19. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 U.S./Canadian oil & gas rig count falls to record low: Baker Hughes U.S. and Canadian energy firms cut the number of oil and natural gas rigs operating to a record low as they slash spending on new drilling after global coronavirus lockdowns caused energy prices and demand to collapse. The U.S. oil and gas rig count, an early indicator of future output, fell by 17 to an all-time low of 301 in the week to May 29, according to data from energy services firm Baker Hughes Co going back to 1940. That was 683 rigs, or 69%, below this time last year and was the fourth week in a row the U.S. count fell to a fresh record low. For the month, the U.S. rigs dropped by 164, its third monthly decline in a row. The Canadian rig count fell by one to an all-time low of 20 this week, according to Baker Hughes. That was 65 rigs, or 76%, below this time last year and was the third week in a row it fell to a record low. Analysts said they expect U.S. energy firms to continue chopping rigs for the rest of the year and keep the count low in 2021 and 2022. “Rig activity should ... drop below 300 despite the recent modest recovery in oil prices. Obviously, lower drilling activity will lead to production decline,” said James Williams of WTRG Economics in Arkansas, noting “Natural gas drilling should start to recover before oil.” U.S. crude futures were trading above $33 a barrel on Friday, up about 78% this month but still down about 45% since the start of the year. [O/R] U.S. oil rigs fell 15 to 222 this week, their lowest since June 2009, while gas rigs fell two to 77, their lowest on record according data going back to 1987.

- 20. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20

- 21. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21 NewBase Special Coverage The Energy world - Special 01- May-2020 Lasting contango in oil: market spread to outlast supply- demand imbalance Reporting by Noah Browning; Editing by Jan Harvey While vast cuts by producer countries and renewed fuel consumption from easing coronavirus lockdowns may soon rebalance oil supply and demand, some analysts and traders see a glut in storage keeping the market in contango for much longer. A contango market structure LCOc1-LCOc7 means the current value is lower than it will be in later months and encourages traders to store oil to resell it in the future. An especially skewed spread for oil futures or “super-contango” emerged last month, prompting traders to seek quick bargains, store the oil and sell at a greater a profit later. With economic life slowly returning to normal and less supply to go around with major exporters reining in output, the market will begin to move into deficit as early as June. But the need to siphon off the stored oil before buying new supply could keep markets in contango well beyond. “The forward curve should flatten as the market moves into undersupply in 2h 2020 and inventories should support a modest backwardation by early 2021,” Morgan Stanley said.

- 22. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 22 This opposite structure - backwardation - encourages financial investors to hold large positions in oil futures because it makes it cheaper to roll over monthly contracts. The bank saw it taking hold by February-March. A demand recovery has already seen the tapping of some crude stored on ships in China and India. But traders in oil for the region said the trend would likely be slow, with owners of some of the largest ships having already agreed long-term storage contracts. “It seems a bit early to come out of storage .... there is a plenty of contango to go, and VLCC owners were demanding 6-month minimum storage,” one trader said. Analysts at Citi said a recent rise in spot prices may be fleeting as contango narrows and the sea of stored oil is unleashed. “An inflection point is happening in physical fundamentals, although oil-on-water may cast a shadow on the recovery,” they said.

- 23. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 23

- 24. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 24 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE The Editor :”Khaled Al Awadi” Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 www.linkedin.com/in/khaled-al-awadi-38b995b Mobile: +971504822502 khdmohd@hawkenergy.net or khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 28 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 2020 K. Al Awadi

- 25. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 25

- 26. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 26 For Your Recruitments needs and Top Talents, please seek our approved agents below