NewBase 21-September -2022 Energy News issue - 1551 by Khaled Al Awadi_compressed.pdf

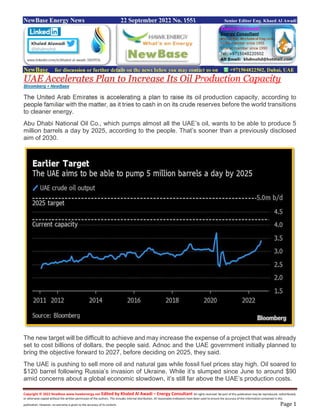

- 1. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 22 September 2022 No. 1551 Senior Editor Eng. Khaed Al Awadi NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE UAE Accelerates Plan to Increase Its Oil Production Capacity Bloomberg + NewBase The United Arab Emirates is accelerating a plan to raise its oil production capacity, according to people familiar with the matter, as it tries to cash in on its crude reserves before the world transitions to cleaner energy. Abu Dhabi National Oil Co., which pumps almost all the UAE’s oil, wants to be able to produce 5 million barrels a day by 2025, according to the people. That’s sooner than a previously disclosed aim of 2030. The new target will be difficult to achieve and may increase the expense of a project that was already set to cost billions of dollars, the people said. Adnoc and the UAE government initially planned to bring the objective forward to 2027, before deciding on 2025, they said. The UAE is pushing to sell more oil and natural gas while fossil fuel prices stay high. Oil soared to $120 barrel following Russia’s invasion of Ukraine. While it’s slumped since June to around $90 amid concerns about a global economic slowdown, it’s still far above the UAE’s production costs.

- 2. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 “As we embrace the energy transition and future-proof our business, we will continue to explore potential opportunities that can further unlock value, free up capital and enhance returns,” Adnoc said in a statement to Bloomberg. It did not say whether the 2030 target had changed. The UAE’s Energy Ministry didn’t immediately respond to a request for comment. State-owned Adnoc has asked international companies that are partners in its oilfields to raise their long-term production levels by 10% or more, according to the people. If the UAE’s successful in reaching the 2025 goal, it may try to boost its capacity further to 6 million barrels daily by the end of the decade, they said. The UAE is the biggest oil producer in OPEC after Saudi Arabia and Iraq. It says it has the ability to produce slightly over 4 million barrels a day. But it’s restricted from reaching that level because of caps imposed by the cartel, which is trying to balance supply and demand. Last month, the UAE’s daily crude output was just under 3.4 million barrels, according to data compiled by Bloomberg. Green Goals The Organization of Petroleum Exporting Countries and its allies, a 23-nation group led by the Saudis and Russia, are set to to maintain production limits for the rest of the year. Saudi Arabia has said it wants to extend them with a new deal that goes into 2023. The UAE is increasing oil output capacity while also trying to neutralize carbon emissions by 2050, partly by investing in solar power and cleaner fuels such as hydrogen. The country says the easy accessibility of its oil reserves and technologies like carbon capture will make its crude is among the least polluting to pump out of the ground. Like Saudi Arabia, the UAE has said oil demand will remain high for decades and major producers need to invest in exploration to avoid future supply shortages. “As long as the world requires oil and gas to maintain energy security, it is critical that the least carbon-intensive barrels are made available,” Adnoc said in the statement. Saudi Arabia and the UAE are among the few producers investing in greater output. Saudi Arabia is trying to raise its crude capacity to 13 million barrels a day from 12 million by 2027. Energy Intelligence earlier reported that the UAE wanted to increase its capacity to 5 million barrels a day by 2027.

- 3. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Weatherford lands $400m Abu Dhabi drilling services contract Weatherford International, a leading global energy services company based in Houston, has announced that it has signed a five-year framework agreement with Abu Dhabi National Oil Company (Adnoc), to provide directional drilling and logging-while-drilling services for a key project of the group. The contract is currently valued at over $400 million, stated the US-based firm. However, Adnoc has an option to extend the contract for an additional two years, it added. The Weatherford Drilling Services portfolio includes a suite of technology that combines world-class services, real-time information analysis, and innovative drilling tools to maximize efficiency in any environment. According to the US-based group, deploying these service and technology offerings will add value to Adnoc’s drilling operations by minimising Opex, reducing risks, and optimising production. These benefits are mission-critical to the Abu Dhabi group’s near- and long-term goals. Weatherford President and CEO Girish Saligram said: "We are thrilled about this award as it showcases our commitment to creating value for every customer through our differentiated technology and services." "Our field-proven directional and logging-while-drilling services and technology will support Adnoc in expanding its operations and achieving its production goals," stated Girish. Weatherford had in November last year clinched two five-year contracts from Adnoc with a combined value of more than $1 billion for downhole completions equipment and liner hanger systems. With operations in approximately 75 countries, the company answers the challenges of the energy industry with its global talent network of 17,000 team members and 350 operating locations, including manufacturing, research and development, service, and training facilities, he stated. "Our manufacturing facility in Abu Dhabi will further bolster its In-Country Value Program—an initiative Weatherford has supported since the beginning. We look forward to delivering successful outcomes to one of our long-time energy partners," he added.-TradeArabia News Service

- 4. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Malaysia: PETRONAS announces new gas discovery in Central Luconia Province, offshore… Source: PETRONAS PETRONAS has announced a gas discovery from its Cengkih-1 exploration well in Block SK 320 in the Central Luconia Province, about 220 kms off the coast of Bintulu, Sarawak, offshore Malaysia. The Cengkih-1 exploration well was successfully drilled to a total depth of 1,680 metres in August 2022, hitting more than 110 metres gas column in Miocene Cycle IV/V pinnacle carbonate reservoirs, firming up more gas resources within Block SK320. Mubadala Development Company Oil and Gas (Mubadala Petroleum) operates the block with a 55 per cent participating interest in the Production Sharing Contract (PSC). PETRONAS Carigali holds 25 per cent while Sarawak Shell holds the remaining 20 per cent. PETRONAS Senior Vice President of Malaysia Petroleum Management, Mohamed Firouz Asnan said: 'We are thrilled by this latest discovery in Cengkih-1, building on the string of exploration successes in the Central Luconia region. The discovery confirms the large potential of this proven carbonate play type in Central Luconia. The monetisation of this discovery can be expedited with a lower cost given the proximity to the many existing facilities, including that of Pegaga which started production in March this year.' 'This latest success was enabled by the close partnership between PETRONAS and its petroleum arrangement contractors in expanding the resource base to meet the rising demand for gas in Sarawak, including the PETRONAS LNG complex in Bintulu,' he added.

- 5. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 China's Aug coal imports from Russia highest in at least 5 years Reuters + NewBase China's coal imports from Russia rose in August, exceeding last month's level and hitting the highest in at least five years, as power utilities sought overseas supplies to meet soaring demand in extreme hot weather. Arrivals of Russian coal last month reached 8.54 million tonnes, up from the previous peak of 7.42 million tonnes in July and 57% higher than in the same period last year, data from the General Administration of Customs showed on Tuesday. The monthly figure was the highest since comparable statistics began in 2017. Imports from Russia have surged in recent months as Europe suspended purchasing from the country after it sent tens of thousands of troops into Ukraine, forcing Russian coal to be traded at a steep discount. Prices for Russian coal have climbed as both China and India stepped up buying, traders said, but were still cheaper than the domestic coal of same quality. Russian thermal coal at 5,500 kcal on delivery basis to China was assessed at about $155 a tonne in late August, up from about $150 a tonne a month earlier. As severe drought and heatwave hit western and southern China from late July, coal-fired power plants geared up production to meet the spiking demand for air conditioning and the supply gap from hydropower stations. They also increased purchases of higher quality thermal coal, such as Russian coal, to improve electricity generation efficiency.

- 6. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 West African nations to build Nigeria-Morocco gas pipeline ONG + NewBase A number of West African states have signed a memorandum of understanding to build a pipeline from Nigeria to Morocco to supply gas to all West African countries and open a new channel of export to Europe. The agreement was signed in Rabat, Morocco, between Economic Community of West African States (ECOWAS), the Federal Republic of Nigeria and the Kingdom of Morocco. The memorandum of understanding attests to the commitment of ECOWAS and all the countries crossed by the gas pipeline, to contribute to the feasibility and technical studies, the mobilisation of resources and execution of the Nigeria-Morocco gas pipeline project. The three sides were respectively represented by Mr Sediko Douka, ECOWAS Commissioner for Infrastructure, Energy and Digitalisation, Mallam Mele Kolo Kyari, Group Chief Executive Officer of Nigerian National Petroleum Company Limited (NNPC) and Amina Benkhadra, Director General of Office National des Hydrocarbures et des Mines (ONHYM). This project, once completed, will supply gas to all the countries of West Africa and will open a new channel of export to Europe. It is a strategic project that will contribute towards improving the living standards of the population, integrating the economies in the region, decreasing the level of desertification thanks to a sustainable and reliable gas supply and a reduction in or outright end to gas flaring, among others. Sixteen countries that include fourteen ECOWAS Member States, are involved in this project. The project will also assist other countries to export their surplus natural gas: Ghana, Cote d’Ivoire, Senegal and Mauritania.

- 7. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 The strategic Nigeria-Morocco gas pipeline project will traverse the West African coast from Nigeria to Morocco, through Benin, Togo, Ghana, Cote d’Ivoire, Liberia, Sierra Leone, Guinea, Guinea Bissau, The Gambia, Senegal, Mauritania. In the long term, it will be connected to the Maghreb- Europe gas pipeline and to the European gas network. It will also help cater to the land-locked countries of Burkina Faso, Mali and Niger. Commissioner Sediko Douka, speaking on behalf of the ECOWAS Commission President, H.E Dr Omar Alieu Touray, stated that the Economic Community of West African States (ECOWAS) upheld the view that the Nigeria-Morocco pipeline project was indeed viable and would therefore spare no effort for its success: We, as a regional economic community, are convinced that it is indeed a viable project, one that holds great promise, and we will spare no effort for its success». The ECOWAS Commissioner for Infrastructure, Energy and Digitalisation further reaffirmed, on behalf of the ECOWAS Commission President, total support for this regional project which would positively impact the lives of more than 400 million persons. “The project’s impact is far reaching because it would help ensure electricity supply in the West African region, and in the long term the export of natural gas as fuel in Europe. We have carefully monitored from beginning to end the feasibility studies at the various levels of validation, he revealed, adding that the next phase would involve the detailed design of execution, resource mobilisation and the actual construction. With the launch of the project, efforts will be made to attract public and private investors including multilateral or commercial banks, pension fund, insurance companies, among others. The project will span 6,000km and cost $25 billion. The financing of the project is expected to involve several stakeholders. The signing of the Memorandum of Understanding witnessed the participation of government officials of the Kingdom of Morocco, Nadia Fettah Alaoui, Minister for Economy and Finance, Mohcine Jazouli, Minister of State for Public Policy Evaluation, Convergence and Investments. Finally, a courtesy call was paid to Nasser Bourita, Minister for Foreign Affairs, African Cooperation and Moroccans Abroad. -

- 8. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 NewBase September 21 -2022 Khaled Al Awadi NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Oil prices extend losses on fears aggressive Fed rate hike will curb demand.. Reuters + NewBase Oil prices slid on Wednesday, extending the previous day's losses, as investors braced for another aggressive interest rate hike from the U.S. Federal Reserve that they fear could lead to recession and plunging fuel demand. Brent crude futures dropped 26 cents, or 0.3%, to $90.36 a barrel by 0040 GMT after falling $1.38 the previous day. U.S. West Texas Intermediate crude was at $83.74 a barrel, down 20 cents, or 0.2%. The October delivery contract expired down $1.28 on Tuesday while the more active November contract lost $1.42. Oil price special coverage •All eyes on Fed interest rate policy decision later on Wednesday •API shows crude, fuel stocks rise - market source •OPEC+ supply shortfall now stands at 3.5% of global oil demand

- 9. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 "The market tone remained bearish due to concerns that the aggressive monetary tightening in the U.S. and Europe would boost the likelihood of a recession and a slump in fuel demand," said Toshitaka Tazawa, an analyst at Fujitomi Securities Co Ltd. "Since oil prices have been falling in the anticipation of the rate hikes, they may briefly rise after the announcements, but they will likely return to a downward trend again on fears over weakening demand," he said. The Fed is widely expected to hike rates by 75 basis points for the third time in a row later on Wednesday in its drive to rein in inflation. Those expectations are weighing on equities, which often move in tandem with oil prices. Other central banks, including the Bank of England, meet this week as well. Higher rates have bolstered the dollar, which neared a two-decade high on Tuesday, making oil more expensive for holders of other currencies. Meanwhile, U.S. crude and fuel stocks rose by about 1 million barrels for the week ended Sept. 16., according to market sources citing American Petroleum Institute figures on Tuesday. Gasoline inventories rose by about 3.2 million barrels, while distillate stocks rose by about 1.5 million barrels. API/ U.S. crude oil and distillate stockpiles were expected to have risen last week, while gasoline inventories were seen lower, according to an extended Reuters poll. On the supply side, the OPEC+ producer grouping - the Organization of the Petroleum Exporting Countries and associates including Russia - is now falling a record 3.58 million barrels per day short of its targets, or about 3.5% of global demand. The shortfall highlights underlying tightness of supply in the market, even as recession fears drag prices lower. The head of Saudi state oil giant Aramco (2222.SE) said on Tuesday Europe's plans to cap energy bills for consumers and tax energy companies were not long-term or helpful solutions for the global energy crisis, spurred largely by under-investment in hydrocarbons.

- 10. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 U.S Waha Hub N.gas price falls below the Henry Hub price Data source: U.S. Energy Information Administration Since late 2021, the difference has been widening between the natural gas price at the Waha Hub in West Texas and the U.S. benchmark Henry Hub in Louisiana. The price of natural gas traded at the Waha Hub, which is near production from the Permian Basin, averaged $1.43 per million British thermal units (MMBtu) less than the Henry Hub price during the first half of September. In comparison, in the first half of September 2021, natural gas at the Waha Hub traded at an average of 24 cents/MMBtu less than the Henry Hub price. Data source: Natural Gas Intelligence Note: Price differential is between the local market price (Waha Hub) and the national benchmark price (Henry Hub). Production rates in a region, in addition to the availability of infrastructure to transport natural gas to high-demand regions, can influence regional natural gas prices. Recent pipeline maintenance in the Permian Basin area has contributed to a wider price difference between the Waha Hub and the Henry Hub. On May 2, natural gas flows out of the Permian Basin on Kinder Morgan’s Permian Highway Pipeline decreased, and the Waha Hub price fell $1.82/MMBtu below the Henry Hub price. Last month, maintenance on the El Paso Natural Gas Pipeline reduced flows from West Texas into the Desert

- 11. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 Southwest and California, contributing to a Waha Hub price that was $1.78/MMBtu lower than the Henry Hub price on August 26. On September 16, the Waha Hub price dropped $2.06/MMBtu below the Henry Hub price because production in the Permian region remains at relatively high levels. Most natural gas production in the Permian Basin is associated gas, a by-product of (or associated with) crude oil production. Natural gas production in the Permian Basin more than doubled in the past five years and reached an annual high of 16.7 billion cubic feet per day (Bcf/d) in 2021 as a result of increasing crude oil production in the region over the same time period. From 2018 through early 2020, natural gas production in the Permian Basin grew faster than pipeline take-away capacity. Given limited transportation capacity to transport natural gas to consuming centers, producers sold their natural gas at discounted prices. As a result, in 2019, the Waha Hub price averaged $1.66/MMBtu lower than the Henry Hub price. In 2021, additional pipeline capacity to transport natural gas out of the Permian Basin entered service, and the price difference between the Waha Hub and the Henry Hub narrowed. Increased pipeline capacity enabled Permian region producers to deliver natural gas to demand centers in Mexico and along the Texas Gulf Coast, including to liquefied natural gas (LNG) export facilities. Since April 2022, additional pipeline projects out of the Permian Basin have been announced that would expand pipeline takeaway capacity by approximately 4.2 Bcf/d by the end of 2024.

- 12. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 NewBase Specual Coverage The Energy world –September -21 -2022 CLEAN ENERGY Europe races to prepare for energy crunch this winter Reuters + NewBase European governments outlined new measures on Monday to cope with potential energy shortages this winter and raced to improve energy networks to share power, with Russian gas flows still running at severely reduced rates amid the Ukraine war. Spain drew up plans that could force energy-intensive industries to shut at peak demand times, France said it was preparing to send gas to Germany from October, while Berlin said Europe's powerhouse was still in talks on state aid for ailing utility Uniper. German buyers briefly reserved capacity on Monday to receive Russian gas via the Nord Stream 1 pipeline, once one of Europe's major gas supply routes, for the first time since the line was shut three weeks ago. But they soon dropped the requests. It was not immediately clear why buyers had submitted requests for capacity when Russia has given no indication since it shut the line that it would restart any time soon. Russia, which had supplied about 40% of the European Union's gas before its February invasion of Ukraine, has said it closed the pipeline because Western sanctions hindered operations. European politicians say that is a pretext and accuse Moscow of using energy as a weapon. European gas prices have more than doubled from the start of the year amid a decline in Russian supplies. Russian gas flows to Europe via Ukraine, although much reduced, have nevertheless continued. But the sharp drop in Russian fuel exports, in retaliation for Western sanctions over Moscow's invasion of Ukraine, has left governments scrambling to find energy resources, but also to warn that power cuts could happen, amid fears of recession. The German economy is contracting already and will likely get worse over the winter months as gas consumption is cut or rationed, the country's central bank said on Monday. It added that the economy was likely to shrink, even if outright rationing is avoided, as companies cut or halt production. In France, exports of natural gas to Germany could start around Oct. 10, the head of France's CRE energy regulator said, following an announcement by President Emmanuel Macron that the two EU neighbours would help each other with electricity and gas flows amid the crisis.

- 13. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 "Gas was (until now) only flowing from Germany to France, so we did not have the technical tools to reverse the flows and we did not even have a method to regulate prices," CRE chief Emmanuelle Wargon told franceinfo radio. 'NEVER' While French energy group EDF is racing to repair corrosion-hit nuclear reactors, "exceptional" measures this winter could include localised electricity cuts if the winter is cold and EDF's plans are delayed, Wargon said.

- 14. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 "But there will be no gas cuts for households. Never," she said. Spanish Industry Minister Reyes Maroto said that obliging energy-intensive companies to close down during consumption peaks is an option on the table this winter if required. The companies would be compensated financially, she said in an interview with Spanish news agency Europa Press, adding there is no need to impose such closures now. And Finns were warned they should be prepared for power outages. "As a result of great uncertainties, Finns should be prepared for power outages caused by a possible power shortage in the coming winter," national grid operator Fingrid said. Reflecting the disruptions caused across the continent, Finnish power retailer Karhu Voima Oy said it had filed for bankruptcy due to a sharp rise in electricity price rises. 'GOING BACK IN TIME' Europe's imports of thermal coal in 2022 could be the highest in at least four years and may rise further next year, analysts said on Monday, highlighting the extent of the energy crisis following sanctions on top supplier Russia. European imports of thermal coal this year could rise to about 100 million tonnes, the most since 2017, according to Noble Resources International Pte Ltd, while commodities pricing agency Argus expects shipments to reach a four-year high. "Europe is going back in time," Rodrigo Echeverri, head of research at Noble, told a conference.

- 15. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 Meanwhile oil prices fell by more than 1% on Monday, pressured by expectations of weaker global demand and by U.S. dollar strength ahead of a potentially large interest rate hike, though supply worries limited the decline. Oil has also come under pressure from forecasts of weaker demand, such as last week's forecast from the International Energy Agency that the fourth quarter will see zero demand growth. Can Europe keep the lights on this winter? Europe is facing a major energy crisis this winter that will test the continent’s power supply systems to the limit. The EU has been rushing through a plan to reach zero-emissions by 2050, but as a result it has decommissioned too much generating capacity and left itself exposed to Russia’s threat to cut off gas supplies. On top of the gas shortage, some really bad luck has created a perfect storm. Germany’s poorly timed decision to shut down its coal-fired and nuclear power plants, France and the UK’s problems with their NPPs, and a scorching hot summer reducing water levels in hydropower reservoirs have all contributed to reducing Europe’s ability to generate electricity this winter. Europe only imported a tiny 1.8 TWh of power in 2021, but inside the system there are local deficits of up to 100 TWh that are going to be hard to cover. The system is finely balanced and needs to match demand with supply all hours of the day, making it vulnerable to Russian gas supply disruptions. / bne IntelliNews As the cold weather approaches, Europe has probably stored enough gas to get through a mild winter, but the European power system is in a delicate balance ,with many countries relying on a few big producers for power exports, creating vulnerabilities. If one big supplier like Germany runs out of fuel then there is a very real risk that the resulting black- and brown-outs could ripple across the Continent. “Europe’s energy system faces unprecedented physical and institutional stress. The policy response so far has been excessively nationally focused and could undermine the goals of calming energy

- 16. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 markets over the next 18 months and achieving ambitious decarbonisation targets,” The Bruegel think-tank said in a paper that also looked at the consequences for Europe’s Green Deal goals. Not enough wiggle room Europe had a total installed generating capacity of 970 GW at the end of 2021 that could produce a total of 3,628 TWh of power if it was working at full capacity. The actual output was 5% lower, as the stations were run at 95% of capacity over the year – the year when Russia first started squeezing gas supplies and caused an energy crisis-lite. But Europe, or rather the Continental Europe Synchronous Area (CESA) – which covers all of Europe plus new members Ukraine and Moldova, but does not include the UK, Ireland, Norway, Sweden, Finland and the Baltic States – doesn’t have enough generating capacity to meet all its own needs. The CESA was a net importer of power in 2021, sourcing most of the 1.3 TWh extra from Norway and Sweden. The two Scandinavian countries exported 29 TWh in 2021, although most of this was to Finland, the Baltic States and some to the UK. Finland is in the final testing phase of a new 1.7-GW NPP that should come online in 2023 that will reduce its own deficit from 21 TWh to 9.5TWh. That will allow Norway and Sweden to export an extra 10 TWh to the rest of Europe – water levels at Norway’s gigantic hydropower water reservoirs permitting. The difference between what Europe generates and what it consumes is not large, but the problem with the power sector is supply and demand for power have to exactly match each other. If they don’t, in what is called a “frequency incident,” then the power stations are shut down, otherwise the equipment can be badly damaged. Some countries are net exporters and some net importers, but the deficit between the two is very unevenly distributed. The biggest importer of power in Europe is Italy, which imported 31 TWh in 2021 and is expected to import 30 TWh this year. It is followed by Hungary's 8.7 TWh imports, rising to 9.1 TWh this year. The problem child in the family is Austria, which imported 3 TWh in 2021, but that figure will leap to 8.1TWh this year, according to Swiss power company Burggraben and European network of transmission system operators for electricity (ENTSO-E). Together these three countries will need to import a total of 47.3 TWh of power in 2022, which is a lot more than the net 1.8 TWh the EU imported last year as a whole. It is also well beyond the 27 TWh that Norway and Sweden exported to Europe as a whole. Proximity also plays a role as electricity doesn’t travel well over long distances so being close to the generator of power is important increasing the reliance on the Scandinavian exporters. To make matters worse despite the growing tensions with Russia, German is taking coal-fired and nuclear power stations offline. Germany has shuttered its six NPP that that have a capacity of 4GW and produce 35TWh of power as well as another 14GW (122TWh) of coal-fired stations, although Berlin recently said it will keep one reactor and 8GW (61TWh) of coal-fired power as a reserve. In 2021 German was a net exporter of power selling 23 TWh, However, if it goes through with the plan to close all the NPP and coal-fired plants it would need to import 130 TWh, or 69 TWh if it used all its reserve. Altogether Austria, Hungary, Italy, and Germany would need to collectively import some 100 TWh of power, according to bne IntelliNews calculations. While the overall European power system is almost balanced between demand and supply, this group highlight are some very large discrepancies within Europe at a regional level. This shortfall normally would be covered internally within the EU, plus some imports and investment into new

- 17. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 capacity that is ongoing, but this year the Russian-induced gas crisis will push the EU power system to the edge of what it can cope with as there is so little redundancy in the system. With these problems Germany was the first to go to “warning” status on the EU’s three tier energy crisis system, as the impact of removing even a small amount of the power generation mix produced by Russian gas could have a big impact. The European Commission has also been working to head off disaster and in May published its updated REPowerEU Plan in which it had already incorporated an increase in coal power (+105 TWh) and falling gas power (-240 TWh) without derailing EU climate objectives. At the same time as 22% of Europe’s power is produced by gas-fired power plants, the EC plan to reduce gas consumption by 15% could in theory reduce power needs by 120TWh, according to bne IntelliNews calculations. That would solve the problem. However, whereas European Commission President Ursula von der Leyen initially called for the reduction to be EU-wide and mandatory, after stiff resistance from members on the periphery of Europe, especially Spain, Portugal and Greece, the plan was massively watered down to be voluntary with calve outs and exemptions for 17 out of the 27 members. Perfect storm With Europe’s power system so finely balanced, a perfect storm has developed. Europe’s drive to invest into alternative clean energy solutions while decommissioning emission dirty generators has resulted in a profound energy supply-demand imbalance. That has been exacerbated by the

- 18. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 stronger than expected bounce back of global energy demand after the peak COVID-19 crisis, as well as some really poor policy decision and neglect of energy security. Italy closed its NPPs in the 1990s and never replaced the lost capacity. That has left it as one of the biggest importers of power in Europe. Its grid doesn’t have enough capacity to cover its own domestic demand. The power stations it does have are heavily reliant on Russian gas as the government never bothered to diversify its supply of fuel and it never invested into renewables. Despite its long coastline, Italy doesn’t have even 1MW of offshore wind generators. Austria has invested into hydropower, but this year’s long hot summer has seriously reduced their ability generate power and the country’s generating capacity is not enough to meet the domestic load demand. Austria became dependent on neighbour Germany to supply it with its missing power. That would not be a problem but in 2020 Germany abandoned its six nuclear reactors taking 4GW of power off the grid, which is equivalent to 32TWh of power, or around 4.5% of the 700TWh that is traded in Europe every year, according to European network of transmission system operators for electricity (ENTSO-E). Germany has been a net exporter of power, but the remake of its power sector will make it a net importer of power by 2023. The German shortage is a problem for Germany, but it is an even bigger problem for Italy, Austria and Luxembourg that have all become dependent on German power exports to cover their own deficits. Germany has decided to keep two of its six reactors on standby as a reserve and despite the talk to restarting its 16 coal fired plants only one or two can be used as the rest are either “too old” or lack fuel – coal used to be imported from Russian but the ban on imports went into effect on August 10 and has been highly effective. Germany had been planning to use natural gas to plug the hole but now that is suddenly not an option it will be left with a deficit in power and has no way to replace it if gas supplies run too low. That will cause blackouts not only in Germany, but in several countries in the heart of Europe.

- 19. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 “Fact is that 20 year of German Energiewende systematically reduced its dispatchable (frequency reliable) electricity output options to the point where natural gas has to save the day - which we struggle to get,” said Alexander Stahel, a power and commodities expert, in a thread on twitter. Hungary, like Austria, has invested heavily into gas-fired power plants and is even more dependent Russian gas to run them as it produces little of its own gas. The government in Budapest has been reluctant to join any of the energy sanctions on Russia as the economy minister says the economy simply “won’t function” without Russian energy supplies. In Estonia, this week the state-owned energy company Eesti Energia said it was unable to produce enough electricity to meet its own domestic demand during peak consumption hours. It said this was not a big problem as long as Estonia remains connected to the Nordic electricity market where the security of supply is still guaranteed. However, this leaves the country more vulnerable to the conditions of the electricity market, such as fluctuating prices, which are out of its control. Corrosion problems have pushed France to shut down many of its nuclear power plants, increasing the need for gas in power generation. “France is the champion of nuclear power. It's fleet of 57 reactors should be capable to deliver 450TWh pa (62 GW installed). But it does not,” says Stahel. “Our forecast is for 59% utilisation or 315TWh based on EDF's guidance.” NPP usually run at around 95% utilisation, but this years reduction has taken another massive 135TWh of power out of Europe’s generating capacity. France’s will go from exporting more than 19% of the electricity it produced in July 2021 to importing 12% of its electricity needs in July 2022.

- 20. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 Slovakia has also invested in nuclear power and recently completed a third reactor at the Mochovce power plant, making it self sufficient in energy. Belgium is one of the European countries that has invested in renewables and has a fleet of offshore wind turbines, but it still heavily dependent on its nuclear power stations half of which are approaching the end of their working lives and will soon need to be replaced. Norway is a major exporter of hydropower, but this summer was so hot that water levels in reservoirs fell so far that it has reduced its ability to generate hydropower. The same heat as also stymied the use of coal fired power stations as the depth of rivers fell so much that coal barges could only be half loaded else they would be unable to navigate canals. Not enough gas The shortage of generating capacity makes Europe’s power sector dependent on Russian gas. In Germany’s case, although only 15% of generating capacity depends on gas fired power stations with the bulk relying on renewables, it is that 15% that provides the flexible surplus power in times of peak demand. Without it the system breaks down just when power is most needed. This leads to a so-called “frequency incident” when the balance between generation and demand for power must be coordinated and kept in a very tight corridor. If this balance is lost, then the system shuts down to avoid damaging the equipment. An entire system spanning over 20 countries has been built up to maintain this balance – one that Ukraine joined the day before the war with Russia started. Renewables are not suitable for maintain this balance as they are not reliable. The clash with Russia has already affected the reliability of the European power system as the number of frequency incidents has been growing in the last two years. There were 33 hours of frequency incidents in 2020 which grew to 54 hours in 2021. “Well, in 2021 alone the European Grid had two major incidents, classified as “Scale 2” incidents, for which final reports had to be prepared by an expert panel at ENTSO-E,” says Stahel. “The problem is that the Continental grid is increasingly incapable to match load with generation.” Too many countries are relying on the import of power to cover their shortfalls. There is simply not enough generating capacity in Europe to provide power security to the continent. Cutting off Russian gas to just a few countries could have power outrage consequences that will ripple out across the continent. Even before it invaded Ukraine on February 24, Russia was manipulating European natural gas markets. It substantially reduced exports after summer 2021 and did not refill Gazprom-owned storage sites in the EU. Since spring 2022, Russia has used its remaining supplies as leverage to push individual countries to relax sanctions on financial transactions and technology. By the beginning of July 2022, Russia was sending one-third of previously anticipated volumes, leading to a more than tenfold increase in EU gas prices. Germany is a key piece in the jigsaw and replacing the 32TWh of nuclear power is turning into a major headache. “As almost all fuels are affected, short-term fuel-switching supply elasticities are close to being exhausted. For example, EU coal-fired power generation increased only from 82TWh in the second quarter of 2021 to 95TWh in the second quarter of 2022 because available capacities were limited and coal prices tripled. Instead, demand reductions – both actual and anticipated – now play an outsized role in clearing the market,” says Bruegel.

- 21. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21 Expanding the coal fired power output in all of the EU produced only an extra 13TWh of power -- only a third of the missing German nuclear output. The alternative of reducing demand is not working either as government’s decision to rush into offering subsidies for soaring gasa bills is actually working against efforts to tackle the crisis. Despite soaring gas costs, thanks to both the regulation of prices on most national markets and the subsidies governments are already paying, prices were up ten-fold but demand fell only 7% in the first half of this year. The demand elasticity in the gas business is very low indeed. As governments are very reluctant to make consumers pay for political reasons, reducing gas demand by using marketing mechanisms is almost impossible so Europe burns more gas than it should. “While it is essential to continue targeted supports for vulnerable households, the overall result has been that governments have burned money in a race to consume more gas,” says Bruegel. Italy has not reduced its demand at all, which lead to substantial amounts of gas transiting Austria to meet this demand. If Italy had cut demand by only 3% then its tanks would be 80% full now, not the current 63%, Bruegel concludes. The European gas market is a complex system that is nevertheless quite efficient at dispatching gas across the continent. But since Gazprom cut off supplies to Europe via Nord Stream 1 pipeline indefinitely at the start of September the European gas transport system is stretched to breaking point. Bruegel says the system faces four major coordination problems: refilling of storage; gas use reductions; new supply; and ensuring continued gas flow to where it is most needed. “All four areas require national government intervention, with coordination failures leading to a less secure, sustainable and affordable system,” says Bruegel, which it goes on to say is not happening. One of the biggest changes in the last year is LNG has gone from being a top-up supply of gas to keep the system running smoothly and as a buffer to external shocks to one of the key sources of fuel and that has sent its price through the roof. “Prior to the crisis, Belgium imported moderate volumes of LNG, steady volumes of gas from the Netherlands and Russian gas via Germany in winter months to meet peak demand. Trade with the United Kingdom fluctuated depending on demand. As the crisis has developed, Belgium has increased its LNG imports to maximum capacity and has boosted pipeline imports from the UK. As a result Belgium has become a significant net exporter to Germany, a vital aid as Russian gas flows are cut,” says Bruegel. Prices and money The power system is already in crisis. Faced with the prospect of freezing homes as the first snows fall, most European governments have focused on their own populations and thrown money at the problem rather than cut demand. Hundreds of billions of euros worth relief packages have already been spent and more will follow if prices continue to climb. The efforts so far run the risk of fragmenting Europe’s power market and could lead to massive over-investment into redundant generating capacity that will also undermine the investments into new renewable capacity which is the long-term solution to the current crisis. “Subsidising energy consumption instead of demand reduction has been a common and misguided approach. Governments run the risk that energy consumption subsidies become unsustainable, eroding trust in energy markets, slowing action in sanctioning Russia and increasing the cost of the net-zero transition,” says Bruegel.

- 22. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 22 Even before the blackouts arrive, the wild swings in prices have already wreaked havoc on the power business. The European power market is highly coordinated but the business of buying and selling electricity – essential so that generating capacity and demand remain matched every hour of the day – remains a local business and exposes smaller traders to big losses. Since September 2021, nearly 30 UK energy suppliers have filed for bankruptcy. Bankruptcies elsewhere include Bohemia Energy, the largest alternative supplier to state-owned CEZ in Czechia, which filed for bankruptcy in October 2021, while multiple energy providers have said they will withdraw from the French market, with Planet Oui activating an accelerated safeguard procedure in January 2022. It’s also costing a lot of extra money. The volatility in the market has pushed up the margin requirements for traders. Normally contracts on supply are signed well in advance of delivery dates to ensure demand and supply can be matched. Central counterparties (CCPs) that facilitate these trades demand a percentage of the contract as a down payment, but that share has risen to 80% of the contract price creating a liquidity problem that sends up costs for everyone. If the volatility gets worse then banks may stop providing the credits to cover these charges which would create a liquidity crisis that could spill over into the banking sector, says Bruegel. Several large utility players have already got into trouble. The German government is preparing to bail out its major utility company, Uniper, with a rescue package worth €15bn; the Élysée has announced a €10bn package to finalise the nationalisation of Electricité de France (EDF); and in early July CEZ, Czechia’s biggest utility, signed a credit agreement with the country’s finance At some point the cost of fuels like LNG and the subsidies governments are dolling out to their population become unsustainable: it become cheaper to shut down half your economy than it does to pay for gas and your citizen’s power bills.

- 23. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 23 NewBase Energy News 05 September 2022 - Issue No. 1551 call on +971504822502, UAE The Editor:” Khaled Al Awadi” Your partner in Energy Services NewBase energy news is produced Twice a week and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscriptions, please email us. About: Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 www.linkedin.com/in/khaled-al-awadi-38b995b Mobile: +971504822502 khdmohd@hawkenergy.net or khdmohd@hotmail.com Khaled Al Awadi is a UAE National with over 30 years of experience in the Oil & Gas sector. Has Mechanical Engineering BSc. & MSc. Degrees from leading U.S. Universities. Currently working as self leading external Energy consultant for the GCC area via many leading Energy Services companies. Khaled is the Founder of the NewBase Energy news articles issues, Khaled is an international consultant, advisor, ecopreneur and journalist with expertise in Gas & Oil pipeline Networks, waste management, waste-to-energy, renewable energy, environment protection and sustainable development. His geographical areas of focus include Middle East, Africa and Asia. Khaled has successfully accomplished a wide range of projects in the areas of Gas & Oil with extensive works on Gas Pipeline Network Facilities & gas compressor stations. Executed projects in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of gas/oil supply routes. Has drafted & finalized many contracts/agreements in products sale, transportation, operation & maintenance agreements. Along with many MOUs & JVs for organizations & governments authorities. Currently dealing for biomass energy, biogas, waste-to-energy, recycling and waste management. He has participated in numerous conferences and workshops as chairman, session chair, keynote speaker and panelist. Khaled is the Editor-in-Chief of NewBase Energy News and is a professional environmental writer with over 1400 popular articles to his credit. He is proactively engaged in creating mass awareness on renewable energy, waste management, plant Automation IA and environmental sustainability in different parts of the world. Khaled has become a reference for many of the Oil & Gas Conferences and for many Energy program broadcasted internationally, via GCC leading satellite Channels. Khaled can be reached at any time, see contact details above.

- 24. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 24

- 25. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 25

- 26. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 26

- 27. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 27

- 28. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 28