December 2012 Corn Futures Rise Sharply

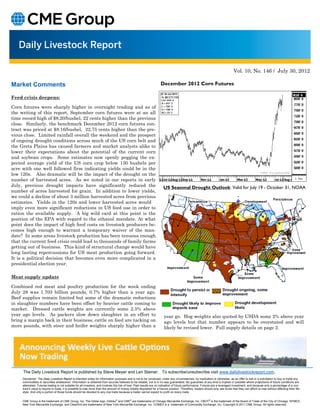

- 1. Vol. 10, No. 146 / July 30, 2012 Market Comments December 2012 Corn Futures Feed crisis deepens: Corn futures were sharply higher in overnight trading and as of the writing of this report, September corn futures were at an all time record high of $8.20/bushel, 22 cents higher than the previous close. Similarly, the benchmark December 2012 corn futures con- tract was priced at $8.16/bushel, 22.75 cents higher than the pre- vious close. Limited rainfall overall the weekend and the prospect of ongoing drought conditions across much of the US corn belt and the Greta Plains has caused farmers and market analysts alike to lower their expectations about the potential of the current corn and soybean crops. Some estimates now openly pegging the ex- pected average yield of the US corn crop below 130 bushels per acre with one well followed firm indicating yields could be in the low 120s. Also dramatic will be the impact of the drought on the number of harvested acres. As we noted in our reports in early July, previous drought impacts have significantly reduced the US Seasonal Drought Outlook: Valid for July 19 - October 31, NOAA number of acres harvested for grain. In addition to lower yields, we could a decline of about 3 million harvested acres from previous estimates. Yields in the 120s and lower harvested acres would imply even more significant reductions in US feed use in order to ration the available supply. A big wild card at this point is the position of the EPA with regard to the ethanol mandate. At what point does the impact of high feed costs on livestock producers be- comes high enough to warrant a temporary waiver of the man- date? In some areas livestock production has been tenuous enough that the current feed crisis could lead to thousands of family farms getting out of business. This kind of structural change would have long lasting repercussions for US meat production going forward. It is a political decision that becomes even more complicated in a presidential election year. Meat supply update Combined red meat and poultry production for the week ending July 28 was 1.703 billion pounds, 0.7% higher than a year ago. Beef supplies remain limited but some of the dramatic reductions in slaughter numbers have been offset by heavier cattle coming to market. Dressed cattle weights are currently some 2.5% above year ago levels. As packers slow down slaughter in an effort to year go. Hog weights also quoted by USDA some 2% above year bring a margin back in their business, cattle on feed are tacking on ago levels but that number appears to be overstated and will more pounds, with steer and heifer weights sharply higher than a likely be revised lower. Full supply details on page 2. The Daily Livestock Report is published by Steve Meyer and Len Steiner. To subscribe/unsubscribe visit www.dailylivestockreport.com. Disclaimer: The Daily Livestock Report is intended solely for information purposes and is not to be construed, under any circumstances, by implication or otherwise, as an offer to sell or a solicitation to buy or trade any commodities or securities whatsoever. Information is obtained from sources believed to be reliable, but is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. Futures trading is not suitable for all investors, and involves the risk of loss. Past results are no indication of future performance. Futures are a leveraged investment, and because only a percentage of a con- tract’s value is require to trade, it is possible to lose more than the amount of money initially deposited for a futures position. Therefore, traders should only use funds that they can afford to lose without affecting their life- style. And only a portion of those funds should be devoted to any one trade because a trader cannot expect to profit on every trade. CME Group is the trademark of CME Group, Inc. The Globe logo, Globex® and CME® are trademarks of Chicago Mercantile Exchange, Inc. CBOT® is the trademark of the Board of Trade of the City of Chicago. NYMEX, New York Mercantile Exchange, and ClearPort are trademarks of New York Mercantile Exchange. Inc. COMEX is a trademark of Commodity Exchange, Inc. Copyright © 2011 CME Group. All rights reserved.

- 2. Page 2 Vol. 10, No. 146 / July 30, 2012 PRODUCTION & PRICE SUMMARY Week Ending 7/28/2012 Current Pct. Pct. Y/Y % Item Units Week Last Week Change Last Year Change YTD Change 28-Jul-12 21-Jul-12 30-Jul-11 Total Red Meat & Poultry mil lbs., cwe 1,703 1,671 1.90% 1,691 0.73% 49,506 10.5% FI Slaughter Thou. Head 637 654 -2.60% 665 -4.22% 18,589 -4.3% C FI Cow Slaughter ** Thou. Head 125 101 23.90% 130 -3.75% 3,313 -3.4% A Avg. Live Weight Lbs. 1297 1304 -0.54% 1268 2.29% 1,296 1.7% T Avg. Dressed Weight Lbs. 793 793 0.00% 774 2.45% 786 2.0% T Beef Production Million Lbs. 504.4 518.0 -2.63% 513.2 -1.71% 14,576 -2.2% L Live Fed Steer Price $ per cwt 113.93 112.90 0.91% 108.57 4.94% E Dressed Fed Steer Price $ per cwt 180.13 178.88 0.70% 174.48 3.24% OKC Feeder Steer, 600-700 $ per cwt N/A N/A N/A 139.17 N/A & Choice Beef Cutout $ per cwt 178.06 182.07 -2.20% 175.04 1.73% Hide/Offal $ per cwt, live wt 13.32 13.28 0.30% 13.67 -2.56% B Rib, Choice $ per cwt 263.64 270.42 -2.51% 244.93 7.64% E Round, Choice $ per cwt 158.05 158.27 -0.14% 150.88 4.75% E Chuck, Choice $ per cwt 139.94 141.72 -1.26% 140.37 -0.31% F Trimmings, 50% $ per cwt 45.85 47.80 -4.08% 77.73 -41.01% Trimmings, 90% $ per cwt 208.75 214.87 -2.85% 181.34 15.12% FI Slaughter Thou. Head 2,003 1,961 2.14% 1,989 0.68% 62,015 1.2% FI Sow Slaughter ** Thou. Head 57.7 43.2 33.42% 56.1 2.83% 1,551 -2.1% H Avg. Dressed Weight Lbs. 203.0 203.0 0.00% 199.0 2.01% 207 0.4% O Pork Production Million Lbs. 405.3 398.5 1.71% 396.4 2.25% 12,853 1.7% G Iowa-S. Minn. Direct Wtd. Avg. 94.45 94.40 0.05% 100.89 -6.38% S Natl. Base Carcass Price Wtd. Avg. 93.10 92.67 0.46% 95.49 -2.50% Natl. Net Carcass Price Wtd. Avg. 95.57 95.23 0.36% 98.62 -3.09% Pork Cutout 185 Lbs. 92.27 90.33 2.15% 102.55 -10.02% Hams $ per cwt 74.46 73.24 1.67% 81.60 -8.75% Loins $ per cwt 104.00 101.09 2.88% 122.07 -14.80% Bellies $ per cwt 139.54 134.90 3.44% 142.47 -2.06% C Young Chicken Slaughter * Million Head 158.7 156.3 1.51% 160.5 -1.15% 4,404 -4.9% H Avg. Weight (Live) Lbs. 5.67 5.56 1.98% 5.66 0.18% 5.72 -0.2% I Chicken Production (RTC) Million Lbs. 679.2 656.1 3.51% 676.8 0.36% 18,968 -4.0% C Eggs Set Million 195.2 195.8 -0.32% 195.1 0.02% 5,714 -3.8% K Chicks Placed Million Head 163.1 162.9 0.14% 162.8 0.17% 4,763 -3.2% E 12-City Broiler Price Composite 81.89 83.92 -2.42% 79.78 2.64% N Georgia Dock Broiler Price 2.5-3 Lbs. 93.88 93.92 -0.04% 86.02 9.14% Northeast Breast, B/S $/cwt 139.11 137.92 0.86% 116.95 18.95% Northeast Legs $/cwt 63.5 61.99 2.44% 63.21 0.46% T Young Turkey Slaughter * Million Head 4.735 4.253 11.33% 4.544 4.20% 126.654 -0.5% U Avg. Live Weight Lbs. 30.16 29.01 3.96% 28.71 5.05% 30.11 0.0% R Turkey Production (RTC) Million Lbs. 114.2 98.7 15.76% 104.3 9.46% 3,110 1.8% K Eastern Region Hen Price 8-16 Lbs. 107.50 106.50 0.94% 104.00 3.37% G Corn, Omaha $ per Bushel 7.78 8.12 -4.19% 7.24 7.46% R DDGs, Minnesota $ per Ton 287.50 272.50 5.50% 182.50 57.53% A Wheat, Kansas City $ per Bushel 8.78 9.13 -3.83% 7.47 17.54% I Soybeans, S. Iowa $ per Bushel 17.01 17.96 -5.29% 13.83 22.99% N Soybn Meal, 48% Decatur $ per Ton 553.30 551.00 0.42% 347.80 59.09% * Chicken & turkey slaughter & production are 1 week earlier than the date at the top of this sheet. ** Cow and sow slaughter reflect levels from two weeks ago due to reporting lag.