After the storm comes the calm - Fixed Income Outlook

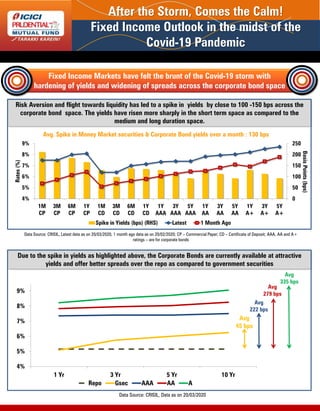

- 1. After the Storm, Comes the Calm! Fixed Income Outlook in the midst of the Covid-19 Pandemic Fixed Income Markets have felt the brunt of the Covid-19 storm with hardening of yields and widening of spreads across the corporate bond space Risk Aversion and flight towards liquidity has led to a spike in yields by close to 100 -150 bps across the corporate bond space. The yields have risen more sharply in the short term space as compared to the medium and long duration space. Data Source: CRISIL, Latest data as on 20/03/2020, 1 month ago data as on 20/02/2020; CP – Commercial Paper; CD – Certificate of Deposit; AAA, AA and A+ ratings – are for corporate bonds Due to the spike in yields as highlighted above, the Corporate Bonds are currently available at attractive yields and offer better spreads over the repo as compared to government securities Data Source: CRISIL, Data as on 20/03/2020 4% 5% 6% 7% 8% 9% 1 Yr 3 Yr 5 Yr 10 Yr Repo Gsec AAA AA A Avg 45 bps Avg 222 bps Avg 279 bps Avg 335 bps Avg. Spike in Money Market securities & Corporate Bond yields over a month : 130 bps 0 50 100 150 200 250 4% 5% 6% 7% 8% 9% 1M CP 3M CP 6M CP 1Y CP 1M CD 3M CD 6M CD 1Y CD 1Y AAA 3Y AAA 5Y AAA 1Y AA 3Y AA 5Y AA 1Y A+ 3Y A+ 5Y A+ BasisPoints(bps) Rates(%) Spike in Yields (bps) (RHS) Latest 1 Month Ago

- 2. 7 8 9 10 11 12 1 Year 3 Year 5 Year 10 Year Yields spiked during GFC in 2008 G-Sec (Post the Event) G-Sec (6M before the event) CB (Post the Event) CB (6M before the event) 7 8 9 10 11 1 Year 3 Year 5 Year 10 Year Yields spiked during Taper Tantrum in 2013 G-Sec (Post the Event) G-Sec (6M before the event) CB (Post the event) CB (6M before the event) After the Storm, Comes the Calm! Fixed Income Outlook in the midst of the Covid-19 Pandemic However, we believe Investors could soon experience the calm as yields normalise from their current unsustainable levels Have we seen a calm after a Storm? Instances from the Past The Storm: Yields had spiked during the uncertainties and panic in bond markets during the Global Financial Crisis (GFC) in 2008 and Taper Tantrums in 2013 The Calm: Favorable Returns in 6 Months post the crisis across fixed income categories 6 Months Returns post the crisis in 2008 & 2013 (% p.a.) Category Post the Taper Tantrums Post the Global Financial Crisis Category Post the Taper Tantrums Post the Global Financial Crisis Money Market 9.81 9.41 Banking & PSU 11.12 7.99 Ultra Short Duration 10.41 9.49 Medium Duration 11.06 13.79 Short Duration 11.39 14.34 Credit Risk 11.87 8.11 Corporate Bond 10.51 16.78 10 yr Government Bond 14.20 14.35 As highlighted above, In both the instances of bond market volatility in 2008 & 2013, investors have subsequently witnessed positive returns for categories across the fixed income space Data Source: Crisil; 6 Months Back Data as on 17/02/2013; After Taper tantrum effect data as on 19/08/2013; CB – Corporate Bond; G-Sec- Government Security Data Source: Crisil; 6 Months Back Data as on 14/01/2008; After Taper tantrum effect data as on 15/07/2008; CB – Corporate Bond; G-Sec- Government Security The aforementioned information is indicative in nature and past performance may or may not sustain in the future. Data Source: Morning Star; Returns are for the period 18/08/2013 to 17/02/2014 for Taper Tantrums and from 14/07/2008 to 13/01/2009 for Global Financial Crisis. Returns are annualized.

- 3. Just as seen in 2008 & 2013, the current volatility provides an attractive opportunity to invest After the Storm, Comes the Calm! Fixed Income Outlook in the midst of the Covid-19 Pandemic The Way Forward for Fixed Income Markets • Central Banks around the globe are adopting a “Whatever it takes” approach to provide the required boost to the economy in this period of crisis and RBI is expected to follow suit. • Positive macro economic indicators, Spread of India’s interest rates above global interest rates and lower inflation expectations provide the RBI and government a large headroom for giving monetary and fiscal stimuli. • Some of the Expected measures from the RBI and Government are as follows: Liquidity through Quantitative Easing Relax credit stipulation Eg: Relaxation of NPA norms Fiscal Stimulus from the Government Our View Invest before the RBI & Govt. Stimulus Accrual schemes most attractive Buy Call on Debt as entire yield curve looks attractive Current debt markets - Volatile But Attractive Investors should invest before the expected supportive action is taken to get maximum benefit from the normalization of yields. Investors with a higher risk appetite should consider investing in accrual funds as the spread over repo in accrual space* is the highest and is very attractive at this point We give a strong buy call on debt markets and recommend investing in schemes in the Low Duration, Ultra Short, Short Duration and Medium Duration *(Corporate Bonds with rating below AAA)

- 4. After the Storm, Comes the Calm! Fixed Income Outlook in the midst of the Covid-19 Pandemic Our Recommendation Riskometers Scheme Name YTM Average Maturity in Years Modified Duration in Years Macaulay Duration in Years ICICI Prudential Savings Fund 7.92% 1.23 0.98 1.07 ICICI Prudential Ultra Short term Fund 9.05% 0.54 0.43 0.48 ICICI Prudential Short Term Fund 8.31% 3.40 2.47 2.64 ICICI Prudential Corporate Bond Fund 7.91% 2.92 2.10 2.24 ICICI Prudential Banking & PSU Debt Fund 8.08% 4.14 2.68 2.89 ICICI Prudential Credit Risk Fund 10.49% 2.29 1.80 1.95 ICICI Prudential Medium Term Bond Fund 9.36% 4.02 2.83 3.06 ICICI Prudential All Seasons Bond Fund 8.65% 6.83 4.33 4.56 Data as on March 20, 2020 ICICI Prudential Short Term Fund (An open ended short term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 1 Year and 3 Years) is suitable for investors who are seeking*: • Short term income generation and capital appreciation solution • A debt fund that aims to generate income by investing in a range of debt and money market instruments of various maturities ICICI Prudential Credit Risk Fund (An open ended debt scheme predominantly investing in AA and below rated corporate bonds) is suitable for investors who are seeking*: Medium term savings A debt scheme that aims to generate income through investing predominantly in AA and below rated corporate bonds while maintaining the optimum balance of yield, safety and liquidity ICICI Prudential Medium Term Bond Fund (An open ended medium term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 3 Years and 4 Years. The Macaulay duration of the portfolio is 1 Year to 4 years under anticipated adverse situation) is suitable for investors who are seeking*: Medium term savings A debt scheme that invests in debt and money market instruments with a view to maximize income while maintaining optimum balance of yield, safety and liquidity ICICI Prudential All Seasons Bond Fund (An open ended dynamic debt scheme investing across duration) is suitable for investors who are seeking*: All duration savings A debt scheme that invests in debt and money market instruments with a view to maximize income while maintaining optimum balance of yield, safety and liquidity

- 5. After the Storm, Comes the Calm! Fixed Income Outlook in the midst of the Covid-19 Pandemic Riskometers Mutual Fund investments are subject to market risks, read all scheme related documents carefully. In preparation of the material contained in this document, ICICI Prudential Asset Management Company Limited (the AMC) has used information that is publicly available, including information developed in-house. Some of the material used in the document may have been obtained from members/persons other than the AMC and/or its affiliates and which may have been made available to the AMC and/or to its affiliates. Information gathered and material used in this document is believed to be from reliable sources. The AMC, however, does not warrant the accuracy, reasonableness and / or completeness of any information. We have included statements / opinions / recommendations in this document, which contain words, or phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such expressions that are “forward looking statements”. Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our services and / or investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices etc. The AMC (including its affiliates), the Mutual Fund, the trust and any of its officers, directors, personnel and employees, shall not be liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this material in any manner. The recipient alone shall be fully responsible/are liable for any decision taken on this material. All figures and other data given in this document are dated and the same may or may not be relevant in future. The information contained herein should not be construed as a forecast or promise nor should it be considered as an investment advice. Investors are advised to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implication or consequence of subscribing to the units of ICICI Prudential Mutual Fund. The debt securities mentioned in this communication do not constitute any recommendation of the same and ICICI Prudential Mutual Fund may or may not have any future position in these debt securities. Past performance may or may not be sustained in the future. The portfolio of the scheme is subject to changes within the provisions of the Scheme Information document of the scheme. Please refer to the SID for investment pattern, strategy and risk factors. The information contained herein is only for the purpose of information and not for distribution and do not constitute an offer to buy or sell or solicitation of any offer to buy or sell any securities or financial instruments in the United States of America ("US") and/or Canada or for the benefit of US persons (being persons falling within the definition of the term "US Person" under the US Securities Act, 1933, as amended) or persons residing in Canada. Disclaimer ICICI Prudential Ultra Short Term Fund(An open ended ultra-short term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 3 months and 6 months) is suitable for investors who are seeking*: Short term regular income An open ended ultra-short term debt scheme investing in a range of debt and money market instruments ICICI Prudential Savings Fund (An open ended low duration debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 6 months and 12 months) is suitable for investors who are seeking* Short term savings An open ended low duration debt scheme that aims to maximize income by investing in debt and money market instruments while maintaining optimum balance of yield, safety and liquidity ICICI Prudential Banking & PSU Debt Fund (An open ended debt scheme predominantly investing in Debt instruments of banks, Public Sector Undertakings, Public Financial Institutions and Municipal Bonds.) is suitable for investors who are seeking* Short term savings An open ended debt scheme predominantly investing in Debt instruments of banks, Public Sector Undertakings, Public Financial Institutions and Municipal Bonds ICICI Prudential Corporate Bond Fund (An open ended debt scheme predominantly investing in AA+ and above rated corporate bonds.) is suitable for investors who are seeking* Short term savings An open ended debt scheme predominantly investing in highest rated corporate bonds. *Investors should consult their financial advisers if in doubt about whether the product is suitable for them . Note: The Macaulay duration is the weighted average term to maturity of the cash flows from a bond. The weight of each cash flow is determined by dividing the present value of the cash flow by the price.