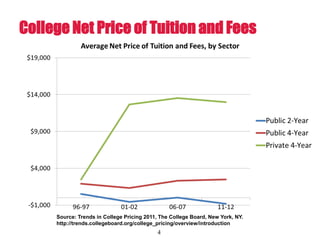

The document discusses the financial aid process for paying for college in Illinois. It explains that the Illinois Student Assistance Commission (ISAC) administers financial aid programs in the state, including scholarships, grants, and prepaid tuition. It provides details on the types of financial aid (grants, scholarships, work-study, loans), sources of aid (federal, state, college, private), and examples of major aid programs from ISAC and the U.S. Department of Education. The document emphasizes applying for financial aid through the Free Application for Federal Student Aid (FAFSA) and knowing the options available to make college affordable.