Fha Vs Conventional Loans Compare Mortgage Loans

•

0 likes•238 views

Fha Vs Conventional Loans Compare Fha Loans Vs Conventional loans

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

Recently uploaded

Recently uploaded (20)

Elegant Evergreen Homes - Timeless Luxury in Yelahanka, Bangalore

Elegant Evergreen Homes - Timeless Luxury in Yelahanka, Bangalore

Purvanchal Skyline Vista is commercial Project in Sector 94 Noida.

Purvanchal Skyline Vista is commercial Project in Sector 94 Noida.

Transforming Your Home Expert Guide to Renovations and Extensions in Upwey

Transforming Your Home Expert Guide to Renovations and Extensions in Upwey

Why Sell With Urban Cool KC - Listing Presentation

Why Sell With Urban Cool KC - Listing Presentation

What is a TA7 Form used for in relation to a property?

What is a TA7 Form used for in relation to a property?

Featured

More than Just Lines on a Map: Best Practices for U.S Bike Routes

This session highlights best practices and lessons learned for U.S. Bike Route System designation, as well as how and why these routes should be integrated into bicycle planning at the local and regional level.

Presenters:

Presenter: Kevin Luecke Toole Design Group

Co-Presenter: Virginia Sullivan Adventure Cycling AssociationMore than Just Lines on a Map: Best Practices for U.S Bike Routes

More than Just Lines on a Map: Best Practices for U.S Bike RoutesProject for Public Spaces & National Center for Biking and Walking

Featured (20)

Content Methodology: A Best Practices Report (Webinar)

Content Methodology: A Best Practices Report (Webinar)

How to Prepare For a Successful Job Search for 2024

How to Prepare For a Successful Job Search for 2024

Social Media Marketing Trends 2024 // The Global Indie Insights

Social Media Marketing Trends 2024 // The Global Indie Insights

Trends In Paid Search: Navigating The Digital Landscape In 2024

Trends In Paid Search: Navigating The Digital Landscape In 2024

5 Public speaking tips from TED - Visualized summary

5 Public speaking tips from TED - Visualized summary

Google's Just Not That Into You: Understanding Core Updates & Search Intent

Google's Just Not That Into You: Understanding Core Updates & Search Intent

The six step guide to practical project management

The six step guide to practical project management

Beginners Guide to TikTok for Search - Rachel Pearson - We are Tilt __ Bright...

Beginners Guide to TikTok for Search - Rachel Pearson - We are Tilt __ Bright...

Unlocking the Power of ChatGPT and AI in Testing - A Real-World Look, present...

Unlocking the Power of ChatGPT and AI in Testing - A Real-World Look, present...

More than Just Lines on a Map: Best Practices for U.S Bike Routes

More than Just Lines on a Map: Best Practices for U.S Bike Routes

Ride the Storm: Navigating Through Unstable Periods / Katerina Rudko (Belka G...

Ride the Storm: Navigating Through Unstable Periods / Katerina Rudko (Belka G...

Good Stuff Happens in 1:1 Meetings: Why you need them and how to do them well

Good Stuff Happens in 1:1 Meetings: Why you need them and how to do them well

Fha Vs Conventional Loans Compare Mortgage Loans

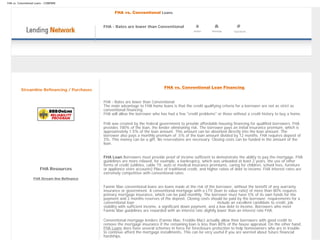

- 1. FHA vs. Conventional Loans - COMPARE FHA vs. Conventional Loans FHA - Rates are lower than Conventional Home Sitemap Questions FHA vs. Conventional Loan Financing Streamline Refinancing / Purchases FHA - Rates are lower than Conventional The main advantage to FHA home loans is that the credit qualifying criteria for a borrower are not as strict as conventional financing. FHA will allow the borrower who has had a few "credit problems" or those without a credit history to buy a home. FHA was created by the federal government to provide affordable housing financing for qualified borrowers. FHA provides 100% of the loan, the lender eliminating risk. The borrower pays an initial insurance premium, which is approximately 1.5% of the loan amount. This amount can be absorbed directly into the loan amount. The borrower also pays a monthly premium of .5% of the loan amount divided by 12 months. FHA requires deposit of 3%. This money can be a gift. No reservations are necessary. Closing costs can be funded in the amount of the loan. FHA Loan Borrowers must provide proof of income sufficient to demonstrate the ability to pay the mortgage. FHA guidelines are more relaxed, for example, a bankruptcy, which was unloaded at least 2 years, the use of other forms of credit (utilities, cable TV, auto or medical insurance premiums, caring for children, school fees, furniture FHA Resources or appliance store accounts) Place of traditional credit, and higher ratios of debt to income. FHA interest rates are extremely competitive with conventional rates. FHA Stream line Refinance Fannie Mae conventional loans are loans made at the risk of the borrower, without the benefit of any warranty insurance or government. A conventional mortgage with a LTV (loan to value ratio) of more than 80% requires primary mortgage insurance, which can be paid monthly. The borrower must have 5% of its own funds for the payment and 2 months reserves of the deposit. Closing costs should be paid by the borrower. requirements for a conventional loan include an excellent candidate to credit, job stability with sufficient income, a significant down payment, and a low debt to income. Borrowers who meet Fannie Mae guidelines are rewarded with an interest rate slightly lower than an interest rate FHA. Conventional mortgage lenders (Fannie Mae, Freddie Mac) actually allow their borrowers with good credit to remove the mortgage insurance if the remaining loan is less than 80% of the house appraisal. On the other hand, FHA Loans does have several schemes in force for foreclosure protection to help homeowners who are in trouble to continue afford the mortgage installments. This can be very useful if you are worried about future financial hardships.

- 2. FHA vs. Conventional Loans - COMPARE FHA loans compare to conventional loans? Conventional loans usually require a larger down payment. And, if you have less than perfect credit you may not qualify for many conventional loans and find yourself being offered loans with higher interest rates and/or fees than you expected. The best thing to do is compare the cost of the conventional loan to an FHA loan line-by-line. What are the fees, interest rate and mortgage insurance on each? How much down payment is required? For some borrowers, a conventional loan may be less expensive. For many others, it will be more expensive than FHA. Example FHA Conventional Maximum Loan Limits per County Yes No Mortgage insurance included in loan Yes Not always *Maximum purchase loan 97% 107% Rate depends on Credit Score No Yes Seasoning requirement for bankruptcy 2+ yr None with some programs Seasoning requirement foreclosure 2+ yr Varies on program Open Collections None Varies on program Drop mortgage insurance with equity No Yes Non-verified (stated) income programs No Yes Streamline refinance Yes No Non-occupant cosigner Yes No * There is a 102% FHA program- 97% first mortgage and a 5% second mortgage. Qualification for the 5% second mortgage though is based on low income limits set per county. Mortgage Quote Mortgage Glossary Mortgage loan Home Mortgage Rates LA Alabama Mortgage Rates FHA -Mortgage