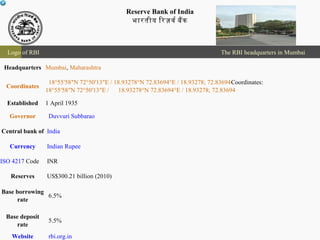

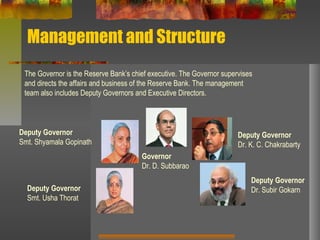

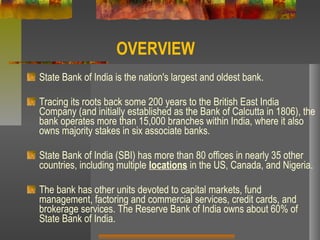

1) The document provides an overview of the Reserve Bank of India (RBI) and State Bank of India (SBI). RBI is the central banking system of India that was established in 1935 and is headquartered in Mumbai. It controls monetary policy and currency reserves. SBI is the largest bank in India, tracing its roots back to 1806, and has over 15,000 branches nationally and internationally.

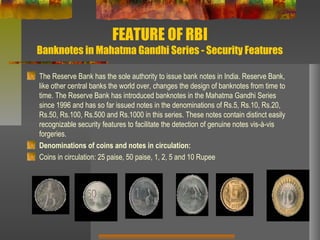

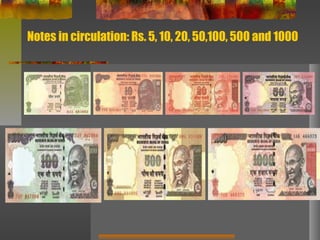

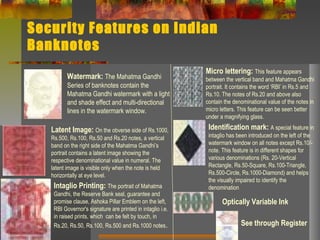

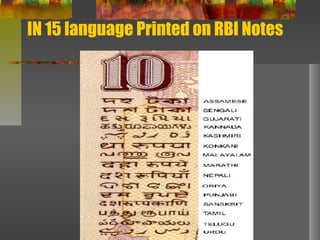

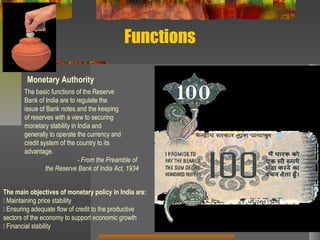

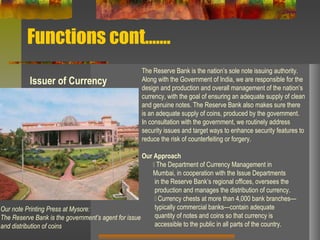

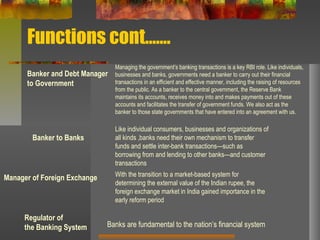

2) RBI functions include monetary policy, issuing currency, managing the government's finances, regulating other banks, and overseeing foreign exchange. It aims to maintain price stability and adequate credit flow.

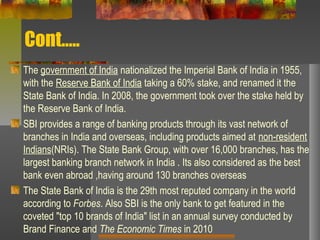

3) SBI started as Bank of Calcutta and was nationalized in 1955. It

![Cont…..

Revenue 133,851 crore (US$29.05 billion)(2010) [1]

Profi 11,733 crore (US$2.55 billion)(2010) [1]

Total assets US$ 323.0 billion (2010)

Total equity US$ 18.5 billion (2010)

Owner(s) Government of India

Employees 200,299 (2010)

Website satebankofindia.com](https://image.slidesharecdn.com/rbisbi-140427132856-phpapp02/85/RBI-SBI-20-320.jpg)