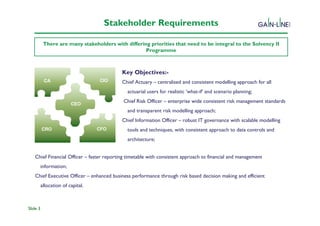

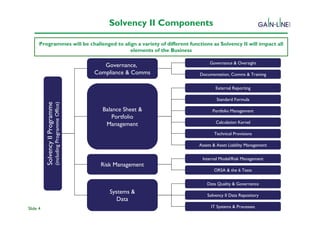

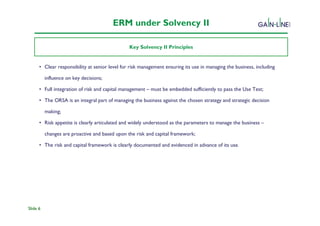

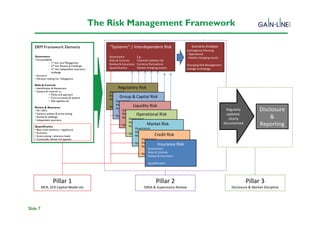

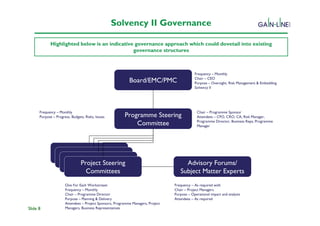

The document outlines the Solvency II initiative, a regulatory framework for insurers and reinsurers aimed at enhancing risk management across all business areas. It emphasizes a collaborative approach through the Gain-Line consortium, highlighting stakeholder requirements, governance structures, and an integrated risk management framework. Key objectives include fostering a consistent modeling approach, adhering to regulatory standards, and tailoring solutions for various companies based on their specific needs.