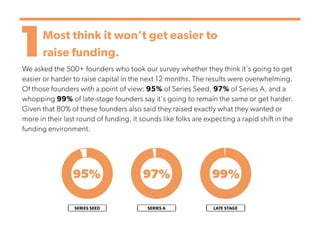

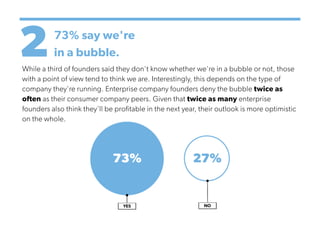

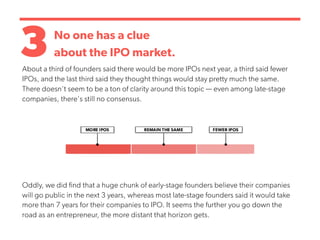

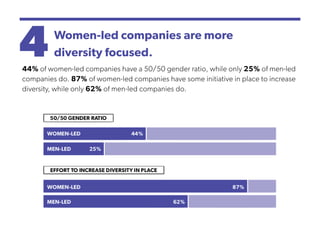

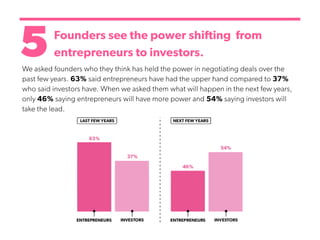

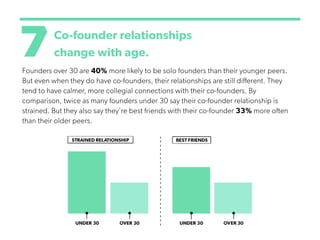

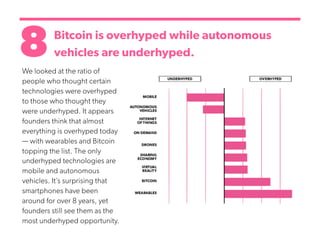

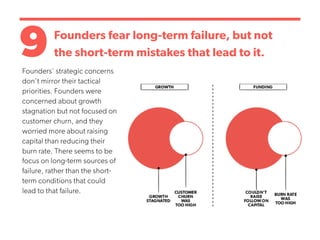

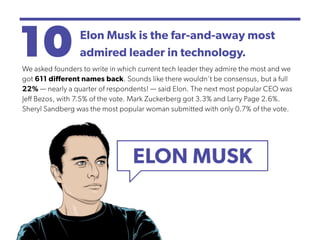

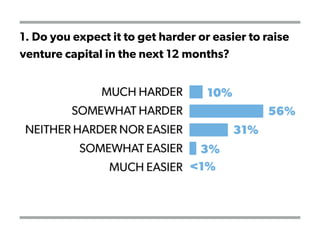

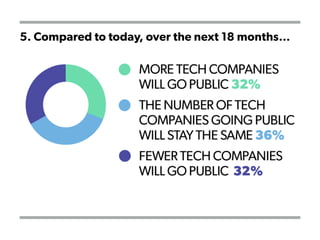

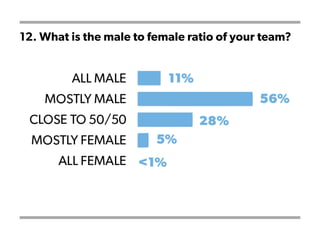

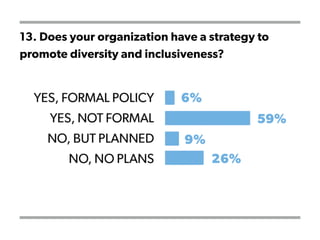

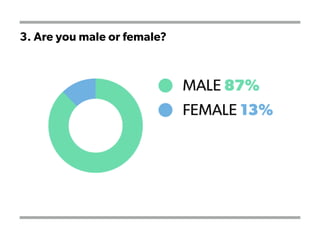

The 2015 State of Startups report surveys over 500 venture-backed founders to gauge their perspectives on funding, market conditions, and company operations. Key findings include expectations that raising capital will become more difficult, a notable focus on diversity in women-led companies, and a shift of power in negotiations from entrepreneurs to investors. Additionally, concerns regarding hiring talent and long-term business viability are emphasized, alongside the popularity of tech leaders like Elon Musk.