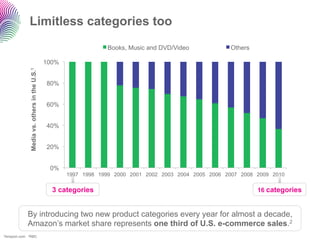

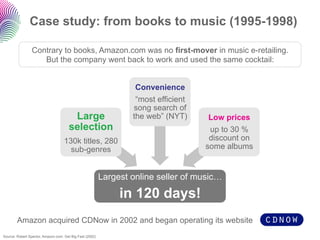

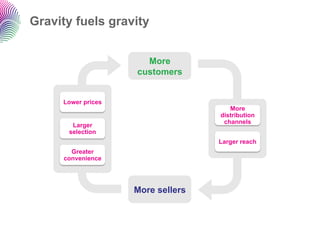

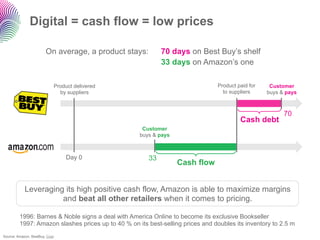

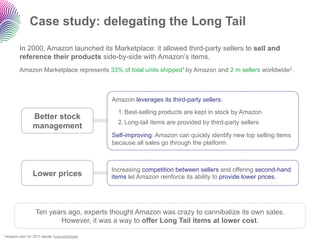

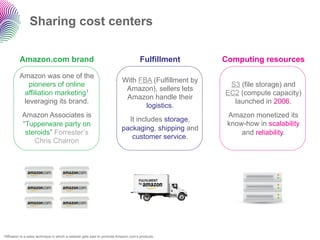

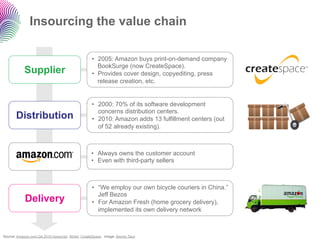

The document outlines Amazon's rapid growth and dominance in the retail market, highlighting how Jeff Bezos leveraged the internet's advantages to build a successful e-commerce platform with limitless inventory, optimized supply chains, and a strong focus on customer service. It emphasizes Amazon's innovative strategies, such as the introduction of the 1-click ordering system and expansion into new categories, while maintaining competitive pricing through efficient logistics and third-party seller partnerships. The company's long-term vision and investment in technology have allowed it to achieve significant market share and a leading position in global e-commerce.

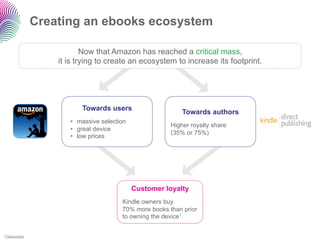

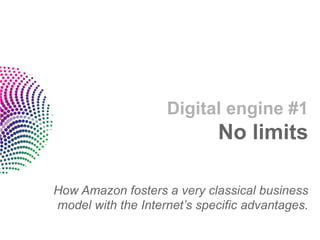

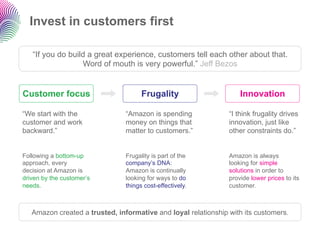

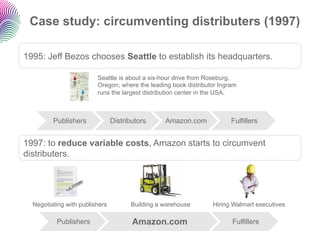

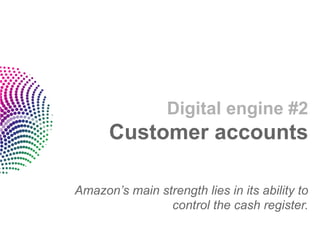

![Not that disruptive of a model:

“sell and deliver stuff to customers”

Amazon perfectly understood the old-economy retail cocktail:

low prices, large selection, convenience/customer experience.

“I can't imagine that ten years from

now [customers] are going to say:

‘I really love Amazon, but I wish

their prices were a little higher’”

Low Large

prices selection Jeff Bezos

Convenience](https://image.slidesharecdn.com/amazonwhitepaper-110511144038-phpapp01/85/Amazon-com-the-Hidden-Empire-Update-2013-12-320.jpg)

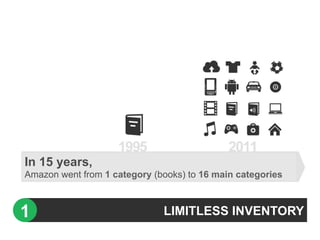

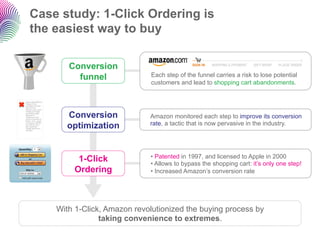

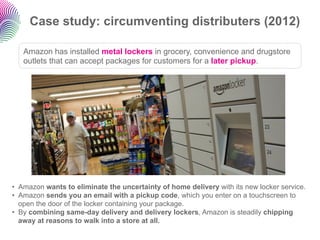

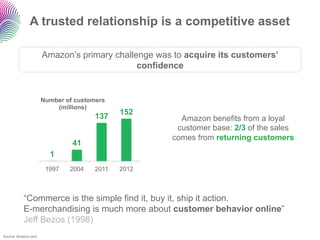

![Customer centric innovations:

pushing boundaries further

Very much like Google, Amazon is always 1-Click ordering

User experience innovating to improve its users’ experience and Amazon Prime

make them feel at home. Vouchers

One-to-one marketing to tailor the content to the “Your Recent History”

Personalized customer, help him discover new products and “Customers Who Bought

stores provide unique experiences. This Item Also Bought”

Detailed and safe step-by-step buying process with “You can always remove

A-to-Z Safe Buying Protection. it later” [from the cart]

Trust Amazon won and maintained customers’ “Shopping with us is

confidence. safe”

Amazon.com implements all its consumers’ hidden needs

to become their first destination when thinking of buying online.](https://image.slidesharecdn.com/amazonwhitepaper-110511144038-phpapp01/85/Amazon-com-the-Hidden-Empire-Update-2013-27-320.jpg)

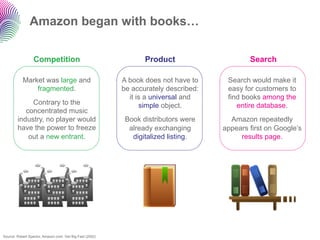

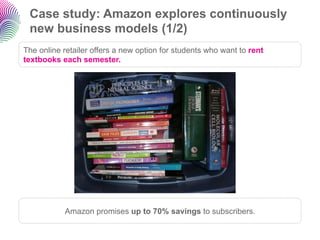

![Financing margin optimization

Amazon.com lost a staggering $3 bn between 1995 and 2003

(IPO)

1997 2003

-200

Profit (Millions)

-600

2000: “We were hoping to build a

small, profitable company, and […] -1 000

what we've done is build a large,

unprofitable company”

Jeff Bezos

-1 400

• By going public in 1997, Amazon acknowledged that only the stock market would be able to

provide the kind of financing it was looking for.

• Thanks to ever improving business metrics, investors’ trust remained and was instrumental in

helping Amazon’s development.

Source: Amazon.com](https://image.slidesharecdn.com/amazonwhitepaper-110511144038-phpapp01/85/Amazon-com-the-Hidden-Empire-Update-2013-38-320.jpg)

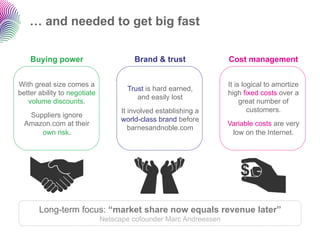

![A data-driven company

Amazon pioneered A/B testing in 1997.

“Online, we can show half of our customers one thing and half of customers another,

and very quickly get some results back on how people actually behave.” Jeff Bezos

[ ] (in weeks)

[ ] (in seconds)

In 2001, for the first time in its history, Amazon implemented a

software to measure its costs for each shipped product.

As a result, Amazon started dereferencing its so-called CRAP

C.R.A.P. (Can’t Realize Any Profit) products.

In 2000, Jeff Bezos discovered it took 15 minutes to pack a best-

selling $25 folding chair, which obliterated the margin.

He then negotiated with the manufacturer, who agreed to send it

pre-packaged for ¢25.

Source: Robert Spector, Amazon.com: Get Big Fast (2002)](https://image.slidesharecdn.com/amazonwhitepaper-110511144038-phpapp01/85/Amazon-com-the-Hidden-Empire-Update-2013-39-320.jpg)

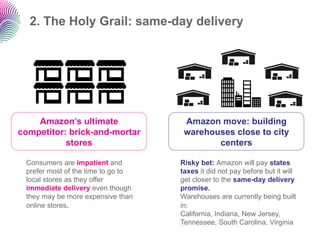

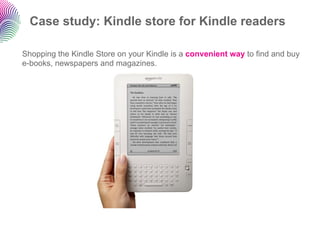

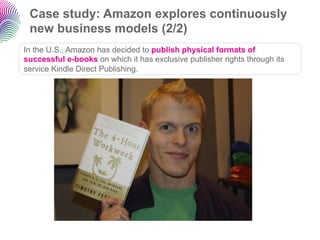

![An entry point to harness the market

Barnes & Noble Nook

Sony Librié Amazon Kindle Cybook Opus Kobo eReader

2004 2007 2009 2010

Ebooks sales: 6% of Amazon’s 115 ebooks sold for

microscopic book units sold1 every 100 paperbacks2

Staying ahead of retailers Harnessing the market

Books are Amazon’s DNA. “We’ve been selling e-Books for ten

To demonstrate its resolve, it needed to years, but we needed an electron

push its digital advantage to its end: microscope to find the sales. […]

• Digital distribution: every book Three years ago we said, ‘Look, what we

available in less than 60 seconds need to do is create a perfect, integrated,

• Value chain: Amazon now integrates streamlined customer experience all the

retail and distribution way through.’” Jeff Bezos (2008)

“[And] if we can get other devices to also be able

to buy Kindle books, that’s great.”3

1PaidContent 2Amazon.com 3Despite Jeff Bezos’ stance, currently only Amazon’s official apps enable purchasing via Amazon.](https://image.slidesharecdn.com/amazonwhitepaper-110511144038-phpapp01/85/Amazon-com-the-Hidden-Empire-Update-2013-64-320.jpg)