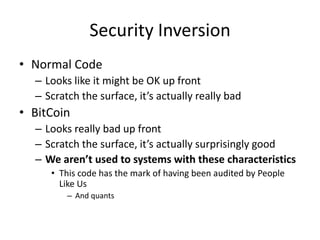

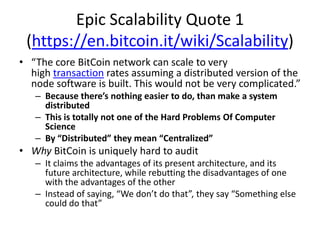

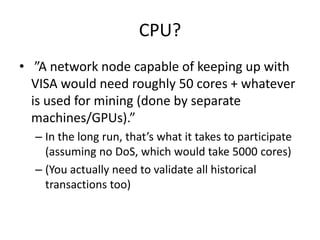

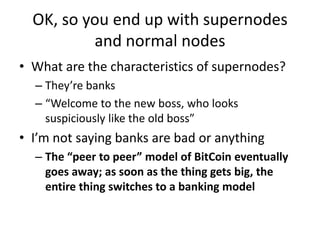

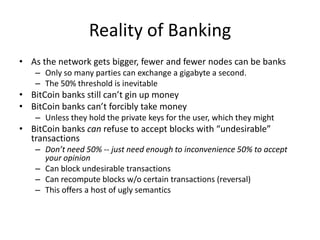

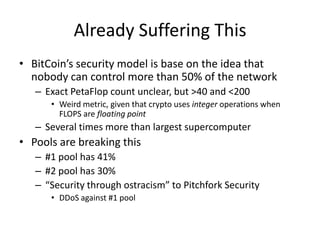

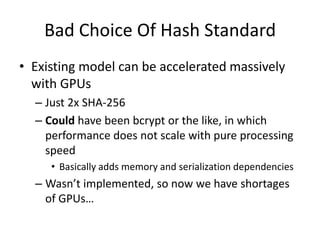

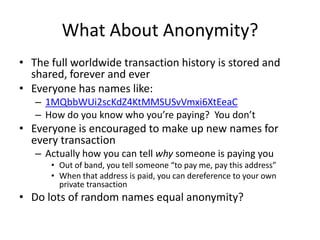

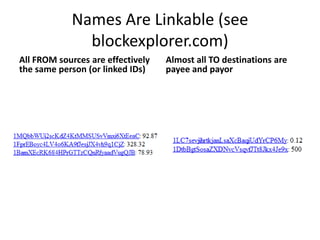

Bitcoin has some promising technical aspects but faces significant scalability issues that threaten its core properties over time. While it currently works as a decentralized system, the need to process vast amounts of data means nodes will consolidate into "supernodes" that effectively function like centralized banks. This transition would compromise Bitcoin's anonymity and censorship-resistance as identities become linked and certain transactions could be blocked. Overall Bitcoin shows innovation but may not retain its present security model if it aims to seriously compete with mainstream payment networks in transaction volume.