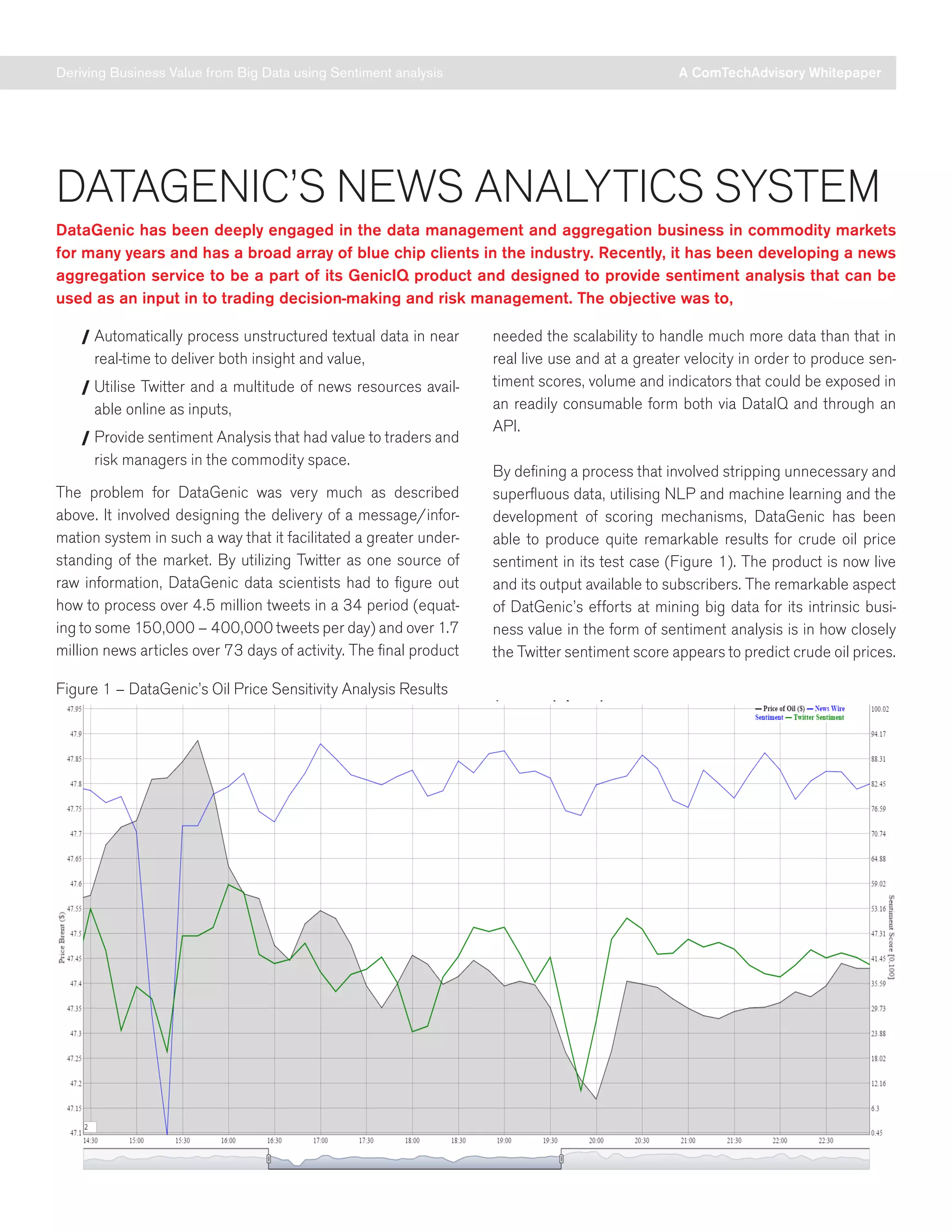

This white paper explores how businesses can derive value from big data using sentiment analysis, particularly in the context of commodity trading and risk management. It highlights how unstructured data, primarily from social media and news sources, can provide predictive insights, and discusses Datagenic's innovations in processing this data to assess market sentiment for crude oil prices. The paper emphasizes the need for advanced analytics and machine learning skills to make sense of vast, variable-quality data for actionable business intelligence.