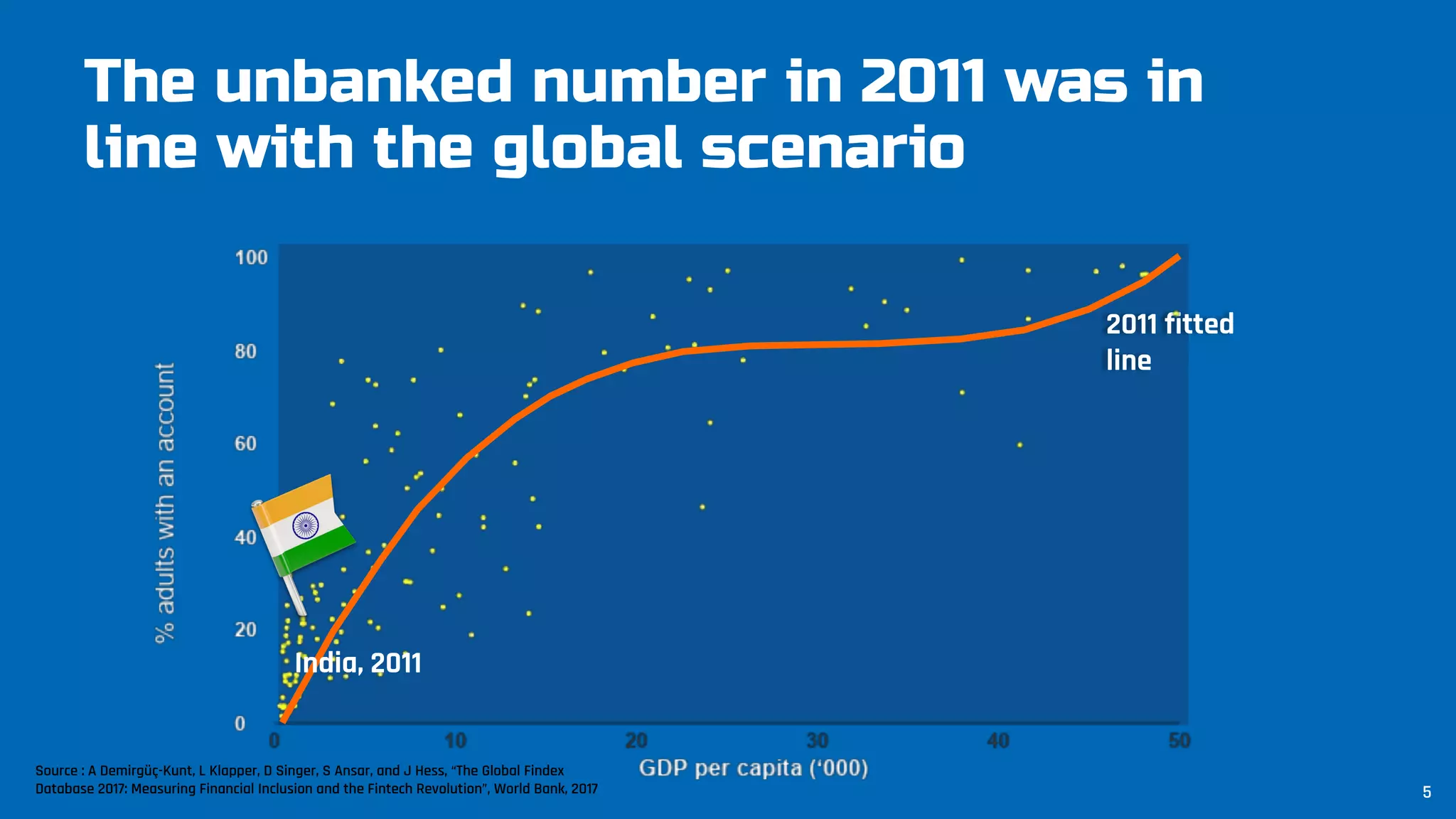

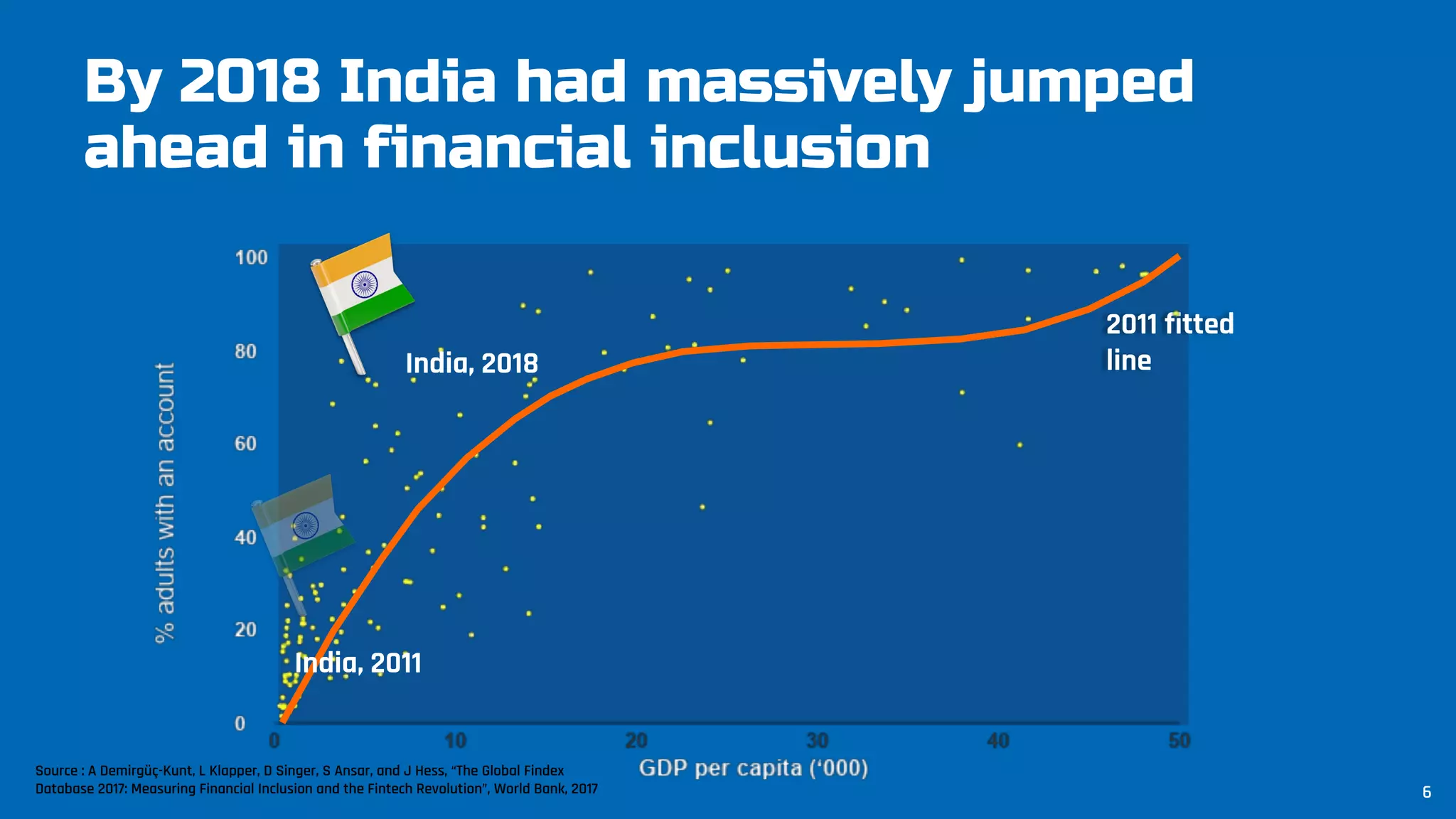

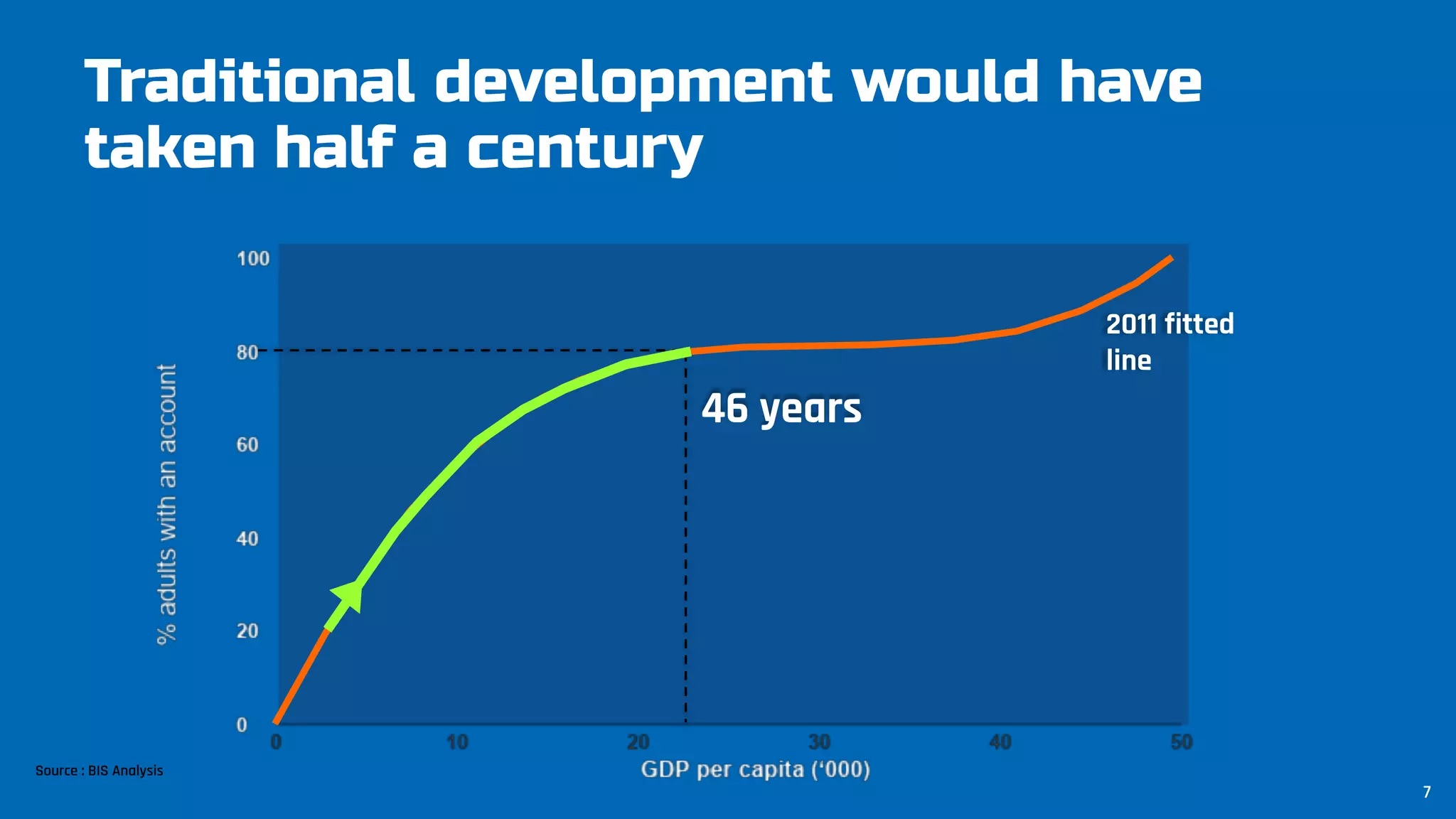

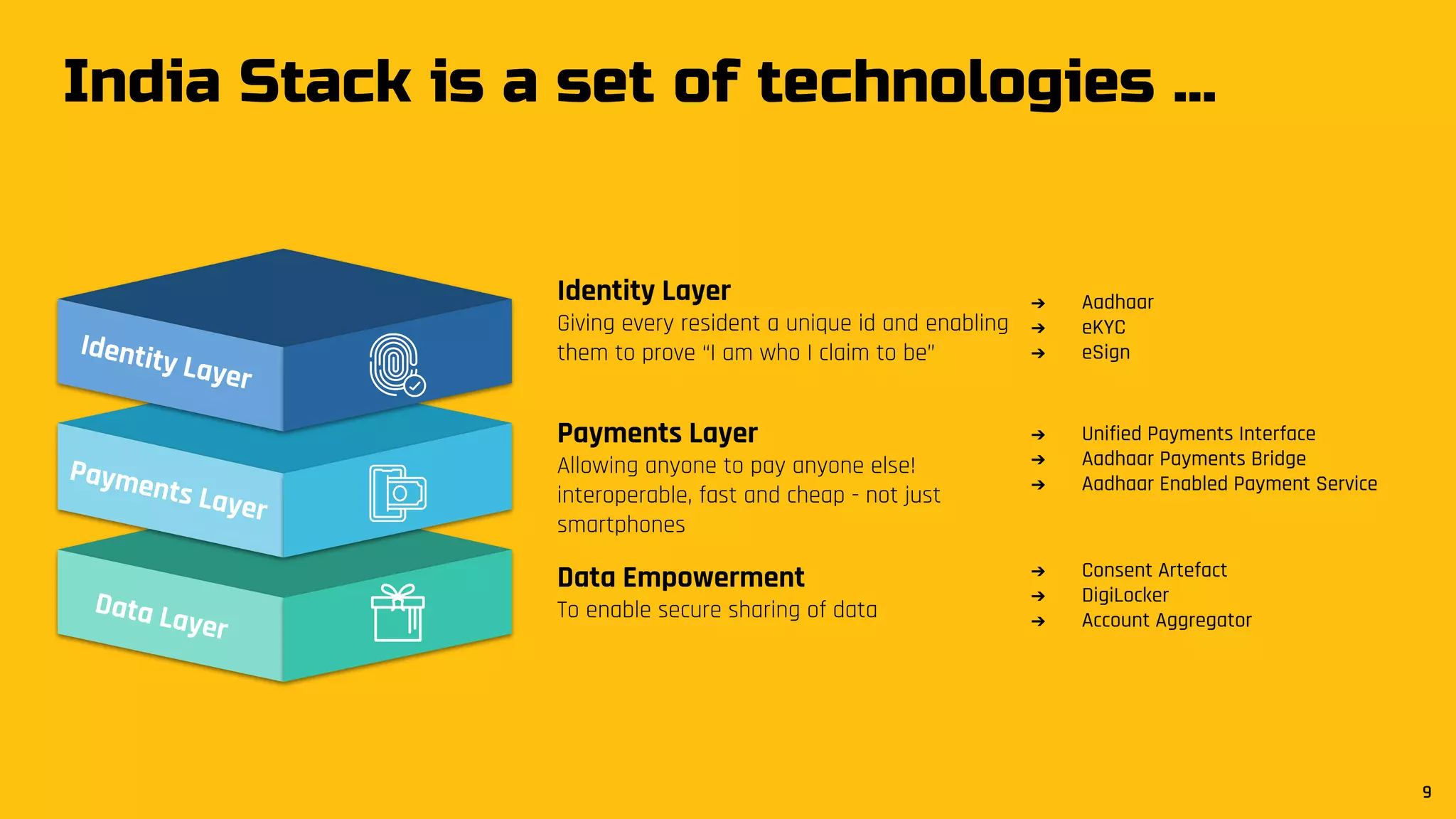

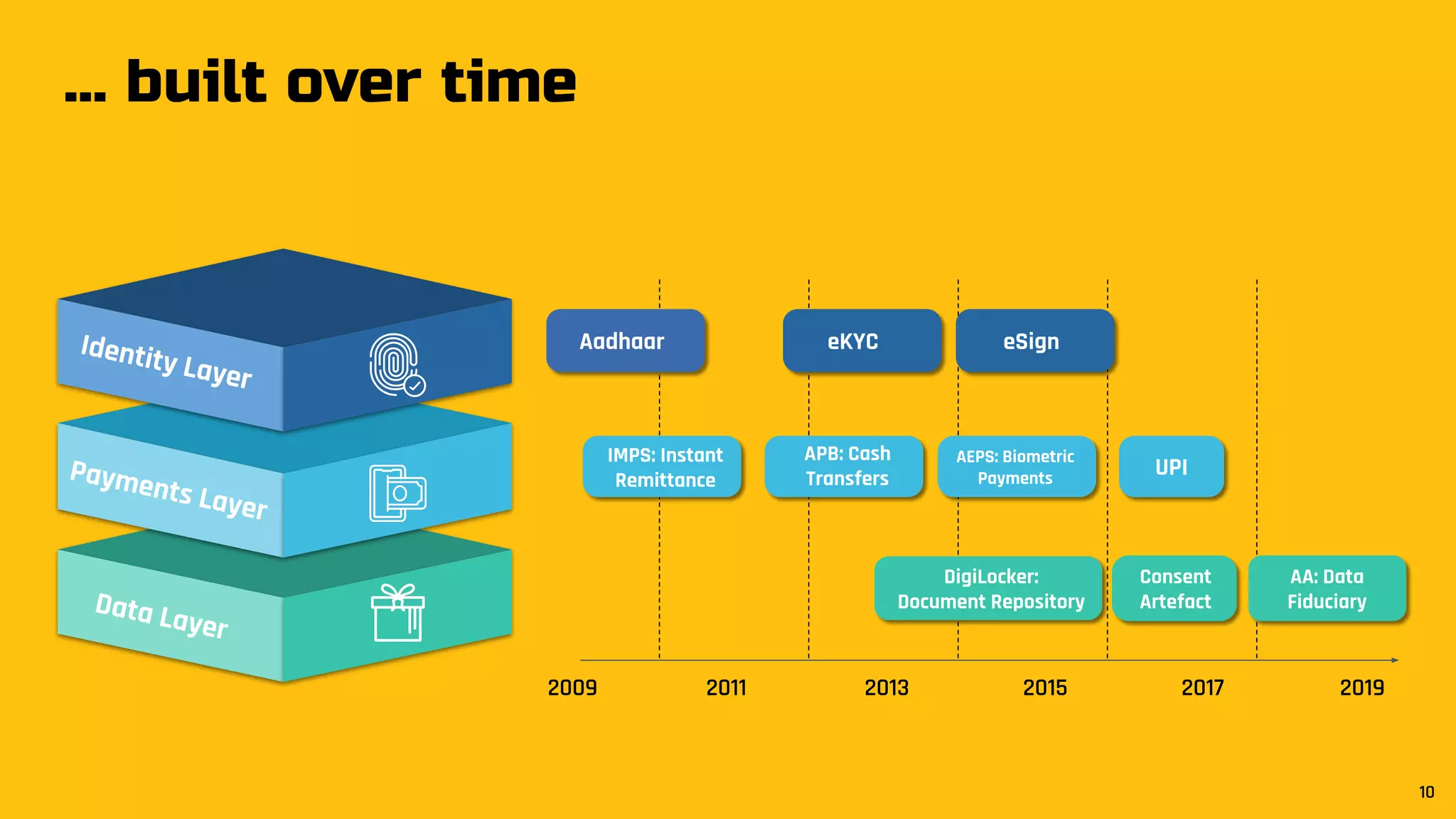

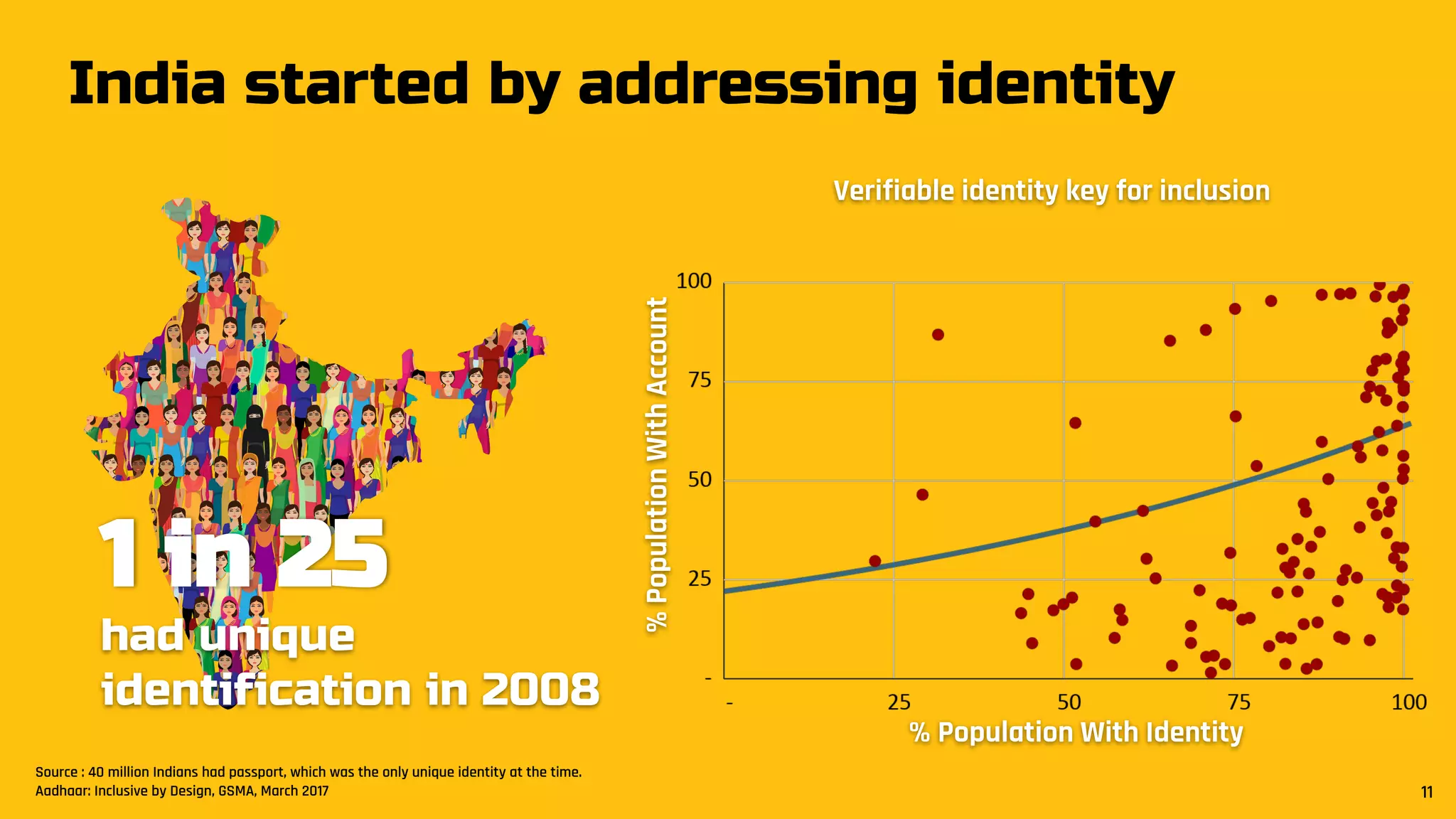

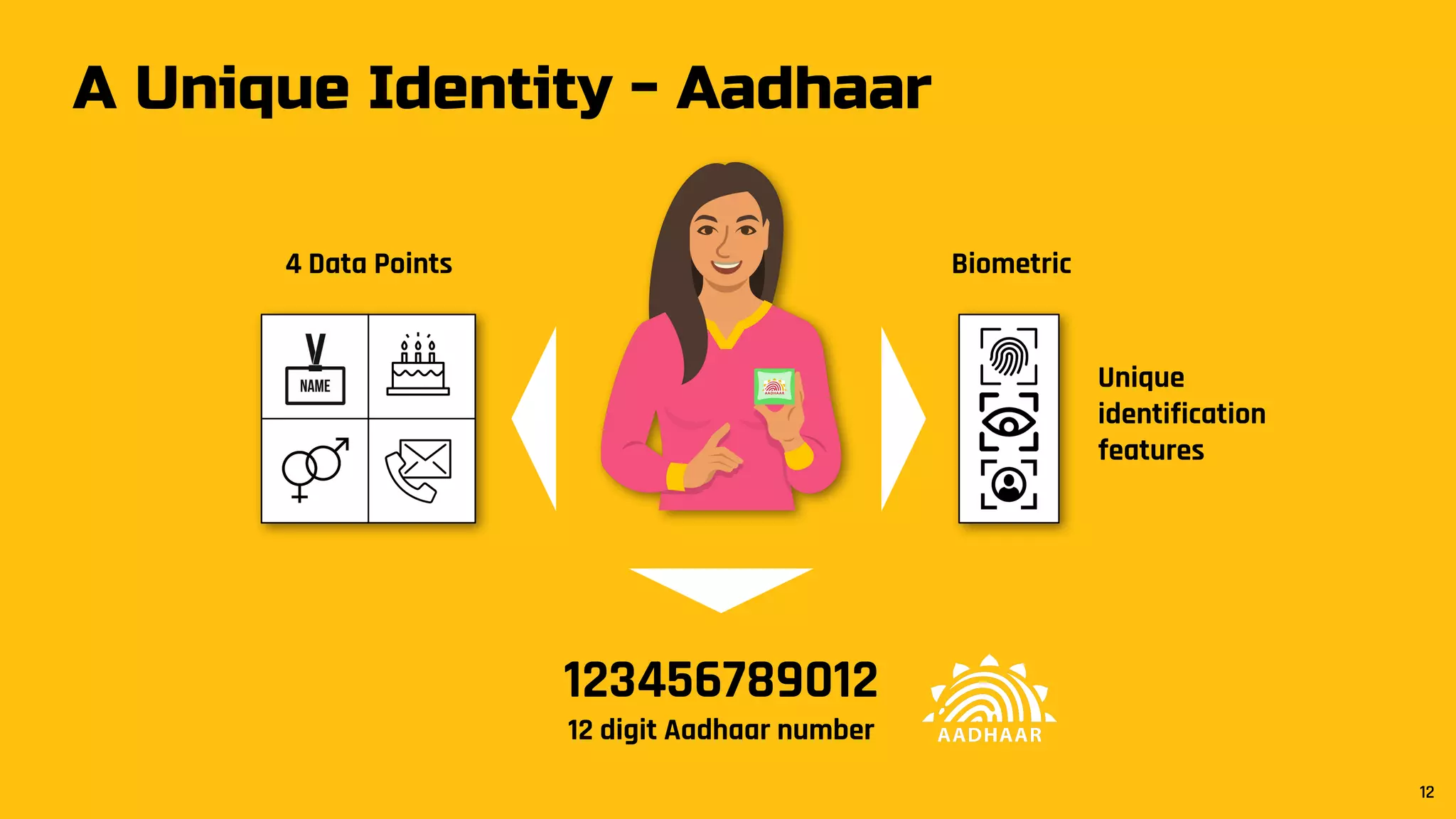

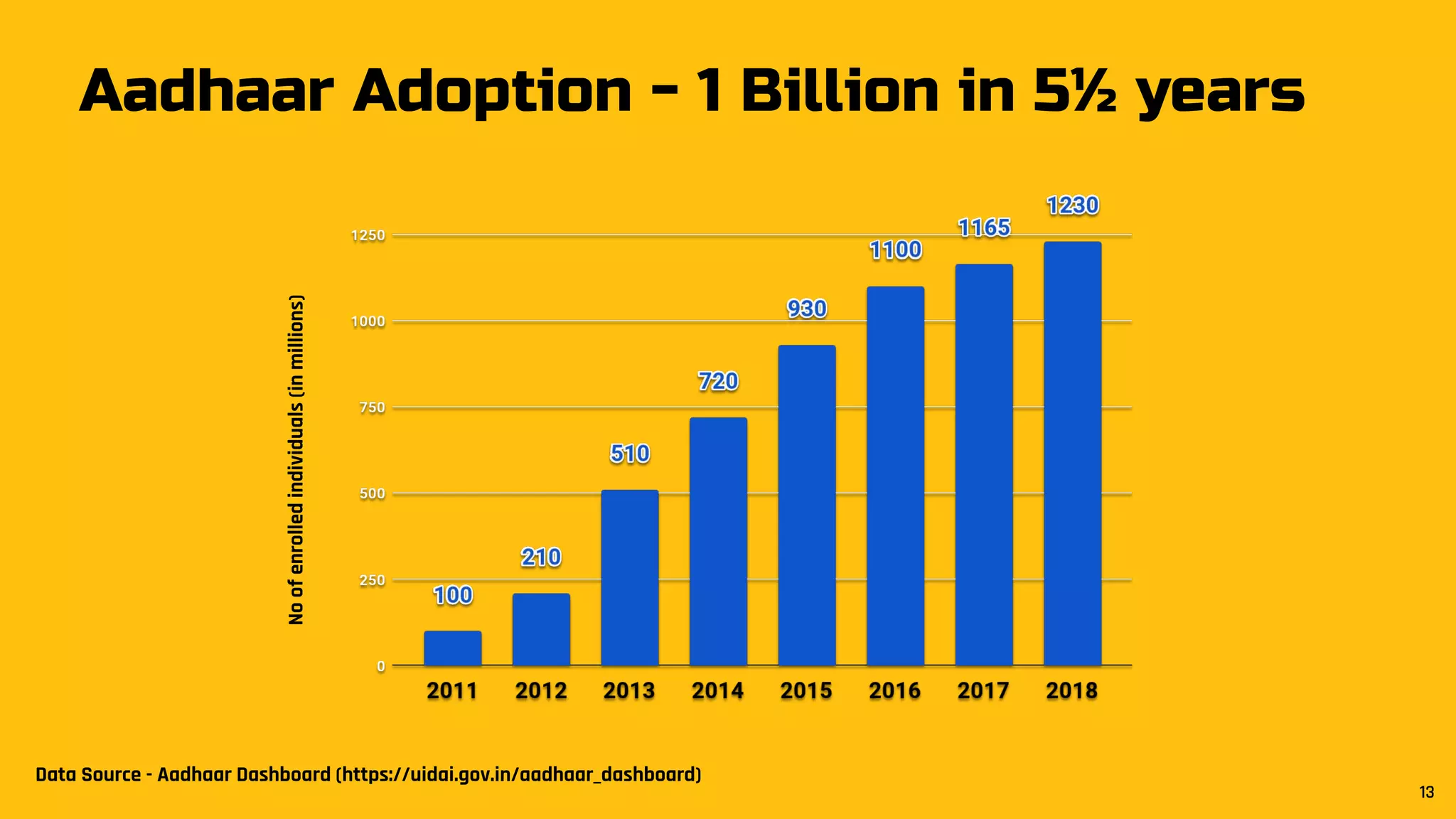

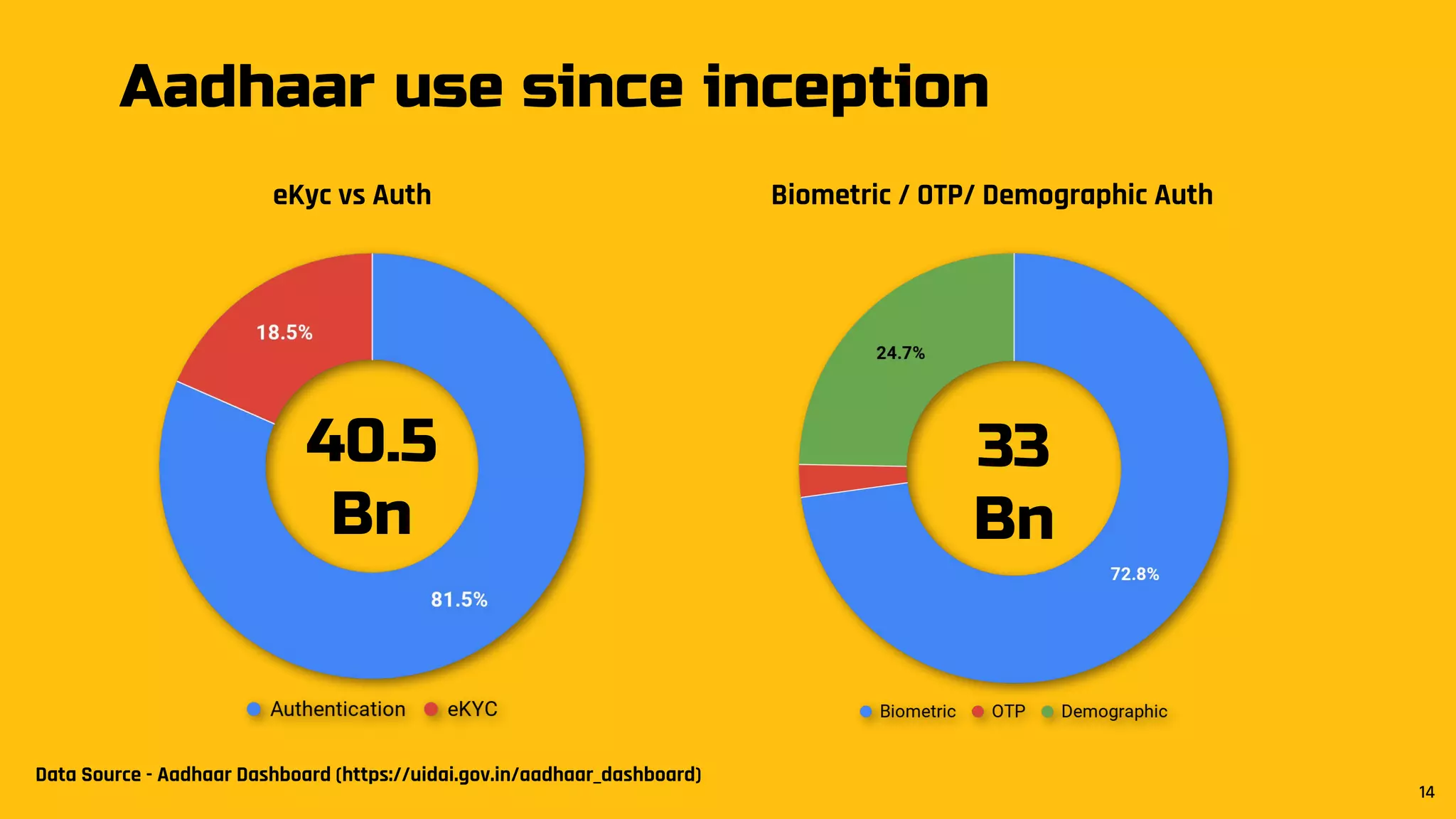

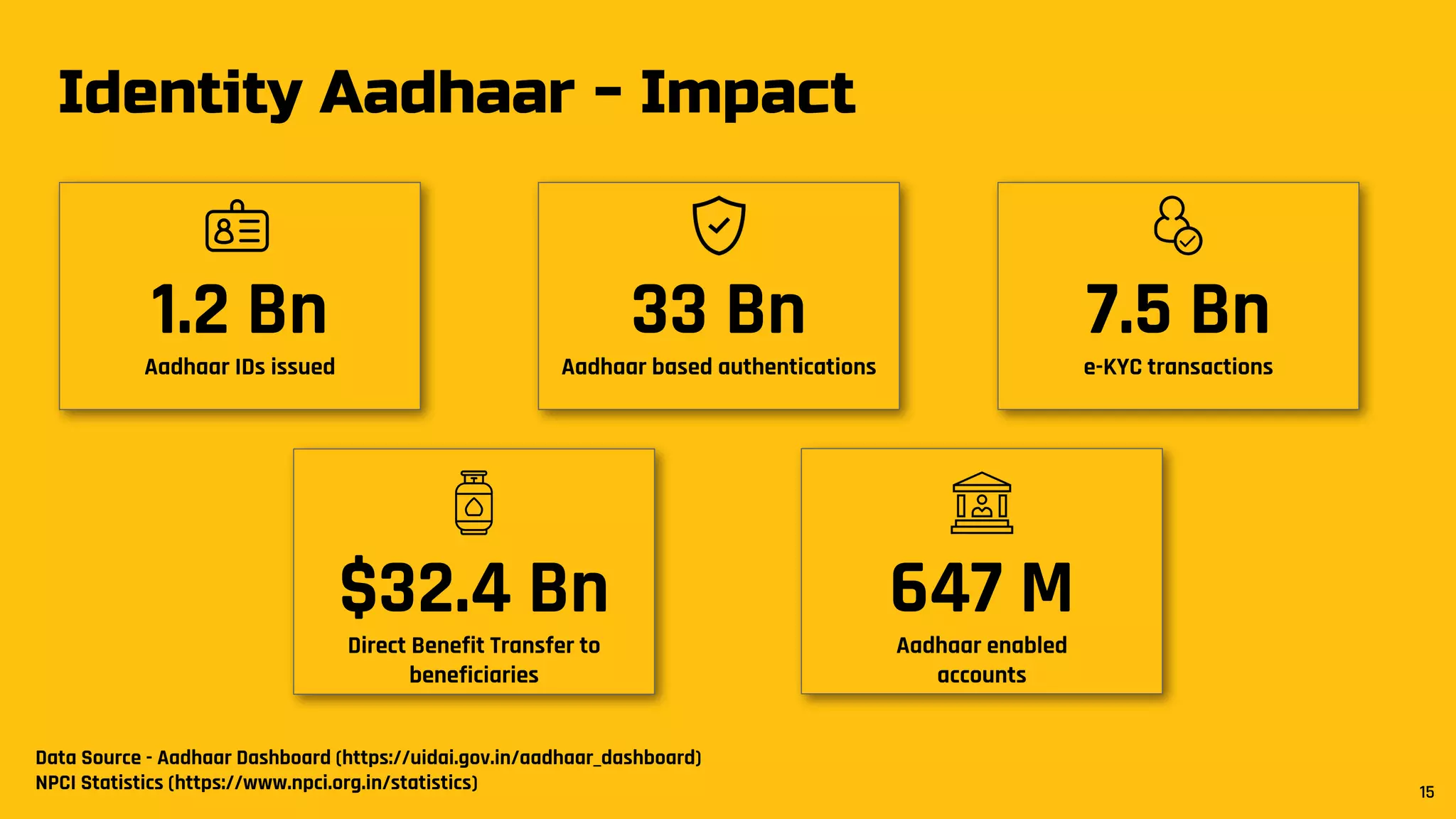

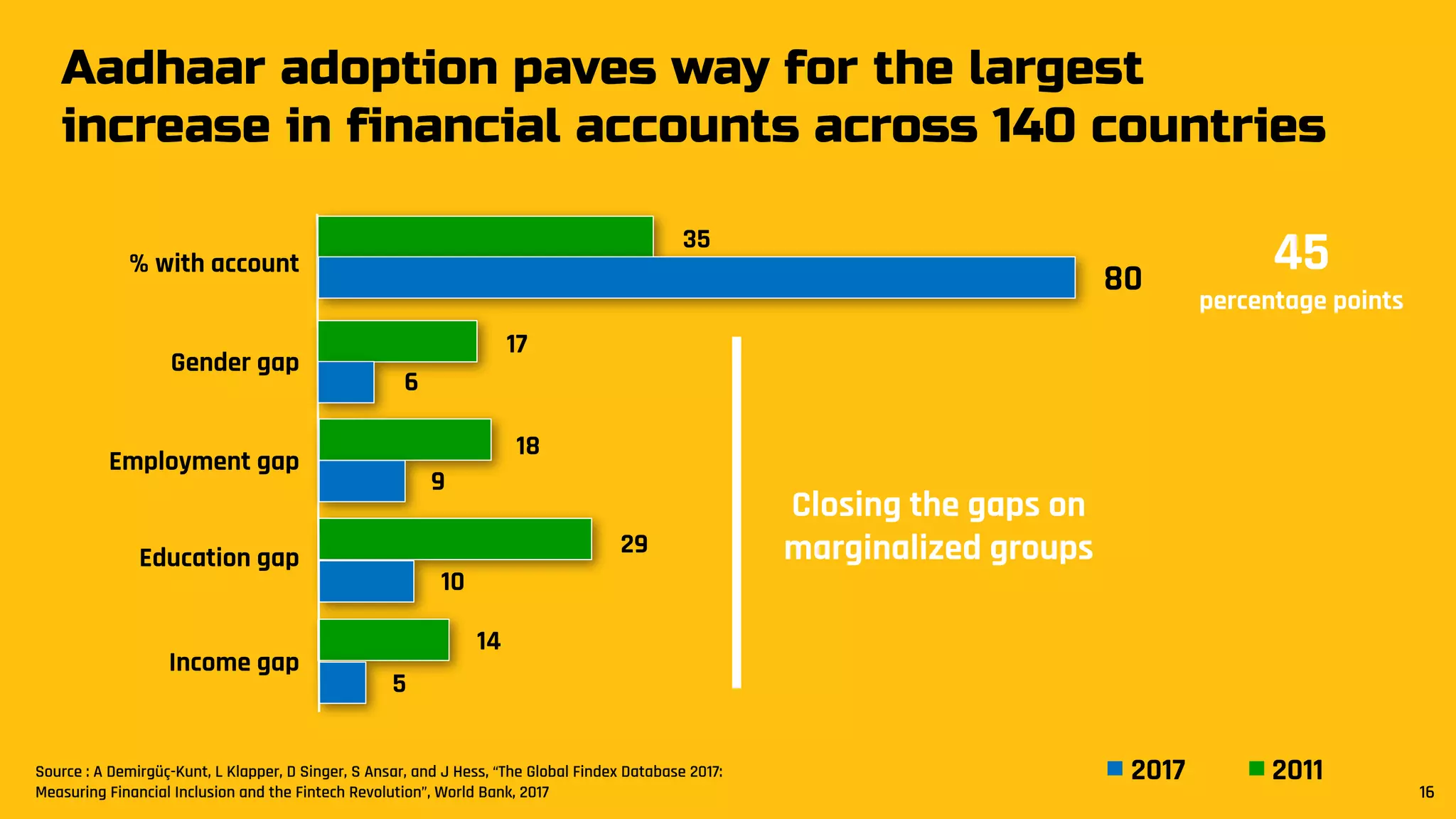

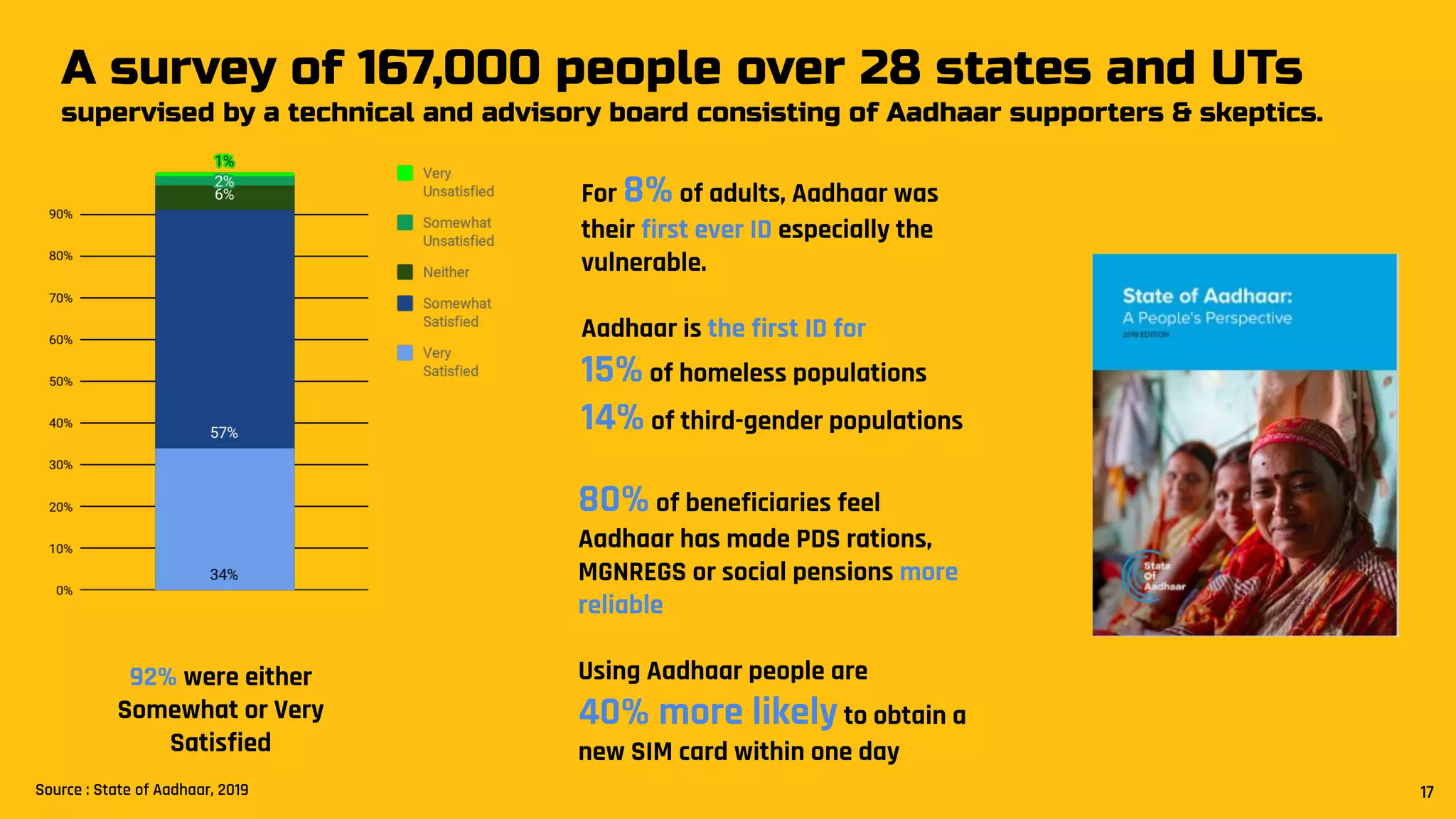

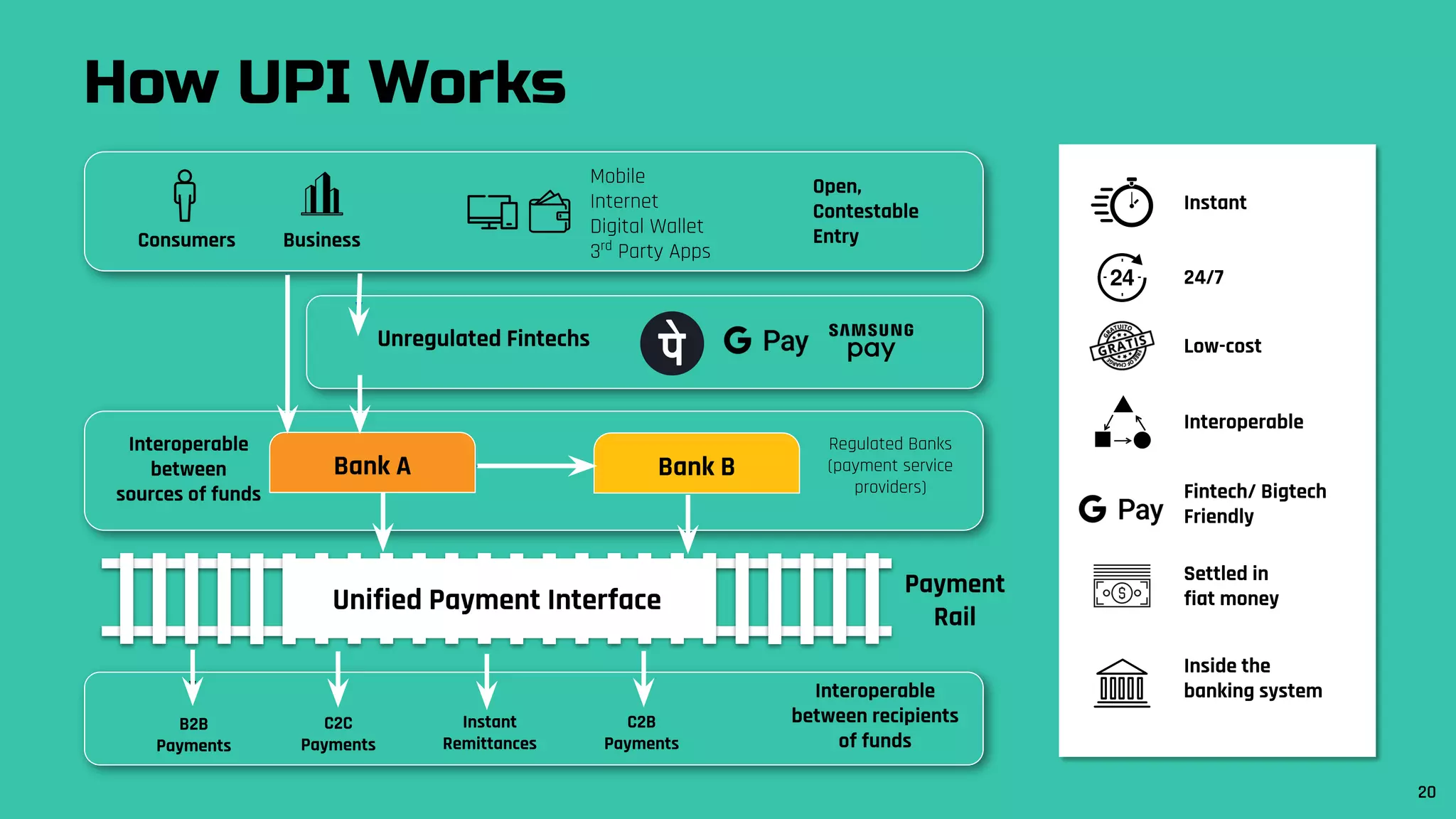

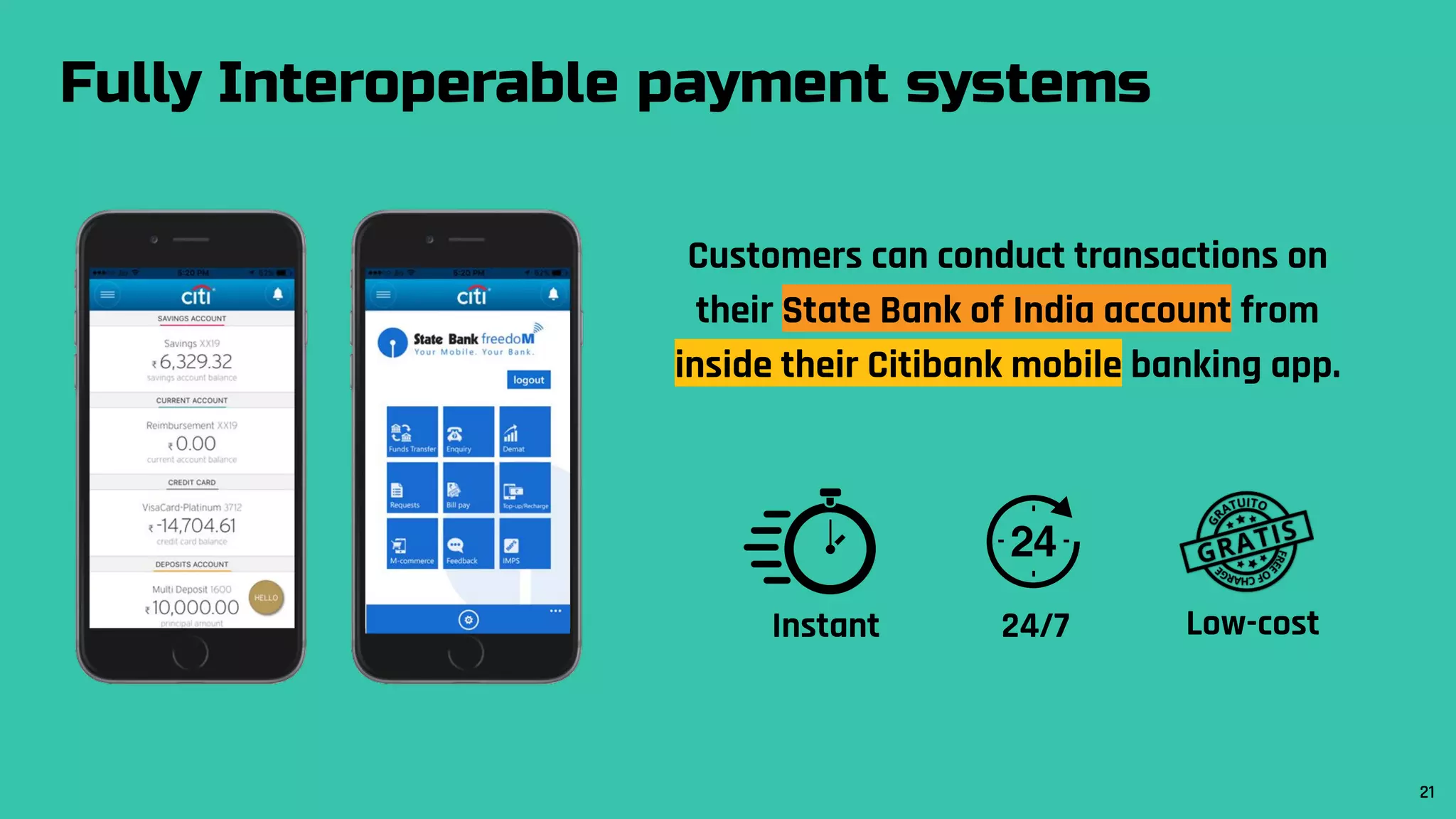

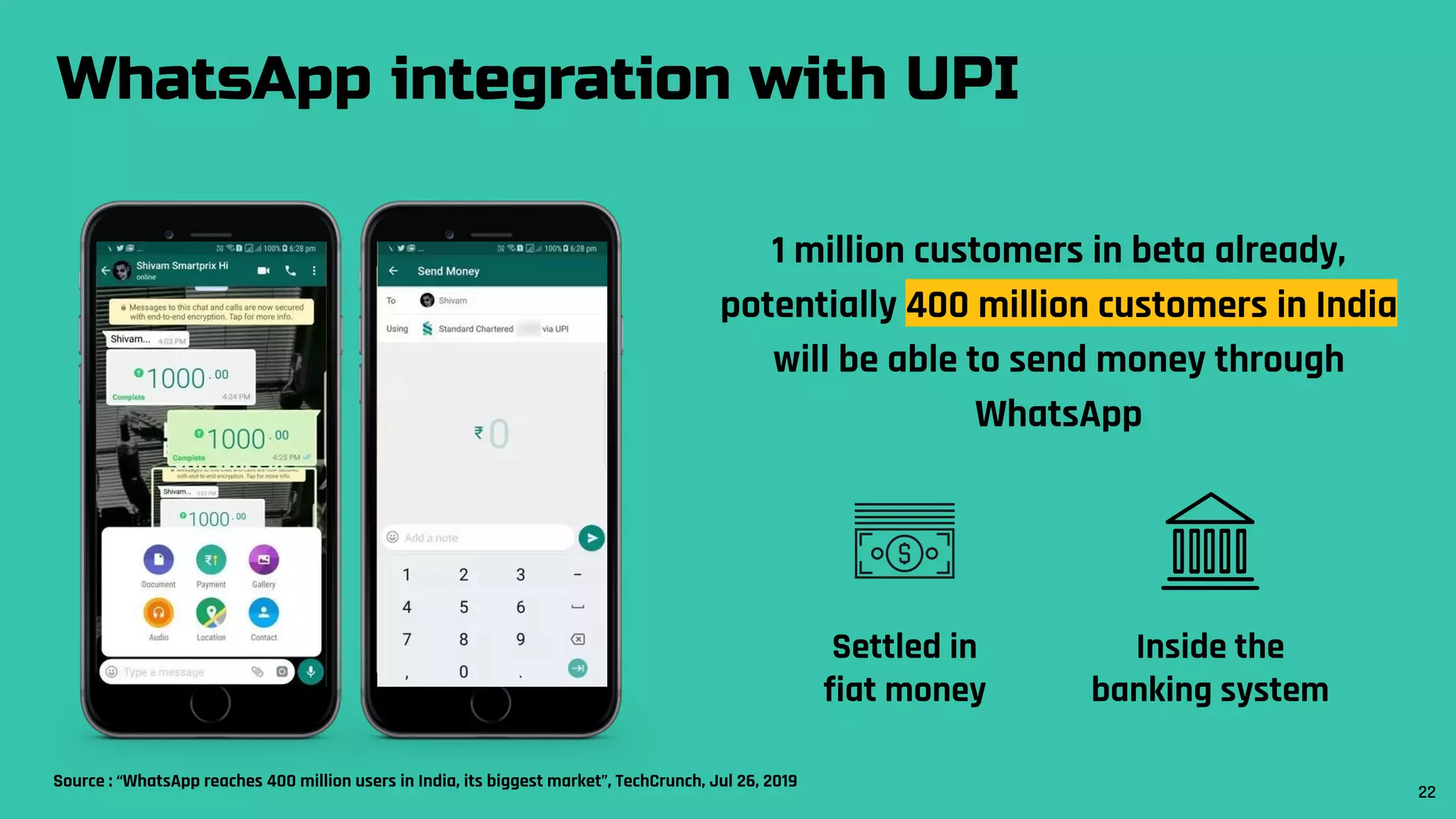

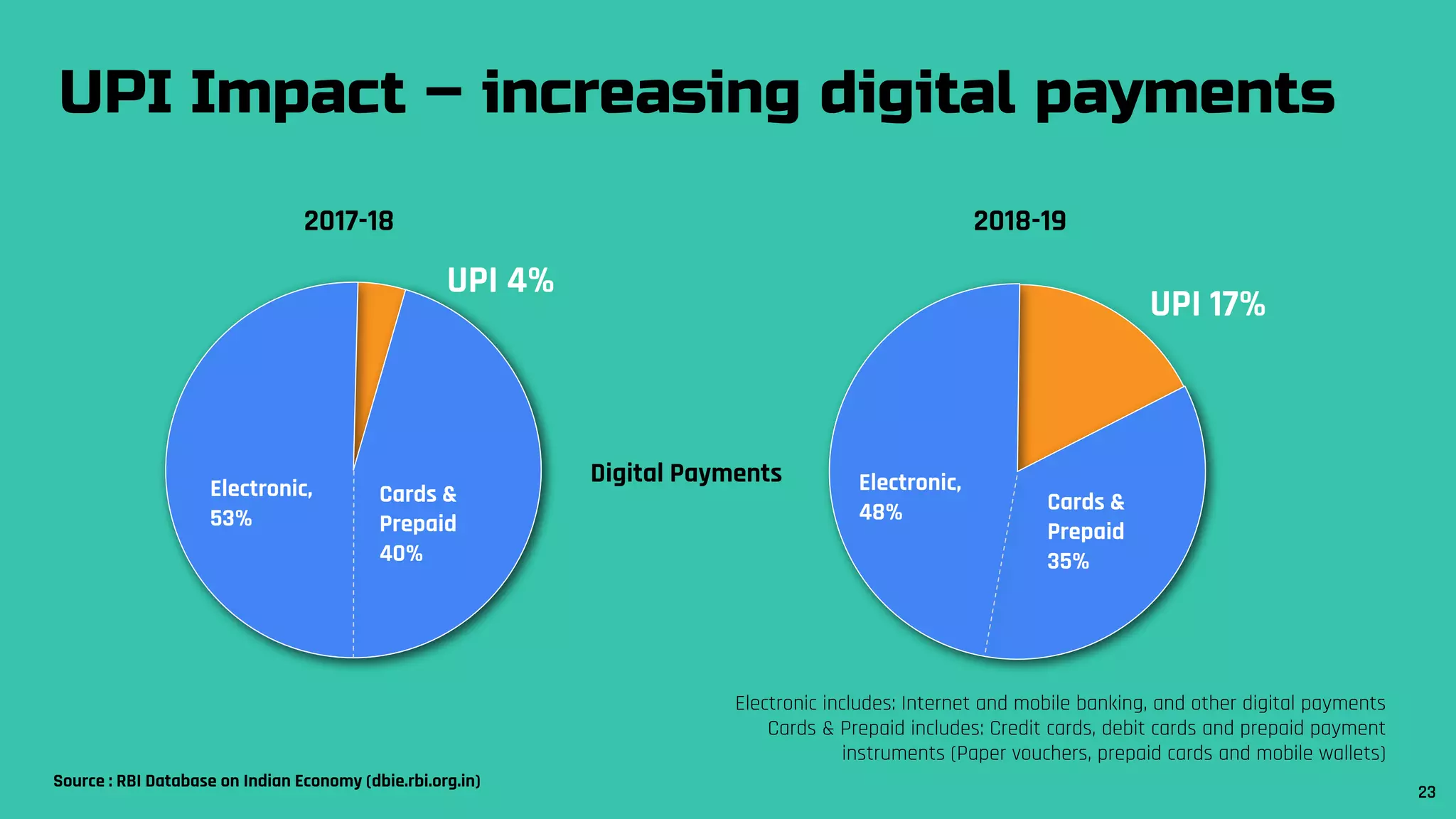

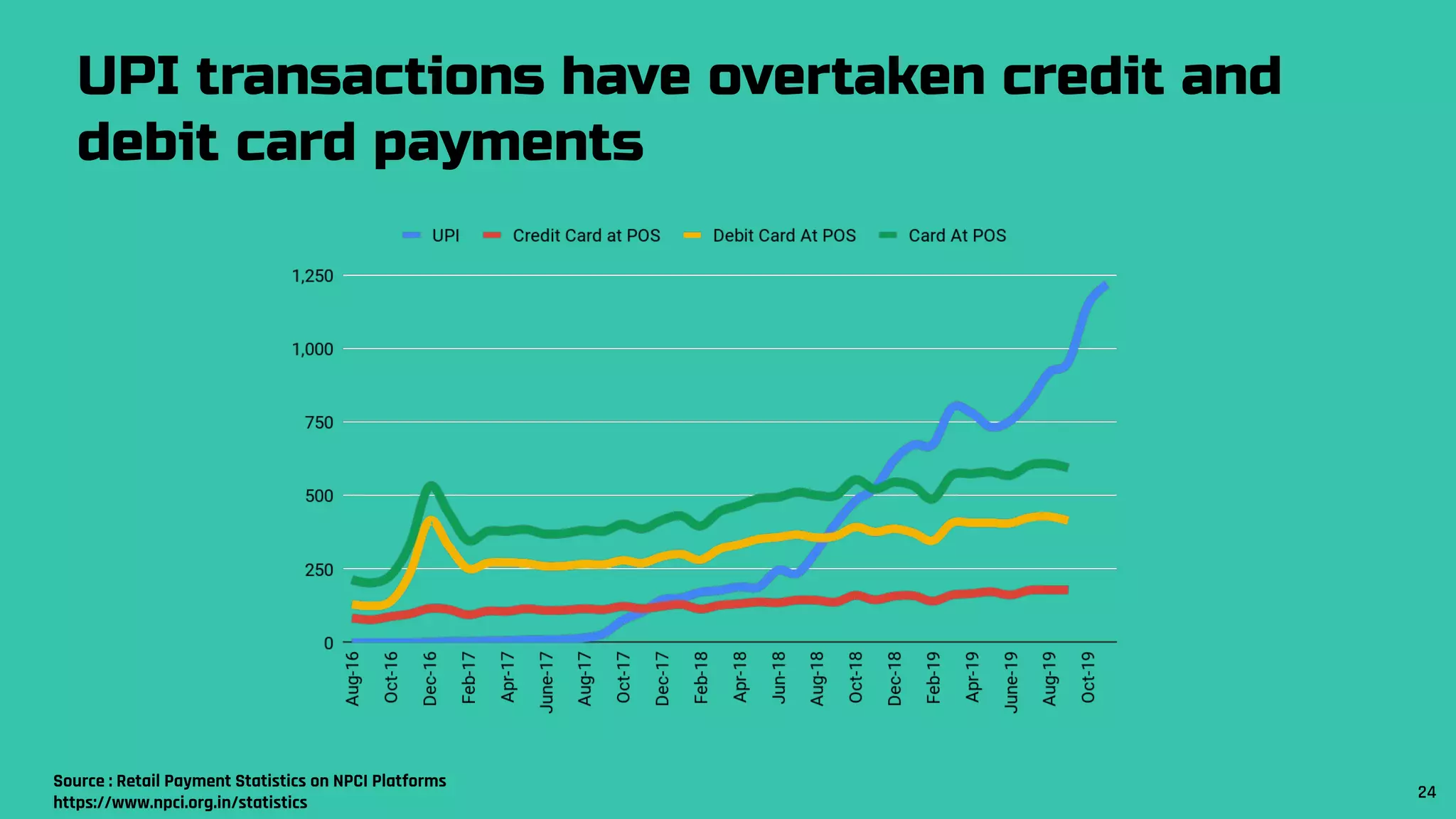

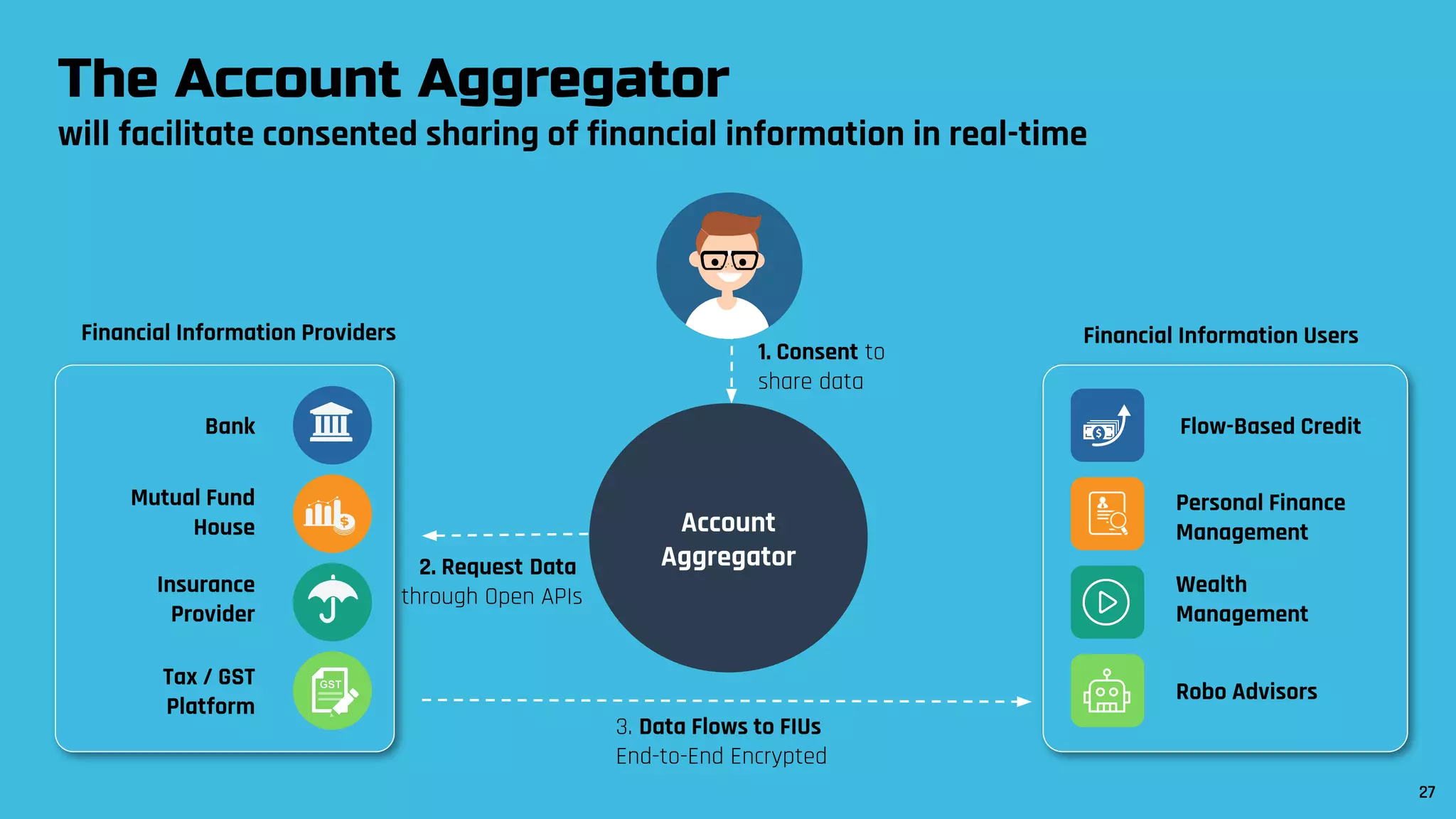

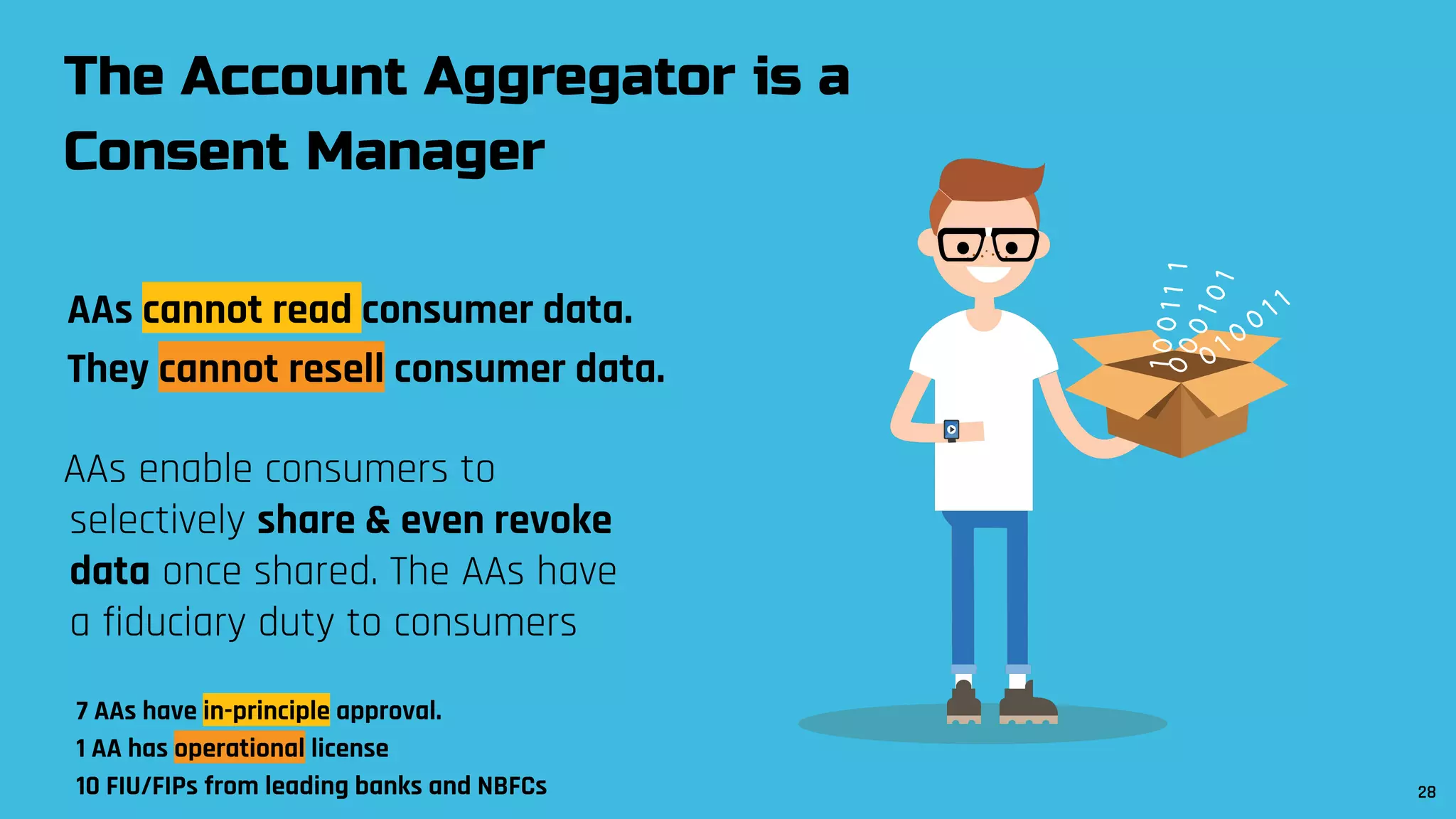

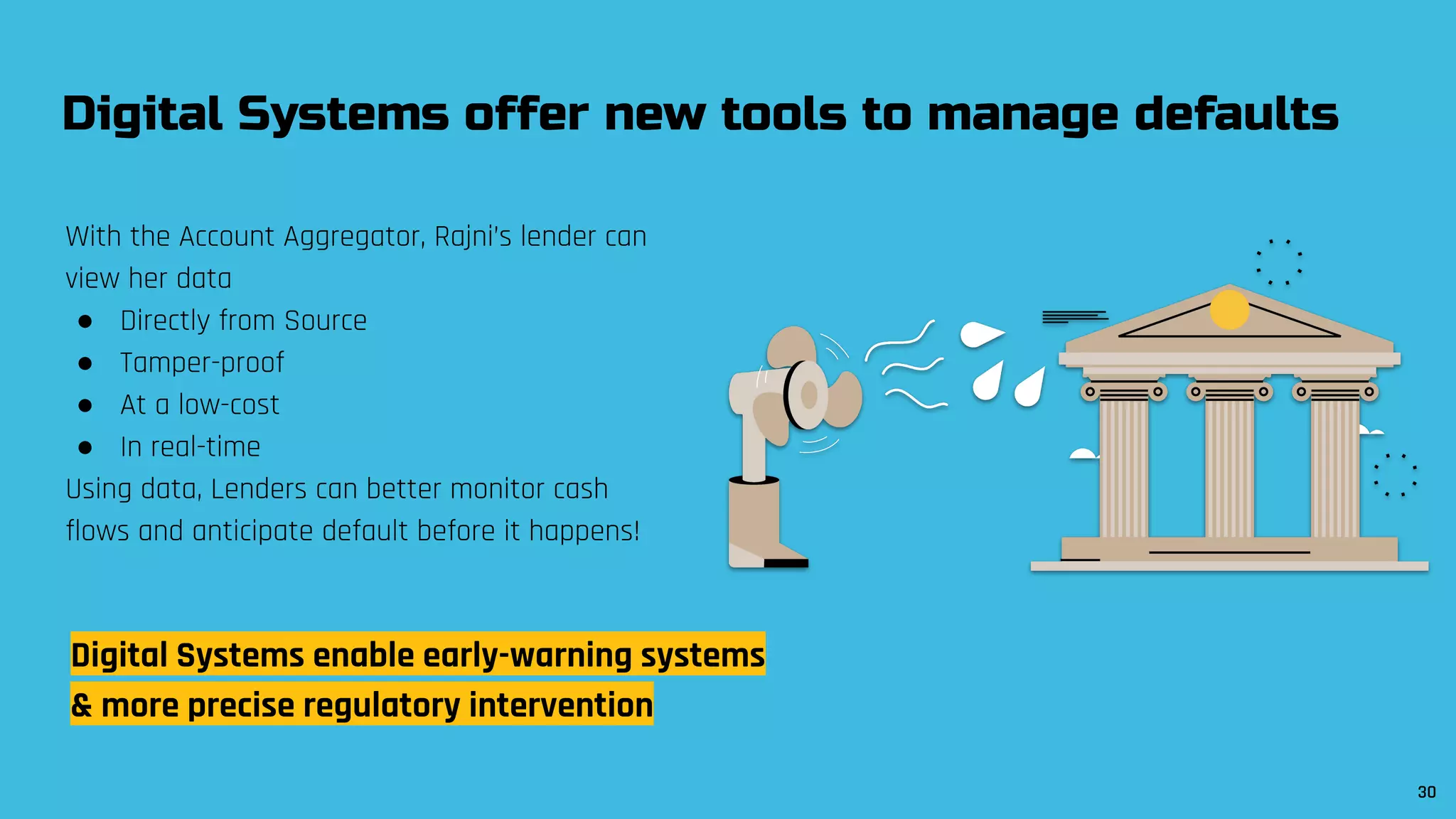

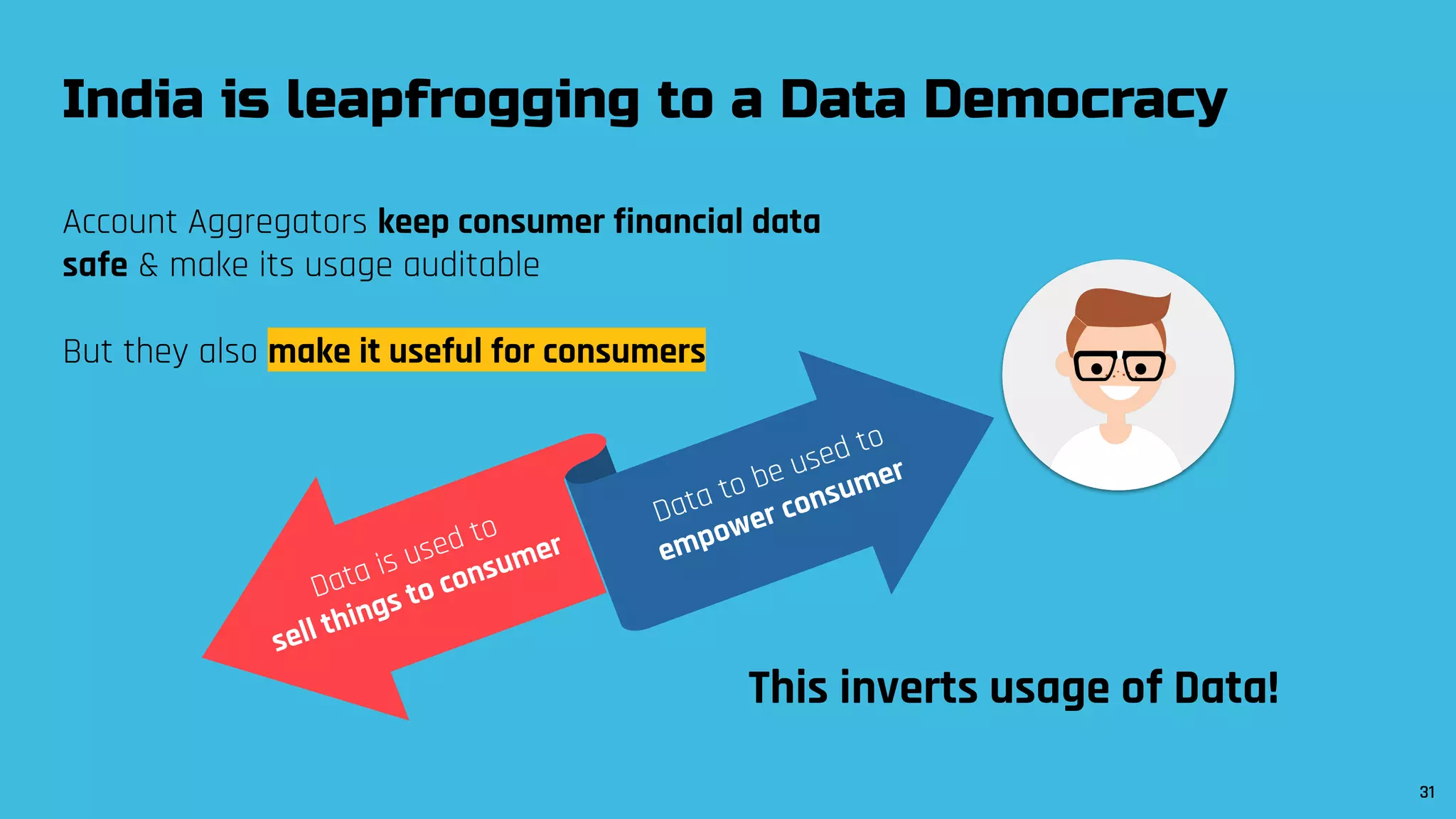

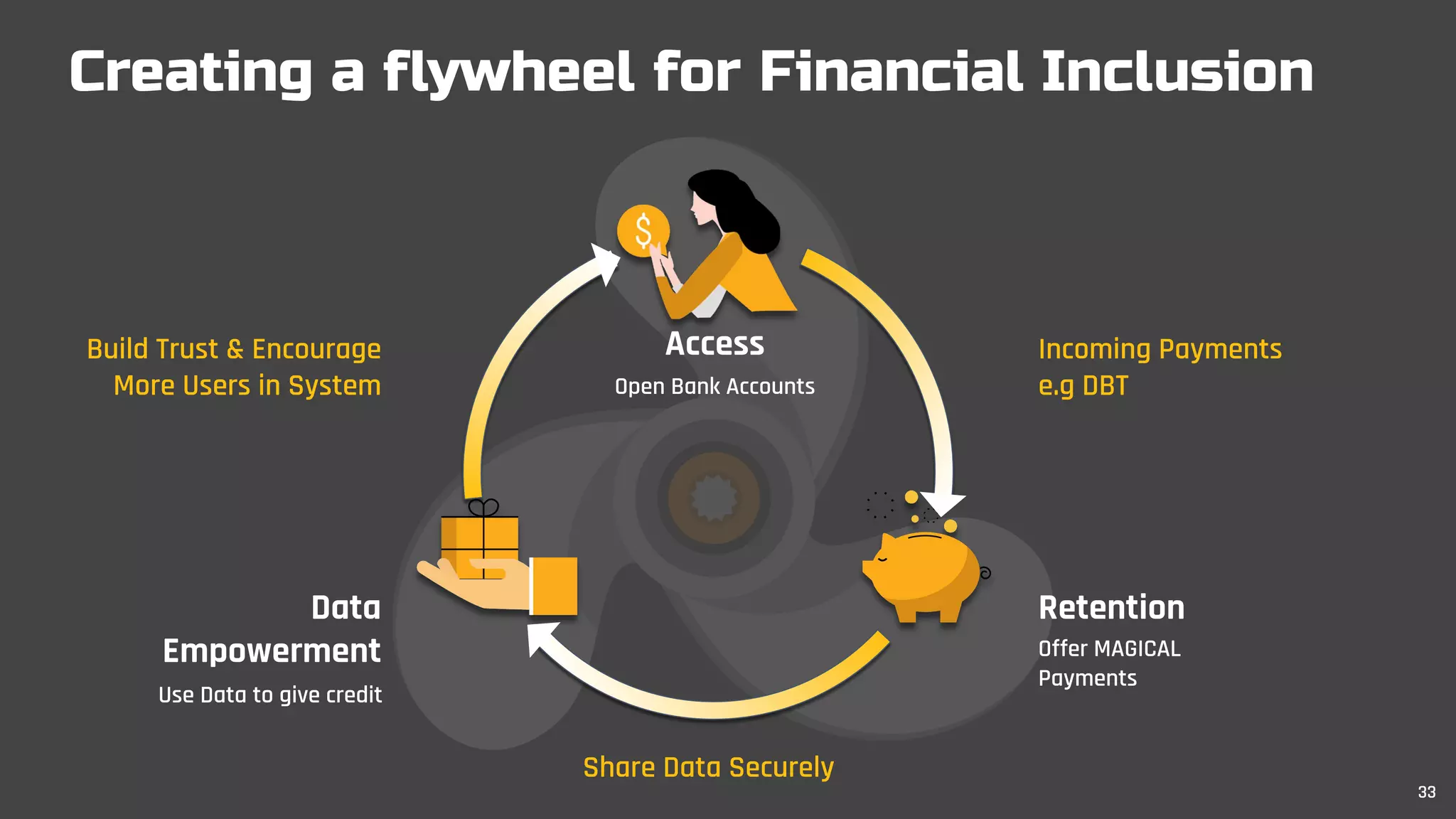

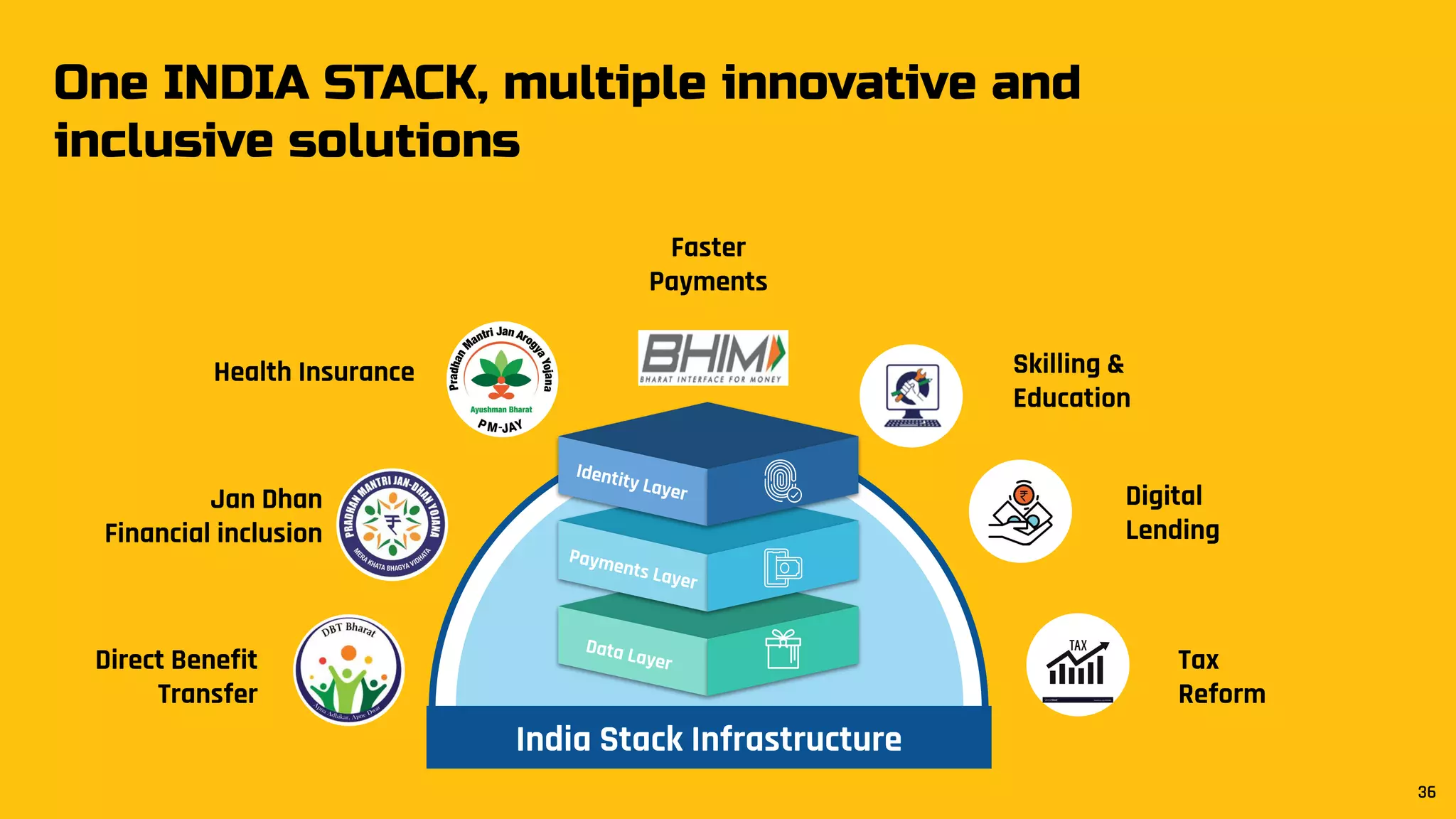

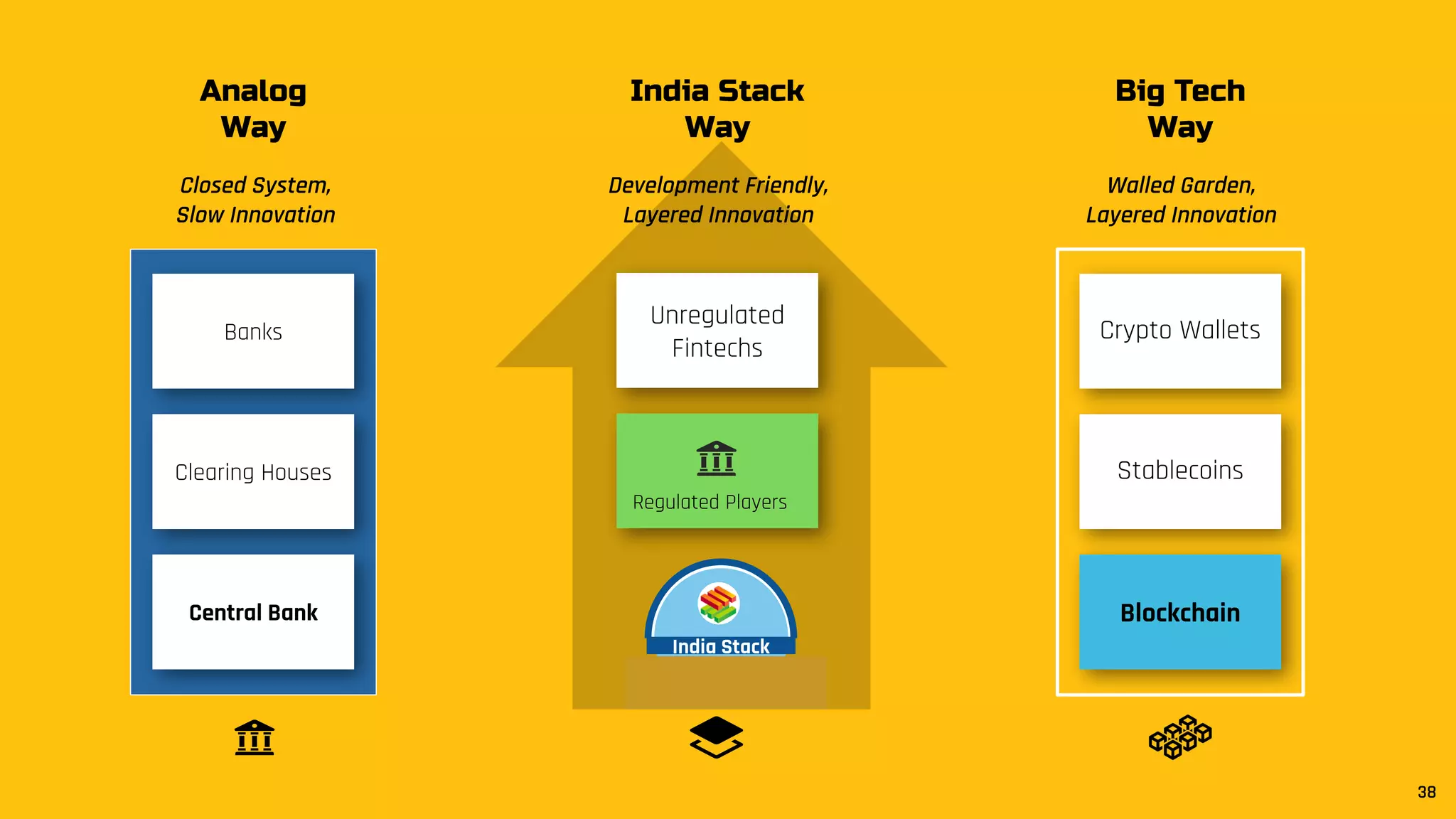

The document discusses the three challenges of financial inclusion in India: access, retention, and data empowerment. It highlights the success of the India Stack initiative, which includes unique identity verification through Aadhaar, a unified payments interface (UPI), and mechanisms for secure data sharing. These innovations have significantly increased financial inclusion and improved access to services for marginalized groups while addressing privacy concerns in data usage.