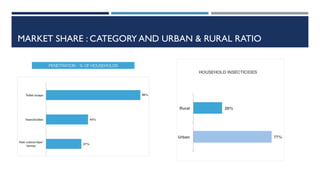

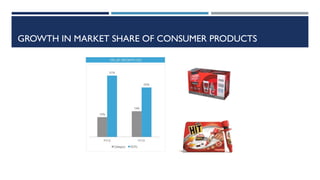

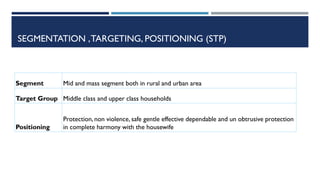

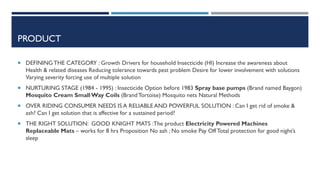

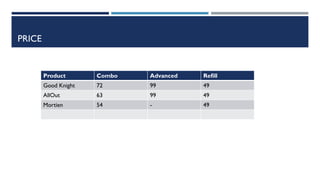

The document discusses the mosquito repellent market in India, highlighting Godrej's leading position with its brand Good Knight alongside competitors like Reckitt Benckiser's Mortein and S.C. Johnson's All Out. It covers market size, shares, key players, and the strategic history and branding of Godrej Consumer Products. Additionally, it outlines recommendations for further growth and addresses the brand's strengths, weaknesses, opportunities, and threats in an evolving market.