GSTR 9C Annual Return with example

•

0 likes•488 views

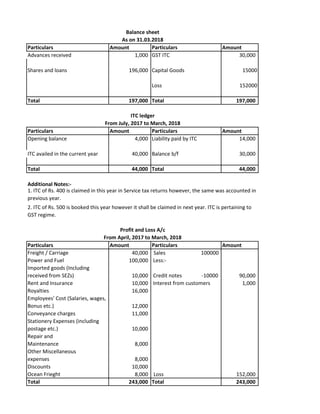

This document contains financial statements and additional notes related to income, expenses, input tax credit, and sales for a business. It includes a balance sheet, input tax credit ledger, and profit and loss statement for the period of April 2017 to March 2018. The additional notes provide clarifications on revenue and expense amounts, import of services, credit notes, discounts, sales booking and billing dates, annual return details, blocked and reversed input tax credits, and taxable rates.

Report

Share

Report

Share

Download to read offline

Recommended

More Related Content

What's hot

What's hot (20)

Updated master guide on gst annual return and audit including 20 case studies

Updated master guide on gst annual return and audit including 20 case studies

All about GST Department's Audit under section 65 of CGST Act

All about GST Department's Audit under section 65 of CGST Act

Tax Audit under section 44AB of Income Tax Act,1961

Tax Audit under section 44AB of Income Tax Act,1961

Step by Step Guide to File GSTR 9A Annual Composition Form

Step by Step Guide to File GSTR 9A Annual Composition Form

Reconciliation Statement and Certification under GST - Form GSTR 9C

Reconciliation Statement and Certification under GST - Form GSTR 9C

Finance Act 2016 Amendments in Income Tax Laws - A Y 2017-18

Finance Act 2016 Amendments in Income Tax Laws - A Y 2017-18

Similar to GSTR 9C Annual Return with example

Question analysis icab application level taxation ii (syllabus weight based)

Question analysis icab application level taxation ii (syllabus weight based)Optimal Management Solution

Budget 2016 Presentation - Part i (Transfer Pricing and International Tax)

Budget 2016 Presentation - Part i (Transfer Pricing and International Tax)Nilesh Patel - CPA (USA), IRS

Similar to GSTR 9C Annual Return with example (20)

Question analysis icab application level taxation ii (syllabus weight based)

Question analysis icab application level taxation ii (syllabus weight based)

Budget 2016 Presentation - Part i (Transfer Pricing and International Tax)

Budget 2016 Presentation - Part i (Transfer Pricing and International Tax)

Advanced taxation (cfap5) by fawad hassan [lecture2]![Advanced taxation (cfap5) by fawad hassan [lecture2]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Advanced taxation (cfap5) by fawad hassan [lecture2]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Advanced taxation (cfap5) by fawad hassan [lecture2]

More from sandesh mundra

More from sandesh mundra (20)

Complications of GST for Real-Estate and Developers

Complications of GST for Real-Estate and Developers

Rotary Club of Ahmedabad West - Lets Connect to the Future

Rotary Club of Ahmedabad West - Lets Connect to the Future

Recently uploaded

80 ĐỀ THI THỬ TUYỂN SINH TIẾNG ANH VÀO 10 SỞ GD – ĐT THÀNH PHỐ HỒ CHÍ MINH NĂ...

80 ĐỀ THI THỬ TUYỂN SINH TIẾNG ANH VÀO 10 SỞ GD – ĐT THÀNH PHỐ HỒ CHÍ MINH NĂ...Nguyen Thanh Tu Collection

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...Nguyen Thanh Tu Collection

Recently uploaded (20)

80 ĐỀ THI THỬ TUYỂN SINH TIẾNG ANH VÀO 10 SỞ GD – ĐT THÀNH PHỐ HỒ CHÍ MINH NĂ...

80 ĐỀ THI THỬ TUYỂN SINH TIẾNG ANH VÀO 10 SỞ GD – ĐT THÀNH PHỐ HỒ CHÍ MINH NĂ...

HMCS Vancouver Pre-Deployment Brief - May 2024 (Web Version).pptx

HMCS Vancouver Pre-Deployment Brief - May 2024 (Web Version).pptx

HMCS Max Bernays Pre-Deployment Brief (May 2024).pptx

HMCS Max Bernays Pre-Deployment Brief (May 2024).pptx

Micro-Scholarship, What it is, How can it help me.pdf

Micro-Scholarship, What it is, How can it help me.pdf

ICT role in 21st century education and it's challenges.

ICT role in 21st century education and it's challenges.

Kodo Millet PPT made by Ghanshyam bairwa college of Agriculture kumher bhara...

Kodo Millet PPT made by Ghanshyam bairwa college of Agriculture kumher bhara...

Fostering Friendships - Enhancing Social Bonds in the Classroom

Fostering Friendships - Enhancing Social Bonds in the Classroom

Python Notes for mca i year students osmania university.docx

Python Notes for mca i year students osmania university.docx

This PowerPoint helps students to consider the concept of infinity.

This PowerPoint helps students to consider the concept of infinity.

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

Beyond_Borders_Understanding_Anime_and_Manga_Fandom_A_Comprehensive_Audience_...

Beyond_Borders_Understanding_Anime_and_Manga_Fandom_A_Comprehensive_Audience_...

GSTR 9C Annual Return with example

- 1. Particulars Amount Particulars Amount Advances received 1,000 GST ITC 30,000 Shares and loans 196,000 Capital Goods 15000 Loss 152000 Total 197,000 Total 197,000 Particulars Amount Particulars Amount Opening balance 4,000 Liability paid by ITC 14,000 ITC availed in the current year 40,000 Balance b/f 30,000 Total 44,000 Total 44,000 Additional Notes:- Particulars Amount Particulars Amount Freight / Carriage 40,000 Sales 100000 Power and Fuel 100,000 Less:- Imported goods (Including received from SEZs) 10,000 Credit notes -10000 90,000 Rent and Insurance 10,000 Interest from customers 1,000 Royalties 16,000 Employees' Cost (Salaries, wages, Bonus etc.) 12,000 Conveyance charges 11,000 Stationery Expenses (including postage etc.) 10,000 Repair and Maintenance 8,000 Other Miscellaneous expenses 8,000 Discounts 10,000 Ocean Frieght 8,000 Loss 152,000 Total 243,000 Total 243,000 2. ITC of Rs. 500 is booked this year however it shall be claimed in next year. ITC is pertaining to GST regime. Balance sheet ITC ledger 1. ITC of Rs. 400 is claimed in this year in Service tax returns however, the same was accounted in previous year. As on 31.03.2018 From July, 2017 to March, 2018 Profit and Loss A/c From April, 2017 to March, 2018

- 2. Additional Information :- 1. Amount of Rs. 5,000 was booked as revenue last year but billing is done in this year after July, 2. Import of service without consideration from a sister concern amounts to Rs. 10,000. The 3. Credits notes of February, 2018 was issued in May, 2018 for Rs. 10,000. 4. Discounts shown in Profit and Loss account are pertaining to March, 2018 and are not 5. Turnover in Profit and Loss account includes Rs. 5,000 for the period of April, 2017 to June, 6. Sales for Rs. 4,000 is booked in March, 2018 but niether the invoice has been issued and nor 7. Sales includes advance adjustment of last year for Rs. 1,000. 8. Turnover shown in annual return is Rs. 1,10,000. Taxable turnover shown in annual return is Rs. 14. Credit of tax paid on Insurance expense of Rs. 1800 are blocked u/s 17(5) which have not 15.Credit reversed under Rule 42 is 100 which was reversed in April, 2018 pertaining to 16. Credit of tax paid on other miscellaneous expense of Rs. 1440 is blocked u/s 17(5) which have 17. ITC claimed in annual return is Rs. 39,900. 9. Receipts of RS. 40,000 are not taxable on account of zero rated, RCM and other factors. The 10. The expense shown under Profit and Loss account may be assumed to be post GST only. 11. All expenses are subjected to GST at 18% and are booked net of GST. 12. Turnover of Rs. 50,000 is taxable at 5% and the balance turnover is taxable at 18%. 13. All sales are IGST in nature.