GSTR-9 Annual Return -Updated with Case Studies (GST)

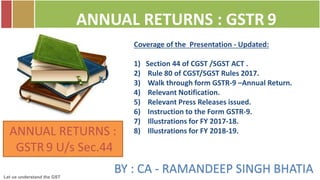

- 1. Let us understand the GST BY : CA - RAMANDEEP SINGH BHATIA ANNUAL RETURNS : GSTR 9 ANNUAL RETURNS : GSTR 9 U/s Sec.44 Coverage of the Presentation - Updated: 1) Section 44 of CGST /SGST ACT . 2) Rule 80 of CGST/SGST Rules 2017. 3) Walk through form GSTR-9 –Annual Return. 4) Relevant Notification. 5) Relevant Press Releases issued. 6) Instruction to the Form GSTR-9. 7) Illustrations for FY 2017-18. 8) Illustrations for FY 2018-19.

- 2. Let us understand the GST CONTENTS 1)Section 44 of CGST /SGST ACT . 2) Rule 80 of CGST/SGST Rules 2017. 3) Walk through form GSTR-9 –Annual Return. 4) Relevant Notification issued with regards GSTR-9. 5) Relevant Press Releases issued. 6) Instruction to the Form GSTR-9. 7) Illustrations for FY 2017-18. 8) Illustrations for FY 2018-19. GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 3. Let us understand the GST GST PORTAL – LIABILITY INPUT TAX CREDIT BOOKS OF ACCOUNTS – FINANCIAL STATEMENTS GSTR-9- Annual Return - Scrutiny –U/s 61 - Assessments-U/s 62, 63 ,64 - Audit –U/s 65 - Special Audit –U/s 66 - Demand & Recovery U/s 73 & 74 Etc. GSTR -3B GSTR-1 -Registered Suppliers GSTR-9C – GST AUDIT & RECONCILIATION Registered Suppliers with over & above prescribed turnover limits OVERVIEW GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 4. Let us understand the GST WHAT IS SUPRESSION ? Section 74 Explanation 2.–– For the purposes of this Act, the expression “suppression” shall mean non-declaration of facts or information which a taxable person is required to declare in the return, statement, report or any other document furnished under this Act or the rules made thereunder, or failure to furnish any information on being asked for, in writing, by the proper officer. GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 5. Let us understand the GST LEGAL PROVISION – ANNUAL RETURN Sec 44(1) requires every registered person furnish an annual return for every financialyear electronically Not Applicable for • Input Service Distributor, • a person paying tax under section 51 or section 52, • a casual taxable person and • a non-resident taxable person GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 6. Let us understand the GST LEGAL PROVISION – RULE -80 80. Annual return. — (1) Every registered person [other than those referred to in the proviso to sub-section (5) of section 35], other than an Input Service Distributor, a person paying tax under section 51 or section 52, a casual taxable person and a nonresident taxable person, shall furnish an annual return as specified under sub- section (1) of section 44 electronically in FORM GSTR-9 through the common portal either directly or through a Facilitation Centre notified by the Commissioner : Provided that a person paying tax under section 10 shall furnish the annual return in FORM GSTR-9A. (2) Every electronic commerce operator required to collect tax at source under section 52 shall furnish annual statement referred to in sub-section (5) of the said section in FORM GSTR-9B. GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 7. Let us understand the GST LEGAL PROVISION – SEC-35(5) 35-(5) Every registered person whose turnover during a financial year exceeds the prescribed limit shall get his accounts audited by a chartered accountant or a cost accountant and shall submit a copy of the audited annual accounts, the reconciliation statement under sub-section (2) of section 44 and such other documents in such form and manner as may be prescribed. “Provided that nothing contained in this sub-section shall apply to any department of the Central Government or a State Government or a local authority, whose books of account are subject to audit by the Comptroller and Auditor-General of India or an auditor appointed for auditing the accounts of local authorities under any law for the time being in force.” GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 8. Let us understand the GST OPTIONAL FOR SMALL TAXPAYERS HAVING AGGREGATE TURNOVER LESS THAN 2 CRORE Annual return — Filing of Annual return under Section 44(1) of CGST Act for FY 2017-18 2018-19 and 2019-20* optional for small taxpayers having aggregate turnover less than 2 crore rupees and who have not filed the return before the due date In exercise of the powers conferred by section 148 of the Central Goods and Services Tax Act, 2017 (12 of 2017) (hereinafter referred to as the said Act), Follow the special procedure such that the said persons shall have the option to furnish the annual return under sub-section (1) of section 44 of the said Act read with sub-rule (1) of rule 80 of the said rules : Provided that the said return shall be deemed to be furnished on the due date if it has not been furnished before the due date. [Notification No. 47/2019-C.T., dated 9-10-2019] *[Notification No. 77/2020-C.T., dated 15-10-2020]

- 9. Let us understand the GST LEGAL PROVIOSNS (3) Every registered person whose aggregate turnover during a financial year exceeds two crore rupees shall get his accounts audited as specified under sub- section (5) of section 35 and he shall furnish a copy of audited annual accounts and a reconciliation statement, duly certified, in FORM GSTR-9C, electronically through the common portal either directly or through a Facilitation Centre notified by the Commissioner. “Provided that for the financial year 2018-2019 and 2019-2020, every registered person whose aggregate turnover exceeds five crore rupees shall get his accounts audited as specified under sub-section (5) of section 35 and he shall furnish a copy of audited annual accounts and a reconciliation statement, duly certified, in FORM GSTR- 9C for the said financial year, electronically through the common portal either directly or through a Facilitation Centre notified by the Commissioner.”. Originally Inserted vide Notf no. 16/2020-CT dt. 23.03.2020 Substituted vide Notf no. 79/2020-CT dt. 15.10.2020 GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 10. Let us understand the GST SUMMARY – APPLICABILITY Financial Year 2017-18 2018-19 2019-2020 GSTR-9 Annual Return Optional for small taxpayers having aggregate turnover less than 2 crore rupees GSTR-9A Composition Optional for small taxpayers having aggregate turnover less than 2 crore rupees GSTR-9B E-Com-TCS Form not notified as of date GSTR-9C Reconciliation Statement Exceeds two crore rupees Exceeds Five crore rupees GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 11. Let us understand the GST SUMMARY -APPLICABILITY OF ANNUAL RETURN Annual Return Registered Person: Rule 80(1) GSTR9 Composition Dealer : Rule 80(1) GSTR 9A TCS : Rule80(2) GSTR 9B Audit TO > 2 crores : : Rule 80(3) + GSTR9C Excludes ISD /TDS CTP/NRTP GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 12. Let us understand the GST SOME CRUCIAL ASPECTS –ANNUAL RETURN Period Coverage For 2017-18 : 1st July 2017 to 31st March 2018 Time Lines : 31st December following the end of FY. • Filling of GSTR-9 Annual Return / 9C is extended: Financial Year Due Date 2017-18 : 05th February 2020 2018-19 : 31st October 2020. 2019-20 : 31st December 2020. GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 13. Let us understand the GST CONSEQUENCES OF EXTENSION OF DUE DATE OF FILLING GSTR-9 Notice to issue show cause under section 73 (3 Year) & 74 (5 Years). Maintain books of account or other records Section 36 (72 Months ) Assessment of non-filers of returns Sec. 62 (5 Years) GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 14. Let us understand the GST WHAT IF THE ANNUAL RETURN IS NOT FILLED ON TIME? Notice for Non filer : Sec 46 read with Rule 68, A notice in FORM GSTR-3A shall be issued with in fifteen days, electronically, to a registered person who fails to furnishreturn under section 44. Late Filing Fees : Rs. 100/- per day per Act (CGST + SGST/UTGST), subject to a maximum amount of (0.25% CGST + 0.25% SGST/UTGST) of the turnover in the State. Sec. 125 “General Penalty” : Subjected to penalty up to Rs. 25,000/- per Act, (25000/- CGST plus 25000/- SGST=50,000/- in total) GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 15. Let us understand the GST WHO HAS TO FILE –ANNUAL RETURN 1. Nil Annual Return- A person registered under GST but having no transactions during the year is still required to file a Nil Annual Return. (But option given for FY 17-18 to 19-20) 2. A person who has got his registration cancelled during the year is also required to file the Annual returns. 3. A Registered person who has opted in or opted out of composition is required to file both GSTR 9 & GSTR 9A for the relevant periods. GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 16. Let us understand the GST SOME CRUCIAL ASPECTS –ANNUAL RETURN PAN / GSTIN : This is not an Entity Level reporting, its GSTIN based filing. GSTR-9 does not allow for any revision after filing. It is mandatory to file FORM GSTR-1 and FORM GSTR-3B for the before filing the Annual return. Instructions Source of Information : Circular 26/2017 clarifies how to correct information in returns based on the books. Presuming Returns are corrected, information furnished in GSTR 3B to be reported. GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 17. Let us understand the GST 6 -IMPORTANT PARTS of GSTR-9 (Annual) Return) GSTR- 9 P-I Basic Info P-II Liability P-III Input Tax Credit P-IV Tax Paid P-V Adju- stments P-VI Other Info. Table- 4-5 Table- 6-8 Table- 9 Table- 10-13 Table- 15-19 GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 18. Let us understand the GST BASIC DETAILS Year v. Financial year for GST audit GSTIN validation, duplication and correction Legal name v. Trade name v. Brand name GSTIND GLOBAL SOLUTIONS LLP , RAIPUR

- 19. Let us understand the GST PART II: DETAILS OF OUTWARD SUPPLIES Part II Transactions havingTax Implications Table 4 Transactions not having tax implications Table 5

- 20. Let us understand the GST OUTWARD AND INWARD SUPPLIES Instruction No .4 to GSTR-9 Part II consists of the details of all outward supplies & advances received during the financial year for which the annual return is filed. It may be noted that all the supplies for which payment has been made through FORM GSTR-3B between July 2017 to March 2018 & for FY 18-19 April 18 to March29 shall be declared in this part. GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 21. Let us understand the GST OUTWARD AND INWARD SUPPLIES Transaction -17-18 Liability Paid in 17-18 Part- II – Table-4 Transaction -17-18 Liability Paid in 18-19 Part- V – Table-10/11 FY -2017-18 FY -2018-19 GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 22. Let us understand the GST OUTWARD AND INWARD SUPPLIES Source of data; errors of omission-commission Reference to tables in GSTR 1; GIGO data Invoice value v. Taxable value (abatement) Declared ‘for’2017-18 ‘in’returns filed (belated) Transaction -17-18 Liability Paid in 17-18 Part- II – Table-4 Transaction -17-18 Liability Paid in 18-19 Part- V – Table-10/11 View Confirmed Via Press Release . GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 23. Let us understand the GST OUTWARD AND INWARD SUPPLIES Table 4A, 4C Table 6A Table6B Table 6C Table 5, 7 and 9, 10 • Outward supplies at not only sales but all credits • Supplies actually reported in 2018-19 ‘for’2017-18 • Compliance of Valuation rules . Rule-32 **Schedule-I Supply – should be taken care . GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 24. Let us understand the GST OUTWARD AND INWARD SUPPLIES • Payment of GST on Advances - NN 40/17/CT -13/10 & NN 66/17/CT-11/11 Table 11A Table 4B / Table 3.1(d) Refer NN 8/2017-CT(R) dated Jun 28, 2017 exempts intra-State supply of goods or supply of services does not exceed Rs.5,000/- per day regardless of number of suppliers involved. Refer NN 38/2017-CT(R) dated Oct 13, 2017 which excluded the value limit previously prescribed. Corresponding Integrated tax exemption was issued for the first time in NN 32/2017-Int(R) dated Oct 13, 2017 in respect of inter-State supplies. GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 25. Let us understand the GST OUTWARD AND INWARD SUPPLIES • Date-of-doc’ relevant and related to 4B to4E • ‘Doc-type’ relevant whether s.34 allows ornot • CN-DN issued ‘in’ 2017-18 not ‘for’ 2017-18 • Consider supply invoice ‘amended through’DN-CN *Concept of Commercial : Credit note / Debit note? Optional Optional GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 26. Let us understand the GST j) Treatment of Credit Notes / Debit Notes issued during FY 2018-19 for FY 2017-18: It may be noted that no credit note which has a tax implication can be issued after the month of September 2018 for any supply pertaining to FY 2017-18; a financial/commercial credit note can, however, be issued. If the credit or debit note for any supply was issued and declared in returns of FY 2018-19 and the provision for the same has been made in the books of accounts for FY 2017-18, the same shall be declared in Pt. V of the annual return. Many taxpayers have also represented that there is no provision in Pt. II of the reconciliation statement for adjustment in turnover in lieu of debit notes issued during FY 2018-19 although provision for the same was made in the books of accounts for FY 2017-18. In such cases, they may adjust the same in Table 5O of the reconciliation statement in FORM GSTR-9C. IMPORTANT CLARIFICATION – CREDIT NOTE & DEBIT NOTE Press Release Posted On: 03 JUL 2019 5:03PM by PIB Delhi GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 27. Let us understand the GST OUTWARD AND INWARD SUPPLIES Table 9A and9C Table 9A and9C • Omission-commission (B2C) already reported(4A) • Omission-commission (B2B) now reported (4BCDE-IJ) • Omission-commission ‘for’ 2017-18 but ‘in’ 2018-19 • Invoice-CN-DN-Refund Voucher ‘for’ 2017-18 only Optional Optional GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 28. Let us understand the GST TABLE- 5 – SUPPLIES _NO TAX PAYMENT Table 6A Table 6B Table 4B • Exports (goods or services) declared as ‘nottaxable’ • Export with-IGST payment already reported(4C-D) • Review of ‘export conditions’ not to affect reporting • Outward supplies ‘push’ to counter-partyreported GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 29. Let us understand the GST TABLE- 5 – SUPPLIES _NO TAX PAYMENT • All kinds of ‘un-taxed’ supplies to be actuallyreported • All ‘no supply’ transactions to be reported • Report credits in expenditure-asset-liability accounts • Ensure ‘complete’ transparency of transactions Table 8 This definition entails that exempt supply is a wide term and includes nil rated supply and nontaxable supply. The ratio of exempt supply to taxable supply may be taken for the reversal of the credit attributable to the exempt supply as per Rule 42 and 43 of the CGST Rules. Optional (INCLUDES NOT A SUPPLY) Optional GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 30. Let us understand the GST TABLE- 5 – SUPPLIES _NO TAX PAYMENT • Ensure no overlap with 4IJKL • Supplies ‘with-tax’ in 4IJKL and ‘without-tax’ in5HIJK • ‘Date-of-doc’ relevant whether S.34 allows ornot • Amendment or first-time reporting to be considered Table 9BOptional Optional GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 31. Let us understand the GST TABLE- 5 – SUPPLIES _NO TAX PAYMENT • Total turnover very important for reconciliation in 9C • Taxable PLUS non-taxable turnover ‘for’ 2017-18 & 18-19 • Turnover in 5N may not match with turnover inbooks • All ‘errors’ remain, time to rectify in the corresponding year. GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 32. Let us understand the GST PART- IV TABLE-9 – TAX PAID _GSTR3B RETURN Table 6.1 • Details of tax paid as declared in returns filedduring the financial year i.e Actual ‘tax paid’ data from3B Auto populated Paid Portion , –Cannot be changedAuto Populated, can be changed GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 33. Let us understand the GST IMPORTANT CLARIFICATION – REVERSE CHARGE MECHANISM (RCM) • G) Reverse charge in respect of Financial Year 2017-18 paid during Financial Year 2018- 19: Many taxpayers have requested for clarification on the appropriate column or table in which tax which was to be paid on reverse charge basis for the FY 2017-18 but was paid during FY 2018-19. It may be noted that since the payment was made during FY 2018-19, the input tax credit on such payment of tax would have been availed in FY 2018-19 only. Therefore, such details will not be declared in the annual return for the FY 2017-18 and will be declared in the annual return for FY 2018-19. If there are any variations in the calculation of turnover on account of this adjustment, the same may be reported with reasons in the reconciliation statement (FORM GSTR-9C). Press Release Posted On: 03 JUL 2019 5:03PM by PIB Delhi GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 34. Let us understand the GST PART- V Rollover - TRANSACTION (APRIL-SEPTEMBER ) • ‘Date-of-doc’ relevant even if reportedbelatedly • ‘Return-for-month’ relevant even if filed belatedly • ‘Date-of-filing’ by 20, April 2019 • Included ‘as if’ belongs to2018-19: – Not to be considered in 10 to 13 of GSTR 9 Part- V Particulars of the transaction for the FY 2017-18 (declared in returns between April 2018 till March 2019) & for the FY 2018-19 (declared in returns between April 2019 till Septmeber2019) Description Taxable Value Central Tax State Tax / UT Integrated Tax Cess 1 2 3 4 5 6 GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 35. Let us understand the GST PART- V Rollover - TRANSACTION (APRIL-SEPTEMBER ) Table 9A, 9B and 9C • Follow ‘date-of-doc’ and report ‘new’ / ‘amendment’ declared ‘in’ 2018-19 (avoid double-counting) GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 36. Let us understand the GST SR 2017-18 2018-19 Remarks Which Part to be Reported in Annual Return Tax Payable as Books of Accounts GSTR-3B GSTR-1 GSTR-3B GSTR-1 1 1000 1000 1000 0 0 II ILLUSTRATION –OUTWARD SUPPLY – CASE – I GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 37. Let us understand the GST Part-II Details of Outward Supplies made during the Financial year Nature of Supply Taxable Value Central Tax State Tax / UT Integrated Tax Cess 1 2 3 4 5 6 4 Details of advance , inward & Outward supplies made during the financial year A Supplies made to Unregistered person (B2C) 500 500 B Supplies made to registered person (B2B) Part-IV Details of tax paid in returns filed during the financial year 9 Description Tax Payable Paid Cash Paid through ITC Central Tax State Tax Integrated Tax Cess 1 2 3 4 5 6 7 Integrated Tax Central Tax 500 300 100 100 State Tax / UT 500 300 100 100 ILLUSTRATION –OUTWARD SUPPLY – CASE – I GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 38. Let us understand the GST SR 2017-18 2018-19 Remarks Which Part to be Reported in Annual Return Tax Payable as Books of Accounts GSTR-3B GSTR-1 GSTR-3B GSTR-1 2 1000 800 0 0 1000 II , DRC ILLUSTRATION –OUTWARD SUPPLY – CASE – II GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 39. Let us understand the GST Part-II Details of Outward Supplies made during the Financial year Nature of Supply Taxable Value Central Tax State Tax / UT Integrated Tax Cess 1 2 3 4 5 6 4 Details of advance , inward & Outward supplies made during the financial year A Supplies made to Unregistered person (B2C) 500 500 B Supplies made to registered person (B2B) Part-IV Details of tax paid in returns filed during the financial year 9 Description Tax Payable Paid Cash Paid through ITC Central Tax State Tax Integrated Tax Cess 1 2 3 4 5 6 7 Integrated Tax Central Tax 500 300 50 50 State Tax / UT 500 300 50 50 ILLUSTRATION –OUTWARD SUPPLY – CASE – II GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA Difference payment by DRC-03

- 40. Let us understand the GST ILLUSTRATION –OUTWARD SUPPLY – CASE – III SR 2017-18 2018-19 Remarks Which Part to be Reported in Annual Return Tax Payable as Books of Accounts GSTR-3B GSTR-1 GSTR-3B GSTR-1 3 1000 800 800 200 200 II , V 1000 800 0 200 1000 II , V GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 41. Let us understand the GST ILLUSTRATION –OUTWARD SUPPLY – CASE – III Part-II Details of Outward Supplies made during the Financial year Nature of Supply Taxable Value Central Tax State Tax / UT Integrated Tax Cess 1 2 3 4 5 6 4 Details of advance , inward & Outward supplies made during the financial year A Supplies made to Unregistered person (B2C) 400 400 B Supplies made to registered person (B2B) Part-IV Details of tax paid in returns filed during the financial year 9 Description Tax Payable Paid Cash Paid through ITC Central Tax State Tax Integrated Tax Cess 1 2 3 4 5 6 7 Integrated Tax Central Tax 400 200 100 100 State Tax / UT 400 200 100 100 GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 42. Let us understand the GST ILLUSTRATION –OUTWARD SUPPLY – CASE – III Part – V Particulars of the transaction for the FY 2017-18 (declared in returns between April 2018 till March 2019) & for the FY 2018-19 (declared in returns between April 2019 till Septmeber2019) Nature of Supply Taxable Value Central Tax State Tax / UT Integrated Tax Cess 10 1 2 3 4 5 6 Supplies / tax declared through Amendments (+) (net of debit notes) 100 100 GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 43. Let us understand the GST ILLUSTRATION –OUTWARD SUPPLY – CASE – IV SR 2017-18 2018-19 Remarks Which Part to be Reported in Annual Return Tax Payable as Books of Accounts GSTR-3B GSTR-1 GSTR-3B GSTR-1 4 1000 800 800 150 150 II , V , DRC GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 44. Let us understand the GST ILLUSTRATION –OUTWARD SUPPLY – CASE – IV Part-II Details of Outward Supplies made during the Financial year Nature of Supply Taxable Value Central Tax State Tax / UT Integrated Tax Cess 1 2 3 4 5 6 4 Details of advance , inward & Outward supplies made during the financial year A Supplies made to Unregistered person (B2C) 425 425 B Supplies made to registered person (B2B) Part-IV Details of tax paid in returns filed during the financial year 9 Description Tax Payable Paid Cash Paid through ITC Central Tax State Tax Integrated Tax Cess 1 2 3 4 5 6 7 Integrated Tax Central Tax 425 200 100 100 State Tax / UT 425 200 100 100 GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA Difference payment by DRC-03

- 45. Let us understand the GST ILLUSTRATION –OUTWARD SUPPLY – CASE – IV Part – V Particulars of the transaction for the FY 2017-18 (declared in returns between April 2018 till March 2019) & for the FY 2018-19 (declared in returns between April 2019 till Septmeber2019) Nature of Supply Taxable Value Central Tax State Tax / UT Integrated Tax Cess 10 1 2 3 4 5 6 Supplies / tax declared through Amendments (+) (net of debit notes) 75 75 GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 46. Let us understand the GST ILLUSTRATION –OUTWARD SUPPLY – CASE – V SR 2017-18 2018-19 Remarks Which Part to be Reported in Annual Return Tax Payable as Books of Accounts GSTR-3B GSTR-1 GSTR-3B GSTR-1 5 800 1000 800 -200 0 II , V GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 47. Let us understand the GST ILLUSTRATION –OUTWARD SUPPLY – CASE – V Part-II Details of Outward Supplies made during the Financial year Nature of Supply Taxable Value Central Tax State Tax / UT Integrated Tax Cess 1 2 3 4 5 6 4 Details of advance , inward & Outward supplies made during the financial year A Supplies made to Unregistered person (B2C) 500 500 B Supplies made to registered person (B2B) Part-IV Details of tax paid in returns filed during the financial year 9 Description Tax Payable Paid Cash Paid through ITC Central Tax State Tax Integrated Tax Cess 1 2 3 4 5 6 7 Integrated Tax Central Tax 500 300 100 100 State Tax / UT 500 300 100 100 GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 48. Let us understand the GST ILLUSTRATION –OUTWARD SUPPLY – CASE – V Part – V Particulars of the transaction for the FY 2017-18 (declared in returns between April 2018 till March 2019) & for the FY 2018-19 (declared in returns between April 2019 till Septmeber2019) Nature of Supply Taxable Value Central Tax State Tax / UT Integrated Tax Cess 1 2 3 4 5 6 10 Supplies / tax declared through Amendments (+) (net of debit notes) 11 Supplies / tax reduced through Amendments (-) (net of credit notes) 100 100 GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 49. Let us understand the GST ILLUSTRATION –OUTWARD SUPPLY – CASE – VI SR 2017-18 2018-19 Remarks Which Part to be Reported in Annual Return Tax Payable as Books of Accounts GSTR-3B GSTR-1 GSTR-3B GSTR-1 6 800 1000 800 0 0 II , Refund GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 50. Let us understand the GST ILLUSTRATION –OUTWARD SUPPLY – CASE – VI Part-II Details of Outward Supplies made during the Financial year Nature of Supply Taxable Value Central Tax State Tax / UT Integrated Tax Cess 1 2 3 4 5 6 4 Details of advance , inward & Outward supplies made during the financial year A Supplies made to Unregistered person (B2C) 400 400 B Supplies made to registered person (B2B) Part-IV Details of tax paid in returns filed during the financial year 9 Description Tax Payable Paid Cash Paid through ITC Central Tax State Tax Integrated Tax Cess 1 2 3 4 5 6 7 Integrated Tax Central Tax 400 300 100 100 State Tax / UT 400 300 100 100 Refund can be claimed GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 51. Let us understand the GST PART-III ITC DECLARED IN RETURN FILED Input Tax Credits Table 6 ITC Declared as per 3B Table 7 ITC Reversed as per 3B Table 8 Reconciliation with 2A GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 52. Let us understand the GST TABLE-4 (ITC SECTION) –GSTR-3B 4 (A) ITC Available (whether in full or part) (1) Import of Goods (2) Import of Services (3)Inward supplies liable to reverse charge (other than 1 & 2 above) (4) Inward supplies from ISD (5) All other ITC 4 (B) ITC Reversed (1) As per rules 42 & 43 of CGST Rules (2) Others 4 (C) Net ITC Available (A) – (B) 4 (D) Ineligible ITC (1) As per section 17(5) (2) Others GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 53. Let us understand the GST TABLE-6 ITC Table 4A Table 4A(5) • Credit flows from GSTR 3B (as claimedactually) • Credit ‘for’ 2017-18 is not based on ‘date’ of invoice • GSTR 3B is ‘consolidated’ amount not ‘invoice-wise’ • Credit ‘for’ 2017-18 is based on ‘month’ of GSTR3B Optional GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 54. Let us understand the GST TABLE-6 ITC Table 4A(3) Table 4A(1) Table 4A(2) • RCM-credits ‘for’ 2017-18 claimed in GSTR3B • RCM transactions taxed as FWC not reported here • Errors in GSTR 3B rectified in 2018-19 notcounted Optional Optional GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 55. Let us understand the GST TABLE-6 ITC • Again FWC credits reported; 6H also FWCcredit • Difference ideally cannot be ‘negative’ value (I – A, not A – I) - • Difference is ‘positive’ indicates ‘short’ claim in 3B • Difference must be ‘nil’ (ideally) – Most of the case • Repeat above credit details forCGST-SGST-IGST-Cess Table 4A(4) Rule -37 & Refund Rejected Re Credited GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 56. Let us understand the GST TABLE-6 ITC • Special case of credit flow only to CGST or onlySGST: – TRAN1-2 credit flow into ECL after revision (up/down) – Stock-on-hand credit when newly taxable (Rule 40) ITC 01 – Transfer of credit with PAN change (Rule 41) ITC-02 Actual balance as reflected in Electronic Credit Ledger Rule 40 stock-on-hand and Rule 41 transfer of credit GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 57. Let us understand the GST TABLE-7 DETAILS OF REVERSED AND INELIGIBLE Table Description Reference 7A As per Rule 37 Section 16(2) – payment to supplier not made – 180 days 7B As per Rule 39 ISD – apportioned is in negative because of CR Noteby the ISD 7C As per Rule 42 Proportionate reversal of credit on common input tax and other than business purpose input tax (D1+D2) 7D As per Rule 43 Proportionate reversal of credit on common Capital Goods 7E As per section 17(5) Blocked Credits 7G Reversal of TRAN-I credit Ineligible credits reversed 7H Reversal of TRAN-II credit Ineligible credits reversed GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 58. Let us understand the GST TABLE-7 DETAILS OF REVERSED AND INELIGIBLE Table 4(B) ITC 03 • Ensure reversal true-up after year-endreview • Ensure 7E is ‘nil’ to avoid ‘double counting’ or tothe extent included in reversal • TRAN1-2 reversal, ensure only admittedreversal Optional Ensure 7E is ‘nil’ to avoid ‘double counting’ Mandatory

- 59. Let us understand the GST TABLE-8 OTHER ITC RELATED INFORMATION • Tax ‘admitted’ by counter-party flows to GSTR 2A • Credit from invoices-on-hand claimed in 6B • If there’s mismatch, consider: – 2A > 6B, see if all credits are availed (directly reported) – 2A < 6B, expect inquiry keep alternative confirmation & Reconciliation ready – 2A > 6B, credit availed in next year (choice of year) *Table 8-A to 8-D Optional upload of GSTR-2A Data in PDF Format duly signed along with GSTR-9C . GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 60. Let us understand the GST Figures in Table 8A of FORM GSTR-9 are auto-populated only for those FORM GSTR-1 which were furnished by the corresponding suppliers by the due date. Thus, ITC on supplies made during the financial year 2017-18, if reported beyond the said date by the corresponding supplier, will not get auto-populated in said Table 8A. It may also be noted that FORM GSTR-2A continues to be auto-populated on the basis of the corresponding FORM GSTR-1 furnished by suppliers even after the due date. In such cases there would be a mis-match between the updated FORM GSTR-2A and the auto-populated information in Table 8A. It is important to note that Table 8A of the annual returns is auto-populated from FORM GSTR-2A as on 1 May, 2019. IMPORTANT CLARIFICATION – GSTR-2A V/s Table 8A (ITC) Press Release Posted On: 03 JUL 2019 5:03PM by PIB Delhi Inference from the above can be drawn for FY 18-19 - Table 8A of the annual returns FY 2018-19 is auto-populated from FORM GSTR-2A as on 1 November, 2019. GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 61. Let us understand the GST TABLE-8 OTHER ITC RELATED INFORMATION Table 4(A)(5) • Credit ‘to be’ lapsed not automatic, ensure it is‘nil’ , - 8D can trigger inquiry; maintain detailedinformation , - Bill of Entry filed by Registered Person ----------------March 2019. For FY 2018-19 – during April 19 to September 19. GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 62. Let us understand the GST Premise of Table 8J of Annual Return: In the press release on annual return issued earlier on 4 June 2019, it has already been clarified that all credit of IGST paid at the time of imports between July 2017 to March 2019 may be declared in Table 6E. If the same is done properly by a taxpayer, then Table 8I and 8J shall contain information on credit which was available to the taxpayer and the taxpayer chose not to avail the same. The deadline has already passed and the taxpayer cannot avail such credit now. There is no question of lapsing of any such credit, since this credit never entered the electronic credit ledger of any taxpayer. Therefore, taxpayers need not be concerned about the values reflected in this table. This is information that the Government needs for settlement purposes. IMPORTANT CLARIFICATION – IGST PAID ON IMPORT OF GOODS Press Release Posted On: 03 JUL 2019 5:03PM by PIB Delhi GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 63. Let us understand the GST PART- IV TABLE-9 – TAX PAID _GSTR3B RETURN Table 6.1 • Details of tax paid as declared in returns filedduring the financial year i.e Actual ‘tax paid’ data from3B GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 64. Let us understand the GST PART- V Rollover – INPUT TAX CREDIT (APRIL-SEPTEMBER ) Part- V Particulars of the transaction for the FY 2017-18 (declared in returns between April 2018 till March 2019) & for the FY 2018-19 (declared in returns between April 2019 till Septmeber2019) Description Taxable Value Central Tax State Tax / UT Integrated Tax Cess 1 2 3 4 5 6 GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 65. Let us understand the GST PART- V ROLL OVER ITC (APRIL-SEPTEMBER 18) Table 4(B) Table 4(A) • Credit cannot ‘belong’ to both years (choice ofyear): – Check conditions of s.16(2) – Receipt latter , not paid etc. – Compared with Table 8C GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 66. Let us understand the GST PART- V PREVIOUS TRANSACTION (APRIL-SEPTEMBER 18) 14 Differential tax paid on account of declaration in 10 & 11above Description Payable Paid 1 2 3 Integrated Tax Central Tax State/UT Tax Cess Interest • Calculate ‘admitted’ tax- payable on 10 and 11 • Ensure no double- counting of liability and payment • Tax ‘unpaid’ can also be reported here Comment – GSTR-9C Towards the end of the return, taxpayers shall be given an option to pay any additional liability declared in this form, through FORM DRC-03. Taxpayers shall select ―Annual Return‖ in the drop down provided in FORM DRC-03. It may be noted that such liability can be paid through electronic cash ledger only.‖. GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 67. Let us understand the GST ILLUSTRATION OF ITC – CASE STUDY -I SR 2017-18 2018-19 Remarks Which Part to be Reported in Annual Return Input Tax Credit as Books of Accounts GSTR-3B GSTR-3B 1 1000 1000 0 Part –III GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 68. Let us understand the GST ILLUSTRATION OF ITC – CASE STUDY -I 500 500 500 500 00 00 GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 69. Let us understand the GST ILLUSTRATION OF ITC – CASE STUDY -II SR 2017-18 2018-19 Remarks Which Part to be Reported in Annual Return Input Tax Credit as Books of Accounts GSTR-3B GSTR-3B 2 1000 800 200 Part –III & Part V GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 70. Let us understand the GST ILLUSTRATION OF ITC – CASE STUDY -II 400 400 400 400 00 00 PART- III PART- V100 100 GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 71. Let us understand the GST ILLUSTRATION OF ITC – CASE STUDY -III SR 2017-18 2018-19 Remarks Which Part to be Reported in Annual ReturnInput Tax Credit as Books of Accounts GSTR-3B GSTR-3B 3 1000 1200 -200 Part –III & Part V GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 72. Let us understand the GST ILLUSTRATION OF ITC – CASE STUDY -III 600 600 600 600 00 00 PART- III PART- V 100 100 GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 73. Let us understand the GST ILLUSTRATION OF ITC – CASE STUDY -IV SR 2017-18 2018-19 Remarks Which Part to be Reported in Annual Return Input Tax Credit as Books of Accounts GSTR-3B GSTR-3B 4 1000 1200 00 Part –III & DRC-03 GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 74. Let us understand the GST ILLUSTRATION OF ITC – CASE STUDY -IV 600 600 500 500 -100 -100 PART- III PART- V Will be paid by DRC-03 GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 75. Let us understand the GST PART- VI T-15 OTHER INFORMATION Refunds Claimed Table 15A Sanctioned Table 15B Rejected Table 15C Pending Table 15D *Optional GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 76. Let us understand the GST PART- VI T-16 OTHER INFORMATION Table 5 • Provide factual data and if details not available, stateit • Tracker for goods sent to job-worker (not transition 141) • Section 31(7) – 6 Months – Goods Sent on Approval • Information only; no tax to be paid *Optional GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 77. Let us understand the GST PART- VI T-17 OTHER INFORMATION • HSN summary of ‘outward’ supplies required • Match with 5N + 10 + 11 • Prepare such summary for non-monetary/sch I supplies • Identify limitations in data collection Table 12 *Optional GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 78. Let us understand the GST PART- VI T-18 OTHER INFORMATION *Optional GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 79. Let us understand the GST PART- VI T-19 OTHER INFORMATION • GSTR 9 attracts late fee; Rs.100+Rs.100,cap 0.25%+0.25% • Single GSTR 9 for CGST-SGST, IGST and Cess • GSTR 9 can be filed with ‘unpaid’ late feealso GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 80. Let us understand the GST VERIFICATION • No ‘text’ space allowed for ‘limitations’disclosure GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 81. Let us understand the GST SPILL OVER TRANSACTION OF 2017-18 to 2018-19 - Transaction of 2017-18 which are given effect in 2018-19 , - How the impact will be given in Gstr-9 of annual return of 2018-19. - No Separate Space in the GSTR-9 to disclose the spill over transaction. Liability of 2017-18 Liability of 2018-19 Auto populated figures in Table-9 of FY 18-19 (Based on GSTR-3B) GSTR-9 Part-V of Annual return 100 Books of Accounts 1000 1100 CASE - I GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 82. Let us understand the GST ILLUSTRATION –SPILLOVER– CASE – I Part-II Details of Outward Supplies made during the Financial year Nature of Supply Taxable Value Central Tax State Tax / UT Integrated Tax Cess 1 2 3 4 5 6 4 Details of advance , inward & Outward supplies made during the financial year A Supplies made to Unregistered person (B2C) 500 500 B Supplies made to registered person (B2B) Part-IV Details of tax paid in returns filed during the financial year 9 Description Tax Payable Paid Cash Paid through ITC Central Tax State Tax Integrated Tax Cess 1 2 3 4 5 6 7 Integrated Tax Central Tax 500 300 150 100 550 State Tax / UT 500 300 150 100 550 Total GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 83. Let us understand the GST SPILL OVER TRANSACTION OF 2017-18 to 2018-19 - Transaction of 2017-18 which are given effect in 2018-19 , - How the impact will be given in Gstr-9 of annual return of 2018-19. Liability of 2017-18 Liability of 2018-19 Auto populated figures in Table-9 of FY 18-19 (Based on GSTR-3B) GSTR-9 Part-V of Annual return -100 Books of Accounts 1000 900 CASE - II GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 84. Let us understand the GST ILLUSTRATION –SPILLOVER– CASE – II Part-II Details of Outward Supplies made during the Financial year Nature of Supply Taxable Value Central Tax State Tax / UT Integrated Tax Cess 1 2 3 4 5 6 4 Details of advance , inward & Outward supplies made during the financial year A Supplies made to Unregistered person (B2C) 500 500 B Supplies made to registered person (B2B) Part-IV Details of tax paid in returns filed during the financial year 9 Description Tax Payable Paid Cash Paid through ITC Central Tax State Tax Integrated Tax Cess 1 2 3 4 5 6 7 Integrated Tax Central Tax 500 200 150 100 450 State Tax / UT 500 200 150 100 450 Total

- 85. Let us understand the GST GST UPDATE- IMPORTANT CLARIFICATION FOR GSTR-9 (ANNUAL RETURN) GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA ISSUE : - The auto populated GSTR 9 for the year 2018-19(Tables 4, 5, 6 and 7) also includes the data for FY 2017-18. There is no mechanism to show the split of two years (2017-18 & 2018-19) in FORM GSTR-9 for 2018-19. It clarified that the taxpayers are required to report only the values pertaining to Financial Year 2018-19 and the values pertaining to Financial Year 2017-18 which may have already been reported or adjusted are to be ignored. No adverse view would be taken in cases where there are variations in returns for taxpayers who have already filed their GSTR-9 of Financial Year 2018-19 by including the details of supplies and ITC pertaining to Financial Year 2017-18 in the Annual return for FY 2018-19. Source :- Press Release , Posted On: 09 OCT 2020 5:30PM by PIB Delhi

- 86. Let us understand the GST SPILL OVER TRANSACTION OF 2017-18 to 2018-19 2017-18 2018-19 Auto populated Figures in Table-9 as per GSTR-3B of FY 18-19 Liability of 2017- 18 discharged in 18-19 100 Liability Books of Accounts 1000 900 GSTR-9 Part-V of Annual return 100 Liability Discharged in GSTR-3B for 18-19 800 Liability Discharged in GSTR-3B for 19-20 200 CASE - III

- 87. Let us understand the GST ILLUSTRATION –SPILLOVER– CASE – III Part-II Details of Outward Supplies made during the Financial year Nature of Supply Taxable Value Central Tax State Tax / UT Integrated Tax Cess 1 2 3 4 5 6 4 Details of advance , inward & Outward supplies made during the financial year A Supplies made to Unregistered person (B2C) 400 400 B Supplies made to registered person (B2B) Part-IV Details of tax paid in returns filed during the financial year 9 Description Tax Payable Paid Cash Paid through ITC Central Tax State Tax Integrated Tax Cess 1 2 3 4 5 6 7 Integrated Tax Central Tax 400 200 150 100 450 State Tax / UT 400 200 150 100 450 Total

- 88. Let us understand the GST ILLUSTRATION –SPILLOVER– CASE – III Part – V Particulars of the transaction for the FY 2017-18 (declared in returns between April 2018 till March 2019) & for the FY 2018-19 (declared in returns between April 2019 till Septmeber2019) Nature of Supply Taxable Value Central Tax State Tax / UT Integrated Tax Cess 1 2 3 4 5 6 10 Supplies / tax declared through Amendments (+) (net of debit notes) 100 100 11 Supplies / tax reduced through Amendments (-) (net of credit notes) GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 89. Let us understand the GST SPILL OVER TRANSACTION OF 2017-18 to 2018-19 2017-18 2018-19 Auto populated Figures in Table-9 as per GSTR-3B of FY 18-19 Input Tax Credit of 2017-18 Availed in 18-19 100 ITC - Books of Accounts 1000 1100 GSTR-9 Part-V of Annual return 100 ITC Availed in GSTR-3B for 18-19 1000 CASE - IV GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 90. Let us understand the GST ILLUSTRATION –SPILLOVER– CASE – IV 550 550 500 500 -50 -50 PART- III PART- V GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 91. Let us understand the GST SPILL OVER TRANSACTION OF 2017-18 to 2018-19 2017-18 2018-19 Auto populated Figures in Table-9 as per GSTR-3B of FY 18-19 Input Tax Credit of 2017-18 Availed in 18-19 -100 ITC - Books of Accounts 1000 900 GSTR-9 Part-V of Annual return -100 ITC Availed in GSTR-3B for 18-19 1000 CASE - V GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 92. Let us understand the GST ILLUSTRATION –SPILLOVER– CASE – V 450 450 500 500 50 50 PART- III PART- V GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 93. Let us understand the GST SPILL OVER TRANSACTION OF 2017-18 to 2018-19 2017-18 2018-19 Auto populated Figures in Table-9 as per GSTR-3B of FY 18-19 Input Tax Credit of 2017-18 Availed in 18-19 100 ITC - Books of Accounts 1000 900 GSTR-9 Part-V of Annual return 100 ITC Availed in GSTR-3B for 18-19 800 GSTR-9 Part-V of Annual return 200 CASE - VI GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 94. Let us understand the GST ILLUSTRATION –SPILLOVER– CASE – V 450 450 400 400 -50 -50 PART- III PART- V100 100 GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA

- 95. Disclaimer: The views and opinions expressed in this article and slides are those of the compiler and zdo not necessarily reflect the official policy or position of any agency/department of the government. The same should not be considered as legal advice in no case. All possible efforts are made to make the compilation error free and incase if there is any left , we regret for the same and request to point out the same at our mail id. Let us understand the GST GSTIND GLOBAL SOLUTIONS LLP , RAIPURCA RAMANDEEP SINGH BHATIA Head Office: GSTIND GLOBAL SOLUTIONS LLP , C-9 to 12, First Floor , Ekatma Parisar , Rajbandha Maiden , Raipur Chhattisgarh -492001 Contact : gstindglobal@gmail.com www.gstingglobal.com