Report

Share

Download to read offline

Recommended

More Related Content

What's hot

What's hot (6)

Viewers also liked

Viewers also liked (12)

CSR Collaboration Hub - Enhancing Alliances & Purview of Schedule VII

CSR Collaboration Hub - Enhancing Alliances & Purview of Schedule VII

Similar to 6 limitations and 6 solutions

Similar to 6 limitations and 6 solutions (20)

Retirement and Estate Planning Project(6 – 10 pages) D.docx

Retirement and Estate Planning Project(6 – 10 pages) D.docx

Cyril de Lalagade partage un Conseils de gestion de portefeuille pour les jeu...

Cyril de Lalagade partage un Conseils de gestion de portefeuille pour les jeu...

Avoid Dreadful Mistakes While Investing in Mutual Funds

Avoid Dreadful Mistakes While Investing in Mutual Funds

6 limitations and 6 solutions

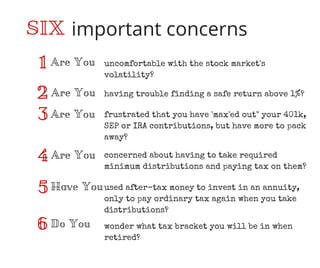

- 1. important concerns Are You1 2 3 4 5 6 SIX Are You Are You Are You Have You Do You uncomfortable with the stock market's volatility? having trouble finding a safe return above 1%? frustrated that you have 'max'ed out" your 401k, SEP or IRA contributions, but have more to pack away? concerned about having to take required minimum distributions and paying tax on them? used after-tax money to invest in an annuity, only to pay ordinary tax again when you take distributions? wonder what tax bracket you will be in when retired?

- 2. reasonable desires What if1 2 3 4 5 6 SIX What if What if What if What if What if you could save for retirement without stock market volatility? you could find an investment platform that provides a positive minimum annual return? you could put away unlimited amounts of money on a tax-advantaged basis? your new plan provided for unlimited matching contributions? you had a retirement plan that never goes negative? you could find a way to achieve an 87% probability of an 7% return - without active management (and high fees)?